Interview with Andrea Biscia, Equity Analyst, ESG Analyst

O2 & Ecology is one of the seven major themes in the DECALIA’s Sustainable strategy that will shape our society of tomorrow.

There is enormous potential in the solar energy supply chain, and here’s what you should know about it:

• Key figures for the solar energy sector

• Most significant developments

• Main market operators

• Investment opportunities

What are the key figures for understanding the solar energy sector right now?

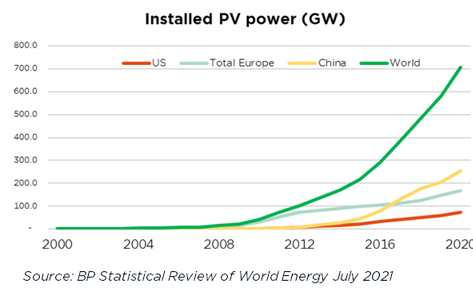

In 2021, renewable energy had a growth spurt of about 10%. Solar energy alone was responsible for more than half of that jump and now makes up 27% of the world’s renewable energy market.

On the global market, though, it’s still sidelined at barely 3% of total power generation. But its potential is the reason investor interest is growing.

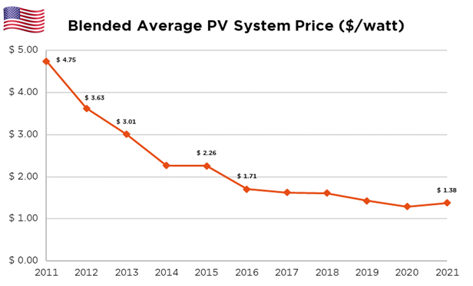

In fact, according to the International Energy Agency, wind and solar power could make up 70% of global supply by 2050. Especially since their adoption is accelerating. Through the REPowerEU programme, for example, the European Union is aiming for annual output of 600 gigawatts by 2030 – more than three times what’s currently being supplied. Over the next few years, solar energy is expected to experience annual growth of 15-20%. For Europe, as for the rest of the world, these forecasts are useful because incentive programmes are developing widely, like the Build Back Better initiative implemented by President Biden. In the United States, the goal is to reduce solar panel installation costs by 30% on the residential market.

On that subject, what are the top segments making up the solar energy market today?

The solar energy market is divided into three blocs. The largest of them is utilities and public services. This is half the market because these are massive installations that can cover many square kilometres.

Next is the residential market with 30%, then the commercial sector with 20%; but it’s on the residential market that growth is strongest. It’s drawing in the most attractive investment opportunities today.

How has the market changed over the past decade?

Clearly, it’s succeeded in breaking through because annualised growth stands at 40% for the past ten years. Actually, in China it’s above 50%. There are several factors behind this impressive rise, starting with incentives which are available mainly on the residential market. In addition, mindsets are changing, and consumers want alternatives to fossil fuels.

In the US, many lending companies are offering individuals financing solutions spread over time to get them set up for solar power without sacrificing their savings.

And lowering the learning curve has brought significant gains in terms of efficiency for solar installations.

Technologically speaking, where are the biggest changes happening?

There have been major changes, but they haven’t been instrumental in creating real competitive advantages. In solar panels, where China controls over three-quarters of the market, there’s been a lot of improvement in the panels and in solar cells. Their efficiency rates are now close to 25%, far above the standards set a few years ago.

There’s also been progress in inverters,* which are used to convert the direct current generated by solar panels to alternating current that we can use. This is a key component where US manufacturers have a head start, because they’re focusing on more advanced and therefore more powerful systems. This is creating some promising opportunities.

Finally, we’re also seeing some breakthroughs in utilities. These massive installations have fairly heavy ancillary costs that can amount to as much as 25% of the final bill. Indeed, they require frequent servicing by highly qualified technicians. So a lot of companies have positioned themselves in this niche to develop simpler and less labour-intensive technology solutions.

In your opinion, who are the main operators to watch in this market?

Chinese companies are totally dominating the solar panel market and the market for its various components, whether it be silicon ingots, wafers, cells or modules.

To take the example of wafers, China controls 69% of the global market. Longi, Zhonghuan, Jinko, Shangii and JA Solar are the key players. They have the advantage of an abundant commodity, because China is the world’s top producer of silicon. They also have very low production costs, since their government has provided them with many support measures. However, the US ended up imposing trade barriers on them. At this stage, it’s also best to underline the ESG risk by talking about the solar industry in China and the fact that the Xinjiang region counts for 40% of Chinese production.

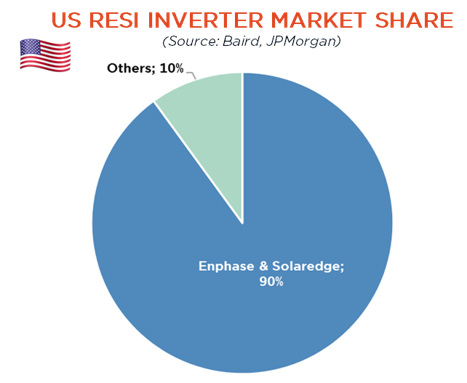

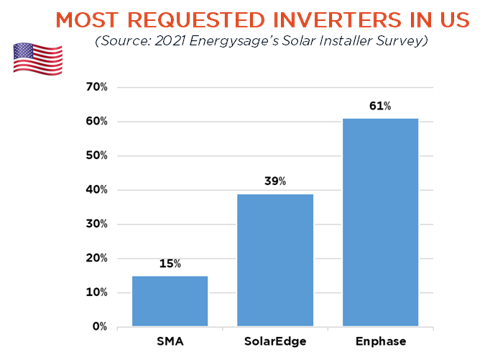

Virtually none of the solar-panel manufacturers is located in the US. You have to move up the value chain to find the companies driving the market. The bulk of them are in the inverter sector and, a bit further downstream, retail. In terms of inverters, SolarEdge and Enphase are two cutting-edge companies that work on technologically advanced products with above-average efficiency rates. Specialists refer to them as “smart inverters”. And in retail, keep an eye on stocks like SunPower, Sunrun and Sunnova.

They have a lot of potential because solar’s penetration in the US residential market is still just 4%.

On the American market, there’s also Shoals, which produces connection and cabling systems, which I talked about a little while ago, for XXL-sized solar installations.

As for the European market, it’s now under Chinese and American control, with the possible exception of the German company SMA, which makes inverters but is losing market shares to SolarEdge and Enphase for cost reasons.

Where do you see the most significant investment opportunities emerging right now?

I like the American residential market, particularly companies like SolarEdge, Enphase and Generac, that are positioned on inverters. The regulations are also playing in their favour. In fact, many states are requiring that their residents get smart inverters when they choose solar energy. Yet the Chinese aren’t really in this smart inverters niche and they’re not ready to venture further into it. Also, SolarEdge and Enphase control 90% of the US residential market.

If you need convincing, just know that SolarEdge already earns 45% of its revenues in Europe!

Their sales may have doubled between 2019 and 2021, but their profitability has fallen. No matter how much volumes increase, they still have to fight over prices.

They’re offering pretty similar products with comparable performance and, without a competitive edge, they have to sacrifice their margins to stay competitive. To my mind, despite the market dynamic, it’s too risky to invest in right now. Better to wait and see how the situation shakes out and whether the price war will have any winners.

*Inverters transform the direct current produced by solar panels into alternating current, which can be used by household appliances

About the strategy DECALIA Sustainable

- a multi-thematic global equity fund, investing in innovative sectors and disruptive companies shaping our SOCIETY in the future

- invests in the 7 themes (Security, O2 & Ecology, Cloud & Digitalisation, Industrial 5.0, Elder & Well being, Tech Med, Young Generation) regrouped by the acronym SOCIETY

- managed by an experienced team: Alexander Roose (ex-CIO of the Fundamental Equity of Degroof Petercam AM) & Quirien Lemey (ex-Lead PM of a Multi-thematic fund at Degroof Petercam AM)

About DECALIA SA

Established in 2014, DECALIA SA is a Swiss investment management company. With more than 70 employees and assets under management that stand at €4.9 billion, DECALIA has expanded rapidly, in particular thanks to its active-management experience built up over the last 30 years by its founders. The strategies developed by DECALIA focus on four investment themes deemed promising in the long term: the disintermediation of the banking sector, the search for yield, long-term trends and market inefficiencies. DECALIA is regulated by FINMA through a collective assets manager’s license. In addition to its Geneva headquarter, the group has offices in Zurich, Milan & distributors of the DECALIA Sicav in Spain & Germany.