Should I join or stay (away)?

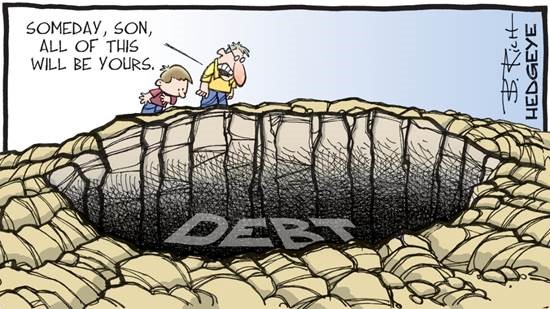

Last week I spoke about the overall resilience of US economy and the unexpectedly strong US equity performance, driven mainly by just a handful mega-tech stocks until recently, which has taken the vast majority of investors (including your humble servitor) by surprise. I tried to explain the reasons in retrospect (unfortunately): too light positioning & […]