- With nearly two thirds of European buildings at least 35 years of age…

- … the payback from better insulation is evident, and will be fast to come

- Can investors look to a similar opportunity in insulation manufacturers?

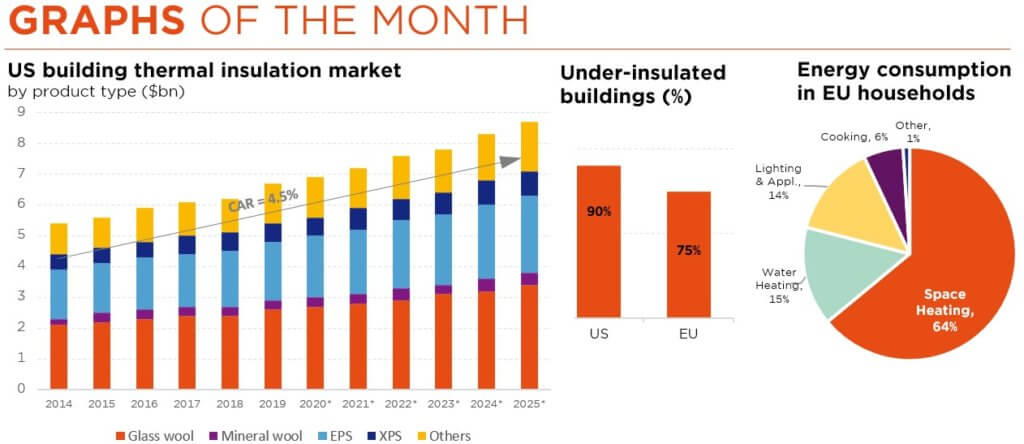

Europe is headed for a tough winter on the energy front and policymakers’ immediate focus is obviously on securing sufficient access to power sources to avoid blackouts – as well as limiting the inflationary blow to consumers. That said, their longer-term goal must be to reduce energy usage across all segments of the economy. In this respect, more efficient insulation certainly has a role to play. Particularly since three quarters of buildings in Europe (ca. 1 million houses just in Switzerland) are currently deemed to be under-insulated.

A couple more figures to begin with. Did you know that buildings currently account for 40% of Europe’s energy consumption? Or that 64% of the energy consumed by European households goes into heating? ADEME, the French Environment and Energy Management Agency, estimates that, for a pre-1974 non-insulated house, half of the heat loss is attributable to the walls and roof. As such, the current energy crisis, coupled with policy support, could foster high-single-digit growth for the insulation market over the next decade – with innovative companies, exposed to the right mix of end markets, doing even better.

Specifically, we expect companies that have US exposure to outgrow those active mainly in Europe. The construction industry is cycle-sensitive and the old continent’s high dependence on Russian gas clearly makes for a tougher economic outlook. Being exposed to non-residential construction also looks more attractive than residential construction, given the various government support measures being deployed and because of the trend towards multi-family housing in the residential space – which tends to make it more akin to commercial building, in terms of the companies that are contracted. Finally, in an environment of rising inflation and mortgage rates, renovations typically hold up better than new constructions.

A newbuild project can be postponed, but not the repair of, say, a leaking roof.

Delving further into wall insulation and setting aside plant- and animal-based “solutions”, which may be a factor at some point in the future but remain anecdotical for now, two types of materials are used: foam (oil derivative-based) and mineral wool (rock-based). The former currently appears the most interesting, offering not only the best thermal performance, in terms of conductivity and resistance notably, but also being less capital-intensive, thinner to install and (because the prices of minerals have actually risen much more than oil) cheaper.

Kingspan, Rockwool, Owens Corning and Carlisle are the four large “pureplay” companies in the sector. Rockwool – as its name suggests – being active in mineral wool, Kingspan and Carlisle in foam, while Owens Corning produces both. From an end-market perspective, Carlisle probably boasts the best profile (80% of the revenues generated in the US and 90% commercial exposure), also explaining that it currently trades at a premium multiple.

Still, the current market jitters are fast pushing the stock prices of all these companies south, to the point of approaching our “stress test” levels – using very negative assumptions for the various end markets, notably a 40% decline in new residential building (as a matter of comparison, it dropped 50% during the 2007-2008 Great Financial Crisis) and a 25% decline in new non-residential construction. Investors should thus be on the lookout for opportunities to gain exposure to this promising and necessary component of the energy transition.

Written by Andrea Biscia, Equity Analyst, ESG Analyst

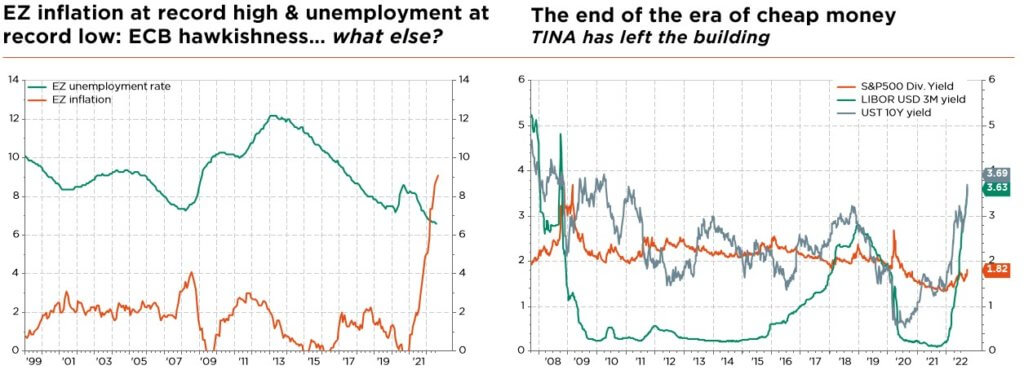

Game of Thrones: the ruling monarch is not our friend

Winter is coming…. God save the Fed! With Her Majesty Queen Elizabeth II peacefully passing away and “King” Federer announcing his retirement within just a few days, investor eyes rapidly turned back to the markets’ current ruling monarch, the US central bank. The summer bear market rally is well and truly over, reality having brutally struck back. Powell’s hawkish Jackson Hole speech dealt the first blow, followed by hotter-than-expected US employment & inflation reports, and then other major central banks joining the Fed’s fight against inflation. Global interest rates moved higher again, and bond prices lower, tempering hopes of a soft landing.

Central banks seem determined to tighten monetary policy until inflation is close to target, even at the risk of inflicting some economic pain – a challenging backdrop for most assets. Even currencies are not spared by the Game of Thrones drama: the forex market lately experienced heightened volatility on the back of central bank intentions and… debt sustainability. The GBP has suffered a confidence crisis (rising government debt, higher inflation, chronic external deficit and a central bank that is behind the curve), while the dollar continues its relentless advance, the Fed being not only the first mover among major central banks but having also adopted the most hawkish stance.

Mounting fears of slower earnings growth, revived geopolitical tensions and a looming energy crisis in Europe obviously did little to help an already depressed market sentiment. As a result, valuations have plummeted, with positioning following suit as investors unloaded equities to record-light levels – pending initial signs of the royal Fed’s first monetary policy easing decree. In fixed income, stickier inflation and the prospect of aggressive monetary tightening have prevented government bonds from acting as a risk-off decorrelated asset (as usually the case during the past 30 years).

Worse, government bond indices have lost as much ground as their equity peers.

While the global macro picture is undeniably deteriorating, the big question remains how much of the bad news is already priced in. Put differently, how far are we from “peak inflation”, aka “peak hawkishness”? Not too far probably, but not there yet. With still limited near-term visibility and most investors “stuck in the middle”, we thus remain on the sidelines for now, expecting global markets to remain bumpy.

At the portfolio level, we retain our near-term cautious stance (slight underweight) in both equities and bonds, on account of the higher risk and inflation premium. Within equities, although maintaining a balanced multi-style all-terrain approach to portfolio construction, we continue to advocate a slightly more defensive, high-quality allocation and selection. As for the fixed income space, we still favour the short end of the curve globally and investment grade quality, to mitigate overall portfolio volatility. Following the recent surge in short-term rates, even cash instruments have recovered some appeal: after a decade of financial repression, they now again offer a decent yield and may provide dry powder in due course.

With central banks determined to regain control over inflation and the (real) cash yield moving up, we are turning cautious on gold, moving it from overweight to a slight underweight. Any upside now seems capped by the Fed’s hawkish intentions, while the downside risk is increasing on the back of rising opportunity costs – which also challenge its diversification virtues.

Written by Fabrizio Quirighetti, CIO & Head of Multi-Asset