*Nestlé statement

Interview with Alexander Roose, Head of Equities, Senior Fund Manager and

Gian-Luca Grassini, Financial and ESG Analyst

- Discover how nutrition and healthcare are converging

- Dive into the world of dietary supplements and functional foods, and who the key enablers are

- Learn how nutraceutical developments are targeting the different demographic groups

- Understand the importance of the microbiome

- Get a measure of the huge opportunities – but also risks – of investing in this fascinating space

Earlier this year, we introduced our new Wellness Series, where we shine a spotlight on the most captivating health trends, bringing you insights into the most recent and intriguing developments in the realm of well-being.

Did you realise that the gut produces more than 90% of body serotonin – otherwise known as the happiness hormone?

This is but one of the many connections between nutrition and healthcare, a fast developing playfield for scientists, company managements and investors alike. This second edition of our Wellness series delves into the huge opportunity heralded by this convergence of food and health, but also its complexities and pitfalls.

Alexander and Gian-Luca, could you start by defining “nutraceuticals”? What types of products fall into this category, and which are the main companies involved – be they coming from a food or a healthcare angle?

Nutraceuticals is a term merging “nutrition” and “pharmaceuticals”. It denotes products originating from food that are believed to offer health advantages beyond the fundamental nutrients typically found in foods. They are viewed as general biological treatments that enhance overall health, manage symptoms, and ward off harmful medical conditions. Such benefits can target specific metabolic disorders, or be of a more general nature, helping to improve overall health and delay the ageing process.

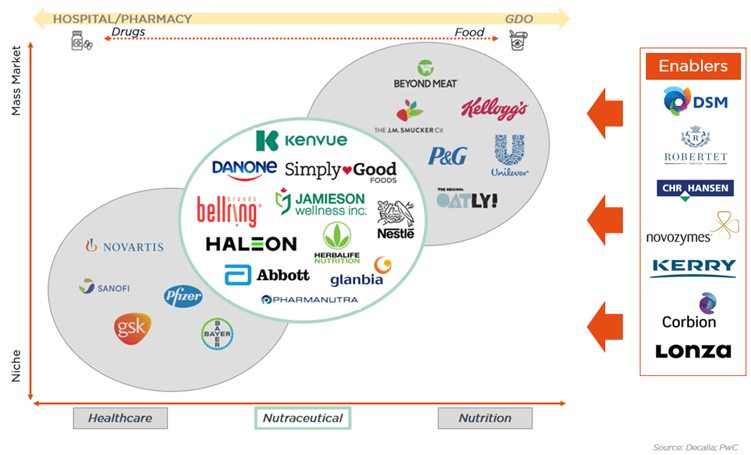

Given the wide-ranging definition of nutraceuticals, there is a vast array of distribution channels, spanning from hospitals to basic retail stores and even gyms. Nutraceuticals can thus be broken down into two large groups:

- Dietary supplements: vitamins, minerals and enzymes

- Functional foods: including prebiotics, probiotics, medical foods, fortified foods (i.e. food products from which harmful ingredients – such as sugar or excessive salt – have been removed and other – beneficial – nutrients added)

Dietary supplements and vitamins tend to be proposed by pureplay “nutraceutical” companies, whereas functional foods are typically produced by mass-market food companies crossing over to the medical space, or pharmaceutical companies moving into the food space.

Often a lot of the innovation contained in these functional foods (whether reformulated or entirely new products) is outsourced to B2B (science-led) ingredients companies.

From an investor perspective, and referring to DECALIA’s value chain approach, where should attention be focused?

In the U.S., while the FDA does not pre-approve dietary supplements for safety and efficacy ahead of their market introduction, it actively monitors and addresses mislabelled or unsafe products post-launch. This regulatory approach reduces entry barriers for businesses, but it significantly amplifies regulatory and reputational risks in the B2C space.

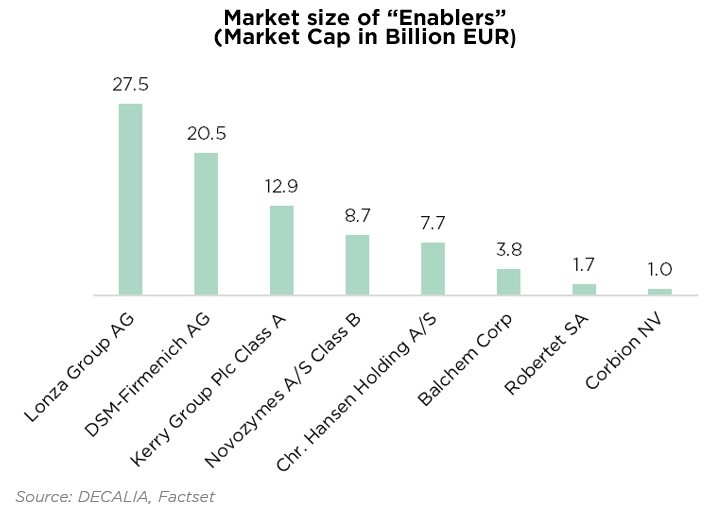

Given these heightened risks in the B2C domain, we consider the most interesting companies to be what we call the “enablers”, meaning business-to-business companies.

This is partly because enablers harbour much of the science and innovation, and thus have built up higher barriers to entry (mainly through IP related to microorganisms).

Nutraceutical market snapshot: a merger between Healthcare and Nutrition

Source: DECALIA, PwC

When we speak of science, we should add that the microbiome lies at the heart of most nutraceutical research and development. The very strong relationship between gut health and brain health is now well established, with the enteric nervous system (i.e. nerves in the gut) commonly referred to as the second brain. Working to improve the microbiome with good bacteria rather than using antibiotics to kill bacteria is akin to how the farm industry is evolving, with soil nutrients increasingly preferred to pesticides.

Since when has the influence of nutrition on human health come to be widely recognised – by the scientific community but also the general public?

In our view, an important catalyst was the 2007 publication by The Lancet, one of the oldest and most recognised medical journals, of the so-called “Southampton study”. This scientific paper established a link between hyperactivity in young children and the consumption of certain artificial food colours (as well as sodium benzoate preservative).

This led to profound changes in food industry processes, switching from synthetic to natural colourings.

As of today, the nutraceutical business is already large, and growing by the day. Could you flag what you consider to be the most interesting developments, by age group of targeted customers?

Age is often correlated with the prevalence of certain diseases. As individuals get older, they may become more susceptible to chronic conditions such as heart disease, diabetes, and arthritis.

Conversely, younger age groups might face higher risks of infectious diseases due to underdeveloped immune systems. It is essential to recognise these age-related health patterns to provide appropriate medical care and interventions.

In addition, the human microbiome evolves over a person’s lifetime, with for example significantly less

bacterial gut diversity at an older age.

Early life

After fat and carbohydrates, HMOs (Human Milk Oligosaccharides) constitute the third most plentiful ingredient in maternal breast milk. Scientific research has shown that the stronger immunity displayed by breast-fed children is attributable in part to these HMOs. Indeed, they have a positive impact on a baby’s intestinal flora, where lies a major part of the immune system. Simply put, HMOs feed the gut with good bacteria and help destroy bad bacteria.

Recognising these benefits, a number of companies have worked to produce HMOs synthetically, in particular the 2’FL type (generally the most abundant in breast milk), using fermentation processes. The idea being first to incorporate them into formula milk and then, on a longer-term perspective, to extend the market beyond the infant category.

Two of the pioneers in this field have actually already been taken over (Glycom by DSM-Firmenich and Jennewein by Chr. Hansen), illustrating the promising future for HMOs, even beyond the targeted field of baby nutrition.

Young age

Earlier in this discussion, we mentioned the 2007 “Southampton study” which made a connection between artificial food colourings and hyperactivity. In addition, Balchem highlights its Ferrochel and VitaCholine products for supporting children’s neurodevelopment. Experts from the company emphasise the critical role of maternal nutrition, especially during pregnancy, in enhancing cognitive functions in children that persist beyond their 7th birthday.

Not only that, but another example is Biogaia’s probiotics, which are recommended by paediatricians to maintain the natural balance in a child’s gut.

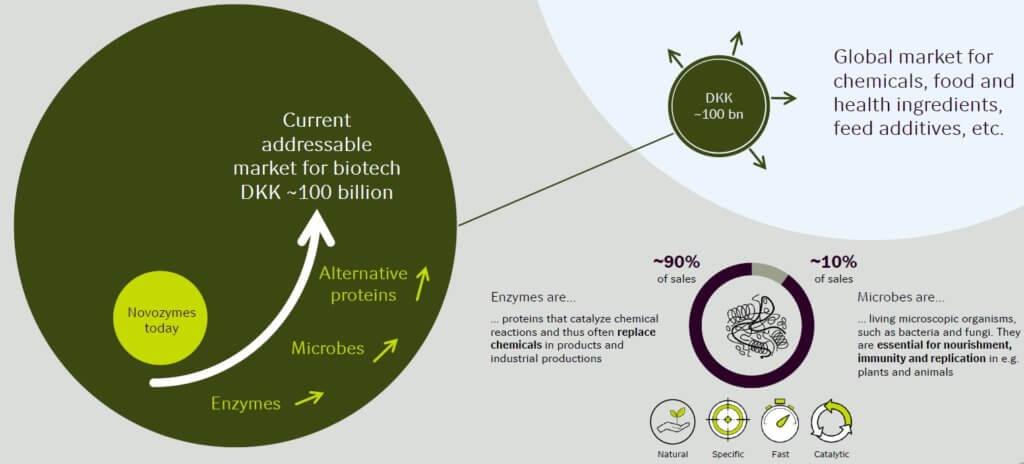

Novozymes: innovative bio-based health solutions

Source: Novozymes presentation

Middle age

Turning to adults, several areas of development look promising. The first pertains to the now widely recognised negative effects of ultra-processed food. Offering “clean label” products, i.e. ones that are made of fewer, natural ingredients and that are free of genetically-modified organisms, artificial preservatives or antibiotic traces, will definitely bring overall health benefits – not least in terms of combatting the obesity pandemic.

Readers of our first edition of this Wellness series will remember that the current prevalence of processed and convenience foods have been shown to contribute to weight gain even for a similar calorie intake.

Next, we would pinpoint the omega 3 opportunity, whose heart health and longevity virtues have been abundantly documented. What interests us more specifically is how omega 3-rich products can be sourced, in a more sustainable manner, from algae oil. Indeed, relying on a process as old as the world, fermentation, Corbion has shown that algae oil offers a locally-sourced alternative to fish oil – the production of which not only threatens under-water biodiversity, but also has a heavy carbon footprint. Algae oil is also arguably healthier than fish oil, insofar as it is free of PCB (polychlorinated biphenyl) residues. And beyond a library of micro-organisms and a technological know-how, two clear barriers to entry, the production of algae oil requires only a form of sugar feedstock (sugar cane, beetroot… depending on the region).

Last but not least, we must mention antioxidants, whose benefits for the body are believed – albeit not always fully proven – to be numerous. Stress, immune system, eye diseases, brain function, mental health… and the list goes on. Consumers certainly seem convinced, keen to ingest their daily serving of antioxidant supplements.

Old age

We come finally to the more senior age group, for whom whey-based dietary supplements (whey being a by-product of cheese-making, the liquid that is left after milk has been curdled) are now touted as a tool to fight osteoporosis. Note that whey is the main ingredient in most protein powders, hence has long appealed to the fitness and bodybuilding communities, as a means to increased muscle volume.

In addition, the older age group is more likely to undergo surgeries and hospitalisations. In such cases, nutrition can play a pivotal role in post-operative recovery, both by reducing the risk of complications and shortening the recovery time.

As the health challenges of modern lifestyles evolve, companies like Novozymes OneHealth are seeking biology-based solutions in areas like gastrointestinal, immune, and cognitive health, using advanced technologies combined with consumer insights to address these needs. Leading players in the dietary supplement field for senior health are Abbott Laboratories and Nestlé, with their respective products, Ensure Surgery and Nestlé Impact Advanced Recovery.

Not all promises come true though, as Nestlé’s recent decision to divest its peanut-allergy business illustrates. A word on the risks involved when investing in nutraceuticals?

Palforzia (the first peanut allergy pill to gain FDA approval) did not live up to “blockbuster” expectations, leading Nestlé management to first book a USD 2.2 billion impairment charge in early 2023 and then, a few weeks ago, announce the sale of the unit to Stallergenes. This is, however, by no means a rebuttal of Nestlé’s strategy when it comes to food/health convergence, as evidenced also by the fact the Nestlé’s CEO has a healthcare background.

Other example of a craze that fizzled out is plant-based meat… in actual fact not that healthy because of its ultra-processed format, high sodium and unhealthy oil content, etc. This will undoubtedly improve in the future, particularly thanks to innovations introduced by “enablers”, for whom the plant-based food sector also represents a significant opportunity.

According to Novozymes, the third reason people opt against consuming plant-based dairy is the perception that traditional dairy offers superior nutrition. The Danish company assists businesses aiming for success in the plant-based food sector by offering enzymatic biosolutions. Unlike typical ingredients, these biosolutions transform raw materials, unveiling their inherent flavour, texture, and nutritional benefits.

You have made clear that the microbiome and bacterial solutions to improve its condition are the holy grail. What current pioneering developments warrant close monitoring?

In 2019, Swiss-based Lonza, one of the leading CDMOs (Contract Development and Manufacturing Organisation) for the pharmaceutical industry joined forces with Danish Chr. Hansen, a bioscience company renowned for its fermentation know-how and best-in-kind library of bacteria. The goal of this Bacthera joint venture is to develop a microbiome-based treatment for recurrent Clostridium difficile infections. Admittedly on a long-term horizon, this stands to be the first commercially produced live biotherapeutic product, or “bug as a drug” as the class of medicines containing live microorganisms is sometimes called.

Certainly something to be watched over the next years, assuming the recent USD 12.3 billion takeover of Chr. Hansen by Novozymes (a prominent nutraceutical enabler in itself, indeed perhaps the most advanced actor in the gut health) does not jeopardise the joint venture.

And to end on an even more futuristic note, how about this thought? The convergence of health and nutrition that has brought about the market for nutraceuticals might eventually be taken one step further, to personalised nutrition. As the mirror image of personalised medicine, which is just now starting to gain traction…

Alexander Roose, Head of Equities

Gian-Luca Grassini, Financial and ESG Analyst

About DECALIA’s strategy

- a multi-thematic global equity fund, investing in innovative sectors and disruptive companies shaping our SOCIETY in the future

- invests in the 7 themes (Security, O2 & Ecology, Cloud & Digitalisation, Industrial 5.0, Elder & Well being, Tech Med, Young Generation) regrouped by the acronym SOCIETY

- managed by an experienced team: Alexander Roose (ex-CIO of the Fundamental Equity of Degroof Petercam AM) & Quirien Lemey (ex-Lead PM of a Multi-thematic fund at Degroof Petercam AM)

About DECALIA SA

Established in 2014, DECALIA SA is a Swiss investment management company. With more than 70 employees and assets under management that stand at €4.9 billion, DECALIA has expanded rapidly, in particular thanks to its active-management experience built up over the last 30 years by its founders. The strategies developed by DECALIA focus on four investment themes deemed promising in the long term: the disintermediation of the banking sector, the search for yield, long-term trends and market inefficiencies. DECALIA is regulated by FINMA through a collective assets manager’s license. In addition to its Geneva headquarter, the group has offices in Zurich, Milan & distributors of the DECALIA Sicav in Spain & Germany.