• Growing audiences, TV rights, sponsorships, company revenues…

• … the ball is rolling fast on the women’s sports field

• Enough to hope for the gender pay gap to recede?

They brought it home! A feminine “they”, mind you, in the final match of a Euro 2022 tournament that heralds a new era for women’s football – and for women’s sports more generally. Gone are the days of chronic lack of investment which, in a form of self-fulfilling prophecy, also made for much lesser profitability. In this post-Covid world, female athletes and leagues are coming up with creative financial strategies, capitalising on social media, the drive for gender parity and the increasing clout of women and Gen Z consumer groups. No wonder brands and investors are eager to be part of the action.

On 31 July, 17.4 million people saw the Lionesses beat Germany live on BBC, making it the UK channel’s most-watched programme of 2022 – ahead even of the Queen’s Platinum Jubilee celebrations. And it is not just women’s football that is attracting greater audiences these days. Women’s basketball, golf and tennis have also experienced a step-up in interest over the past year or so, even as viewership of male sports has receded.

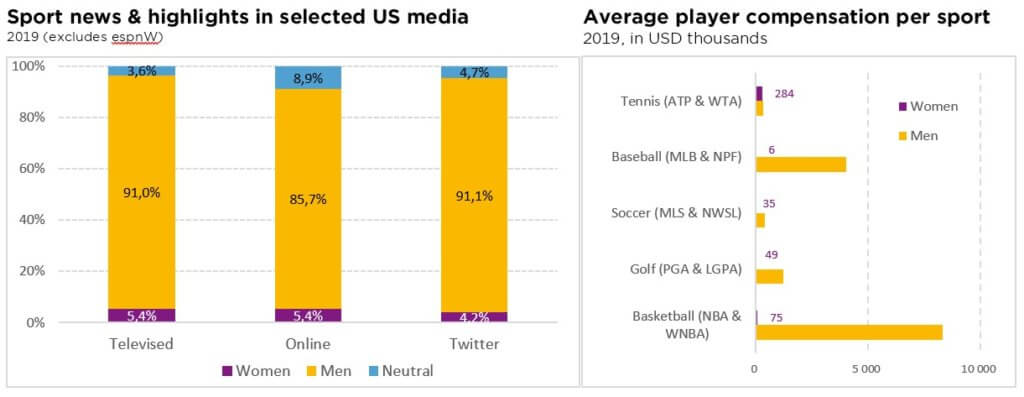

Such growing attention makes women’s sports “ripe for greater monetization”, to quote a 2021 report by Deloitte. TV rights, the largest source of elite sports revenues, are certainly starting to climb. The BBC is said to have forked out EUR 10-12 million for coverage of the Euro 2022 vs. the EUR 1 million paid by Channel 4 for the prior edition. Still, the gap relative to men’s sports remains huge. On the other side of the Atlantic, ESPN’s latest deal with the WNBA was a paltry USD 25 million relative to the 2019 TV rights of USD 2.6 billion for men’s basketball. Note, however, that this cost differential should make women’s events especially attractive to public service broadcasters, which lack the financial clout to compete for rights on men’s sports.

And that female leagues’ lesser dependence on restrictive TV contracts gives them greater opportunity to build their presence on social media and digital streaming platforms.

As for sponsorships, women’s sports still account for only a fraction of the total USD 45 billion spent annually – also suggesting huge potential ahead. Barclays, title sponsor of the UK Women’s (football) Super League since 2019, for instance just doubled its support to GBP 30 million, setting a record for brand spending in UK women’s sports. At the European level, PepsiCo has committed with the UEFA to support women’s football through 2025 – alongside its better-known sponsorship of the men’s Champions League. And Nike, whose stated goal is no less than “empowering the next generation of women in sport” and who serves as kit sponsor to the Lionesses, is already seeing the payback: April-June marked the best quarter ever for its women’s division.

Beyond being the next frontier for traditional sports companies, women’s sports offer fertile grounds for new brands to develop, whether already public (Lululemon is an example that springs to mind) or still in the private equity realm. For the picture to be perfect though, the improving economics of women’s sports should also flow through to the athletes themselves. With equal prize money at all four grand slam tournaments, tennis is presently an exception.

In most sports, gender pay disparities well exceed the 15-20% national averages. And even the top-paid female athletes cannot rival – financially that is! – with their male counterparts.

Written by Iana Perova, Analyst

The Holy Grail of soft landing will be tough to achieve

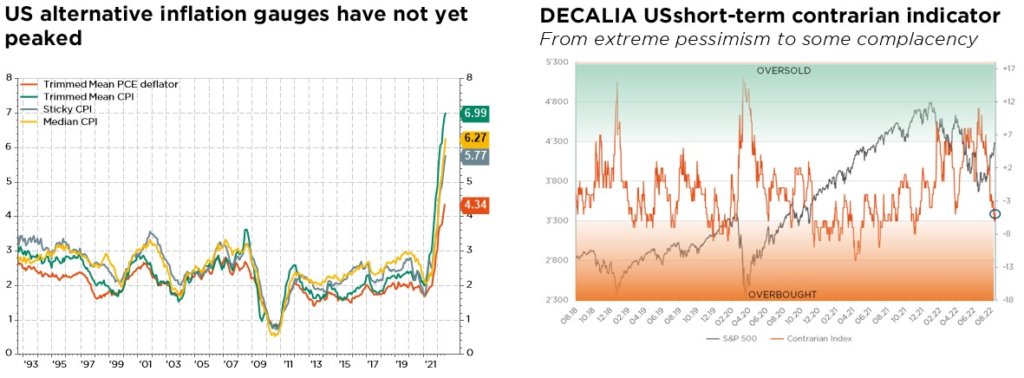

Doom and gloom stories of a pending recession, persistent inflation and monetary tightening that so weighed on investor sentiment in June have since been replaced by a more supportive “peak inflation and soft landing” narrative. Such hope has been fuelled by a flurry of good news, notably a stronger-than-expected US July employment report (reducing the odds of an imminent recession), an overall decent – and certainly better-than-feared – earnings season, and the lower-than-anticipated US July CPI reading.

Can this optimism last? We are sceptical. While there were good reasons for a summer respite, with investor positioning and sentiment having reached overly pessimistic levels in mid-June, we now suspect that markets are somewhat ahead of themselves. Fed’s Chairman Powell opening speech at the Jackson Hole Economic Symposium just confirmed our views: inflation rates will likely remain too high to afford central bankers the luxury of turning dovish in the foreseeable future. In fact, Fed officials are still discussing a much more hawkish path for rates than investors were anticipating. In addition, the recent easing in financial conditions may be self-defeating (assuming it even lasts), as central banks are then liable to lean more easily on the hawkish side. Finally, growth momentum is not expected to improve anytime soon and further earnings downgrades can be anticipated as the economy slows. Indeed, China is still struggling to recover from its Covid/crackdown/real estate-induced slump, while leading indicators continue to trend down in developed markets.

The combination of a still pandemic-distorted economy and a challenging geopolitical context means that uncertainty remains high, with a much wider distribution of outcomes than usual. The only good news truly to be cheered is that some tail risks have receded, particularly with regards to an imminent growth accident because of overly aggressive monetary policy. Unfortunately, there is not yet strong enough evidence that we are out of the woods. Until the monetary policy and inflation trajectories become clearer, likewise the timing, duration and severity of the next recession, we expect further bumpiness in global equity markets and rates.

While investor sentiment and positioning were extremely bearish back in mid-June, some form of complacency currently seems to prevail. As such, just as we did not cut risk further going into summer, we have decided to not chase the recent rally, preferring to stick to a prudent near-term approach. At the portfolio level, this means keeping our asset allocation unchanged for now, with a slight underweight of both global equities and bonds.

In equities, consistent with a higher risk premium and still limited earnings visibility, we may opportunistically implement some protections (put options) if the fairy tale endures. Meanwhile, although maintaining a balanced, multi-style, all-terrain approach to portfolio construction, we adopted last month a slightly more defensive high-quality equity allocation and selection. In fixed income, we stick to our guns, favouring the short end of the curve globally and investment grade quality names, to mitigate overall portfolio volatility.

Elsewhere, we keep an overweight stance on gold and a slight tactical underweight of other materials (i.e. industrial metals and energy), due to downside cyclical risks. Finally, we still believe that USD strength is coming to an end (slight underweight), as other major central banks gradually catch up with the Fed’s tightening intentions in order to tame record high inflation. In this context, the CHF remains our favourite currency, supported by still-solid structural fundamentals and the SNB’s hawkish stance.

Written by Fabrizio Quirighetti, CIO & Head of Multi-Asset