Here are our quick take-aways from yesterday’s Fed meeting:

As we were guesstimating lately, the Fed delivered a hawkish 50bps cut.

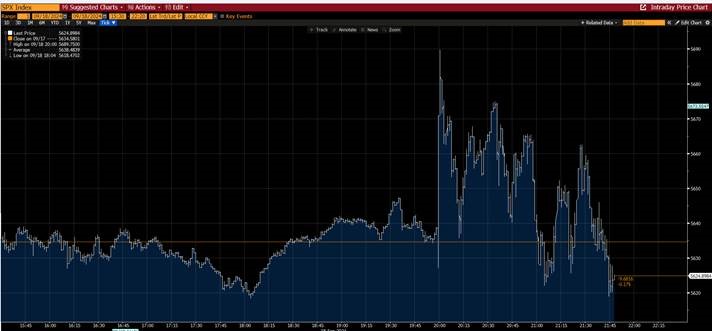

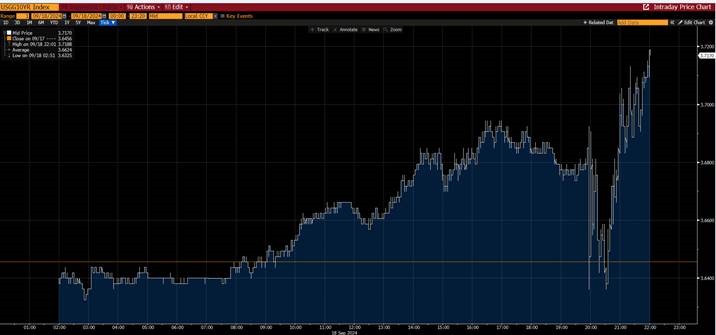

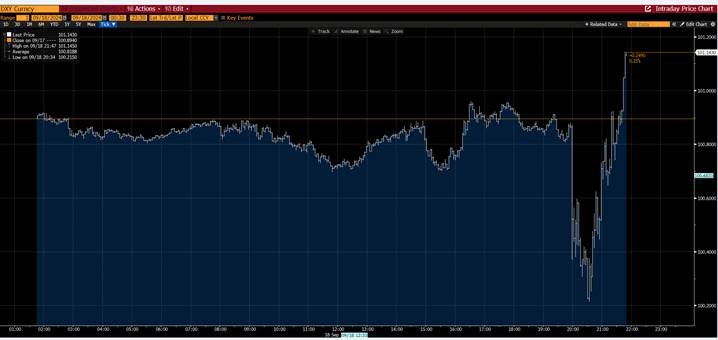

On the news of the dovish headline decision to ease somewhat more aggressively than anticipated (at 8pm CET time), markets reacted accordingly: equity up, bond’s yields down, USD down and gold up (see graph).

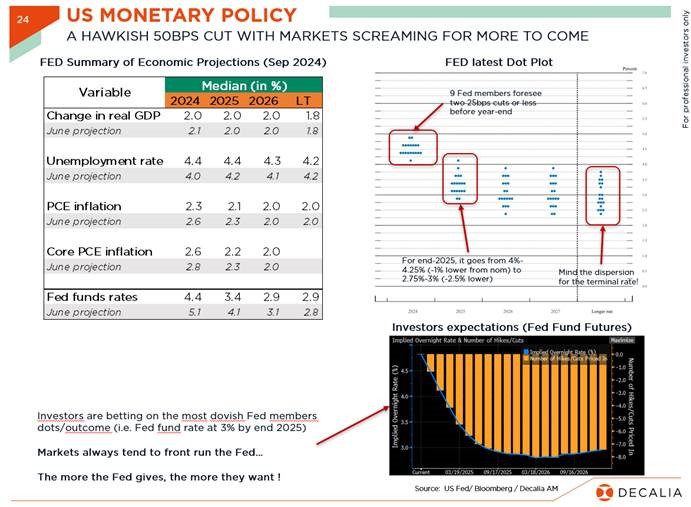

This 50bps cut was motivated by a deterioration in labor market with unemployment rate expected to be at 4.4% by the end of this year vs. 4% foreseen three months ago (June), while inflation has also declined more rapidly than forecasted by the Fed members last June. See Summary of Economic Projections below.

In other words, upside inflation risks have diminished and downside risks to employment have increased, while GDP growth projections were broadly unchanged.

And, as a result, the Fed sees now risks to employment & inflation goals roughly in balance, while still expecting steady solid economic growth.

On the hawkish side, it is worth to note that:

- 1 Fed member dissented (Michelle Bowman) in favor of 25bps rate cut

- 9 officials penciled in 50bps or less additional cuts before year-end

- The key sentence, which has turned markets upside down, was when Powell said during the press conference Q&A: NO ONE SHOULD LOOK AT 50BP CUT AND SAY THIS IS NEW PACE

Investors are still betting on a more dovish outcome than Fed members median dot plots as they expect another 200bps easing over the next 12 months vs. around 150bps around median for end-2025 (over the next 15 months).

Markets have a bad habit, like spoiled children, to front run the Fed… The more the Fed gives, the more they want!

Sometimes, it may end in tears… when parents don’t give as much as children ask for.

So, Fed’s difficult task going forward will be to find the right balance.

S&P500 daily.

Russell 2000 & SP500 equal-weight slightly up. Nasdaq down in line with S&P500.

US 10y rate daily (US 2y +3bps, US 30y +8bps) => bear steepening

US DXY Index (dollar got slightly firmer finally)

Gold ended down

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.