In the same way that national soccer interests in Europe have taken precedence over the respective national championships due to the Nation’s League games and subsequent qualification to the next World Cup, my usual weekly editorial has morphed into a broader, more comprehensive and pragmatic, I hope, summary of our latest monthly strategy meeting held last week. The title is obviously ironic but reflects quite well the fact that most of incoming Trump policies could be self-defeating for the US economy and market themselves. Like in sport’s team, you can’t really set optimal policies or strategies without taking into account what could be the responses of your partners or opponents and therefore the 2nd round consequences of them. Trump, his administration as well as US businesses & citizens may learn it the hard way.

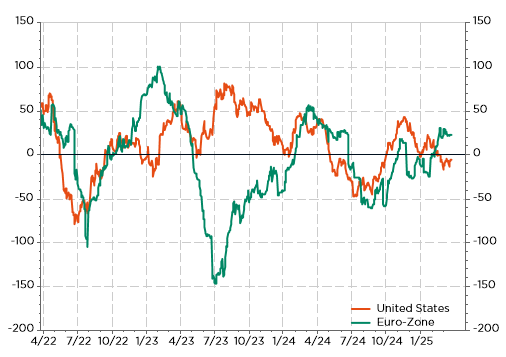

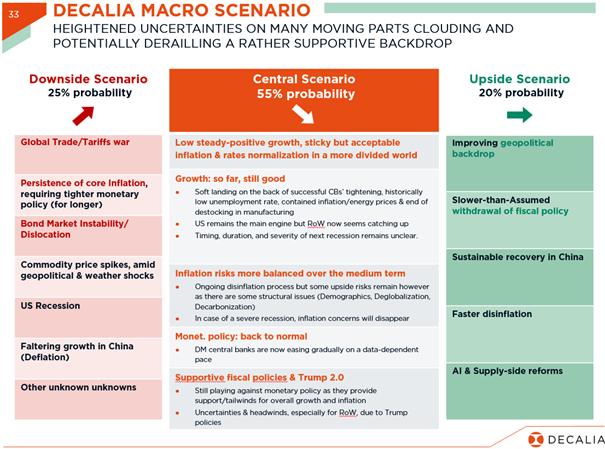

- Market Narrative: Making the Rest of the World Great Again – On top of creating uncertainties, US Trump economic and geopolitical policies are also disrupting the world order and leading to historic shifts, with unexpected consequences. It really seems that we are experiencing “…weeks where decades happen”. The good news is that the US administration is putting pressure on the rest of the world and on Europe especially, which is therefore forced to wake up, show off his muscles, regain his strength and, as a result, also boosting sentiment in non-US economies and markets. In the same time, this remake of Make America Great Again has been ironically self-defeating for Wall-Street itself so far, and potentially even for the US economy on the long run unfortunately. Meanwhile, some cracks have also appeared in the resilient US growth narrative and inflation remains like a gum sticking to the Fed’s shoe. Even Trump’s put has likely been reset lower as he seems tolerating some temporary downside detox on the US economy and markets in exchange of expected (but very uncertain and thus not guaranteed, in our views) long term gains. All that has contributed to dent seriously the investors love story with the US exceptionalism fairy tale.

Citi Economic Surprises: US economy losing momentum, while Europe seems to be catching up

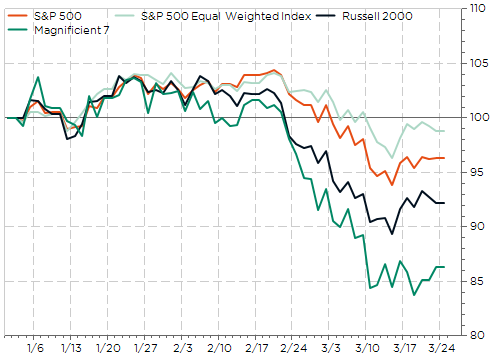

Selected US equity market indices YTD performances: Detox

- Global Macro Scenario: Heightened Uncertainties Clouding -at best- and Derailing -eventually- a Rather Supportive Backdrop – While our base case macro scenario still remains unchanged (steady-positive growth, sticky but acceptable inflation & gradual rates normalization in a more divided world), some cautiousness is now warranted given the very uncertain and challenging context due to Trump policies and its ripple or second-round effects. As a result, the downside scenario risks have increased somewhat at the expense of our confidence in the central one, while the odds of an upside macro -i.e. not necessarily markets- scenario have been kept unchanged thanks to the encouraging prospects coming from the Rest of the World lately (German fiscal package, improving sentiment in China, ongoing disinflation progress or AI development also outside the US).

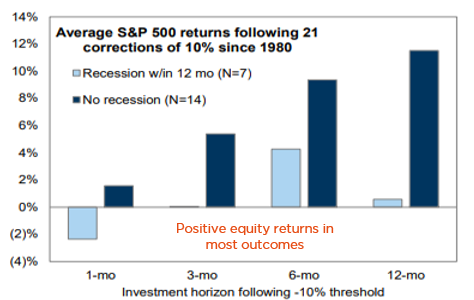

- Equity: A great & healthy rotation – While on the surface, global equity and especially the US and even more specifically the growthier part, such as the tech-heavy Nasdaq and its Mag7 flagships, didn’t fare well over the last few weeks, most regional or sectorial indices showed some greater resilience. Overall, global equity outlook remains supported by a constructive macro backdrop (with growth prospects improving outside the US compensating eventually the negative impact of lower growth, stickier US inflation and a more gradual Fed’s easing), along with resilient corporate earnings trends (consensus global EPS growth of +11% this year and 13% in 2026), unabated equity inflows, and a healthy broader market participation lately. Furthermore, sentiment has turned from greed at the end of last year to fear now, positioning has become less stretched, Global and US equity valuation have come down somewhat, dragged down by growth and IT 5%-10% derating, while our contrarian-indicator is now close to oversold conditions. In other words, we consider this equity correction as healthy in the same way that freezing temperature is beneficial to lakes, thanks to the mixing of water at the surface with that at the bottom. As we flagged many times in the past, expensive markets valuation isn’t sufficient per se to prevent positive returns, but it may represent a glass ceiling at some point… and turn out as a major tailwind when earning’s growth peters out (recession) or bond yields surge, which is still not our base case scenario currently. As a result, we expect equity market gains to be in line with earnings growth along with lower equity risk premium if bond yields recede in parallel with disinflation progress eventually. As illustrated lately, elevated equity index multiples conceal a much more complex reality beneath the surface with segments such as Europe, EM, SMIDs or financials still offering selective pockets of value beyond Magnificent US titans.

Historical S&P500 Returns after Corrections: Not all of them are equal

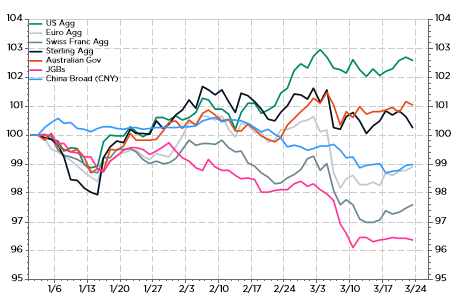

- Fixed Income: An all-weather high-quality positioning for challenging & uncertain times – While both the ECB’s -25bps rate cut and the Fed’s pause were already well telegraphed, bond yields are still witnessing a bumpy ride so far. Either because of growth scares as it has been the case with US Treasury yields recently, public debt trajectories such as for German Bunds this month, inflation term premium in Japan or a mix of all that for UK Gilts. In other words, the dispersion has been quite wide among sovereign bonds indices YTD returns. Here too, uncertainties still prevail, from global fiscal policy, economic growth trajectories, inflation trends, geopolitical new order and the subsequent response of monetary policies going forward. In this context, we believe the Fed funds rate should drift back to a neutral level close to 3.5%-3.75% by the end of the year (i.e. 2-3 additional cuts), while the ECB will continue to cut 2 more times before the end of the summer and then make a wait-and see pause. Tail risks remain on the both sides as unambiguously bad economic data would likely lead to a sharp rally in rates (with credit spreads widening), while a spike in inflation, growth reacceleration, or supply debt concerns filtering into the long end of some sovereign curves cannot be ruled out either. As far as Credit is concerned, it provides limited compensation for the associated risks even if spreads may remain historically tight for a long time. In this context, greater selectivity is now required in this space, especially in the HY and EM segments, as well as for a gradual up quality (and duration & liquidity) of bonds allocation.

Aggregate Bond Indices YTD Total Returns in l.c.: A wide dispersion of fortunes so far this year

- Tactical Positioning (TAA): More Cautious on the Greenback as the US Exceptionalism Gap is Shrinking – At the portfolio level, we maintain a neutral stance on equity and fixed income. This balanced position reflects our assessment of current market conditions and evolving global macroeconomic factors: we are staying invested through a cautiously balanced and well-diversified allocation, which should allow portfolios to benefit from expected positive, but contained, returns in most asset classes this year, while mitigating the bumps and maintaining flexibility to adapt to evolving conditions during the journey. That said, on an opportunistic way, we may also add some “cheap” tactical protections to still capture projected upside potential though with a lower risk profile. Otherwise, the main change in our allocation grid was to fine-tuned our currency positioning by downgrading our stance on the USD to Slight Underweight as we believe that most of the recent developments and smokes (such as the idea of a Mar-a-Lago Accord inspired from an essay written last year by one of Trump’s economic advisor) are denting the greenback’s hegemony in the world economic and financial markets. Elsewhere, we keep our preference for US equities, carefully balancing our (actively-managed) small-mid caps allocation and passive S&P500 equal-weight ETF position with somewhat less growthier mega-caps. We are warming up on Eurozone equity markets (raised to slight underweight last month) on the eventuality of an imminent cease fire in Ukraine and the incoming German fiscal package, which could be a game changer for long term growth prospects. Nevertheless, we remain warry of the overall political instability in the region, the more imminent tariffs threat as well as the execution risks on fiscal spending. EM equities stance remained unchanged at slight underweight despite we see less risks and headwinds for China than for others markets as there is some catch-up potential there. Finally, we continue to favor diversification through Gold but we are adopting a more tempered bullish standpoint than in the past after its strong run.

Economic Calendar

Here’s the menu for the week ahead. It’s relatively light but quite varied:

- Main courses: preliminary Global PMIs for March (today) and US core PCE deflator, along with February consumer spending and disposable income (Friday).

- Hors d’œuvre: German IFO (Tuesday) to see if the announcement of the German plan is already boosting morale and, on the same day, the US Conference Board Consumer Confidence to assess the anxiety-inducing of Trump’s policies uncertainties on consumer’s sentiment.

- Sweet, or not: UK CPI (Wednesday) after last week’s hawkish hold BoE’s decision. Lower inflation would reopen the door to a rate cut in the coming months (the sweetness). Otherwise, the BoE may not (re)consider any easing in the immediate future even if the economy slows down. That’s would be the bitter pill to swallow…with a warm beer.

Today, the focus will be on the global flash PMIs (March) for the main economies. These sentiment indicators will provide the first insights on how the policy headlines (and their related uncertainties) from both the US and Europe in recent weeks have impacted (positively in Europe? Negatively in the US?) the business cycle trend. In the US, the main highlight will be the February core PCE deflator, along with the personal income and spending data on Friday. The consensus expects +0.3% MoM and 2.5% YoY in the core PCE, as in January, while both income and consumption are expected to grow by around +0.4%-0.5% MoM after a disappointing -0.2% in spending the prior month. In the US, we will get also the US consumer confidence and the durable goods orders report for February on Wednesday. Note also, that the CBO (Congressional Budget Office) will publish the long-term budget outlook on Thursday. It won’t be great… as it looks more and more like Greece. In the UK, the spotlight will be on inflation as the February CPI is due on Wednesday: the consensus foresees a +0.5% MoM jump in the headline figure, which should lead to more or less unchanged YoY% readings of circa 3% for the headline, slightly above 3.5% for the core index and close to 5% for the services. Higher/Lower figures could be seen as quite bitter or sweeter for UK Gilts. Note finally that CPI data will also be released in Australia on the same day (economists expect no change with the headline annual inflation remaining stable at 2.5%).

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.