- So far, markets have ignored the headwinds of higher policy rates and overall stretched valuations. I tried last week to explain the reasons behind the overall resilience of US economy and the unexpectedly strong US equity performance.

- The Fed has taken the punch bowl away, but a few stocks and a bunch of happy few investors are still having fun dancing as the music/growth is still playing. Should I join or should I stay (away) as we know that there aren’t many drinks (read liquidity) left and, above all, we fear to have to clean the mess when a recession will happen.

- There are some ways to resolve this dilemma…

- “The US economy has landed, but it’s however still rolling way too fast”, while a rebound of US manufacturing activity may happen this summer.

- I still don’t expect a recession soon but I just fear that the longer the economy will prove resilient, the greater damage could be thereafter! Enjoy the party but stay on your guard.

Last week I spoke about the overall resilience of US economy and the unexpectedly strong US equity performance, driven mainly by just a handful mega-tech stocks until recently, which has taken the vast majority of investors (including your humble servitor) by surprise. I tried to explain the reasons in retrospect (unfortunately): too light positioning & extreme pessimism entering into 2023, inflation relief, near peaking rates, lower valuations at the end of 2022, better/improving EPS growth, AI cherry on the cake narrative, slower but positive growth, etc…).

So far, markets have ignored the tailwinds of higher policy rates and overall stretched valuations because of a favorable macro backdrop (growth and inflation issues moved into the background). It’s like if the Fed did in fact take the punch bowl swiftly away last year, but a few stocks and a bunch of happy few investors decided to throw an after-party at the beginning of this year. Most of us have already get out but we hear the music and we see some people having fun dancing as the music/growth is still playing, while we are still debating how far, how long the punch bowl will be taken away or when the music will be turn off (i.e. when a recession will happen). In the meantime, the largesse of government fiscal support during the covid means that some participants have still a few vouchers to spend in food, as well as some jukebox tokens in their pockets. Of course, we know that there aren’t many drinks (read liquidity) left and, above all, we fear to have to clean the mess when a recession will happen. As a result, the key question we face: should I join or should I stay (away)?

There are some ways to resolve this dilemma to some extent. The first one is to add to (US) equities through options, either by buying S&P500 index calls on or by adding diversified equities exposure with a put-spread hedge, benefitting from the current low volatility. Insurance should be bought when risks are dismissed or apparently underpriced. In other words, it’s a way to participate to the ongoing party and cover your back if it turns sour at some point. Note that a flattish trending-range US market over the next few months will likely be the most detrimental outcome for such strategies. The other way, which will likely accommodate this drawback, would be to add to equities by buying “the laggards” such as small caps for example or more generally stocks/sectors/styles that haven’t participated much to the recent rally. To be honest, the participation or breath is improving within the S&P500 and small caps experienced a tentative rebound at the beginning of the month but it has somewhat petered out last week. I must say I have some sympathy for this strategy given my own views on the US economy.

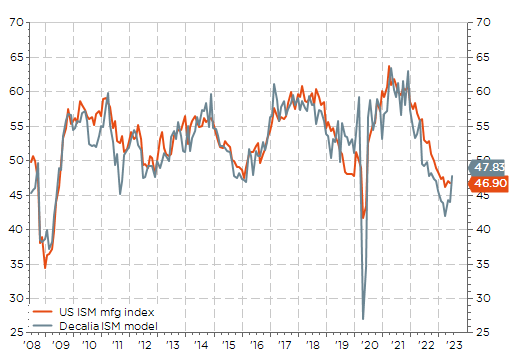

Hat tip to Anton Bender, CIO of Candriam, who summed up my thinking perfectly by saying “the US economy has landed, but it’s however still rolling way too fast”. To add to this bullish narrative on the economy, our ISM model forecasts a rebound to 47.8 in June from 44.1 forecasted or 46.9 released last month, on the back of the latest US regional manufacturing indices released last week.

Our ISM model forecasts a rebound to 47.8 in June

In the details, the Philadelphia Fed was broadly unchanged and close to expectations (-13.7 in July vs. -14.0 expected and -10.4% in June), while the Empire manufacturing came well above expectations and pointed to a sharp improvement (+6.6 in July vs. -15.5 expected and -31.8 the prior month). Given the weighting or importance of manufacturing activity in the New York area, we should take this data and our subsequent forecast with a pinch of salt.

However, assuming we attend a bottoming of the manufacturing sector during the summer, it will perfectly fit into a narrative of still more hawkish central banks than currently priced in and a sort of “revenge” of old economy value / small cap / cyclical stocks over new economy growth / large / defensive ones. In other words, beware or brace for another potential powerful sectors rotation… especially if China also announces a “true” stimulus plan at some point and/or energy prices rebound for an (yet) unknown reason.

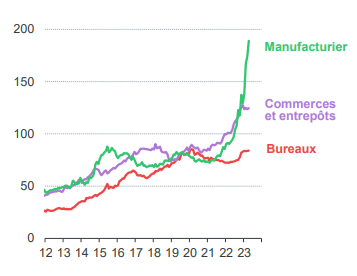

Furthermore, a bottoming out of the US manufacturing sector is not purely a personal wishful thinking. The latest Grant’s interest rate observer mentions recent articles and speeches, which lay out striking facts about a revival of this sector: Paul Krugman in the NY Times of June 6 “Making Manufacturing Great Again”, Steven Bogden, an investment analyst and former adviser of Senator John McCain, in a op-ed in the Wall Street Journal on April 3rd “Capital is Making a Comeback” and remarks by Jake Sullivan, President Biden’s national security adviser on “Renewing American Leadership” at the Brookings Institution at the end of April. The hand of the Biden’s administration Inflation Reduction Act is already visible in data with a sudden doubling in construction spending for manufacturing. For sure, it represents “only” 20% of non-residential construction spending or just 0.7% of overall GDP, but keep in mind that it will then be likely filled with machinery and R&D investments to make this new capacity worthwhile.

Private investments in non-residential construction ($bn, annualized rate)

Source: Candriam

I am not convinced that economic growth could take off again (meaningfully) even for a brief period of time. However, I still believe that we can’t rule out that the Fed will have to tighten again (more than expected) with a growing risk of a run-off as long as the economy ground speed is not sufficiently reduced. In this context, I don’t expect a recession soon but I just fear that the longer the economy will prove resilient, the greater damage could be thereafter! So, we may consider to have a last dance but stay close to the exit door.

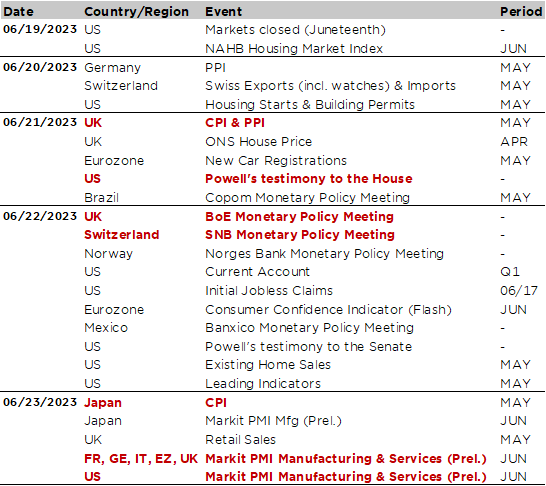

Economic calendar

After a pretty packed economic agenda last week, it should be somewhat quieter today, with US markets closed for the Juneteenth National Independence Day, and tomorrow as there won’t be major data releases except perhaps the US housing starts and building permits. For the rest of the week, global flash PMIs for June (Friday) will be among the key highlights of the week as investors continue to assess the growth outlook and the recession odds. More precisely, investors will scrutinize if the divergent trajectory between the still-robust services and the lagging manufacturing gauges across key economies persists, or if the services start to feel policy rates gravity too. Note that a key surprise would be a rebound of the manufacturing sector, closing the gap by catching up still flying high services.

Inflation will also be in focus in UK (Wednesday) and Japan (Friday), without forgetting monetary policy as we will get four central banks meetings on Thursday with BoE (+25bps to 4.75% expected), SNB (+25bps to 1.75% according to the consensus), Norges Bank (+25bps to 3.5%) & Mexico Banxico (unchanged at 11.25%), as well as one the prior day (Brazil Copom is expected to stay put at 13.75%). Moreover, Fed Chair Powell’s will also deliver his semiannual congressional testimony to the House and Senate Committees on Wednesday and Thursday.

In the UK, the May CPI followed the next day by the BoE meeting will be an interesting sequence given the current strong upward pressures on UK rates (UK Gilts are down -4.5% YTD after posting a -25.0% loss last year) on the back of persistent inflationary pressures due to an unfavorable mix of currency weakness, post-Brexit consequences (limiting labor supply and rising imports prices), central bank tergiversation between growth and inflation risks (due to household mortgages leverage), political cacophony and overall weak structural fundamentals (large current account deficit) among the many issues UK encounters. The consensus expects UK headline inflation to fall slightly from 8.7% to 8.4% and core inflation to decline from 6.8% to 6.6% in May. Some of the erratic components that contributed to the rise in April core inflation may indeed reverse in May. As far as the BoE is concerned, a 25bps hike is expected, but we can’t rule out a more aggressive +50bps if inflation surprised once again on the upside. Anyway, the guidance is likely to remain hawkish, keeping the door open for future hikes based on evidence of more persistent inflation pressures, which should not be a surprise for investors as they are indeed already pricing a terminal rate of 5.75% by the beginning of 2024 …

Over in Switzerland, while the consensus expects a hike of +25bps to 1.75% from the SNB on Thursday, some participants foresee a bolder +50bps to 2.0% given (1) a recent declaration of Jordan about the neutral rate, which he sees around 2% and (2) the fact that the SNB needs somewhat to catch up -but not too much- with ECB current hawkishness to avoid a potential CHF cyclical weakness down on the road. In other words, it’s all about the right calibration now to avoid larger moves latter.

To conclude with Asia, Japan headline inflation is expected to fall to 3.2% from 3.5%, but to increase slightly from 4.1% to 4.2% excluding food & energy. Investors will also keep an eye on China, as the domestic 5y banks’ loan prime rate (benchmark for Chinese mortgages) may be cut this week following last week PBoC reverse repo and MLF rate cuts as economic data, especially housing, continue to disappoint. Chinese government may also announce a broader stimulus (fiscal, credit, housing) to support the waning recovery and manage the downside risks (i.e. as it is still concerned by the over leverage issues).

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.