Second-hand online exchanges are thriving, thanks to the pandemic but not only.

Going forward, they stand to play a key role in a more circular economy…

…as well as being an attractive – high margin/return/growth – investment space.

The move towards a more circular economy is far from just a short-term fad. Unlike many other “green” transitions that have had their fashionable moments during the past decades, this one makes complete business sense. Consumers like it and investors ditto. With perhaps no more compelling an example than online marketplaces.

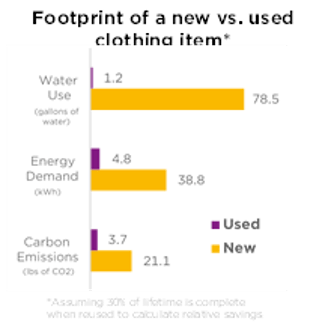

The behavioural shift towards buying vintage products is the first pillar of the investment thesis for internet exchange platforms. Consumers feel good when making such a purchase not only because it saves them money (the “I found a bargain” type of sentiment), but also because they are acting in a more environmentally friendly manner by keeping a used product in the loop – avoiding unnecessary waste. Which thus makes for strong underlying growth in demand.

Then, for the more established marketplaces, comes one of the most robust competitive advantages of all, network effects. These are commonly defined as the “phenomenon whereby a product or service gains additional value as more people use it”. Put differently, the greater the choice a buyer has, the more he/she will value the marketplace and the more frequently he/she will return. This larger pool of buyers will in turn attract more sellers, making for an increasing number of transactions – and attracting yet more users. eBay, Etsy and Mercari, for example, have opened up a much broader potential market for households and local artisans.

Completing the investment thesis for marketplace companies are their high margins, high returns on capital, low capex intensity and, last but not least, their scalability. Once a platform is up and running for a million users, it can comfortably host many more – Facebook Marketplace being perhaps the ultimate example. Note also in this regard that the growth in user base has proved particularly strong during the pandemic for many of the marketplaces that we monitor, promising rich payoffs in the years ahead.

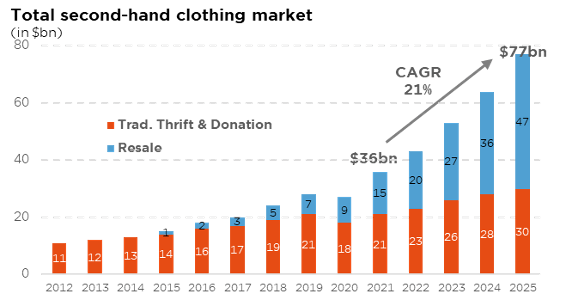

In terms of types of products sold, second-hand clothing stands to be one of the fastest growth areas over the next years, powered by the younger generations. According to a recent report by ThredUp, the world’s largest fashion resale platform, itself based on GlobalData surveys, over 40% of Millennial and Gen Z shoppers bought used clothes, shoes or accessories in 2020. Sales are expected to double over the next 5 years, from $36 bn in 2021 to $77 bn in 2025, as more and more consumers purge their wardrobes. Just consider: of the 52.6 mn total sellers in 2020, 36.2 mn did so for the first time.

Automobiles too are a fast-growing segment, boosted by pandemic side-effects such as a desire to maintain the social distancing that individual transport provides, receding income levels and supply-chain issues hampering the production of new cars. Allied Market Research expects the global market for second-hand cars to reach $1,355bn by 2027, up from $828bn in 2019. And online exchanges in this space are not just a matter of buying/selling used cars. Turo, for instance, which is looking to go public this year, seeks to become the equivalent of Airbnb in car rental. Ultimately, what marketplaces make possible is a form of optimised buying, whereby consumers need not cut back on their purchases or “deprive” themselves, but avoid unwarranted wastage and environmental impacts. Which definitely looks like a win-win proposition – including for investors. And one that could be particularly timely, given the recent sector rotation that has brought down multiples on IT high-flying stocks, making them more attractive now on a long-term basis.

Taking the rough with the smooth

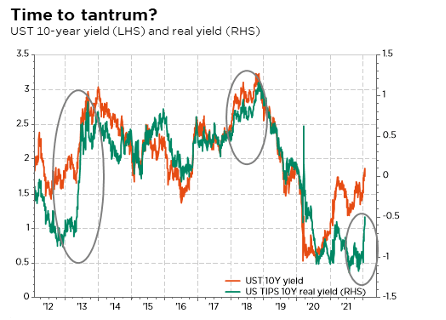

What a start to the year! Volatility levels have spiked, markets whipsawed and rates crept up, as investors struggle to digest the increasingly hawkish Fed rhetoric since the end of 2021. The bellwether S&P500 index posted its worst January performance since 2009, with damages even more severe below the surface. “Long duration” assets, particularly unprofitable ones, have been pulled down by interest rates gravity – growth, small-cap, quality and “stay-at-home” stocks being the greatest victims of the sharp backup in real yields.

In this context, the latest Fed meeting did nothing to help temper growing speculation that it has now fallen behind the curve and may soon need to embark on a fast (and eventually furious) first stage of rate tightening in order to get inflation back under control. As a result, markets are now pricing almost five hikes this year, compared to “half-one” last summer. A month ago, we wrote that “the next market upleg will be no walk in the park, with volatility set to increase again”. This unfortunately proved prescient in a shorter timeframe than we expected.

Although the macro environment is becoming less friendly, with slowing growth, elevated inflation and higher rates, it remains supportive overall for equities. Indeed, economic growth should remain robust, above potential, inflation is expected to roll over after spring, and real rates will likely stay negative. What this transition backdrop simply suggests is a slower pace of stock market gains, more corrective episodes and higher volatility. In terms of earnings, this reporting season has so far been mixed, with no change in the big themes (solid demand and strong corporate balance sheets). Most of the companies that have already reported beat expectations, but ca. 2/3 of them have cut their guidance due to lingering supply chain frictions and input price pressures.

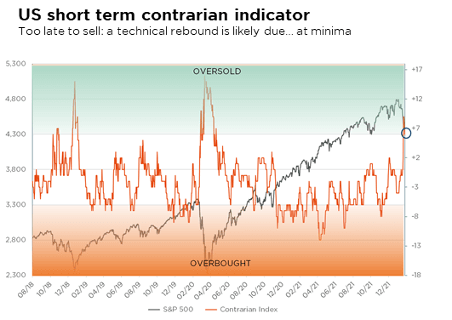

While higher volatility is likely here to stay, there are good news too. First, investors did not begin the year eating the cake… Valuations have eased further, volatility may actually serve as a fertile ground of opportunities, given current oversold conditions and depressed sentiment indicators, and EPS growth expectations for the foreseeable future remain reasonable. Cherry on the cake, equity markets, as well as commodities, have a good track record in coping with inflation, rising rates and hiking cycles, so long as these are driven by economic expansion. Which looks to be the case as the Omicron-caused slowdown will be short-lived and Chinese economic policy is now shifting to a more accommodative gear.

As a result, we stick to our constructive global macro scenario, keeping our asset allocation broadly unchanged as we navigate this “transition period” dominated by the inflection in financial conditions. At the portfolio level, we thus maintain our slight equity overweight. The recent market vulnerability to higher real rates supports our more balanced approach in terms of sectors (energy, materials & financials), size (large-cap) and style (value). Hence also our warming up to UK equities, as the FTSE ticks all the boxes.

In fixed income we remain underweight but keep our 7-10y US Treasuries position as a hedge against a policy mistake or geopolitical turmoil. As regards currencies, the USD should continue to benefit from higher rates overall and the monetary policy divergences. Finally, in commodities, beyond keeping our gold allocation as a safe haven, we remain constructive on base metals and energy fundamentals, for both structural and cyclical reasons that have led to rarely seen supply-demand imbalances.