March Madness… It has to be said that the term is certainly not overused this year! A prestigious “Mannshaft” victory against France (we were no longer used to seeing Germany win, whether in sport or economics), the Prancing Horse overtaking again its rivals with an unexpected double for Ferrari at the F1 Australian Grand Prix, BoJ ending negative rates (a historical landmark), the US economy that doesn’t seem ready to land yet, many equity markets indices setting new all-time highs almost on a daily basis, after lost decades for those in Europe and Japan (S&P500 just had its best week of the year amid growing optimism that Fed rate cuts are now on their way, while the Nikkei soared +5.6% last week), and so on and so forth. Speaking about surprises, faking out, feints or being caught off-balance and off guard, I must admit I was “posterized” by Jordan slam-dunk rate cut last week… Not Michael Jordan of course but Thomas, but still right in my face with clients and prospects surrounding me!

So, to my surprise and that of a large number of economists and investors, the Swiss National Bank (SNB) delivered indeed the first G10 rate cut of the cycle (from 1.75% to 1.5%), confirming therefore the overall dovish tone and thus willingness to cut rates soon by other major central banks across both sides of the Atlantic. I didn’t think the SNB would be brave enough to be the first to fire a shot -despite SNB track-record of catching sometimes markets off guard-, given the depreciation trajectory of the Swiss franc since the beginning of the year and the non-negligible risks of other central banks procrastinating before lowering their key rates in the case of an inflation’s resurgence. Furthermore, I was also fooled, in a subconscious way, by a former Bank of England Chairman’s analogy between monetary policy and Diego Maradona…

Back in 2005, then BoE’s governor Lord Mervyn King described the two goals that the Argentine scored against England in the 1986 World Cup to show how central bankers had modernized. Both goals were memorable. Each for totally different reasons. The first, the so-called “Hand of God” goal, saw Maradona beat England goalkeeper to the ball with an outstretched fist. This, Lord King said, summed up the old “mystery and mystique” approach to central banking. It was “unexpected, time-inconsistent and against the rules”. Since then, we experienced QE and negative rates… the very visible hand of central banks!

The second goal? Well here’s how Mervin King put it: “Maradona ran 60 yards from inside his own half beating five players before placing the ball in the English goal. The truly remarkable thing, however, is that, Maradona ran virtually in a straight line. How can you beat five players by running in a straight line? The answer is that the English defenders reacted to what they expected Maradona to do. Because they expected Maradona to move either left or right, he was able to go straight on. Monetary policy works in a similar way. Market interest rates react to what the central bank is expected to do.” Here’s the goal (a real beauty!).

In fact, there were (long) periods of time back at the end of the 90’s or around 2005 in which central banks were able to influence the path of the economy without making large moves in official interest rates because financial markets did not expect interest rates to remain constant… They expected that rates would move either up or down. That’s exactly what is happening today -at least for the Fed and the ECB which haven’t moved yet while markets have already priced in the incoming rate cuts-

So, with that in hands what are the pragmatic lessons and conclusions we may draw looking forward:

- Thomas Jordan’s rate cut move was more like the Maradona “Hand of God” goal to some extent as it may be considered as “unexpected, time-inconsistent and against the rules”. A surprise in terms of timing but consistent with low Swiss inflation experienced in recent months: the SNB’s rate cuts are coming sooner than expected, but the expected magnitude of overall easing hasn’t change (I don’t expect more than 3 cuts in 2024). After having won the fight against inflation, Thomas Jordan last dance may be thus mainly focused on impeding further CHF strength (before he leaves), reducing somewhat SNB balance’s sheet with a nice profit thanks to weakening CHF on top of favorable financial markets (NB: lower SNB rate means also less interest to be paid to commercial banks for their excess reserves). He will be remembered as a great central banker!

- The CHF is likely to stay weak against the EUR and USD in the short term as long as ECB and Fed don’t cut (or uncertainty about the timing of their first rate’s cuts remain), especially if risk-on environment and subsequent carry trades continue to prevail.

- I feel now somewhat more comfortable with a scenario of a first cut in June for the Fed and the ECB (which may eventually even start easing as soon as its next meeting on April 11th) as I believe the SNB was convinced enough by this scenario to go ahead. In this context, the Swiss Franc is likely to regain ground against both the EUR (more likely) and USD in the 2nd half of this year… especially if things turn sourer for the global economy and markets.

- Somewhat more comfortable but not yet fully reassured because I still consider that we can’t completely rule out a scenario where the Fed follow the script of Maradona’s 2nd goal against England in 1986. Keeping the door open for a rate cut, easing therefore financial conditions without using any ammunitions, and letting indirectly the economy running hot without really leaning against it! That could prove as subtle, audacious and successful than Maradona’s goal of the century.

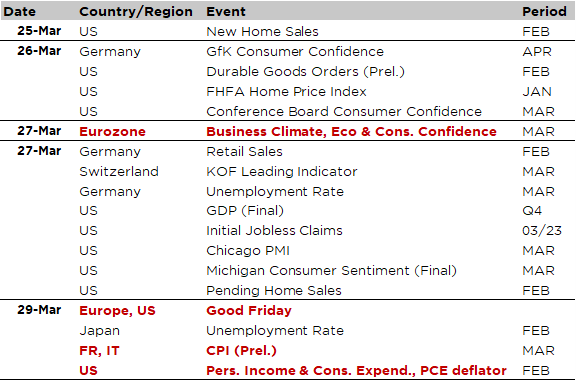

Economic Calendar

Thanks God is Good Friday soon… and Easter Monday just thereafter! As a result, major US and European markets will be closed on Friday, with holidays in Europe extending to Monday as well (US markets will be open). Furthermore, this last week of March should be rather quiet considering the lack of key macro data publications, central bank’s meetings or major earnings releases over the next days. However, before to end an incredibly positive first quarter for most equity markets and not-so-great one for fixed income investors, all eyes will be (again) on US prices trajectory when the PCE deflator will be released -on (Good) Friday- along with the personal income, spending and savings rate data for February. Inflation will also be on the forefront in the Euro Area as France & Italy flash March CPI report is due on Good Friday too.

The headline & core PCE deflator (Fed’s preferred inflation gauge), following last week’s Fed meeting, will be released on Friday afternoon. The consensus expects they will increase +0.4% and +0.3% MoM respectively in February (a touch higher and softer vs. January), leading to stable YoY annual change of +2.4% (headline) and +2.8% (core) compared to the prior month. As far as personal income and consumption are concerned, they are expected to grow around +0.5% -consistent with resilient household consumption-.

Other notable economic data releases include the February preliminary reading of US durable goods orders on Tuesday, US new and existing home sales (today and Thursday), the Eurozone Business Climate, Consumer Confidence and Economic Sentiment indicators for March on Wednesday and the Conference Board’s March US consumer confidence on Thursday.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.