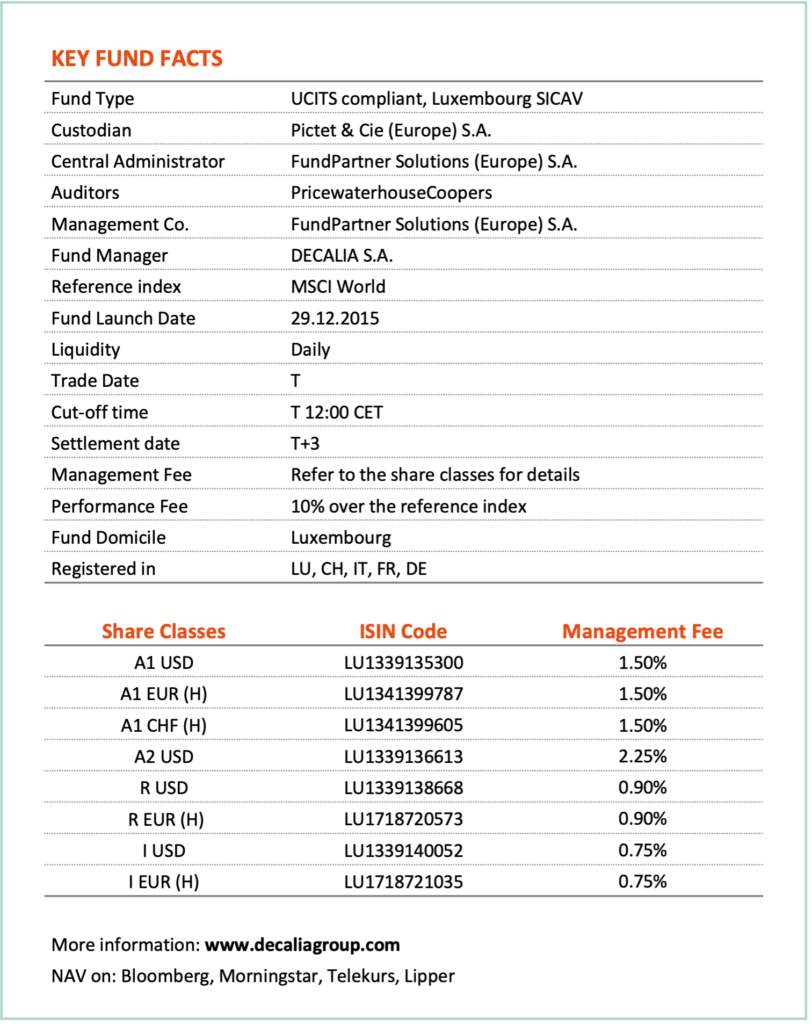

The Millennials generation is described as the people born between 1980 and 2000. There are more than 2 billion Millennials in the world, and they represent one third of the world population.

They are already the biggest workforce in America with $200 billion in annual purchasing power. By 2030, Millennials will account for 75% of the workforce in the world and their annual income is projected to reach $32tn. In Emerging Markets notably in China and India, it is the first time a generation (the Millennials) will be wealthier than their parents.

Their impact on the global economy is considerable and companies, across all industries, are fiercely competing for this growing generation of new consumers.

2.4 billion

Millennials, aged between 20-40 years old, currently represent one third of the world population

1st

Millennials in Emerging Markets, notably inChina & India are the first Generation richer than their parents

75%

The proportion of the workforce Millennials are expected to account for

$32 trillion

The projected annual income of the millennial generation by 2030

74%

Of Millennials say that the new technology makes their life easier and 54% think that it helps them be closer to their friends and families

$10 trillion

Global education is expected to reach $10T by 2030 as around 40% Millennials have a bachelor’s degree, compared with only 15% of the Silent Generation

25 years

Car sharing will be the norm, and car ownership an anomaly, 25 years from now

WHY NOW?

DECALIA Millennials as an investment

- A permanent source of growth which is particularly compelling in a low economic growth / low visibility environment.

- Millennials are creating a major global trend shift. This is an opportunity to invest in major disruptive trends.

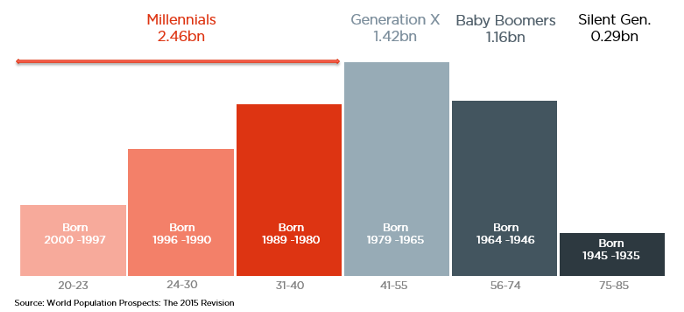

- A global equity fund (30-50 stocks) investing into companies that structurally benefit from changes in consumer trends of this generation.

- A great addition to a core position in global equities.

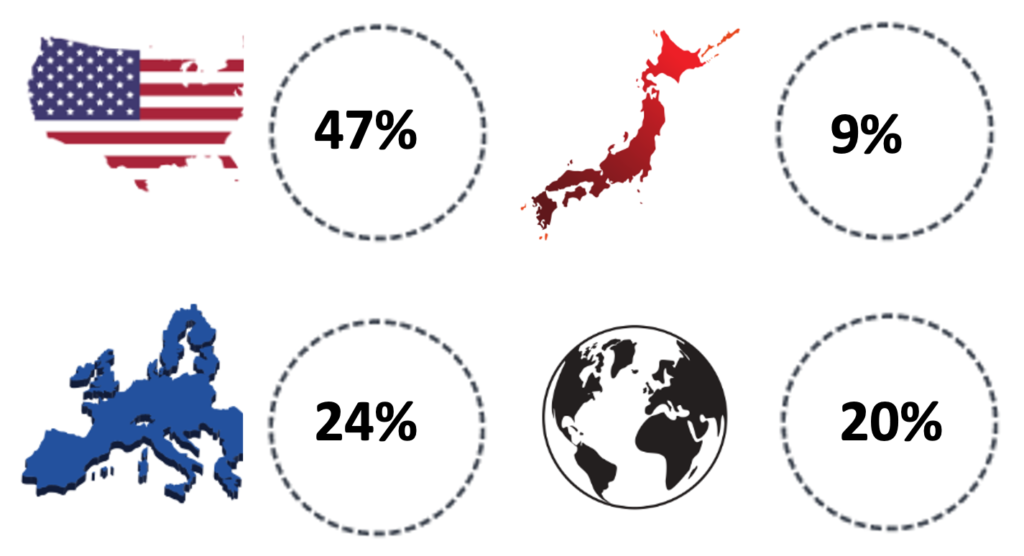

- A diversified exposure across various sectors: Technology, Health & Wellness, Leisure & Style, Education, Eat & Drink, Energy transition.

- A high active share to create alpha.

- A style-agnostic approach to adapt the portfolio to new market conditions.

Thematic Impact

We carefully model how the Millennials effect should benefit the company. This often means that Millennials offer a company a bigger revenue opportunity than the market believes.

Fundamental features

We are looking for companies that exhibit the following 5 traits:

- Accelerating revenue growth

- Evidence of operating leverage

- ESG / Sustainability credentials

- Strong capital allocation

- Low Price / FCF, three years out

MILLENNIALS TRENDS

Digital natives

Millennials were the first generation growing up with Internet. 94% of US Millennials have a cell phone. They represent a USD 1 trillion e-commerce potential.

Higher education

Millennials are the most educated generation ever. Global education will reach at least $10T by 2030. They have a raising awareness on climate change.

Sharing economy

Millennials prefer to rent than to own assets. The “sharing economy” is expected to represent a US$ 335bn market by 2025.

Lifestyle

Millennials are willing to spend more on healthy food, sports, fast-fashion and cosmetics.

Fintech

Millennials think that big banks aren’t designed for them: 58% of them prefer to borrow money from friends or family than from banks.

STOCKS IN THE INVESMENT UNIVERSE: 700

Decalia’s analyst team has identified eight proprietary sectors that will give investors access to the Millennials theme. These sectors represent the investable universe of approx. 700 stocks globally.

FUND MANAGERS

Jean-Christophe Labbé

Lead Portfolio Manager

Jean-Christophe Labbé is the lead Portfolio Manager of DECALIA Millennials. Prior to joining, Jean-Christophe successfully managed a fund dedicated to the same thematic at Goldman Sachs in New York. Before, he worked 10 years as equity Analyst at ING IM & Merrill Lynch.

Roberto Magnatantini

Deputy Portfolio manager

Roberto Magnatantini is deputy portfolio manager of DECALIA Millennials. Before joining DECALIA, Roberto Magnatantini was Head of Global Equities at SYZ Asset Management, where he spent 12 years managing two strategies for the OYSTER funds’ franchise. Before that, he worked 4 years at Lombard Odier and 4 years at HSBC where he managed equity funds.

DECALIA

Created in 2014 in Geneva, DECALIA is active in private and institutional asset management. It has more than 60 employees and CHF 4.2 billion in assets under management. DECALIA is wholly owned by its management, which ensures a total alignment of interests.

DECALIA develops investment solutions around four main areas: disintermediation of the banking sector, quest for yield, market inefficiencies & consumer trends. On the latter, DECALIA offer three UCITS strategies:

- DECALIA Millennials

- DECALIA Circular Economy

- DECALIA Silver Generation