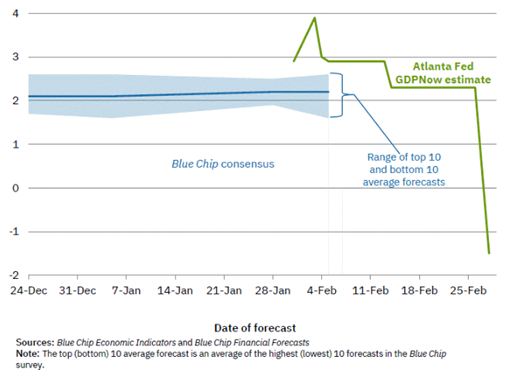

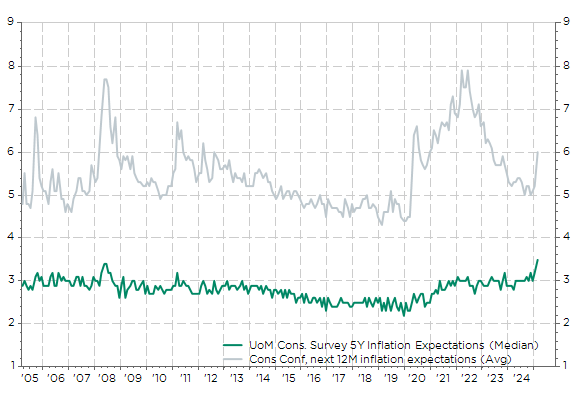

After another creditable defeat against Bologna yesterday, Cagliari Calcio is now stagnating in the Serie A standings, hovering just above the fateful relegation zone. Like my beloved red & blue club, the same seems to be true of the US economy, where the latest figures have for once rather surprised on the downside, particularly as regards consumption in January with a decline in both retail sales and personal consumers spending. As a result, the Atlanta Fed GDPNow real GDP forecast for the 1st quarter has plunged into negative territory… One of the key reasons behind these disappointing consumption figures isn’t due to a weak labor market or an income squeeze (personal disposable income grew +0.9% MoM in January) but to concerns about expectations of a pickup in future inflation as illustrated by the latest consumer’s surveys of the University of Michigan and the Conference Board.

Evolution of Atlanta Fed GDPNow real GDP estimate for 2025:Q1 (Q/Q % change SAAR)

US consumers inflation expectations for the next 12M (Conference Board, average) and 5Y (UoM, median)

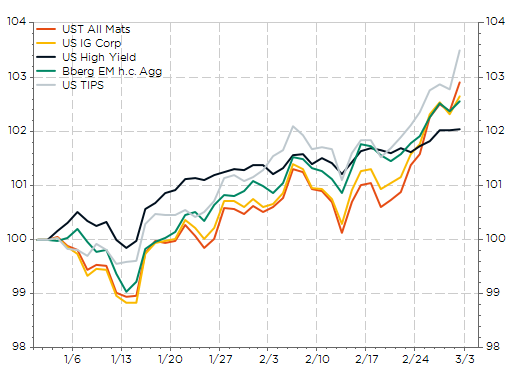

The culprit of higher inflation expectations may be related to the incoming tariffs. “The most beautiful word in the dictionary” for Trump (after disrespect?) but certainly not for most consumers and companies. According to Deutsche Bank’s economists, 25% tariffs on Canada and Mexico, may create a 0.4%-0.7% drag on 2025’s US GDP and boost core PCE (Fed’s favorite inflation gauge) by +0.3%-0.7%. Lower growth and higher inflation, that’s a good recipe for a toxic stagflation cocktail. Against such a backdrop of inflation uncertainty, it may be worth taking a look in TIPS (acronym for “Treasury Inflation-Protected Securities”). TIPS are government bonds issued by the United States whose principal and coupon are indexed to inflation. They are therefore designed to protect investors against the loss of purchasing power due to rising prices and, in fact, they have outperformed other US bond’s segments year-to-date, delivering a total return over +3% in the first 2 months of 2025.

Major US bond indices YTD total returns

Introduced in the mid-1990s, these bonds now represent a market of around $4 trillion, a relatively modest share of the global bond market as a whole, estimated at over $150 trillion. Other governments in Europe (France, Germany, Italy and the UK) and elsewhere (Canada, Australia, Brazil, Mexico and South Africa) also issue inflation-linked bonds. These are generally referred to as “linkers” or “inflation-linked bonds”. However, with very few exceptions, there is no equivalent for corporate bonds.

How TIPS work?

The principal, i.e. the amount that will be repaid on maturity of the bond or when it is resold before maturity, is adjusted according to changes in the consumer price index. Thus, in the event of inflation, the bond’s principal increases. Conversely, in a period of deflation, it falls… However, the investor is guaranteed to recover at least the initial capital invested at maturity (i.e. that’s an important feature as in case of anticipated prolonged deflation, recently issued TIPS offer a relative advantage compared to older ones as the principal inflation-adjustment can’t decrease below 1 or 100%). The logic is similar for the coupons (or interests): these are also adjusted for inflation.

What are the main advantages and disadvantages of TIPS compared with conventional bonds?

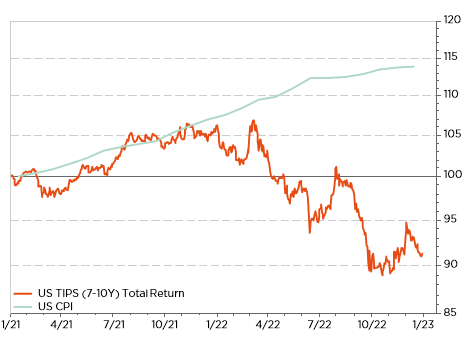

It may seem obvious, but if you really anticipate a sharp acceleration in inflation, the first thing to do would be… not to buy bonds, at least not with excessively long maturities, and to prefer real assets instead. However, as part of a bond portfolio management, TIPS offer a key advantage over conventional bonds: they come up with (some) protection against inflation. As such, they provide a diversification tool within the bond portfolio, particularly useful in times of rising inflation expectations as it has been the case lately. Beware, however, of the difference between theory and practice… First, their real yield may turn out to be lower than that of conventional bonds if future inflation is ultimately lower than that currently “priced in”. Then, inflation won’t be stable over time (TIPS should be favored at the expense of traditional Treasuries if you expect… an unexpected pick up in the inflation rate in the foreseeable future). Finally, there is no guarantee of a perfect or timely inflation protection in the short term. In other words, you may lose money both in nominal terms (and even more so in real terms) during a period of higher inflation… as it was the case in 2021-2022.

US 7-10y TIPS total return & US inflation between 2021 and 2022

Let’s take a concrete example by comparing a traditional 10-year US Treasury bond with a TIPS (Treasury Inflation-Protected Security) of equivalent maturity. The former currently offers an annualized nominal yield to maturity of 4.24%, while the latter has an “expected” real yield of 1.87%. This means that average inflation expectations in the US over the next ten years stand at 2.37% (4.24% nominal – 1.87% real = 2.37% of expected inflation).

Consequently, if you hold these bonds to maturity and expect average annual inflation to exceed 2.37% over this full period, TIPS will be more advantageous than the traditional Treasury bond. Otherwise, the latter will remain the better choice. But this scenario remains somewhat “theorical”, while the reality is often more nuanced: investors generally don’t hold these instruments for ten years. What’s more, inflation will not be stable over the entire period, which could make TIPS more attractive tactically -at least in relative terms- if a sharp acceleration is expected in the coming quarters. Against this backdrop, the daily price trend – and therefore the real yield to maturity – of TIPS depends on the market’s “expected” real rate. The latter is influenced both by the nominal rate (that of conventional Treasury bills) and by inflation expectations.

It is therefore impossible to know precisely and in advance the sensitivity of the TIPS price to a variation in the nominal rate… unlike conventional bonds, for which duration provides a good approximation of this sensitivity. Indeed, if the nominal rate varies by ±10 bps (i.e. ±0.1%) in one day, it is impossible to determine in anticipation how much of this movement is due to changes in the real rate, and how much to an adjustment in inflation expectations for the coming years. In this respect, it should be noted that the TIPS duration should be thus calculated using the real rates that’s why various suppliers of financial information consider a priori, and in a purely arbitrary and theoretical way, that it is about half and half, thus attributing a duration twice as low to TIPS as to Treasury notes of the same maturity.

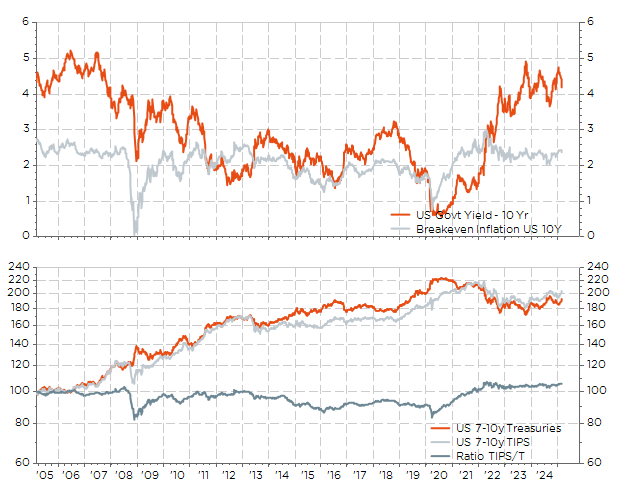

As a graph is worth 1’000 words, let’s take a look at the 2 long term graphs (over the last 20 years) here below to draw several key interesting takeaways

Chart 1: US 10-year (nominal) yields and inflation expectations over the next 10 years

Chart 2: Absolute and relative performance of TIPS (7-10y) versus US Treasuries of the same maturity

- It’s better to buy TIPS when inflation expectations are (exaggeratedly) low, like in 2008 or 2020. Just as it’s better to buy insurance when its price is low, because people underestimate the underlying risk.

- When we enter a recession, inflation risks tend to diminish rapidly, so it would be better to invest in traditional bonds (pre-2008 or pre-Covid, for example).

- When inflation rises, both in figures and in expectations, as between 2021 and 2023, TIPS do not necessarily deliver a positive performance (right away), as real rates may also rise. However, in relative terms, losses are more contained than with Treasury notes.

- Over the past 20 years, the TIPS total returns have been slightly higher than traditional Treasury notes. However, it is only recently that they have overtaken them (thanks to the return of inflation since the covid-19), whereas the long decade preceding the great financial crisis, characterized by an heightened persistent risk of deflation, was rather favorable to traditional bonds.

Given today’s highly uncertain inflation environment, do TIPS represent an opportunity in 2025 or, on the contrary, an asset to be avoided?

As the current environment is marked by a high degree of uncertainty, I would say neither… It would seem prudent to hold a certain proportion, as a re-acceleration of inflation – and above all of future inflation expectations – remains a possibility in the months ahead. This could happen in particular if US growth surprises again on the upside, and/or if the new US administration trade tariffs are applied across the board, swiftly and indiscriminately. It would be even better (for TIPS) if US trading partners were to launch retaliatory measures that would lead to even more inflation globally, and certainly also to an economic slowdown… and thus to a potential stagflation scenario. As a result, we currently hold 3 positions split into 1y, 10y and 30y maturities in our DECALIA Global Income fund, representing 5% of its total assets under management. Conversely, it is also conceivable that US growth prospects could deteriorate faster than expected, due to a slowdown in consumption, which already seems to be apparent at the start of the year, and a possible deceleration in CAPEX within the AI ecosystem.

What other bond opportunities could arise going forward?

At present, there are no longer any obvious opportunities in the bond market. Long-term interest rates seem to broadly reflect our macroeconomic scenario, which remains relatively consensual: relatively stable global growth, slightly declining inflation reaching acceptable levels, and, consequently, a gradual normalization of interest rates that will adjust accordingly to economic data releases. In the meantime, credit spreads, which are near historically low levels, leave little room for any economic disappointments or a deterioration in financial conditions. However, this does not mean that performance will be disappointing this year, nor that new opportunities could not emerge in the coming months.

Donald Trump’s new policies will certainly have numerous effects on bond markets, both in the short and long term. Whether in terms of fiscal policy, regulatory reforms, tariff measures, stricter immigration controls, or concerns about debt sustainability, these factors could impact the evolution of interest rates and credit spreads. Not to mention a potential challenge to the Federal Reserve’s independence. Additionally, major geopolitical developments or significant events in the eurozone could also influence bond markets, such as a potential ceasefire in Ukraine or a reform of Germany’s debt brake, for example.

In this context, I anticipate that interest rates and credit spreads will remain generally stable… on average. However, a downward bias seems likely for interest rates, while a widening of credit spreads cannot be ruled out. So, the key to success over the coming months will lie in the ability to adapt and react quickly to ongoing developments while adopting a selective approach to asset selection. The goal will be (in theory) to avoid poorly compensated risks and identify (quickly enough) pockets of (relative) value, while waiting for greater clarity. Capital should then be redeployed toward future sources of performance. That’s why it’s also key to keep a liquid enough portfolio.

In other words, bond’s managers are currently in the same situation that Davide Nicola, Calgliari Calcio coach, and his closest peers: they will have to adapt to other teams results and overall conditions of each game (the context), win the games against the closest adversaries (relative value), avoid losing excessive forces or key players -due to injuries or red cards- when playing against top clubs (avoid poorly compensated risks) and have enough good players on the bench (liquidity) to eventually turn the game around in its favor. Keeping these basic rules in mind is a prerequisite to stay in Serie A next season, while also keeping our top 5-stars Morningstar rating going forward.

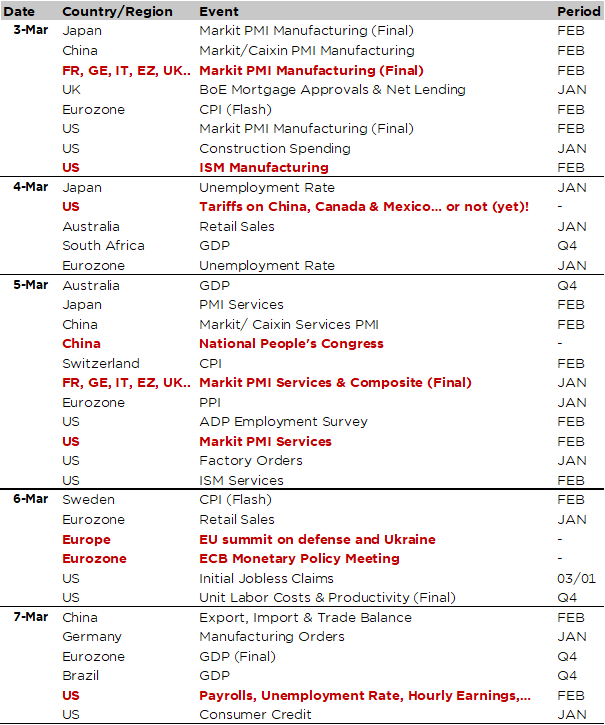

Economic Calendar

Welcome to… March Madness as this month kicks off with a busily packed schedule for investors. Let’s start for once with politics: the deadline for a potential start of proposed 25% tariffs on Canada and Mexico, as well as an additional (i.e. new) 10% on China according to last week Trump’s declaration, is set for tomorrow (March 4th). Tic tac tic tac… Overall, it’s hard to see China tariffs being negotiated lower but there’s still a chance that those on Mexico and Canada could finally be lower. We will soon know. Then, the annual session of the Chinese National People’s Congress will start on Wednesday. Investors expect to get some answers about how much Beijing is willing to boost stimulus, support private businesses, and respond to Trump’s trade policies. The following day, another special and, once again “emergency,” EU summit on defense and Ukraine will take place.

Turning to economic data, there will be an abundance of releases, culminating with the US jobs report on Friday. The Bloomberg consensus expects payrolls to gain +160k in February (+143k in January), unemployment rate staying at 4.0% but hourly earnings growth returning to +0.3% MoM from +0.5% the prior month. Before that, we will get the ISM indices in the US as well as the final readings for February of PMIs across the world (manufacturing today and services on Wednesday), while the ECB will meet to very likely cut its policy rates by -25bps on Thursday. Fed Chair Powell and ECB President Lagarde also have scheduled appearances on Friday. Elsewhere, February CPIs are due in Switzerland (Wednesday) and Sweden (Thursday) and Q4 GDPs in Australia (Wednesday) and Brazil (Friday). Note also the release of shunto wage hike demands by labor unions on Thursday as a key event for Japan, possibly influencing the BoJ monetary policy stance in the short term.

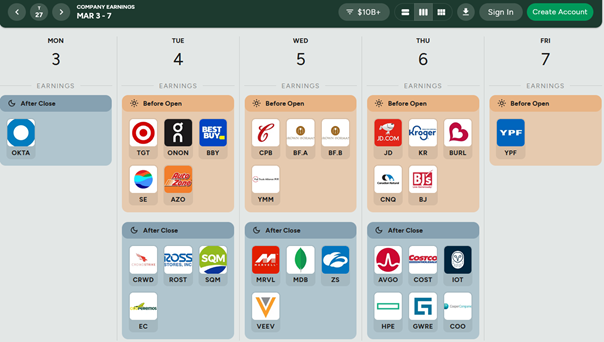

Finally, the earnings season is coming to an end, especially in the US, with less than 20 S&P500 companies left to report… The focus this week will be on the results of Broadcom (part of the BAATMAN acronym), Marvell and Crowdstrike in tech, and Costco for taking the pulse of US consumers.

Non-exhaustive list of major earnings releases over the week (market cap > $10bn)

Source: https://earningshub.com/earnings-calendar/week-of/2025-03-03

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.