“The time has come for [monetary] policy to adjust” according to Jerome Powell during its speech at Jackson Hole last Friday, opening the door for a rate cut in September. The main uncertainty remains the path of these incoming cuts: gradually in case of a soft landing (and somewhat sticky services inflation) -our base case scenario- or much faster in case of a recession. Jerome didn’t help much as he just stated the obvious when he said “we don’t seek or welcome further labor market cooling”, while “timing, pace of cuts will depend on data, outlook and risks”. While waiting for a clearer picture (thanks already to data to be released in early September), please find a summary of our latest strategy meeting and our current tactical allocation changes here below.

Macro Narrative: Did “Sahm-one” say recession? – With the Fed keeping rates on hold longer than anticipated by many and activity finally slowing down, it didn’t take long for investors’ tipping point to be reached: bad economic news eventually became bad news for markets too, sparking renewed hard landing fears. While the latest job report showed another increase in US unemployment rate, which triggered the Sahm rule recession bell (i.e. when the 3-month average unemployment rate rises by +0.5% or more from its 12-month low, a recession is underway), subsequent data – such as still historical low weekly initial jobless claims and solid retail sales – proved them wrong, however, suggesting both resilient growth and a first Fed rate cut in September (i.e. not behind the curve), keeping our soft landing scenario intact.

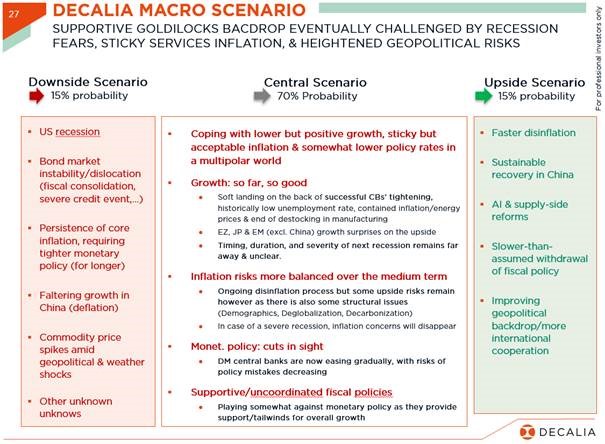

Global Macro Scenario: Supportive Goldilocks backdrop despite topsy-turvy markets – Our base case macro scenario therefore remains unchanged: soft landing with slower but positive growth and slightly above central banks’ target, but acceptable, inflation levels leading to a gradual rates normalization over the next 18 months. Though risks of a temporary reacceleration of inflation and/or an economic soft patch cannot be fully dismissed. In this context, revived geopolitical tensions or any other unexpected external shock may still add some upward pressure to inflation or push the economy into contraction, possibly boost markets volatility (equities, rates, forex and/or commodities). In our view, stagflation or a bond market dislocation would be worst-case scenarios for balanced portfolios, hurting both equities and bonds while impeding an “easy” monetary policy fix.

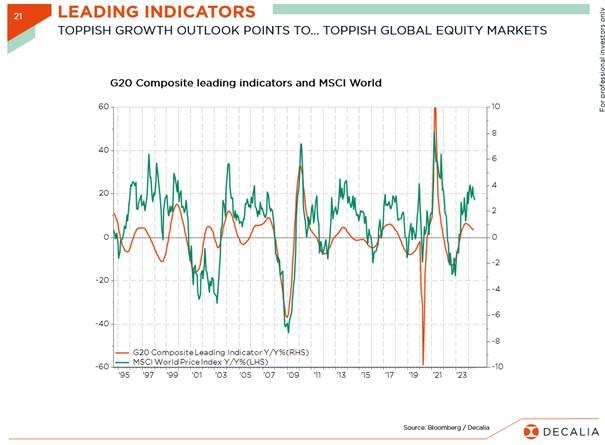

Equity: Summer Rollercoaster – A month to forget for the faint-hearted as equity markets volatility spiked to record levels on macro concerns before fading again. While technical factors (low liquidity; carry trade unwind) can explain the magnitude of the move, it also put an end to July’s big rotation out of growthier stocks. More importantly, these market swings cleaned up much of investors’ prior overly-optimistic positioning: sentiment indicators switched from overbought to oversold within days before returning to Neutral, providing a healthier backdrop today. That’s especially true as the (US) Q2 earnings season proved again solid, with ongoing estimates net upgrades underpinning consensus’ anticipated +10-12% global growth for this year and the next. As far as valuations are concerned, little has changed as today’s elevated equity index valuation multiples conceal a much more complex reality with segments such as Europe & Small-caps still offering attractive value beyond magnificent US titans. Moreover, supportive macro & micro fundamentals combined with declining bond yields should warrant a re-rating of these segments.

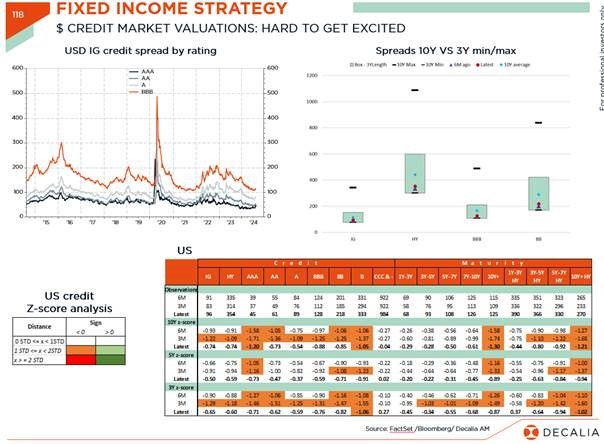

Fixed Income: Disinflation and weaker growth acted finally as tailwinds – Long rates have finally receded as latest disinflation evidence was enough to give the Fed some comfort for starting to ease soon (i.e. September meeting rate cut), while revived recession concerns restored, at least temporarily, diversification benefits of sovereign duration. However, we believe the long end of the curve still doesn’t offer a compelling enough valuation opportunity on duration as a rebound in inflation, higher for longer (neutral) rates, as well as sovereign debt sustainability concerns requiring a higher term premium cannot be fully dismissed at this stage. As far as credit is concerned, spreads have continued to behave well, even during the aforementioned volatility spike in early August, remaining close to historically tight levels and providing a supportive environment for risky assets overall. In this context, we keep a cautious neutral stance on sovereign duration, especially through convex bonds. Meanwhile, our preference for corporates over sovereigns still aims at a hold – rather than a buy – approach towards the short-end of the curve, adopting a selective approach in the HY/EM segment in particular.

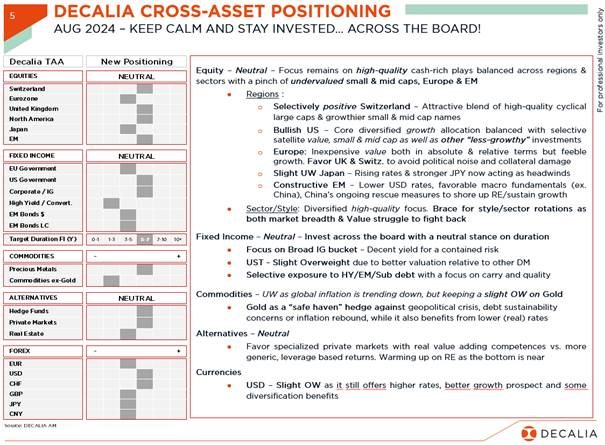

Tactical Positioning (TAA): Keep calm and stay invested… across the board – We made no major changes to our overall asset allocation views. Fundamentally, we remain constructive on equities but still expects bouts of market volatility (nature of landing, geopolitics, monetary easing trajectory, inflation rebound or market rotations among others) as likely to drive some price consolidation, possibly suggesting more muted returns in the near term. At the portfolio level, we keep our (structural) preference for US equity markets with a greater pinch of (actively-managed) small-mid caps and diversified S&P500 equal-weight index allocation, which should benefit most from lower rates and overall cost pressures. Elsewhere, we already reduced our Eurozone equity stance (slight underweight) in the previous month in order to avoid potential trade war collateral damage, especially as growth is again petering out with Germany still struggling. As such, we still prefer other European markets such as the UK and Switzerland (slight overweight). Finally, we retain a cautiously neutral stance on bonds, with a preference for credit at the short end of the curve vs. long term sovereign debt, combined with some diversification in Gold (slight overweight), which is benefitting from the Fed’s anticipated easing cycle and overall uncertain geopolitical context, while keeping a preference for CHF and USD currencies as they offer better risk diversification and fundamentals.

The Bottom-line: Much Ado About Nothing – A lot of noise and volatility but only little investor panic with the global equity rally holding up in quite an impressive manner, once again. Indeed, notwithstanding a widely anticipated growth slowdown, both macro and micro fundamentals are showing healthy signs of resilience and likely to provide support in the near term. In particular, we still expect improving breadth to drive a steady catch-up across equity market segments beyond AI-powered sectors & mega-caps. However, the remainder of 2024 is set to remain eventful for risky assets, having to navigate continued geopolitical tensions, the fate of China, a US presidential election, and AI’s ongoing technological revolution. In this context, we remain cautiously optimistic and continue to favor an all-terrain approach to portfolio construction together with a well-balanced diversified asset and sector allocation tilted towards high-quality plays in equities; favoring credit carry and high quality duration convexity in bonds, while keeping a tangible allocation to Gold combined with USD & CHF as risk diversifiers.

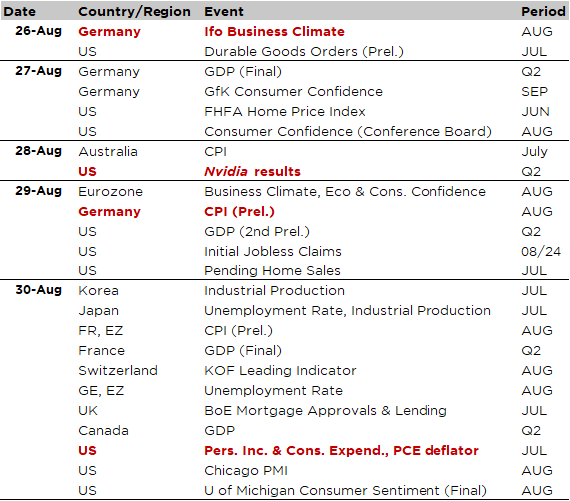

Economic Calendar

Inflation will be the main macro theme this week, with the US core PCE deflator (Fed’s preferred inflation gauge) release on Friday afternoon in the spotlight. Before, we will get Australia July CPI on Wednesday and August flash CPI for major Euro Area economies on Thursday and Friday morning.

Starting with economic data from the US, the focus will be on the July PCE inflation print on Friday (the last one ahead of the Fed’s next decision on September 18). The consensus expects both headline and core index to increase by +0.2% month-over-month, which will bring the YoY change to 2.6% and 2.7% respectively. This release comes along with both personal consumption expenditures and income, as well as the saving rate. Economists foresee moderate but still positive MoM growth of +0.2% for income and +0.3% for real spending in line with prior month’s gains. Other notable US data releases include durable goods orders today, the Conference Board’s consumer confidence tomorrow, weekly initial jobless claims on Thursday and Chicago PMI for August on Friday (latest regional manufacturing index ahead of the US ISM one next week).

In Europe, all eyes will be on the flash August CPIs starting with Germany and Spain on Thursday, with prints for France, Italy and the Eurozone due Friday. The consensus expects further disinflation progress everywhere with annual inflation rate in the Euro Area falling close to the ECB’s 2% target in August (2.2% YoY vs. 2.6% in July for headline, while core inflation should tick down HICP to 2.8% from 2.9%). Apart from inflation data, the other notable releases will be the IFO Business Climate index today (it declined to 86.6 in August from 87.0, in line with once again disappointing German preliminary manufacturing PMI released last week), unemployment rates on Friday and consumer confidence surveys for major Eurozone economies over the week (France probably got a boost from the Olympics).

Last but not the least, the release of Nvidia results on Wednesday evening may indeed steal the show given its direct and indirect importance for global markets, with a market capitalization larger than many national equity indices and its overall impact and influence on the AI/tech macrocosm. Salesforce and Crowdstrike will also report on the same day.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.