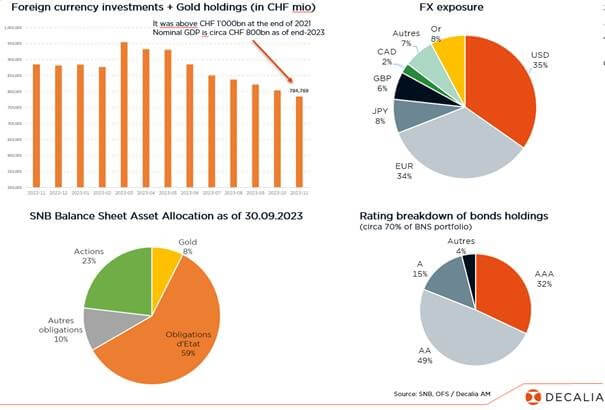

In a recent press release, the SNB published a preliminary version of its accounts for 2023. After losing CHF 132bn in 2022, it lost again circa CHF 3bn last year. To put these losses in perspective, they represent more than 15% of Swiss GDP and almost 4 times the AuM of Compenswiss (Swiss retirement compensation fund). As a result, the SNB decided that it won’t make any profit distributions to the Swiss Confederation and Cantons. As the SNB Observatory explains in its latest comment, it actually made a profit of CHF 4bn on its foreign positions (i.e. a portfolio of bonds and equities, both denominated in foreign currencies) as the strong performance of financial market -especially over the last quarter- more than offset losses due to the appreciation of the Swiss franc over 2023. Its gold position, representing circa 8% of its balance sheet, added CHF 1.7bn.

Deep Dive into SNB Balance Sheet (foreign currency investment + Gold)

However, its interest payments to banks amounted to CHF 8.5 billion as the interest rate has risen (SNB prefers to call them “losses on Swiss Franc positions”…), resulting finally in a CHF 2.8bn loss. Like most other DM central banks, the SNB has been remunerating the deposits of banks (their reserves) since the GFC. For many years, the interest rate was negative, so banks were paying the SNB for holding their reserves but as the reference rate has become positive, the SNB is now paying banks…

While there is no doubt that the SNB has perfectly fulfilled its “price stability mandate”, and even managed very well through the covid & post-pandemic periods, I am not so sure they really deserve a standing ovation… First because of the almost unlimited means they have used with a balance sheet that culminated above CHF 1’000bn back in 2021. The only limit they face is the size of global forex/financial markets as illustrated when they abandoned the 1.20 floor against the EUR before ECB QE (it may seem obvious but the CHF currency is a marginal player compared EUR, USD or JPY within the forex market).

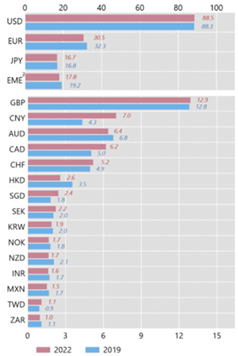

David vs Goliath(s): FX turnover by currency

Source: BIS Triennial Central Bank Survey of foreign exchange and OTC derivatives markets in 2022. Note that the figures sum to 200% as currencies trade by pair

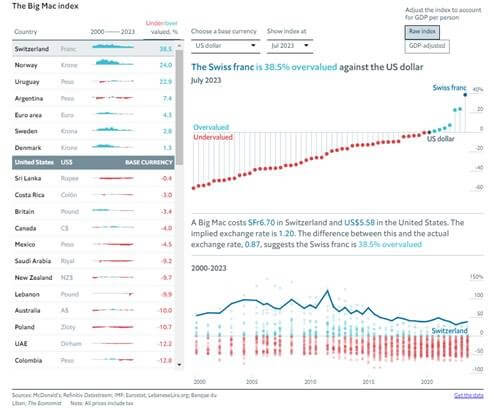

Then, while the SNB has clearly achieved its price stability objective, it hasn’t really impeded the appreciation of the CHF currency, which is indirectly also part of its mandate. Moreover, we may even argue that it is because of the structural factors underpinning the strength of the Swissy (nickname for the Swiss franc) that Swiss inflation has been under control. Namely healthy public finance and high savings rate leading to an extraordinary large current account balance for an economy without any basic resources.

The Big Mac Index: Not sure the SNB is loving it given the CHF overvaluation

So, contrary to what the SNB told us back during the European debt crisis, the key reason of the ongoing strength of the Swiss franc has nothing to do with the « evil speculators » who can sometimes accelerate the movement but are not “The” origin of this issue (the ongoing appreciation of the CHF is, in fact, the flip side of the interconnected positives of the CHF: huge trade surplus, low inflation, resilient growth, very little government debt, exports with high added value – not very sensitive to exchange rates -, strong productivity gains, high saving rates, etc.). To make a long story short, the monetary policy isn’t really effective over the medium-long term to weaken the CHF… except perhaps if the SNB continues to “burn” our excess savings via un-profitable investment in foreign bonds (made when their yields were close to zero and sometimes even negative, while the CHF was not as strong as today or their currencies value wasn’t yet eroded by the inflation spike experienced in US or in Euro Area)

Switzerland Current Account as a % of GDP: world champion for an economy without basic resources

If Swiss government and households will spend more, it may help to reduce the excess savings and thus the current account surplus.

Here is the math:

GDP = C + I + G + (X-M)

GDP – (C + I + G) = X-M

(GDP – (C+G))-I = X-M

S-I = X-M

Unfortunately, low or even negative rates aren’t really effective as both Swiss government and households are insensitive to rates! Government deficit is not allowed by law, while the private sector has already loaded plenty of mortgage debt (in excess of 100% GDP)… for those who are able to afford it (less than 40% of homeowners in Switzerland). In other words, some changes around that will help to weaken “more durably” the CHF. Likely at lower financial costs than the SNB interventions and for a greater benefit to the overall Swiss economic agents.

The irony of the situation is that the Swiss National Bank contributed in part to its recent loss since it « indirectly » bought CHF last year by reducing the size of its investments in foreign currencies (dollars, euros, JPY, etc., must be sold for CHF!). Note that if the Swiss National Bank stops reducing the size of its balance sheet, it does not necessarily mean that the CHF will depreciate but that it could possibly appreciate more slowly. It will also depend on the risk-off context (the CHF is not likely to depreciate much) or risk-on (the CHF could indeed experience a lull, during which the Swiss National Bank might accelerate its sales of foreign assets… and thus slow down this movement!?)

You can think of it as a treadmill continuously moving in the direction of the Swiss franc’s appreciation due to the enormous trade surplus/current account surplus (demand for CHF > supply of CHF). Certainly, you can run against the flow by selling CHF, but this strategy has its limits… as we saw in 2015 or last year. Either because you cannot run fast enough at certain times (2015) or indefinitely against the flow. And when you catch your breath, as in these past two years, you are inexorably pushed in the direction of the treadmill’s movement… Heads you lose, Tails you don’t win!

Last point, as noted in the last article of the SNB Observatory (“The decision not to distribute in 2024”), “The cantons and the Confederation have every right to complain about the arbitrary provisioning policy according to which the provisions are increased by 10% every year without any justification given. It deprives them of a fair share of the wealth that belongs to the people. The Bank council would be in a position to reverse this practice, since it is within its mandate to approve of the provisioning proposed by the Board.”

Almost unlimited means, significant losses, a still overvalued CHF, some arbitrary provisioning policy, … it’s perhaps time for Swiss authority, through the elected people in the SNB Council, to challenge the SNB on the true costs and the effectiveness of going against the CHF appreciation flow, explore openly other possibilities (such as a sovereign fund at the benefit of the Swiss citizens) with their pros and the cons and force the SNB to be less opaque in general. Independence is not a blanc-seing. In particular, SNB should be the first to explain to the authority and citizens that the strength of the CHF is structural (it thus can’t really impede it over the medium-to-long term) and, while it undoubtedly does it best for maintaining price stability and favor economic growth, it should be more open, favor both internal and external debate and even bring valuable insights to the Swiss authority in order to eventually find better alternatives. The SNB will certainly lose some of its heavy balance sheet firepower, but it could be more beneficial to the average Swiss citizen… and for the SNB own heritage.

Economic Calendar

A busy week is awaiting us with several economic indicators, major central banks’ meetings, a key US inflation report, a pinch of US politics and an accelerating & broadening pace in earnings reports. Starting with monetary policies, central bank’s meetings will indeed be again in focus in the next fortnight, starting this week with the BoJ tomorrow, BoC on Wednesday and ECB on Thursday, while the Fed and the BoE will meet next week. There is now a wide consensus about Bank of Japan sticking to its dovish guns (i.e. not abandoning yet its negative interest rate policy) as recent inflation data, as well as consumers and producers’ expectations about future price trends, have come somewhat lower than expected. Moreover, the JPY has stabilized over the last 3 months, thanks mainly to the dovish turn of other major central banks. In other words, it is essential for the BoJ to do nothing (again) as the case for a symbolic hike out of negative interest rates has petered out lately. So, it should be a non-event. However, a hike may come back on the table in April or June, especially if growth and inflation, both domestically and globally prove again more resilient than expected, baring other central banks to turn as dovish as investors expect.

As far as the Bank of Canada is concerned, it’s too early for a radical pivot. Core inflation came indeed in hotter than expected in December, which rules out the BoC shifting meaningfully in a dovish direction this week. Finally, for the ECB, cautiousness about inflation also rules and it should continue pushing back against a rate cut as soon as March but it will certainly leave the door wide open for rate cuts later if, and only if, inflation falls back rapidly or growth outlook deteriorates significantly enough to bring down inflation expectations.

Moving to economic activity indicators, we will get an updated pulse on global growth thanks to the releases of flash PMIs across the major economies on Wednesday. For the time being, they are in a standstill configuration with little clear-cut trends dynamic (Europe underperforming vs. EM outperforming, Services faring better than manufacturing generally). It will be interesting to observe if these flash PMIs confirm signs of bottoming out in manufacturing sentiment in Europe (end of destocking, lower energy prices, resilient global growth). On this matter, keep also an eye on the German IFO on Thursday to see if the sick man of Europe is feeling somewhat better.

Turning to the US, the key economic release will be the preliminary Q4 GDP reading on Thursday. Given the latest upbeat economic data, especially the strong December retail sales, which was way above the consensus expectations, and the ongoing strength of the labor market with the weekly initial jobless claims dropping again below 200k lately, the first estimated print may come close to the Atlanta Fed GDPnow forecast, i.e. around 2.0-2.5% annualized rate… after 4.9% in Q3! Not such a bad H2-2024 for the US economy. Finally, on the inflation front, the US PCE headline and core deflator for December will be published on Friday along with the personal consumption expenditures, disposable income and saving rate. A reading above +0.2% for core PCE will certainly decrease further the odds for a rate cut as soon as March. Still in the US, but moving in the politics sphere, the spotlight will be on the New Hampshire primary tomorrow, where Donald Trump appeared to consolidate his lead among Republican primary voters according to a latest poll from CNN, especially as the candidate Ron DeSantis pulled out of the race yesterday and endorsed Trump…

Let’s conclude with the earnings season, where notable corporate results include a number of key tech-focused large caps such as Netflix, IBM, Tesla, Intel, ASML, SAP or Lam Research among others, as well as consumers companies (J&J, P&G, Colgate-Palmolive, LVMH) or GE & 3M, once seen as very good proxies of global manufacturing activity. As usual, a non-exhaustive list-table of the incoming earning results over the week is available at the end of this text.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.