Another week-end, another cold shower for the Cagliari Calcio at home! After sinking 0-4 against Napoli the prior Sunday, my favorite Italian soccer club ruined my week-end right from the start by losing 0-2 vs. Empoli last Friday. As a result, Cagliari stands now at the much-unenviable bottom of Serie A ranking. So, forget about “cuore rossoblu”… it has rather been bleeding heart & blues for me over the week-end.

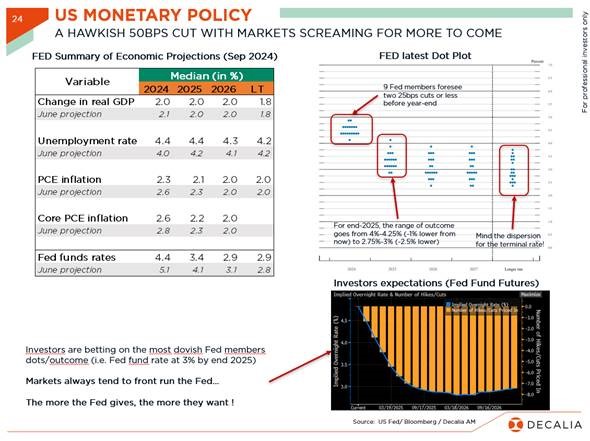

At the opposite, the Fed started its monetary policy easing cycle with a bang last week, delivering a jumbo 50bps cut, as a starting point, to the great joy of markets investors. This dovish decision was motivated by the recent deterioration in labor market with unemployment rate expected to end the year at 4.4% according to the Fed latest Summary of Economic Projections (or SEP), while inflation has also declined more rapidly than forecasted by the Fed members last June. As a result, the Fed sees now risks to employment & inflation goals roughly in balance, while still expecting resilient economic growth (GDP projections remained unchanged actually, see below). By opting for a preventive recalibration of its monetary policy rather than a cure later (in case of recession), the odds of our soft-landing scenario have likely improved.

On this matter, it’s worth highlighting two unusual features compared to previous easing cycle. First, Jerome Powell used the term “recalibration” several times during the press conference Q&A to characterize the FED’s decision to lower rates. The word choice spoke to the relative resilience that Fed officials still see in the US economy. In particular, it shows that the Fed isn’t really concerned by a recession, but instead it “just” wants to maximize the odds of fulfilling its dual mandate of price stability (with inflation now very close to its 2% target) and maximum employment (with unemployment rate starting to move higher now). In other words, and in line with the Jackson Hole speech last month, this recalibration is consistent with Jay Powell’s main concern swinging from inflation to labor market: the Fed can let go a little on one of these objectives and focus a little more on the other. As a result, and contrary to previous easing cycle: rising unemployment isn’t synonym of recession. At some point it could be, but not at this (early) stage. The second point, which is a corollary of the previous one, is that the Fed is therefore cutting from a position of strength in the economy, not weakness, with still some sticky inflation in services… while immigration inflows are expected to slow down in coming months (unemployment rate has been pushed higher lately as the labor supply increased faster than demand).

In this context, history is no longer a guide. Not only the classic trading playbook for when Fed is cutting rates (such as reduce equity exposure, buy defensive stocks, increase bonds, especially sovereign duration and decrease credit, among some basics) may not work, but the Fed’s easing pathway may be more challenging and thus bumpier than usual. In addition, markets have a bad habit, like spoiled kids, to front run the Fed… The more the Fed gives, the more they want! So, Jerome Powell’s difficult task going forward will be to find the right balance as neither risks of an economic recession triggered by a violent deterioration in labor market or financial conditions, nor a temporary reacceleration of inflation next year, can be fully dismissed yet. In the former case, the consequences will be straightforward: Fed would likely deliver other jumbo cuts with the usual defensive trading playbook resuming instantaneously. In the latter, the Fed will have to eat its hat eventually… a less easy-peasy exercise with unknown consequences. Awaiting this judgment day, in Gold, you can certainly trust, especially if the simmering tension between the hawks and the doves culminate in tragedy and violence on a hot election’s day.

Economic Calendar

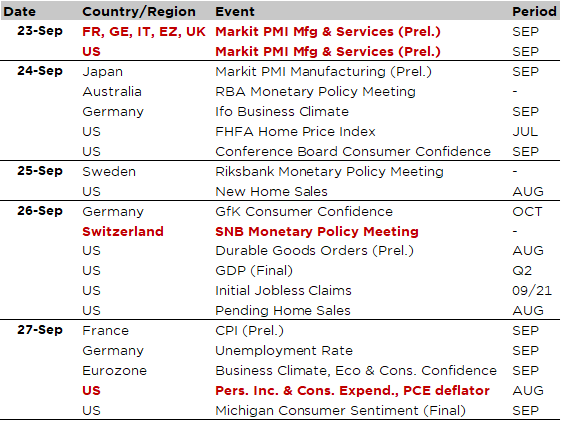

Growth, inflation and monetary policy are on the agenda this week as we will get the September flash PMI’s indices today across key economies, US core PCE deflator for September on Friday, as well as the October flash French CPI in France the same day, whereas central bank decisions are due in Australia (Tuesday), Sweden (Wednesday) and Switzerland (Thursday).

The flash PMIs released today will bring some valuable insights on global growth recent trends: will the manufacturing sector show signs of bottoming up, especially in Europe/Germany (manufacturing gauges seem to be picking up in the US), or will the momentum in the services industry soften further (remaining however above the 50 mark)? In addition, several business and consumer confidence indicators will also be released in Europe and in the US, such as the German IFO and US Conference Board Consumer Confidence tomorrow.

In the US, the key release notable will be the Fed’s preferred inflation gauge, i.e. the core PCE, due Friday along with consumer expenditures, income and saving rate for August. The consensus expects MoM growth of +0.2% (as in July) for core, while the headline is foreseen a touch softer at 0.1%. In this context, the YoY growth should tick up to 2.7% in August from 2.6%, while the headline will decline to 2.3% from 2.5%. As far as the personal income and consumption are concerned, investors point again to solid growth in August of +0.4% and +0.3% respectively (after +0.3% and +0.5% in July). Last but not the least, monetary policy decisions this week include Australia’s RBA tomorrow (expected to deliver a hawkish hold by keeping rates unchanged at 4.35%), Sweden’s Riksbank on Wednesday with a well-telegraphed dovish -25bps cut to 3.25% and Switzerland’s SNB on Thursday for a 3rd cut of 25bps since March (or even more according to some economists as it could be the last one), to 1% (or lower if SNB’s goes all-in -rather to wait- with a jumbo cut) as inflation isn’t an issue, whereas CHF strength headache is already back.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.