Tech lending taking off

By Franco Maria Facecchia, Principal Private Markets at DECALIA and Modesta Rodriguez-Acosta, Principal at Atempo Growth

- Tech funding growing 10x over the last decade

- EU aiming to mobilize €200bn for AI investments over the next 5 years

- Tech lending hit €17bn in 2024—more expansion expected in 2025

- Opportunities on mid-market segment as it remains largely underserved

- Profile of the businesses suited for tech lending

- Downside protection and expected returns

Tech in EU: a decade of growth

Hot on the heels of the AI Action Summit in Paris, European Commission President Ursula von der Leyen unveiled InvestAI, a bold new initiative designed to mobilize €200 billion for AI investments over the next five years. The goal? To supercharge R&D and put Europe back on the global innovation map. This renewed push for capital and innovation comes at a critical time — and it directly echoes the findings of President Mario Draghi’s recent landmark report on Europe’s competitiveness. In his assessment, Draghi made it clear: if Europe wants to close the innovation gap and compete with global tech powerhouses, it will need an additional €750-800 billion in annual investments — every year. The message to investors couldn’t be clearer: Europe is opening the floodgates for tech funding, and the next decade will be shaped by those who seize the opportunity.

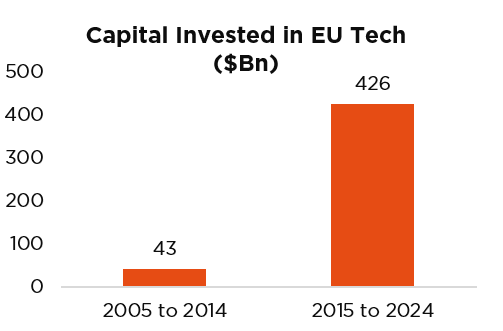

According to Atomico’s latest State of European Tech report, the last 20 years have been nothing short of transformational for Europe’s tech ecosystem. But it’s the last decade that truly redefined the landscape: total capital invested in European companies surged tenfold, jumping from $43 billion in the 2010s to a staggering $426 billion in the 2020s. And 2024? This year alone, Europe attracted up to $45 billion in fresh investments — surpassing the entire amount raised across the continent during the previous decade. For context, while Europe scaled 10x in a decade, the US market — despite its size and maturity — expanded by only 2.8x over the same period, growing from $249 billion to $1.2 trillion. Europe’s acceleration stands out not just for its speed, but for its resilience and breadth across sectors.

This explosion in funding has triggered a parallel boom in talent. Today, Europe’s tech workforce numbers 3.5 million strong — and almost 3 million of those jobs were created within the past decade. With a 24% compound annual growth rate (CAGR), Europe’s talent engine is now growing at a pace comparable to the more established US tech scene.

More work needs to be done

Europe’s innovation engine will continue to drive economic growth for years to come — but to turn bold ideas into global leaders, companies need far more financial firepower than they can access today. As Europe’s startups evolve into scale-ups — with fully developed products, accelerating customer adoption, and predictable recurring revenues — they inevitably outgrow the traditional venture capital playbook. These ambitious companies require more flexible, scalable financing tools, including tailored debt solutions that complement equity rounds and extend their runway for growth.

But here’s the challenge: Europe’s traditional banking sector is simply not built for tech. Most banks lack the specialized teams and sector-specific expertise required to underwrite loans to high-growth tech companies. On top of that, regulatory capital constraints and risk-averse lending practices make banks increasingly reluctant to back businesses with high burn rates — even if their growth potential is undeniable. This widening financing gap is fuelling a surge in private credit strategies focused specifically on European technology companies. Growth lending is emerging as a critical tool to help Europe’s next generation of tech leaders scale globally — without excessive dilution.

The growth of EU tech lending

Tech lending was first introduced in the US market as a form of venture leasing in the 1980s. Over the past two decades, it has gained widespread acceptance among tech entrepreneurs, providing a complement to equity financing.

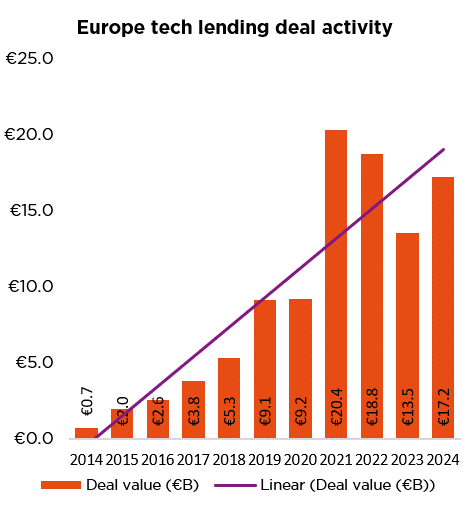

In Europe, the sector has expanded rapidly, though it remains underdeveloped compared to the surging demand. According to Sifted, the European tech lending market reached €17.2 billion in 2024 — The demand for non-dilutive capital is growing among European founders, reinforcing tech lending as a key financing tool.

This trend has also drawn major US investors, with BlackRock’s recent acquisition of a top European venture lender signalling a strong push into private credit across the region. While Europe offers a lucrative opportunity, it remains a complex market for international players.

Unlike the US, where lending follows a unified framework, European tech lending is fragmented, with country-specific regulations, licensing requirements, and jurisdictional differences. Language barriers and local market nuances add to the challenge. These obstacles have kept competition limited, giving European lenders an advantage—but also opening the door for those willing to navigate the complexities strategically.

Smart money for ambitious people

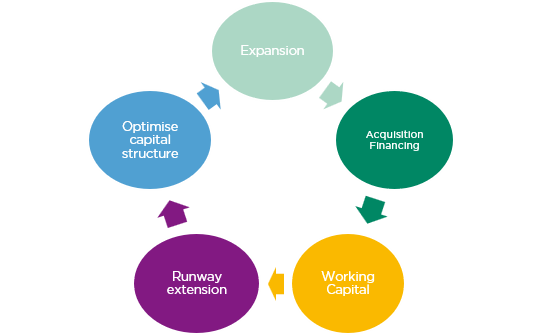

Tech lending solutions offer growth-stage companies the necessary strategic boost to scale, helping businesses achieve key milestones before pursuing further equity rounds, going public, or securing funding from traditional lenders. A concrete example of tech lending usage might include financing the acquisition of a competitor, expanding into new markets, or launching a new service or product.

Startegic use of tech lending

This financing model meets operational and scaling needs while offering steady returns to investors, with contractual IRRs enhanced by equity-linked upside, in senior secured structures.

Mid-market: where the best risk-return profile sits

Despite rising demand, Europe’s mid-market tech lending segment (€5m–€25m deals) remains largely underserved, with only a handful of local players operating at a pan-European level. According to KfW, the German public investment authority, annual demand for mid-market growth debt financing hit nearly €7bn in 2023-24, while total supply remained below €2bn. The funding gap has widened further following the collapse of Silicon Valley Bank, a key growth debt provider in Central Europe for decades.

For scale-ups, tech lending is an attractive alternative to equity financing, allowing them to fund strategic investments and optimize their capital structure without dilution. At this stage, founders are typically aligned with investors, and structuring loans with strong protections—such as rapid amortization, asset security, and governance rights—is often more feasible than in later-stage companies.

Moreover, the repricing of equity after recent market volatility and a more cautious approach to tech investments have ushered in a “New Normal” for the sector. The focus has shifted from “growth at all costs” to a more disciplined emphasis on profitability and sustainable expansion, redefining how capital is deployed in European tech.

Never stop innovating

As the EU ramps up investment to stay competitive with the US and China, tech financing remains essential to sustaining economic growth. In this landscape, tech lending is set to become a critical pillar of Europe’s maturing innovation ecosystem.

With limited competition, traditional lenders lacking expertise, and US growth lenders struggling to gain foothold, Europe’s tech lending market remains an untapped opportunity. Rising demand, coupled with stable valuations, continues to position this asset class as an attractive risk-return play for investors looking to capitalize on the region’s evolving financial landscape.

Tech lending key features

Profile of the businesses suited for tech lending

As mentioned throughout the article, the companies suited for tech lending are high-growth and IP-rich technology businesses with mostly recurring revenue models, high margins and with an enterprise customer base. These businesses have fully developed products with a proven product-market fit and benefit from a high rate of consumer uptake. These are backed by institutional investors, mostly Venture Capital and Growth Equity funds.

Tech lending is generally senior secured against the company’s assets, including cash and cash equivalents, accounts receivables and IP. Additionally Board observer rights provide visibility to navigate any issues ahead of time.

Diversified sectors and geographies across Europe

Expanding across sectors and regions enables lenders to tap into high-growth industries and emerging markets, allowing access to a larger pool of innovative technology businesses. Furthermore, tech lending to companies across diversified sectors and geographies offer risk mitigation through diversification, reducing exposure to impact of sector-specific downturns.

Expected Returns

For investors, this asset class provides high risk-adjusted returns with historically low loss rates, driven by its senior-secured profile, which quickly mitigates risk through monthly cash interest payments and amortization.

The return structure includes:

- Coupon Payments – regular interest payments received by the lender.

- Fees – structuring and exit fees that contribute to a strong Contractual IRR.

- Options/Equity Kickers – these can reprice in the event of a down-round, contributing to a Target IRR, which blends contractual returns with potential equity upside.

Within the specialized private credit industry, we believe that tech lending stands out as an appealing asset class with strong risk-adjusted returns.

About the authors

Franco Maria Facecchia, Private Markets Principal at DECALIA

Modesta Rodriguez-Acosta, Principal at Atempo Growth

Franco Maria Facecchia is a Private Markets Principal at DECALIA, where he is responsible for external GP management, value creation and investor relations. He joined DECALIA in 2019 from Luxottica Group, where he held roles as global brand manager and retail expansion manager. Franco holds a double degree in International Management from Bocconi University in Milan and Fudan University in Shanghai.

Modesta Rodriguez-Acosta is a Principal at Atempo Growth, where she supports all stages of the deal lifecycle for Atempo’s portfolio. She joined Atempo in 2022 from Alvarez & Marsal, where she worked as an Analyst in their Financial Investors Group. Modesta holds a double degree in Law and Business Administration from Universidad de Navarra.

Copyright © 2025 by DECALIA SA. All rights reserved. This report may not be displayed, reproduced, distributed, transmitted, or used to create derivative works in any form, in whole or in portion, by any means, without written permission from DECALIA SA.

This material is intended for informational purposes only and should not be construed as an offer or solicitation for the purchase or sale of any financial instrument, or as a contractual document. The information provided herein is not intended to constitute legal, tax, or accounting advice and may not be suitable for all investors. The market valuations, terms, and calculations contained herein are estimates only and are subject to change without notice. The information provided is believed to be reliable; however DECALIA SA does not guarantee its completeness or accuracy. Past performance is not an indicator of future results.

External sources include:

- Pitchbook, “Venture Debt hits all-timehigh””

- Pitchbook 2024 European Venture Report

- “Growth Debt in Deutschland und Europa: eine Bestandsaufnahme,” KfW, November 2023, Funding rounds, Dealroom.co

- Sifted, H2 2024 Review

- Atomico, “The State of European Tech 2024”

All analysis based on latest available data as of Dec 2024