- Nuclear is an emission-free source of base-load power (i.e. minimum grid requirement)

- The regulatory and public mindset is evolving positively, although some challenges do remain

- For investors, the nuclear value chain offers a broad set of long-term opportunities

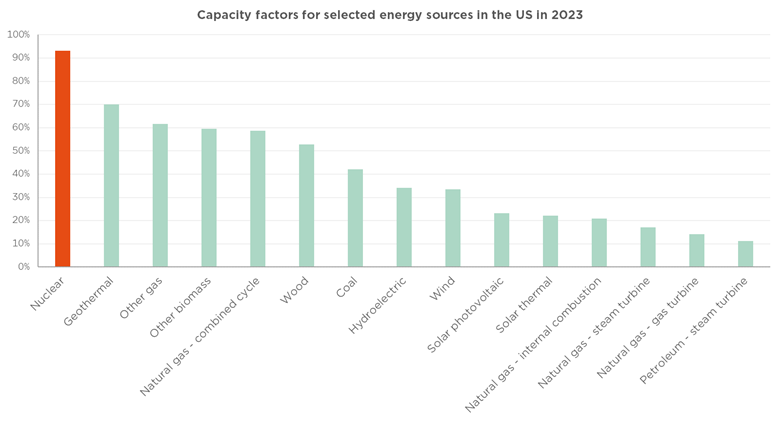

As many leaders across the globe are coming to acknowledge, achieving ambitious 2030/2050 sustainability targets necessarily involves affording nuclear energy a prominent role. As an emission-free source of base-load power, with plants that offer exceptional longevity, it stands to be a key vector of the necessary energy transition away from fossil fuels. This despite lingering waste and safety concerns, which make for a degree of public – and perhaps investor – sensitivity.

The factors pushing up demand for nuclear energy are multiple. First and foremost, the need for power is ever-increasing, with technology – AI advances in particular – a major driver. Data centres are currently estimated to account for ca. 1% of worldwide electricity consumption but, as they fast grow in number and size, this share of demand is set to expand strongly. In some US states, that host a concentration of data centres, it has already surpassed 10% according to a recent IEA report.

Second, the regulatory context is becoming friendlier towards nuclear energy. The COP28 target calls for a tripling of nuclear capacity by 2050. The EU taxonomy, a classification system for sustainable investments, has since mid-2022 opted to consider nuclear activities as compliant provided they meet a number of strict conditions (in terms of waste disposal notably). The mindset of ESG labels is thus changing regarding the exclusion of nuclear assets. We should also point out that Mario Draghi’s September 2024 report on European competitiveness stresses the need to invest in the continent’s low-carbon energy infrastructure, meaning renewable production sources but also nuclear power.

The public opinion, possibly because of Ukraine war-related energy price inflation, is also becoming more positive toward nuclear power stations. A trend that could be reinforced by the promises of innovation, in particular the expected development, during the next decade, of small modular reactors (SMRs). Relative to traditional nuclear plants, they boast advantages in terms of cooling water needs, site flexibility, cost-efficiency, scalability and installation cost. They can also be integrated within energy hubs, alongside more intermittent renewable power sources. Only two such reactors are currently put into commercial operation (in China and Russia respectively) but over 200 projects have been commissioned worldwide – with BigTech indeed leading the move, intent on meeting its own net-zero goals.

That said, nuclear energy still faces some challenges, including long (8-17 year) construction timelines, a shortage of skilled labour and supply-chain bottlenecks – the fact that only 41% of the enriched uranium market is currently accessible to the US (the rest is controlled directly or indirectly by Russia) being a key constraint. Safety and weaponization concerns still mar the sector’s reputation, despite the EU Joint Research Centre having found no “science-based evidence that nuclear energy does more harm to human health or to the environment than other electricity production technologies”.

From an investment perspective, nuclear energy offers extensive opportunities spanning uranium extraction, SMR-focused companies (e.g., NuScale, BWX Technologies or Rolls-Royce), providers of services or products necessary for plant operations (such as Mirion) and utility companies (Constellation Energy and NextEra Energy for instance). It is also interesting to note that some uranium producers are pursuing vertical integration: Cameco for instance recently acquired a 49% stake in Westinghouse, giving it a presence across much of the nuclear value chain.

To conclude, while we would caution against succumbing to a short-term form of “NucleHype”, the conditions – regulatory, technological and environmental – do seem to be falling into place for a longer-term nuclear renaissance.

Written by Gian Luca Grassini, Junior Portfolio Manager, ESG Analyst and Christophe Reuter

Trump 2.0: a better version?

- Trump is back to Make America Great Again… again!

- Equity market upmove: too much, too fast, too narrow? Perhaps not…

- Riding the easy start of the Trump trade – and year-end rally

Trump is back, with a unified Republican government, and markets have so far mostly enjoyed this. US equity markets posted new highs, Bitcoin and Tesla shares skyrocketed, the US dollar rose sharply, while rates eventually crept up further, mirroring both reignited animal spirits and higher inflation expectations for 2025. Admittedly, regional trends proved mixed with many non-US markets initially taking a hit from potential Trump policies (tariffs, trade or geopolitical uncertainties, higher US rates or stronger USD). Meanwhile, US economic data has continued to surprise on the upside, even as the rest of the world struggles to stay afloat. Such divergent trends are also visible in monetary policy trajectories, with the ECB now expected to accelerate rate cuts while the Fed may adopt a slower pace. As for EM central banks, the Trump policies will likely complicate their task as they should both weigh on global trade and push inflation higher.

Put differently, today’s US economic and financial boost was primarily achieved at the expense of Europe, especially the euro area, and emerging countries. In this context, China is unlikely to be the main loser as it was largely prepared for such an outcome and will still have some bargaining power on tariffs (certainly more than the euro area, probably the main victim). Finally, while geopolitical risks remain omnipresent, they may now evolve very quickly, for the best or the worst, under Trump’s renewed leadership.

Our soft-landing base case, involving a gradual rate normalisation over the next 12-18 months, is unchanged. Tail-risks have, however, increased, whereas the ultimate impact on future growth (marginally positive for the US but tilted to the downside elsewhere) and inflation (slightly higher, especially in the US) will depend on the people appointed within key departments of the new US administration, the sequencing of their new policies, and how the rest of the world responds.

As a result, while much good news may now be priced into US markets, as witnessed by the latest surge in portfolio positioning, excessive and indiscriminate pessimism possibly prevails elsewhere, offering selective opportunities as the dust settles. Global equities remain expensive by most standards, but that is nothing new (as in the credit market) and did not hinder this year’s rally. Earnings effectively did much of the job, alongside a deservedly lower equity risk premium as bond yields receded. More specifically, elevated current index multiples conceal a much more complex reality, with segments such as Europe, EM and small/mid-caps still offering selective pockets of value beyond the Magnificent US titans.

At the portfolio level, we intend to benefit from a potential year-end rally by keeping a neutral stance on equities, reflecting our cautiously optimistic near-term view, reinforced by Trump’s red sweep. That said, we are fine-tuning our positioning in both equities and bonds to better reflect the potential impact of new US policies. We maintain our preference for US equities, carefully balancing our (actively managed) small/mid-cap allocation with somewhat less growthier mega-caps, that are now benefitting notably from revived animal spirits and expected deregulation. Elsewhere, we turn even more cautious on eurozone equities (new underweight) as they stand to be the main losers of Trump’s election due to mounting global trade uncertainties and a weak hand in negotiations, especially in light of the political instability in Germany and France. The same goes for EM equities (downgraded to underweight) even though we see less risks and headwinds for China.

Moving to bonds, we retain a neutral stance, with a preference for sovereign duration whose valuation has improved in both the US and the UK (while the euro area backdrop has turned more favourable, upgraded to slight overweight), as well as for IG Credit at the short-end and belly of the curve, over the HY/EM segments. We continue to advocate greater selectivity in this space, especially regarding EM local currency debt that we have downgraded to underweight. Finally, we continue to favour diversification through gold as a broad safe haven under various scenarios, and are turning more bearish on the euro given the recent accumulation of global headwinds and domestic challenges.

Written by Fabrizio Quirighetti, CIO, Head of multi-asset and fixed income strategies

External sources include: LSEG Datastream, Bloomberg, FactSet, J.P. Morgan Asset Management, Statista.