Interview with Alexander Roose, Head of Equities, and Jonathan Graas, Lead Fund Manager

The DECALIA’s Circular strategy invests in the transition towards a circular economy. There is enormous potential in adopting circular business models, and here’s what you should know about it:

- A circular economy goes well beyond simply recycling used products

- It consists of two wings, a technical cycle and a biological cycle, both striving to decouple economic expansion from the depletion of finite resources

- Six secular themes underpin the transition to our CIRCLE model

- Enablers & Disruptors obviously play a key role, but there is also value to be found in Improvers & Adopters

- Notwithstanding current economic woes, catalysts for adoption of circular business models are in place, on a short- and medium/long-term horizon

Is economic expansion compatible with decarbonisation? Never perhaps has this question been so acute as today, with the world headed for a – simultaneous – recession and energy supply crisis.

Where some economists and policymakers argue that the required macro stimulus measures and readily available power alternatives are simply incompatible with the achievement of net zero emission targets, we would counter that it is rather a matter of revisiting the entire economic equation. More specifically, of shifting from a linear model to a circular one.

Alexander, Jonathan, could you start by providing a short explanation of the circular economic framework – which goes well beyond simply recycling used products?

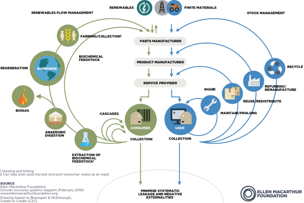

The concept of circular economy dates back to 2009, when it was put forward by the Ellen MacArthur foundation. At its core lies the aim to decouple “economic activity from the consumption of finite resources”. The point indeed being not just to reduce waste through recycling, but to stop producing waste by designing systems that keep existing resources in use at their greatest value and efficiency.

The so-called “Butterfly diagram” (see below) depicts the two wings of a circular economy, with the inner loops on each wing to be prioritised over the larger loops. The right-hand wing represents the technical cycle, which applies to finite materials. It is by now generally well understood – and often summarised by the 4R acronym (reduce, reuse, recycle, repurpose). The biological cycle, on the left-hand, probably warrants more explaining. It pertains to biodegradable resources, with the aim of minimising negative externalities, preserving biodiversity and, ultimately, rebuilding the world’s natural capital1.

2. According to the Greenhouse Gas Protocol, company emissions are split into (1) direct emissions, (2) indirect emissions from purchased power and (3) other indirect emissions pertaining to the entire value chain

To facilitate comprehension of the biological cycle, could you give us a concrete example?

Algae oil is a good example. Relying on a process as old as the world, fermentation, it offers a local-sourced alternative to fish oil – the production of which not only threatens under-water biodiversity, but also has a heavy carbon footprint (anchoveta are fished off the Latin American Pacific coast then transported by vessel across the globe). Beyond a library of micro-organisms and technological know-how, two clear barriers to entry, the production of algae oil requires just a form of sugar feedstock (sugar cane, beetroot, depending on the region). And not only are its health virtues commendable (with a high share of unsaturated fats such as Omega-3), but it enables companies that substitute away from fish oil to reduce scope 3 emissions2.

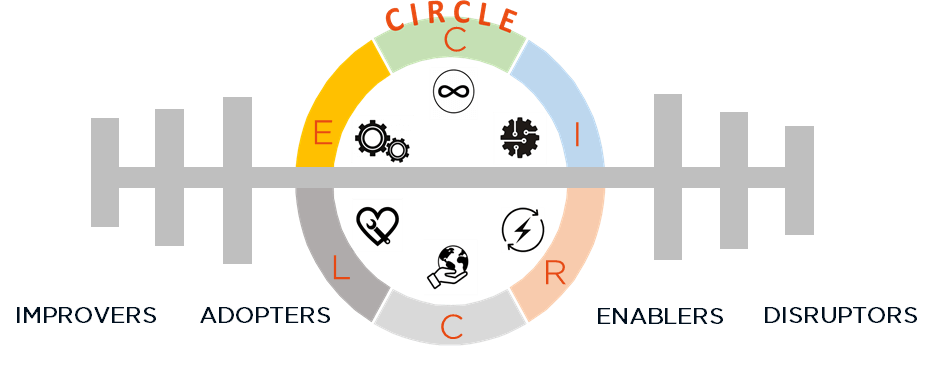

Moving on to the Decalia-developed investment framework, you have chosen to spell out CIRCLE into six different themes. What are these six secular trends that, in your view, will shape the circular economy of tomorrow?

The first C stands, quite logically, for circular models. By that we mean companies that develop shared platforms and/or sell products as a service. A well-known example is Etsy, the 70-million buyer strong digital marketplace for vintage and hand-crafted products.

The I is to be read as innovative technology, whereby companies make the most of the potential for digitisation, implement smart manufacturing processes and develop innovative financial models.

Docusign, for instance, is a pioneer in electronic signature cloud solutions – allowing for much paper usage (hence depletion of natural resources) but also much faster and practical decision-taking.

Then comes the R, for renewables. Hereunder fall companies that work on renewable power sources, more efficient energy solutions and, in a broader sense, what is known as the “smart grid”, i.e. an electricity transmission system that is optimised, thanks – here again – to technological improvements enabling better user monitoring.

Shoals is perhaps a lesser-known name in this space, yet with a critical role in the integration of large solar utility parks into the electrical grid. It enables developers of solar projects to use a much leaner wiring architecture, enabling to save on labour (no general electricians required) and raw materials costs (wire runs are reduced by 90%), all the while improving efficiency and reliability.

External sources include: Ellen Mc Arthur.

The second C pertains to a cleaner environment, thus covering companies active in water and waste treatment, in recycling and in green mobility. Or, put differently, companies that help reduce, avoid and/or eliminate contaminants, waste and emissions.

We can notably point to AO Smith, a leading provider of energy-efficient water heating and treatment processes for the residential sector.

L stands for life preservation, by which we mean companies that bring solutions to preserve the life of machines as well as, crucially, biodiversity. John Deere falls into this category, being a key driver of precision-farming, using data-based technology and automation to improve productivity while optimising crop inputs – aka regenerative agriculture. The AI-powered tractors to be launched by John Deere will also enable farmers to significantly reduce their usage of pesticides and fertilizers.

Finally, the E refers to eco design, that is companies that are rethinking product design and packaging, to enhance reuse, recycling and repair potential. In this regard, Autodesk springs to mind, being a leader in software design for the architecture, engineering and construction sector, as well as industry in a broader sense.

Simply put, and referring back to our prior Ecology Series issue discussing potential energy efficiency gains from better insulation of existing buildings, Autodesk’s software makes it possible to actually design net zero buildings – included embedded carbon emissions.

CIRCLE is the target but how we get there is obviously the issue. In that respect, you make a distinction between enablers & disruptors, on the one hand, and improvers & adopters on the other. Please give us a little more colour on this barbell approach.

The key to ESG investing, indeed to any type of investing, is to be forward-looking. One need not only determine who is currently best-in-class but also look – albeit very selectively –

for heavy carbon footprint companies that are on the path towards greater sustainability.

From a portfolio management perspective, this also means a better mix of valuations. Indeed, enablers & disruptors, being at the forefront of the move to a circular economy, tend to trade at rich multiples – having already attracted a lot of investor attention.

Improvers & adopters, conversely, generally come at a much lower price tag, the catch being to be able to identify those that are truly intent on becoming more circular, putting their money where their mouth is and delivering tangible evidence of improvement.

An interesting example of an “improver” is Air Products. Industrial gas, the company’s area of activity, is clearly a heavy CO2 emitter, mostly due to scope 3 emissions.

That said, the very significant investments that Air Products is making in blue/green hydrogen as well as sustainable aviation fuels, with USD 11 billion already committed and scheduled to come online before 2027 (and a further USD 4 billion to be allocated to future projects by that same year) will help improve the transition towards renewable energy.

You have made it very clear that our economic framework needs to shift from linear to circular. But what will be the catalysts for this transition, particularly in the currently difficult – recessionary and inflationary – circumstances?

Economic actors are obviously not in the best of shapes today, with growth slowing and the cost of debt fast increasing. Still, we would argue that awareness as to the limits of the current economic model is mounting – perhaps actually “helped” by the underlying drivers of inflation, namely the Covid-induced supply chain issues and Ukraine-driven energy supply-demand imbalance.

As such, on a relatively short-term horizon, we expect several catalysts for the adoption of a circular economy: regulatory and policy support at the government level, increasing demand for sustainable products at the consumer lever, and the desire for local/resilient supply chains at the company level. Not to mention rising commodity costs, which provide another strong incentive for change – and fast.

On a medium- to long-term horizon, the superior growth profile of companies having adopted a circular business model (with better risk control, fewer supply chain disruptions and external dependencies, as well as higher customer loyalty) should also prove a catalyst for a more generalised transition. As will be their stronger margins, courtesy of a less capital-intensive business model and lower raw material costs. Finally, this combination of faster growth and higher margins should translate into higher valuation multiples – serving to convince both companies and investors of the virtues of circularisation. For ultimately, it is all about capital flows. We, certainly, are convinced that a circular economy holds the main ingredients for a successful long-term investment.

About DECALIA’s Circular strategy

- Based on circular business model, investing in 6 secular trends (Circular Models, Innovative Technology, Renewables, Cleaner Environment, Life Preservation, Eco Design) regrouped by the acronym CIRCLE

- Forward-looking perspective: investing not only in circular economy pure plays, but also in improvers, companies with significant environmental footprint & high marginal impact potential

- A team focused on thematic investing managed by an experienced team: Alexander Roose (ex-CIO of the Fundamental Equity of Degroof Petercam AM) & Jonathan Graas (ex-Lead PM of two sustainable theme funds at Degroof Petercam AM)

About DECALIA SA

Established in 2014, DECALIA SA is a Swiss investment management company. With more than 70 employees and assets under management that stand at €4.9 billion, DECALIA has expanded rapidly, in particular thanks to its active-management experience built up over the last 30 years by its founders. The strategies developed by DECALIA focus on four investment themes deemed promising in the long term: the disintermediation of the banking sector, the search for yield, long-term trends and market inefficiencies. DECALIA is regulated by FINMA through a collective assets manager’s license. In addition to its Geneva headquarter, the group has offices in Zurich, Milan & distributors of the DECALIA Sicav in Spain & Germany.