No miracle for Cagliari Calcio this weekend, who logically lost to Juventus by the narrowest of margins (0-1) against one of Serie A’s tenors. But sometimes in soccer, as in the market or in life, there are surprises, unexpected turnarounds and even some unthinkable flip-flop that shake up the established order. A case in point is what has been happening in Japan over the last few months with Japanese governments bonds’ yields creeping higher in parallel with inflation expectations and the subsequent expected BoJ rates normalization going forward.

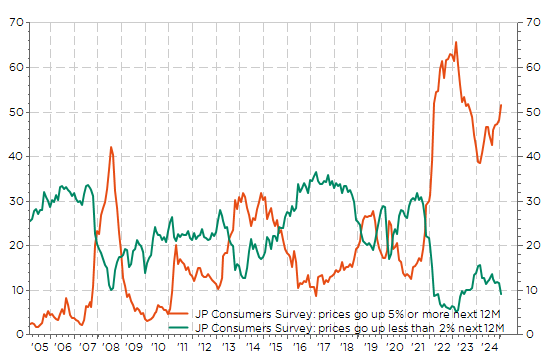

For once, since I started my career more than 20 years ago, there is a real chance that the vicious deflationist spiral experienced by Japan following the burst of its real estate bubble at the beginning of the 90’s is finally coming to an end. Not only consumers inflation are becoming more entrenched according to the latest survey (see graph below) but the recent economic data were also encouraging with Q4 GDP exceeding largely expectations.

Japan consumers expectations about price: more than 50% of households expects price to go up at least 5% over the next 12 months

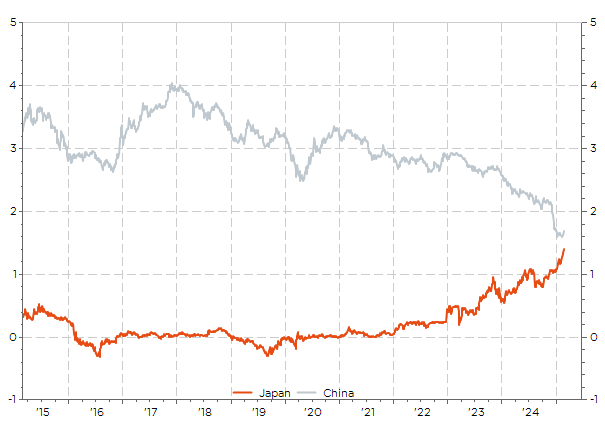

In the same time, Chinese government long bonds rates have experienced a continuous and unnoticed decline. Forget about the 10% or more GDP growth at the beginning of the century… China is now growing barely at 5%, thanks to ongoing government support, while it is flirting with deflation! As a result, China 10y bond’s yields are now close to become the lowest among the key sovereign markets within the Global Aggregate Bond Index. Who would have thought it?

When Chinese economy turns Japanese: China vs. Japan 10y bond’s yields at the crossroad

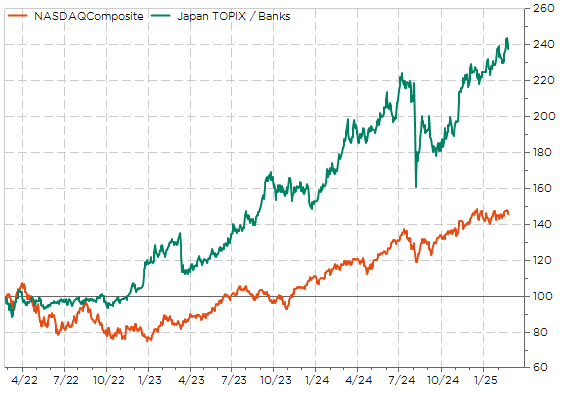

Another unnoticed consequence of Japanese rates normalization is that Japanese banks, not really the most hyped, discussed or fashionable segment on the equity markets, have outperformed over the last 3 years not only the MSCI world but also the US tech -heavy Nasdaq index… by an outstanding margin! Note also that European banks, another below-the radar and unloved sector, did very well during the same period: it clearly outperformed European broad indices. Rates normalization in Europe, coupled with more than a decade of restructuring, bear their fruits apparently.

Another consensual theme has been challenged recently. The now too-famous and thus certainly too-easily-accepted US exceptionalism. As it is all relative in financial markets, there are some signs nowadays that

- US is perhaps not as great as were assuming. US consumers are showing some signs of fatigue according to the latest retail sales and confidence survey, the Mag 7 are down YTD, inflation or debt sustainability concerns may resurface

- The rest of the world is perhaps not coping as bad as we thought: Japan economic activity data have rebounded and BoJ is still at the early stage of its hiking cycle; China is regaining some colors as narrative seems changing thanks to Deepseek -at least in terms of sentiment-; while recent developments regarding Europe appear also going in the right direction eventually (cease fire in Ukraine, increase in defense spending leading to more fiscal and budgetary integration, or a possible German debt brake reform down on the road)

In other words, US exceptionalism is currently being challenged by a Europe that is waking up, a Japan that is normalizing its interest rates, and a China that is perhaps becoming again investable. All the good news for the rest of the world are coming together, turning the sentiment around and taking out some of the excess pessimism and the associated negative risks premium out of these markets. So far, one of the major beneficiaries of this US exceptionalism has been the greenback due to the lack of alternatives in both the developed world (lower economic growth, earnings growths and interest rates elsewhere) and the emerging world (political instability, little respect of property rights and limited market size). If we now imagine the rest of the world regaining some of its appeal to investors, then the US and its assets may well become a little less exceptional.

For sure, there is still a long way before hopes and dreams come true but it these trends should continue, i.e. less favorable for the US and more favorable for the rest of the world, the US dollar will probably tend to move lower (i.e. depreciate) against the major currencies. A development usually favorable for financial markets overall, and especially for risk-assets outside the US. In sports, like in financial markets, the hardest thing is not getting to first place but staying there. Just ask to a Napoli’s fan!

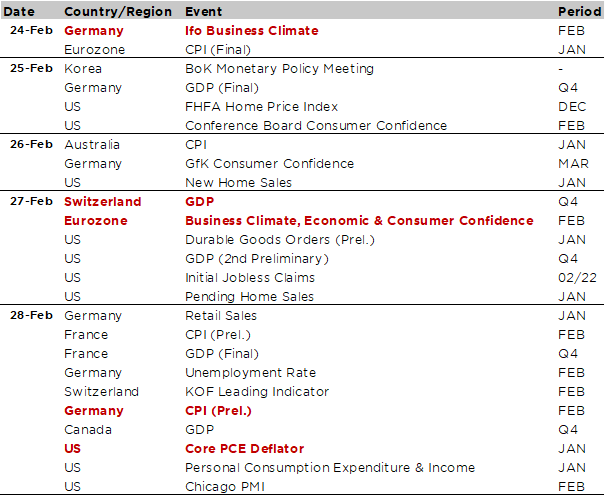

Economic Calendar

Not so happy “celebration day” as today marks the 3rd year since the Russia-Ukraine conflict began and 5 years since the Covid-19 first started to seriously hit financial markets, when a partial lockdown in North Italy was introduced during the week-end. At least there weren’t any specific bad news coming from the German election results last night as the center-right and center-left should have sufficient seats to form a grand coalition… even if this centrist parties’ coalition will clearly fall short of a two-thirds majority to move in a fast and straightforward way regarding the much needed debt break reform. In other words, it means that any debt brake reforms would require enough/significant political compromises to the smallest parties in order to gain the support of one or more of them.

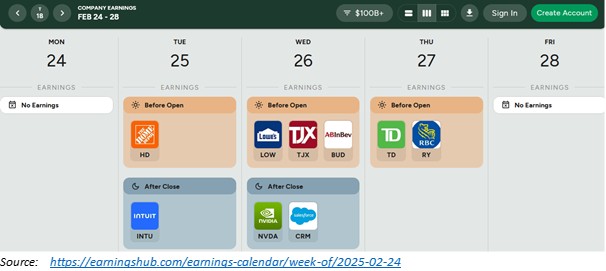

Moving to the economic and financial markets agenda of the week, the main economic data releases include the US January PCE deflator on Friday, along with personal consumption expenditures, income and savings rate, the preliminary estimates of February inflation in Germany and France (still on Friday), as well as a number of consumer and business sentiment gauges over the week. As far as companies’ earnings results are concerned, the spotlight will definitively be on Nvidia on Wednesday (after the close).

All eyes will be on the Fed’s favorite inflation gauge (core PCE deflator), following a higher-than-expected CPI print lately and the rising consumers inflation expectations according to the latest University of Michigan Consumer sentiment (next 5-10y inflation rose to 3.5% in February… highest level since the early 90’s). The Bloomberg consensus expects a +0.3% increase MoM for both the headline and the core index, which will translate into YoY gains of 2.6% and 2.8% respectively, a touch higher than the prior month (2.5% and 1.6% in December). The consensus also expects some moderation in consumption and income growth with a slower, nut sill positive, MoM readings. Other notable US economic data include the Conference Board’s consumer confidence tomorrow and the durable goods orders on Thursday (a good indicator of capex when excluding defense and transportation orders).

Outside the US, Q4 GDP reports will be due in Canada and Switzerland this week, while we will also get the January CPI print for Australia on Wednesday. In Europe, the focus will be on the flash February inflation prints for Germany, France and Italy on Friday. This morning, the German Ifo came slightly below expectations but didn’t moved markets, which were probably more focused on the German elections results. Note also that many central bankers’ speeches and interviews will take place, on top of a G-20 meeting in Cape Town on February 26-27.

To conclude with the corporate earnings, the spotlight will be on results from Nvidia (Wednesday), given its market cap and its overall importance in the AI sphere. Other companies’ Q4 results to keep an eye on include Home Depot, TJX, BASF or Deutsche Telekom among others.

Non-exhaustive list of major earnings releases over the week (market cap > $100bn)

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.