Here are the key takeaways:

- Energy/commodity story -especially in the base metals space- has more to run…

- EM finally find time in the sun

- USD will remain quite strong overall versus other DM currencies

- The German 10y rate will break and remain above 3%

- Value should outperform growth style again this year

Last week, I shared with you my first 5 out of 10 predictions that could shape financial markets and portfolio returns this year. As we enter 2023 -and as a reminder-, our central macro scenario may be summed up as “less growth (but no hard landing), sticky inflation and higher for longer rates”. Despite the year started with a bang, I am sticking to this macro backdrop and, as a result, I will plead for some cautiousness going forward. I also remind you that some of the predictions here below may be considered as consensual, other are provocative, many of them won’t happen, while others seem obvious but I still consider worth to keep them in mind. There aren’t really “surprises” but more educated guesses, which are sometimes linked or bind together to lead to a consistent scenario. Here is a quick reminder of the first five, followed then by the last five.

- No hard landing this year: global growth will prove more resilient than expected

- US and EU annual inflation rates won’t fall back to central banks’ targets and they will re-accelerate in H2

- Forget about Fed’s pivot: there won’t be any Fed‘s rate cuts this year

- The US 10 rate will end the year above 4%

- Within US assets: credit, cash, bonds and equities markets will all end the year with low single digit total returns of less than 6%

- Energy/commodity story -especially in the base metals space- has more to run… as structural factors haven’t changed much and the cycle remains supportive. The lack of investment in production capacity, a challenging and long energy transition and a more fragmented world backdrop are still there, while global growth will prove more resilient than expected and the 3 big economies (US, China and Euro Area) are supporting/boosting infrastructure investment.

- EM finally find time in the sun. Emerging markets may indeed outperform DM both in terms of macro backdrop (better growth prospects on the back of China’s reopening, less inflation worries as inflation has already peaked or is not an issue -see China-, and less restrictive/more accommodative monetary policy trajectories than in DM) and equity markets performances on the back of lower valuations in a scenario where global economy tends to surprise on the upside/doesn’t experience a recession, commodities prices remain elevated, dollar don’t get stronger, rates and credit spreads don’t spike. Anyway, the current overall backdrop has never been so favorable for EM outperformance in my view.

- Despite the recent weakness it experienced over the last 2 months, the USD will remain quite strong overall versus other DM currencies this year. While further greenback’s depreciation can’t be ruled out over the next few months as US nominal growth falls and the Fed slows/ends its hike rates, while China not only re-opens but also reconnects both its economy and markets to the world (i.e. it becomes again “investable” at least temporarily), I expect a stronger greenback in the second part of the year when investors realize that the Fed won’t cut rates soon (i.e. US monetary policy may have to remain restrictive for longer than thought). This prediction is basically a consistent corollary of predictions 1, 2 and 3.

- In the same vein that US 10y rate will end the year above 4%, the German 10y rate will break and remain above 3%. It would imply that Euro bonds duration will underperform US duration (i.e. long US bonds will outperform EU long bonds) and EU credit will outperform EU govies. Thanks to the milder than usual weather experienced so far, the decline in natural gas prices has improved significantly this year growth prospects in the euro area. Despite the subsequent welcome decline in headline inflation, I suspect that the ECB will remain quite hawkish on the back of better growth prospects, a tight labor market, a stickier core inflation and overall concerns about second-round effects (i.e. wages negotiations going forward). Add to that the massive net supply of EU sovereign bonds this year (large issuances + ECB QT), potentially more fiscal integration (common EU funding/new joint EU debt) that will push German rates higher/peripheral spreads tighter and I strongly believe that German 10y rates are really mispriced currently. Perhaps it is due to some misconceptions that I have heard/seen lately from younger investors, such as “German long rates have always been lower than US rates”, which is obviously not true. For example, German 10y Bund’s yield was basically at the same level than UST 10y yield from 1990 to 2012… As a result, a narrowing spread between these two yields doesn’t seem so incredible.

- As a general corollary of most of the points here above, value should outperform growth style again this year and, as a result, US equities markets may underperform global equities markets. The two key pilars of this prediction are (1) no Fed’s pivot or higher for longer rates and (2) relative valuation as US stock markets, due to some extent but not entirely to its sector composition, remain too expensive compared to other markets.

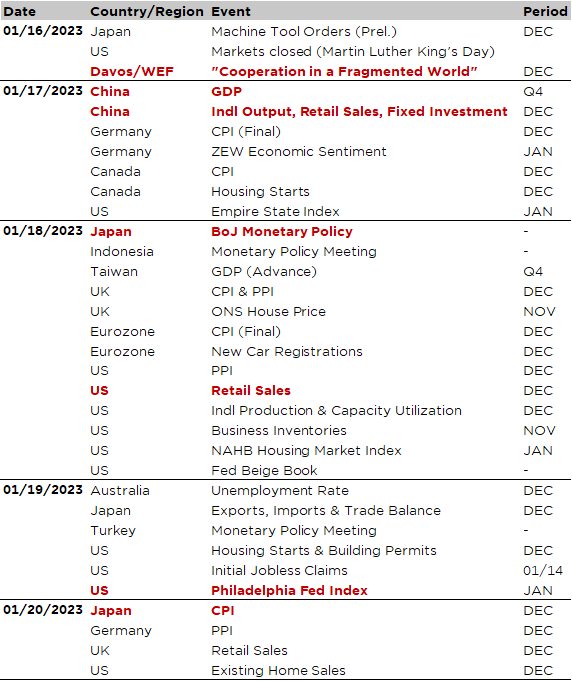

Economic calendar

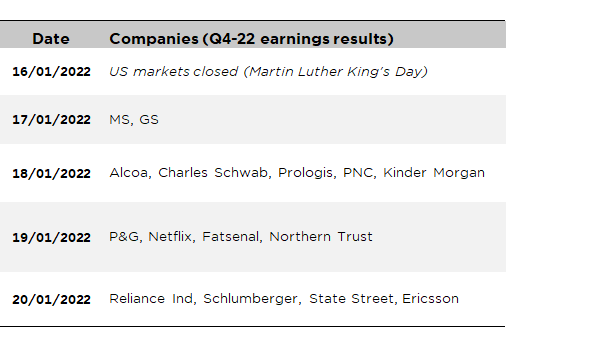

US, China and Japan will be in the spotlight this week. While key activity indicators will be released in the US and China, the BoJ meeting and Japan inflation print for December will also be among this week economic highlights for investors. On top of that, the World Economic Forum’s annual meeting in Davos kicks off today and will run to Friday, with the appearance and speech of ECB President Lagarde among others as numerous central banks heads and finance ministers are expected to attend too. The Q4 earnings season will also slowly gain some traction over the next few days with the results’ releases of GS, MS, Alcoa, Prologis, Kinder Morgan, P&G, Netflix and Schlumberger (see my non-exhaustive weekly agenda’s table at the end of the message). Note finally that this week starts on a slow gear as both US stock and bond markets are closed for Martin Luther King’s Day, which leaves you perhaps some extra spare time to read this prose (who knows?).

Let’s start with the US, where December retail sales and industrial production will be released on Wednesday. The consensus expects some weakening in consumer spending after a strong start in Q4, likely due to a pattern of earlier holiday shopping. Industrial production is also expected to have fallen in December, which will be the 3rd consecutive monthly decline (contained so far). Manufacturing output appears to be weakening broadly in line with the softening in business sentiment indicators such as ISM and PMI indices. On the same day, we will also get the December PPI and the NAHB Housing market index for January, which should remain at depressed level (even if a dead cat bounce seems possible thanks to the recent decline in mortgage rates) and the Fed’s Beige Book. With the releases of the Empire State Index (tomorrow) and the Philadelphia Fed (Thursday), we will be able to get a first estimate of the ISM mfg index that will be released on February 1st. On Thursday, investors will keep an eye on weekly initial jobless claims, which continue to surprisingly point to a robust and thus tight labor market as (1) they aren’t really increasing and (2) 4-week continuing claims average has even slightly decreased recently… Finally, housing starts and building permits (Thursday), as well as existing home sales (Friday) likely declined further in December.

Turning to Asia, the focus will be first on China tomorrow with the releases of December industrial output, retail sales and fixed assets investment and the Q4 GDP. Data should be weak overall amid the adverse effect from the Covid exit wave, and perhaps even showing a sharp contraction of activity last month but who cares… As investors are know focusing on the re-opening going forward, while an “artificially” soft Q4-2022 will then turn into a more favorable base effect in 12M time for Chinese officials as they will likely set ambitious growth target for this year.

Then, all eyes will be on the BoJ on Wednesday with its monetary policy decision. After the surprise YCC tweak last month (it adjusted its yield curve control commitment by allowing a greater range band for the 10y rate in order to improve market’s functioning according to the officials), investors are now focused on what, and when, the next steps of monetary policy normalization will be. While most economists don’t expect a change in policy this week, I strongly believe that odds are rising fast for another tweak in YCC already this week (total abandon or focusing on shorter maturity). BoJ opened the Pandora Box last month, leading to even more speculative pressures, which have already broke the 50bps BoJ ceiling last week (Japan 10y rate hit 0.55% on Friday). Anyway, we may expect to BoJ to revise up its inflation forecast to around 2% for 2022-2024 and they will then almost certainly abandon its yield curve control at some point in H1 (if not this week )… especially given better growth prospect on the back of China’s re-opening, Tokyo December inflation surprised on the upside last week, incoming shunto labour wage growth negotiation and a change in BoJ leadership after March meeting. For all these reasons, I believe the risks are thus tilted towards a sooner rather than latter shift in policy. Interestingly, despite a not really fortunate timing, the day after the BoJ’s decision (i.e. on Wednesday), Japan December CPI will be released with annual inflation getting close to 4%. Staying in Asia and speaking about monetary policy, the Central Bank of Indonesia (BI) is expected to hike its policy rate by 25bps to 5.5% on Wednesday.

Finally, the agenda will be rather quiet in Europe in terms of economic data releases. The January German ZEW will be released tomorrow. The final headline and core inflation should be confirmed at the flash estimates of 9.2% and 5.2% (Wednesday), while in the UK, we will get December CPI, PPI and house price (still on Wednesday), as well as December retail sales on Friday to gauge shoppers behavior and growth dynamics (UK may have avoided a technical recession in Q4).

Non-exhaustive list of major Q4-22 earnings releases over the week

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.