Last week, my column was devoted to the virtue of patience and the many similarities between sport and the financial markets, including the importance of uncertainty and how to manage it in both with predictions and strategies. I concluded with a reminder of our scenario for inflation and rates leading to a cautious stance on bond duration as “long rates don’t offer yet perhaps a sufficient valuation opportunity due to sticky inflation, higher for longer (neutral) rates, as well as sovereign debt sustainability concerns”. I don’t know if it was some kind of premonitory thought, but the events of the last few days are perfectly in line with this, considering the latest stronger-than-expected-again US job report, or the results of the European parliamentary elections, which turned out to be a bigger surprise than expected with President Macron calling for early parliamentary elections on June 30 and July 7, while the ruling coalition in Germany has been further weakened.

As a result, this outcome has raised both eyebrows and market uncertainties, particularly in France. It is clearly negative for the euro in the short term and increases the credit risk for France, which was downgraded just a few days ago (unlucky timing), but also for other European economies with weaker fundamentals (not to say peripheral ones) as illustrated this morning with a widening yield differential between these issuers and Germany. The saying “to live happily, we have to hide away” applies well also in the bond market for the most fragile issuers as being under the spotlight may lead to a vicious circle and eventually a self-fulfilling default prophecy (sovereign debt crisis or, more recently, the Credit Suisse wreck) through an unsustainable credit spreads widening. So, the outcome of this election and the subsequent decision of President Macron have brought back the political weakness of Euro Zone construction in the frontward.

So, what to do now? Likely nothing for the time being, except if you are exaggeratedly exposed to French assets or to the EUR. In this case you may be forced to trim it somewhat for risk control reasons. Otherwise, keep in mind that (1) the results of the incoming French legislative elections could differ from the European elections as it won’t be a one-round proportional election this time but a two-round majority election and (2) in the case a far-right Rassemblement National coalition wins these elections, it could eventually prove less disruptive than feared for the French economy and market. Just look at Italy and what has happened since Giorgia Meloni has been serving as Prime Minister. However, it may still have an impact on the fiscal trajectory policy by delaying the implementation of recent structural reforms and on the overall relations with the EU. That’s clearly not a favorable outcome for sovereign long duration bonds, confirming our overall cautious stance on them, including US treasuries – US elections are coming too – and for the single currency.

The outcome of these European and the French elections may also have ripple effect on the ECB monetary policy trajectory and, to a lesser extent, the SNB one as well, especially if downward pressures on the EUR intensifies going forward… and geopolitical uncertainties increase further in November when we will get the US elections results. Will the SNB cut rates preventively on June 20th, in order to preserve or even increase its interest rate differential “disadvantage” to try impeding an excessive appreciation of the Swiss Franc, or will it keep its limited ammunitions for latter.

Given the current low level of Swiss inflation, it should pick the first option but anyway I still strongly believe the SNB won’t be able to fight indefinitely the structural Swiss franc’s appreciation.

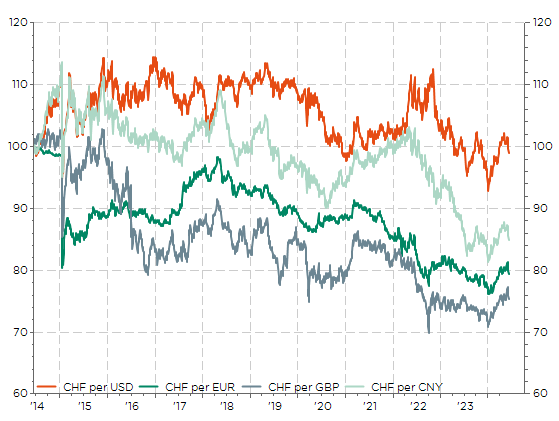

CHF vs. selected currencies over the last 10 years: Swiss Franc weakness won’t last

In these challenging times for most fiat currencies and debt, I thus continue to prefer the Swiss franc, gold, and to a lesser extent USD (by default) as safe haven/diversifying assets in balanced portfolios (rather than bond duration). To conclude this column, I noticed yesterday while watching the Roland Garros final that he said once “victory belongs to the most tenacious”. I took it as a good omen because while I can be impatient at times, when it comes to stubbornness, I’ve inherited a few predispositions, being half Sardinian and born under the sign of Aries…

Let’s hope this character trait will translate into some successes this year, both in my investment decisions and on the court at the FIMBA MaxiBasket European Championship in Pesaro.

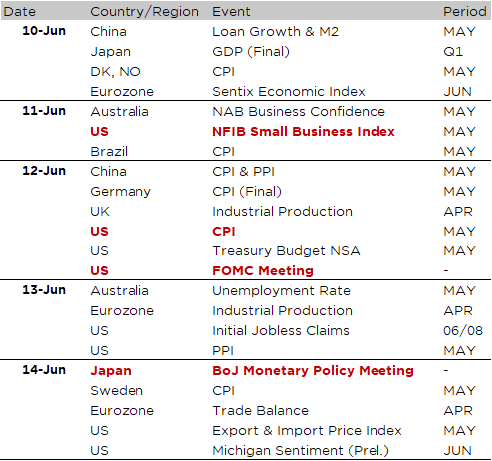

Economic calendar

All investors’ eyes (and ears) will be focused on Wednesday when we will get the US CPI report for May in the afternoon, followed by the Fed decision in the evening. Before that inflation data for May are also due in China on Wednesday morning, where, contrary to the US, they have been running too low for some time as deflation risks are the issue at hand for the PBoC.

Whatever the latest US CPI data will show, the Fed’s decision is already widely anticipated: it will be a hold. So, the focus will quickly turn to the updated version of the infamous dot plot and Fed’s SEP (Summary of Economic Projections) in order to continue gathering some insights on the timing of the first rate cut and the extent of easing going forward. After the stronger than expected US jobs report released last Friday, another above the consensus print for US CPI may eventually lead Fed’s Chairman to adopt a hawkish hold stance/tone than a dovish one during his press conference. In this respect, the Bloomberg consensus points to a +0.1% MoM increase in the headline index and +0.3% for the core measure, which will translate in YoY growth of 3.4% and 3.5% respectively (basically unchanged compared to April)

Staying with prices gauges, the US PPI will also be released on Thursday, as well as the export and import price indices on Friday. Elsewhere, we will get the Denmark and Norway May inflation figures today, the Swedish one on Friday, the final CPI reading in Germany (Wednesday) as well as China CPI & PPI prints. Bloomberg consensus expects an “improvement” there as the Chinese annual inflation rate is seen increasing to +0.4% in May from +0.3% in April, with the PPI also coming in higher relative to the previous reading (-1.5% vs -2.5% in April).

Uncomfortably high inflation in the US, deflation risks in China, what about Japan? Does the BoJ now feels confident enough to lift again rates and/or reduce its JGBs purchases, or does it prefer to wait longer to make sure inflation is definitively moving up to its 2% inflation target on a sustainable way. We will know more on Friday when a quite crucial BoJ decision will be released and analyzed.

Other notable economic releases include the US NFIB Small Business Optimism Index (Tuesday), UK and Eurozone April industrial production data (Wednesday and Thursday), and, to conclude the week, the University of Michigan’s consumer survey on Friday which will also provide insight into consumer inflation expectations among other things. Finally, note that Broadcom, Oracle, Adobe and… GameStop will report their earnings results this week.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.