In a week overshadowed by the geopolitical tensions in the Middle-East after the terrorist attack from Hamas in Israel, the IMF’s latest economic outlook, released last week during the annual meetings of the IMF and World Bank in Marrakesh, went almost unnoticed.

While it wasn’t obviously as tragic as many events currently unfolding around us, it painted however and unsurprisingly a rather sobering picture with global economic growth slowing and persistent inflation risks.

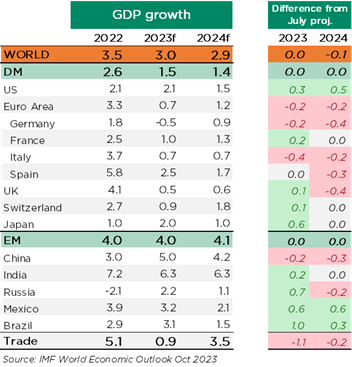

The key message of this report is the global recovery remains slow, with growing regional divergences and little margin for policy error… As far as the divergences are concerned, it’s quite clear that the US has surprised on the upside so far this year, thanks to resilient consumption and investment trends, while Euro Area activity was revised downward after too enthusiastic expectations last winter on the back of falling energy prices and China’s reopening hopes, which proved rapidly too optimistic due to the ongoing headwinds from its real estate crisis and the weakening confidence of the private sector. Finally, many EM proved quite resilient, with the notable obvious exception of China. As a result, IMF growth projections for this year and next have been revised higher for the US and some EM and lower for Euro Zone and China. See the table here below.

IMF growth projections (Oct 2023)

The recovery in services sector is now almost complete but a large part of the slowdown is rather the result of the tighter monetary policy necessary to bring inflation down. This is starting to bite, but the transmission is uneven across countries. These divergences are also due to the fiscal policy as illustrated by recent budget policy developments in the US or Italy, while other governments are trying to regain or keep control of their budget. In this context, it’s worth mentioning the economies which have some ammunitions left (i.e. their governments haven’t been so spendthrift in the past and/or during the Covid) such as Australia, Germany and Switzerland…, while also keeping in mind that higher government debt tends to crowd out private sector debt: look at Italy for example, or China and Switzerland for a reverse example (low government debt and high private sector debt). The good news is that despite signs of softening, DM labor markets remain buoyant, with historically low unemployment rates helping to support activity, while acting also as a floor for inflation.

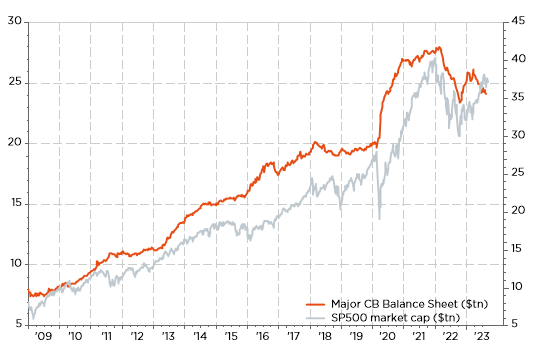

What are the challenges going forward? Fine-tuning monetary policy adequately (i.e. avoiding to ease prematurely or overtighten) is top of the list obviously. It seems quite clear that most DM central banks have done their job on rates now or very close to (except Japan obviously), but it’s more about the alignment of fiscal and monetary policies and rebuilding eventually fiscal buffers, which have been severely eroded by the pandemic and the energy crisis. Strangely enough, and perhaps not entirely coincidentally, I haven’t spotted many mentions in the IMF latest report or heard many talks recently from our central bankers about the Quantitative Tightening… While there is now a widely shared consensus among both investors and central bankers about the trajectory in policy rates in the foreseeable future, nobody is speaking anymore about the central banks’ balance sheet. For the Fed and the ECB, their balance sheets (which may be interpreted as a form of liquidity in the system), is still much higher than pre-covid, at about $8tn and $7.5tn respectively, compared to circa $5.5tn and $4.0tn at the beginning of 2020. As David Zervos (Chief Market Strategist at Jefferies) rightly pointed out in a small meeting in Geneva last week, it will be indeed interesting to know what Jay Powell, Christine Lagarde, Kazuo Ueda or Thomas Jordan consider as a “neutral level” for their respective central bank’s balance sheet… And if they plan to continue QT in the case they need to cut rates at some point? Here is a topic which will likely move in the foreground in coming months.

There is still (too?) ample liquidity in the system: will Quantitative Tightening continue if central banks cut rates at some point?

Last but not least, with a bleaker medium- term outlook on the back of lower growth, higher interest rates, and reduced fiscal space, structural reforms become thus key. That’s good, because 2024 is coming with important elections in US, Mexico, India, South Africa, Indonesia, Taiwan or Russia among others, representing circa 80% of world’s equity market cap, 60% of world GDP and 40% of world population. So, let’s just hope that both our central bankers, as well as our future leaders, won’t mess up in the next few years as the context is getting more challenging and intricate than ever.

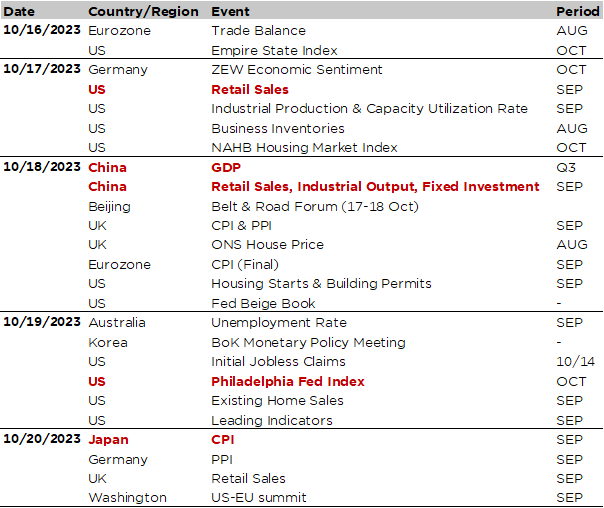

Economic Calendar

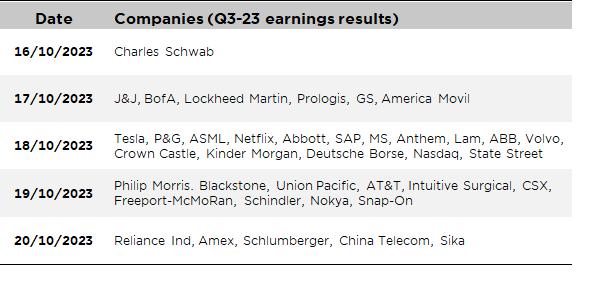

US retail sales (tomorrow), China Q3 GDP & monthly activity indicators (Wednesday) and Japan CPI (Friday) will be the main economic releases of the week, while there will be also a long list of central bankers’ speeches and interviews (with Jay Powell speaking on Thursday) and some notable earnings releases too.

After last week sticky inflation data, investors will focus on last month growth dynamics with the releases of September retail sales and industrial production tomorrow. The consensus expects some softening in growth momentum after a strong summer with a slight increase in retail sales (+0.3% and +0.1% excl. auto & gas) after stronger gains the prior month (+0.6% and +0.2% respectively) and a flattish industrial activity (vs. +0.4% in August). We will also get several housing market data this week with the releases of the NAHB housing market index for October (tomorrow), housing starts and building permits for September (Wednesday) as well as existing home sales (Thursday).

Turning to Asia, the key releases include China Q3 GDP and the latest monthly economic activity data (retail sales, industrial output, fixed investment) on Wednesday, as well as the Japan CPI on Friday. For the former, the consensus estimates China growth somewhat picked up last quarter (+1% QoQ vs. +0.8% in Q2) resulting however in a YoY growth deceleration to 4.5% from 6.3%. Investors will likely focus more on the recent monthly indicators in order to assess if the Chinese economy is showing tentative signs of sustainable recovery and/or if it needs further stimulus. In Japan, both headline and core inflation are expected to slow somewhat to 3% and 4.1% in September from 3.2% and 4.3% respectively the prior month and will be key ahead of the next BoJ meeting at the end of this month as the YCC could be abandoned.

Finally, there won’t be many important releases this week coming out from Europe, but the German ZEW tomorrow and UK CPI (tomorrow) are still worth a look. As far as corporate earnings are concerned, we will get the results of some S&P500 heavyweights such as J&J, Tesla, Netflix, P&G or BofA and key semiconductor players including TSMC & ASML.

Non-exhaustive list of 2023-Q3 major earnings releases over the week

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.