- Qubits instead of bits: the ability to process much larger amounts of information, faster

- Competing quantum technologies are being developed, each with advantages – and challenges

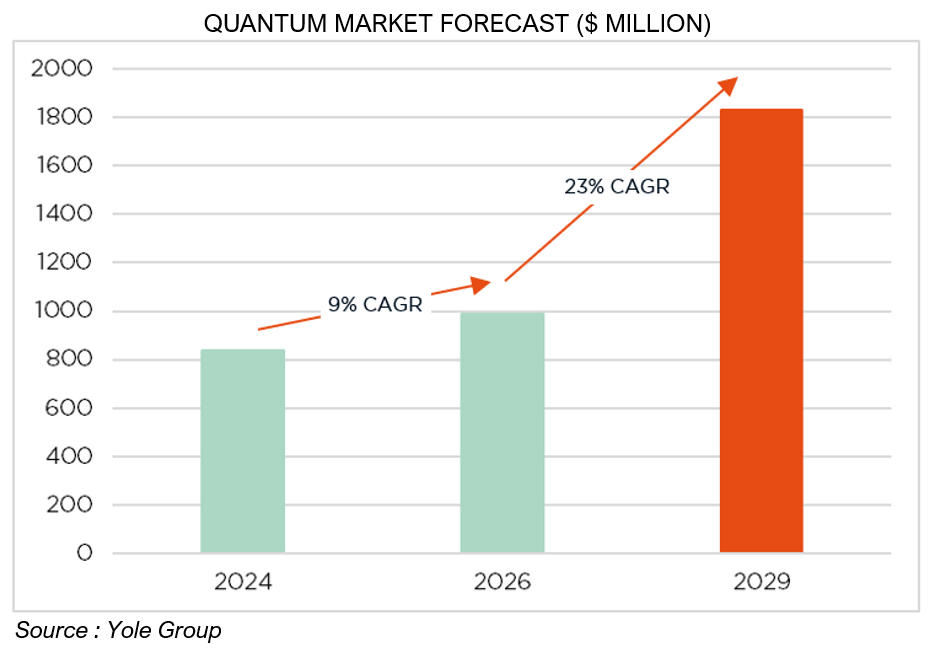

- The opportunity certainly looks exciting, but it requires a long horizon and a big tolerance to risk

Quantum computing promises to transform many industries, thanks to problem-solving capabilities that well exceed those of classic computers. When the leap will be made, and which of the competing quantum technologies wins out remain, however, open questions. Which makes for a field of intense investment, including by governments, but also an uncertain timeline to profitability. For companies active in this space, the risk of running out of funding before commercial viability is achieved cannot be excluded – warranting a prudent, albeit attentive, investment stance.

Microsoft recently made headlines when it unveiled its Majorana 1 chip, touted as “the world’s first Quantum Processing Unit (QPU) powered by a Topological Core, designed to scale to a million qubits on a single chip”. In layman terms, this means that it uses innovative topoconductor material to engineer qubits – themselves the basic unit of information within quantum computing. Unlike classic bits, that take a value of only 0 or 1, qubits can superpose and thus exist in multiple states simultaneously, enabling faster processing of much larger amounts of information. And while this prototype chip contains only 8 qubits, Microsoft researchers claim that, a few years down the road, the number could grow to one million, well above the ca. 1,000 qubits that power today’s largest running quantum computers.

Such existing super-machines rely mostly on “superconducting qubits”: a technology developed notably by IBM, Google and lesser-known Rigetti Computing, that leverages semiconductor fabrication techniques in order to gain scalability but faces difficulties in maintaining qubits stable (known as coherence). Alternative approaches to quantum computing also being explored include “trapped ion qubits” (developed by companies such as IonQ and Quantinuum), which are naturally occurring ions that bring high fidelity but involve scalability and laser control challenges, as well as “photonic qubits” (by PsiQuantum and Xanadu for example), which have the advantage of operating at room temperature and offer high-speed processing but face issues in terms of photon loss and scalability.

Alongside venture and corporate funding of such research, governments are now putting big money into building working quantum hardware (USD 42 billion of such investment has been announced through 2023) – as they see a huge potential in terms of both economic competitiveness and national security. Partnerships are also being increasingly secured with cloud providers, of the likes of AWS (Amazon), Azure (Microsoft) or Google Cloud, seen as a possible pathway to commercialisation.

Still, the timeline to customer adoption – and cash generation – remains very uncertain. Quantum computers, whatever their promises, have yet to demonstrate a clear superiority over classical hardware. Research & developments costs will thus remain durably high for all companies active in this field, requiring likewise enduring capital sources. Ultimately, also, the differentiating factor will not only be which of the above-mentioned competing technologies wins out, but also whether a viable quantum ecosystem can be built (since classical computing tools and languages do not directly translate into quantum environments).

All told, as the next major technological leap after AI, quantum computing certainly warrants investor attention. McKinsey estimates that it could unleash up to USD 2 trillion of economic value by 2035 in chemicals, life sciences, finance and mobility – the four industries likely to be impacted soonest. But it also requires a very long investment horizon (the maturation phase could take decades) and a high degree of appetite for risk…

Written by Christophe Reuter, Portfolio Management Team

A delicate balance with risks on both sides…

- Developments have been volatile and noisy, but overall not as dire as feared

- Improving growth prospects outside of the US are taking out some negative risk premia

- Rich equity index multiples conceal a much more complex reality beneath the surface

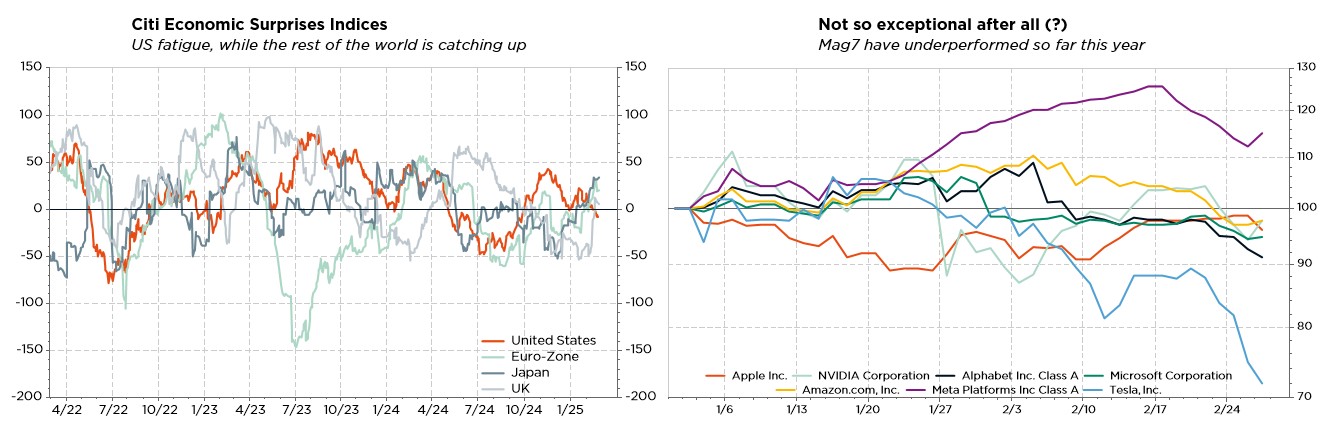

So far, not so bad… Despite all the twists and turns on the tariff front, the ongoing noise coming out of the White House, choppy geopolitical waters or the DeepSeek big splash that dampened the US technology sector, global equities fared decently over the last few weeks, led by Europe on the back of… less dire than feared developments and a reassuring Q4 earnings season. US bond yields meanwhile fell back, mirroring some consumer fatigue and the more challenging path for US equities lately. In currency markets, the US dollar took a breather too, amid what seems to be improving growth prospects in the rest of the world. Finally, gold continued to fly high, helped by US dollar consolidation as well as its safe haven status during times of heightened uncertainties, reaching a new all-time record, before pausing just below the USD 3,000/oz price tag.

Our global economic outlook is still one of a soft landing, with slower but positive growth and inflation at slightly above central bank target, though acceptable, levels – leading to a gradual rate normalisation over the next 12-18 months. In this regard, monetary policymakers will now need to walk a fine line as plenty of (downside and upside) risks and uncertainties remain, ranging from a global trade war, persistent inflation or whatever unexpected shocks that deteriorate financial conditions, to an improving geopolitical backdrop, slower-than-anticipated withdrawal of fiscal policy in Europe or a more sustainable recovery in China.

In addition to these persistent uncertainties, global equity and credit markets are expensive by most standards, although that is nothing new and has not prevented positive returns so far. As again illustrated year-to-date, elevated equity index multiples conceal a much more complex reality beneath the surface, with segments such as Europe, emerging markets, small- and mid-caps or financials still offering selective pockets of value beyond the Magnificent US titans. They may nonetheless constitute a glass ceiling at some point… should earnings growth peter out or bond yields surge – neither being our current base case scenario. As a result, we expect equity market gains to track earnings growth.

At the portfolio level, we thus maintain a neutral stance on equity and fixed income. This balanced position reflects our assessment of current market conditions and expected macro trends: we are staying invested through a cautiously balanced and well-diversified allocation, which should allow portfolios to benefit from expected positive, but contained, returns in most asset classes this year, while mitigating the bumps and maintaining flexibility to adapt to evolving conditions during the journey.

That said, we did fine-tune our positioning to better reflect the broad possible impacts of recent developments in Ukraine. We keep our preference for US equities, carefully balancing an (actively-managed) small- and mid-cap allocation and passive S&P500 equal-weight ETF position, with somewhat less growthy mega-caps, that are now benefitting from revived animal spirits and expected deregulation. We are warming up to Eurozone equity markets (raised to a slight underweight), on the eventuality of an imminent cease fire in Ukraine, greater fiscal spending through joint debt to fund the rebuilding of European defence capabilities and German debt brake reform. This likely means improved growth prospects for the Old Continent, taking out some of the negative equity risk premia (i.e. unlocking market value). That said, we remain wary of political instability in both France and Germany, as well as the tariff threat. In parallel, we are downgrading UK exposure to a slight underweight as the country and the Bank of England, facing stagflation risks, are now stuck between a rock and a hard place, leading to heightened GBP and rate volatility. Our emerging equities stance is unchanged at a slight underweight, despite seeing less risks and headwinds for China than other markets.

Finally, we continue to favour diversification through gold but are tactically tempering our bullish stance in the near term, following the strong run. Downgraded to a slight overweight, gold remains a broad “safe haven” hedge across different scenarios and still enjoys structural tailwinds. It could, however, prove toppish as it reaches USD 3,000/oz… especially if the war in Ukraine comes to an end.

Written by Fabrizio Quirighetti, CIO, Head of multi-asset and fixed income strategies

External sources include: LSEG Datastream, Bloomberg, FactSet, Goldman Sachs, Statista.