- Defy the herd mentality: These stocks have already priced in the possibility of a recession, presenting a favorable risk-reward balance for those looking to capitalize on the market’s forward-thinking.

- Driving Sustainable Innovation: Small and Mid-cap companies are at the forefront of the circular economy, spearheading transformative changes and creating sustainable solutions for a better future.

- Dive into DECALIA’s circular economy strategy

The current market conditions present a compelling case for increasing Small- and Mid-cap allocation. These stocks have recently underperformed larger peers by a significant margin, potentially indicating that a recession is already priced in. Moreover, their attractive valuation ratios, coupled with their historical tendency to outperform early in the economic cycle after central banks have finished hiking rates, make them an appealing investment opportunity. Below we lay out the arguments to increase allocation to Smid caps in more detail:

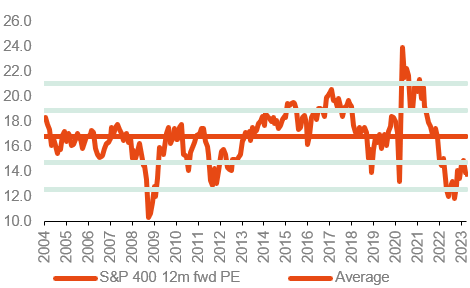

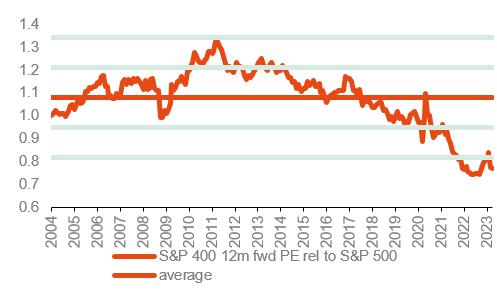

1- Examining the valuation perspective, the S&P 400’s (reference index for midcaps in the US) forward price-to-earnings (PE) ratio stands at 13.2x, near the lows of the past two decades, except for a brief period during the Great Financial Crisis. In relative terms, the valuation picture is even more attractive, with the difference compared to the S&P 500 exceeding two standard deviations. Similar observations can be made for the Russell 2000 (reference index for Small caps), which displays an even lower absolute valuation. Considering the historical relationship between the Russell 2000’s 12-month forward PE and subsequent returns, there is potential for double-digit annualized performance ahead.

S&P 400 Midcap 12m fwd valuation

S&P 400 Midcap 12m fwd valuation relative to S&P 500

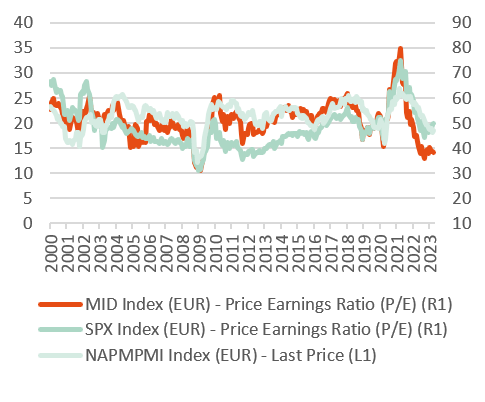

2- Another factor supporting Small- and Mid-cap stocks is their advanced discounting of a recession compared to large caps. When comparing PE levels to the ISM manufacturing index, it becomes apparent that the mid-cap index has experienced more significant declines than the S&P 500. Therefore, increasing Small- and Mid-cap allocation in portfolios appears justified, regardless of whether a recession materializes.

S&P 500 & S&P MidCap 400 P/E & correlation with ISM Manufacturing Index

Source: Bloomberg, DECALIA, 09/05/2023

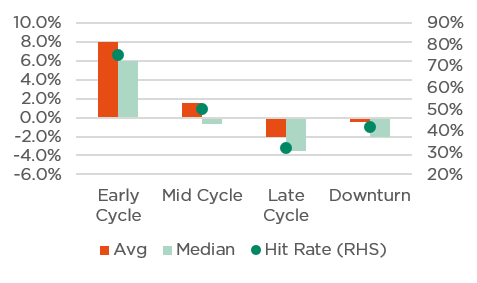

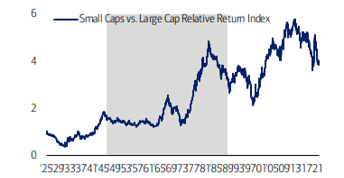

3- The early stage of an economic cycle typically favors Small-cap performance over large caps. Analysing data since 1979, the Russell 2000 has shown an average excess return of 8% relative to the S&P 500 during this phase, with a success rate exceeding 70%. Conversely, it tends to lag by 2-4% during the latter part of the cycle and during an actual downturn.

Early Cycle typically best phase for small vs large caps, with small typically lagging large in Downturns

Average and median relative performance of small vs large caps during the four phases of our US Regime Indicator

4- Moreover, Small-cap earnings tend to rebound swiftly from their trough during early cycle episodes. In the past, it took the Russell 2000 an average of 1.42 years to return to its prior peak, with three-quarters of the recovery achieved within the first year. Even during full-fledged recessions, although the complete earnings recovery took longer (1.87 years), the bounce in the first year was particularly robust.

5- Considering the specificities of the current cycle, characterized by sticky inflation and rapid monetary tightening, historical data supports Small caps once again. Not only did they outperform during the inflationary period of the 1970s, but their returns in the 12 months following the last Fed rate hike were also strongest at that time.

Small caps outperformed during the inflationary period of the 1970s and during the full protectionist Cold War period (in grey) Small caps vs. large cap relative performance (1926-9/30/22)

Source of historical returns: CRSP, Center for Research in Security Prices, Graduate School of Business, The University of Chicago. Used with permission. All rights reserved.

Source: CRSP, The University of Chicago: BofA US Equity & Quant Strategy

In conclusion, to generate alpha and follow the path of future opportunities, it is crucial to increase Small- and Mid-cap exposure. As ice hockey legend Wayne Gretzky wisely said, one should go where the puck is going, not where it has been. Therefore, the time to increase Small- and Mid-cap allocation is now, given the favourable market conditions and the potential for strong performance in the foreseeable future.

Small and Mid-Cap Stocks: “The Driving Force behind the Circular Economy”

Small and Mid-cap stocks are at the forefront of driving innovation and spearheading the transition towards a circular economy. These companies, often characterized by their agility and entrepreneurial spirit, are playing a vital role in reshaping industries and creating sustainable solutions.With their nimble operations and ability to adapt quickly, Small and Mid-cap companies are leading the charge in implementing circular business models, resource efficiency, and sustainable practices. By investing in Small and Mid-cap stocks, investors have the opportunity to support and benefit from the transformative power of these companies, as they shape a more sustainable and resilient future.

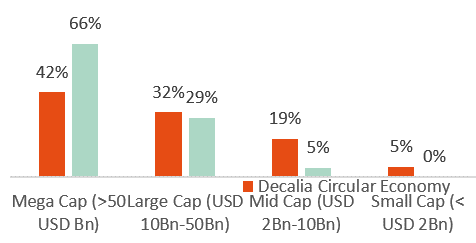

It is not surprising, then, that DECALIA’s circular economy strategy has a significant overweight in these smaller companies. It has an exposure of 25% with a market capitalization below $10bn and up to 35% with a market capitalization below $25bn.

Market Cap Breakdown

Source DECALIA – Data as of 31/05/23

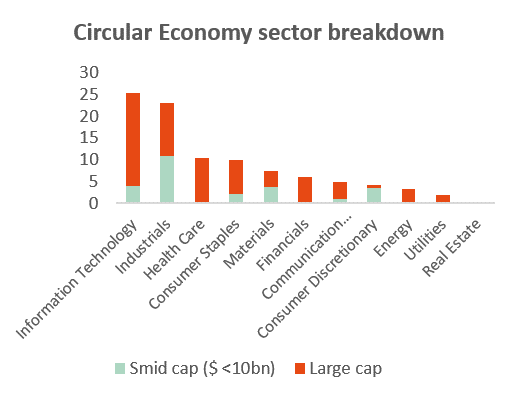

The allocation to Small and Mid-cap stocks is well diversified across sectors, indicating a lack of sector bias.

Source DECALIA – Data as of 31/05/23

This diversified approach offers significant benefits in terms of portfolio diversification. The following companies, which are recent additions to the strategy, exemplify this diversification:

Rohm Semiconductor ($ 8700M, Information Technology), a Japanese microelectronics leader, plays a critical role in the advancement of Electric Vehicles (EVs) through its expertise in next-generation Silicon Carbide power semiconductors. These semiconductors are vital in improving the power conversion efficiency from the EV battery to the powertrain. By utilizing Silicon Carbide technology, Rohm enables significant power savings, resulting in increased driving range for EVs.

Steico ($ 700M, Industrials) is another noteworthy company in DECALIA’s circular economy strategy, specializing in the wood fiber insulation sector. This sector is experiencing rapid growth and is recognized as one of the most environmentally friendly solutions. Wood fiber insulation, being renewable by nature, offers exceptional insulation properties along with moisture and acoustic benefits that outperform traditional insulation materials.

Carbios ($ 500M, Materials), a French company at the forefront of the battle against plastic pollution, is revolutionizing the recycling industry with its innovative enzymatic solution for PET (Polyethylene terephthalate). With a groundbreaking approach, Carbios has developed a highly efficient enzyme capable of breaking down PET plastics into their original building blocks, enabling them to be fully recycled. Taking their commitment a step further,

Carbios is partnering with a leading global plastic producer to build the world’s first industrial-scale plant utilizing their unique technology. This collaboration aims to address the pressing need for large-scale plastic recycling and create a significant impact on the recycled plastic market.

Ariston ($ 1400M, Consumer Discretionary), is a key player in reducing building emissions in Europe, which account for up to 40% of the emissions on the continent. Ariston produces space and water heating products with a focus on innovation and energy-efficient solutions, such as heat pumps. The Italian company has recently acquired Centrotec, a leading German HVAC company. This acquisition will consolidate Ariston’s heat pump business with new, cleaner refrigerant capabilities and enable them to expand their activities in ventilation and air handling businesses.

Conclusion

The current market environment presents an interesting and positive asymmetrical set-up for increasing Small- and Mid-cap allocation. The potential benefits of this allocation strategy are evident in several key factors.

The possibility of a recession has already been discounted, as evidenced by the underperformance of Small- and Mid-cap stocks compared to larger peers. This indicates that the market has already priced in the potential economic downturn, reducing the downside risk for these stocks.

Historical data demonstrates the strong historical outperformance of Small- and Mid-cap stocks early in the economic cycle. Markets tend to anticipate economic trends approximately six months in advance, and the current positioning suggests that these stocks are poised for potential outperformance as the cycle progresses.

Overall, the inclusion of Small- and Mid-cap companies in DECALIA’s Circular Economy strategy provides exposure to a wide range of sectors, while also capturing the potential of innovative companies that are driving solutions for a more sustainable and circular future. These companies combine attractive growth prospects with valuations on par with the average of the market, making them well-suited for long-term investment strategies.

About DECALIA’s Circular Economy strategy

- Based on circular business model, investing in 6 secular trends (Circular Models, Innovative Technology, Renewables, Cleaner Environment, Life Preservation, Eco Design) regrouped by the acronym CIRCLE

- Forward-looking perspective: investing not only in circular economy pure plays, but also in improvers, companies with significant environmental footprint & high marginal impact potential

- A team focused on thematic investing managed by an experienced team: Alexander Roose (ex-CIO of the Fundamental Equity of Degroof Petercam AM) & Jonathan Graas (ex-Lead PM of two sustainable theme funds at Degroof Petercam AM)

From left to right: Alexander Roose, Head of Equities

Quirien Lemey, Senior Portfolio Manager

Jonathan Graas, Senior Portfolio Manager

About DECALIA SA

Established in 2014, DECALIA SA is a Swiss investment management company. With more than 70 employees and assets under management that stand at €4.9 billion, DECALIA has expanded rapidly, in particular thanks to its active-management experience built up over the last 30 years by its founders. The strategies developed by DECALIA focus on four investment themes deemed promising in the long term: the disintermediation of the banking sector, the search for yield, long-term trends and market inefficiencies. DECALIA is regulated by FINMA through a collective assets manager’s license. In addition to its Geneva headquarter, the group has offices in Zurich, Milan & distributors of the DECALIA Sicav in Spain & Germany.