Another respectable defeat for Cagliari Calcio (0-1 against “King Claudio” Ranieri’s Roma), another mortifying defeat for Juventus (0-3 against Fiorentina). While my beloved club remains above the fateful relegation bar, the Old Lady sees a qualifying place for the next Champion’s league slipping away for the time being. In both cases, a “bomber” is urgently needed to find the net again in order to end this drought eventually. And that’s exactly what Germany is preparing to do this week by voting for a mega-stimulus package: forget about “Draghi’s bazooka”, here comes “Die Dicke Bertha” to shake up a moribund Deutschland AG and bring potentially in its wake the whole Continental Europe!

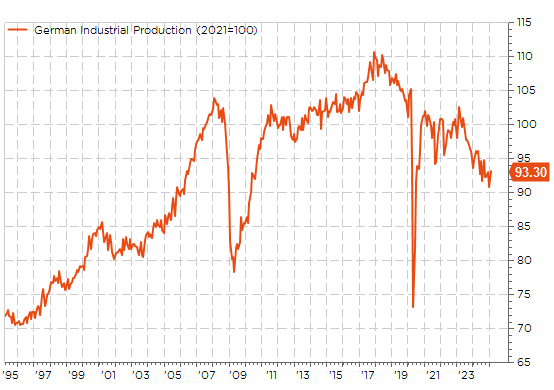

German industrial production index (2021 = 100): back to the future…same level as 20 years ago!

Germany’s new coalition government is on the verge to reform its strict fiscal rules, marking a historic shift away from its rigidly dogmatic fiscal conservatism. The proposed reforms, which are very likely to be validated by the Bundestag tomorrow (2/3 majority is needed) after long negotiations between the CDU/CSU, SPD and the Greens last Friday. They include exempting defense spending above 1% of GDP from fiscal limits (at least €40bn additional spending just to get to 2% of GDP), creating a €500bn infrastructure fund (equivalent to 12% of current GDP) to spend over the next 10 years, and allowing also federal states to run small deficits (slightly above 0% instead of strict zero). If enacted, these changes could increase Germany’s budget deficit to around 4.5% of GDP for the next several years. It would be the largest fiscal expansion since the German reunification…

These reforms are seen as positive because they focus on strategic areas like defense and infrastructure, on top of climate change (small concession given to the Greens last week), which could boost domestic demand and investment. They should also benefit European economies by increasing German imports and reducing (global) trade imbalances. Additionally, the move could influence fiscal policies across the eurozone.

However, optimism should be tempered too as (1) the economic impact will take time (except the indirect sentiment boost support, the direct consequences won’t be visible before year-end at the earliest as infrastructure projects and defense spending are slow to materialize), (2) the fiscal multiplier effect for defense spending is low, and (3) Germany’s near-full employment could further limit growth effects or lead to more inflation. As a result, GDP growth may not rise significantly until 2026, with an estimated boost in between +0.5% and +1.0%, bringing overall growth to … still a meager 1.0%-1.5%.

Selected 10y rates over the last 12M: not yet any direct benefits but already higher funding costs for the Euro borrowers

And there could be also some side effects through higher inflation, higher funding costs for peripherals and European companies, especially those with weaker finances, as the German rate set the “risk-free” lending rate for the euro area borrowers, and, last but not the least, debt sustainability concerns down on the road if the positive effects disappoint relative to the size of this “Grosse Bertha” and related side effects. Finally, it will also complicate the tasks of the ECB, which will face a challenge in balancing this fiscal shift with monetary policy. While both growth and inflation are expected to decline in the next few months, the massive German fiscal expansion means interest rates may not be cut as aggressively as previously anticipated. Forecasts now suggest ECB target rates could rise to 3% by 2027 instead of falling further… In soccer, as in economics, announcements of major player transfers don’t always bring the expected results (in line with the amounts spent). So, let’s hope “Dick Bertha” would really be a game-changer for Europe.. If not, trouble could be even worse in the future with the risks of being definitively kicked-out of the economic champions’ league!

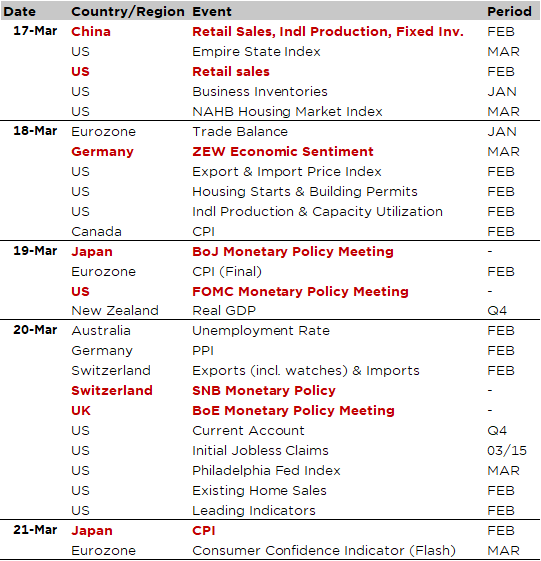

Economic Calendar

So far, so mad this month, isn’t it? It’s really March Madness! Geopolitical uncertainties and the fate of Ukraine still in the air, tariff threats becoming reality, Germany announcing “Der Grosse Bertha” fiscal package, one of the fastest ever S&P500 correction (it took only 5 days!), German bund spiking +50bps, and so on and so forth… This week, it will be the turn to central banks to take center stage with meetings and decisions due from the Fed, the BoJ, the SNB and the BoE. In terms of economic data releases, the highlights include US February retail sales and economic activity in China (released this morning), German ZEW economic sentiment (tomorrow) as well as inflation in Japan (Friday).

The key event will likely be the Fed’s meeting on Wednesday. While there is a widely accepted consensus about the US central bank staying on hold (4.25%-4.50%), investors will be focused on the Summary of Economic Projections, the dot plot and the ensuing press conference of Jay Powell in order to gauge how officials assess the rates trajectories following weeks of market volatility and mixed economic data in a context of heightened uncertainty on the economy and policy. My gut feelings: Jay and his team will reinforce, repeat and thus stick with their data-dependency path… leaving therefore as many options and doors open as possible.

In Japan, the BoJ will also decide on rates on the early morning of the same day. The consensus largely expects policy rate to remain at 0.5% currently but we can’t completely rule out a hike given the latest upbeat activity indicators, consumers’ inflation expectations on the rise, as well as the current wage negotiations (shunto) as a major Japanese labor union group just obtained an average 5.4% pay hike for this year…

On Thursday, the BoE in the UK and the Switzerland’s SNB will also meet and decide on monetary policy. The Bloomberg median consensus expects almost unanimously the BoE to keep the Bank Rate unchanged at 4.5%, while a -25bps cut to 0.25% is penciled for the SNB. I am not so sure that the SNB will use one of its last ammunitions now given the many uncertainties still in the air (even if it could then bring the policy rate in negative territory later if really needed). If the German Big Bertha fiscal plan goes ahead, there should likely be less downward pressures on the euro going forward assuming higher growth, inflation and rates in the euro area, on top of more fiscal integration through common funding for the extra defense spending, while Swiss economy may also indirectly benefit from this potential game-changer (pushing up marginally the potential growth).

In terms of economic data, investors will keep an attentive eye on the US February retail sales this afternoon after the weak consumption figures the previous month and the recent fall in consumer confidence indicators. The consensus foresees a rebound in US retail sales of the same magnitude of the prior month decline. In Europe, on top of the German ZEW survey tomorrow, the spotlight will remain on the negotiations around the proposed fiscal expansion in Germany. The Bundestag and the Bundesrat are expected to hold votes on Tuesday and Friday, respectively, before the new Bundestag sits from March 25. Finally, we will also get Japan February CPI on Friday: core-core inflation (i.e. excluding food and energy) is expected to tick up to 2.6%, while the headline inflation should drop to 3.5% from 4%. This morning, Chinese data activity (retail sales, industrial production and fixed investment) pointed to a decent start to the year as they all came somewhat above expectations. However, Chinese economic growth continues to be supported by low rates and ongoing fiscal stimulus. In fact, there are still some worrying underlying trends with the unemployment rate rising to 5.4% in February (highest level in two years), while new home prices dipped again last month.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.