Interview with Andrea Biscia, Equity Analyst, ESG Analyst

O2 & Ecology is one of the seven major themes in the DECALIA’s Sustainable strategy that will shape our society of tomorrow.

There is enormous potential in the insulation space, and here’s what you should know about it:

- Potential energy efficiency gains from better insulation

- Pros and cons of the different materials used to insulate buildings

- End markets and their respective resilience to an economic downturn

- Main companies active in the insulation and roofing market

- Investment opportunities (and worst-case scenario stress test)

With Europe headed for a tough winter on the energy front, policymakers’ immediate focus is obviously on securing sufficient access to power sources to avoid blackouts – and on limiting the inflationary blow to consumers. That said, their longer-term goal must be to reduce energy usage across all segments of the economy. In this respect, more efficient insulation certainly has a role to play. Particularly since over three quarters of buildings in Europe (ca. 1 million houses just in Switzerland) and 90% in the US are currently deemed to be under-insulated.

Andrea, could you start by providing a brief overview of the construction value chain?

The construction value chain is actually a rather simple one. It begins with the extraction of raw materials, fossil or mineral. These are then transported to manufacturers, which transform them into building products that are sold either directly to contractors, or via distributors – the end markets being split between residential/non-residential and new constructions/renovations.

With inflation weighing on consumer spending, mortgage rates trending up and GDP growth slowing down, is the construction sector not liable to take a hit?

Construction is clearly correlated to the economic situation, as evidenced by the fact that new home sales turned south last month in the US. That said, certain segments of the markets should prove more resilient in the face of an economic downturn.

Specifically, we expect US construction to fare better than European construction.

Not only has new building been declining for several years already in Europe, but the old continent’s high dependence on Russian gas clearly makes for a tougher economic outlook.

We also prefer non-residential construction to residential construction, given the various government support measures being deployed and because of the trend towards multi-family housing in the residential space – which tends to make it more akin to commercial building, in terms of the companies contracted.

Finally, in an environment of rising inflation and mortgage rates, renovations typically hold up better than new constructions. A newbuild project can be postponed, but not the repair of, say, a leaking roof.

When renovating a building, what exactly is the potential for energy efficiency gains through better insulation?

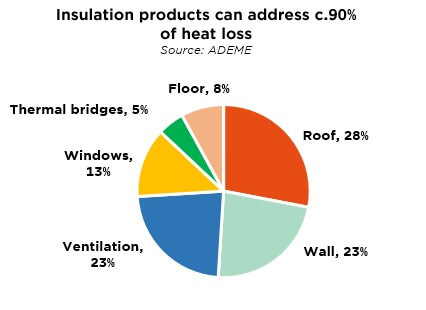

The potential is quite enormous, hence our focus on this segment of the construction value chain. ADEME, the French Environment and Energy Management Agency, estimates that, for a pre-1974 non-insulated house, half of the heat loss is attributable to the walls and the roof. Moreover, a study by the UK Government computes the annual energy-efficiency savings that can be generated by insulation (for a standard F-rated 3-bedroom home) at just under GBP 700, well above what can be achieved through boiler replacement (GPB 300), or thermostats, double-glazing windows and low-energy lighting (each at/ below GBP 100).

Insulation and roofing are so-called “light” building products. Are there not also decarbonisation opportunities in the heavier building product segment?

With no valid “greener” alternatives, as of yet, to concrete and cement, companies active in the heavy building product space are highly polluting, on top of suffering from the currently elevated cost of energy (which they use intensively), carbon taxes and C02 certificates. Not an attractive proposition in our view.

How fast could insulation grow over the coming decade?

The insulation market is expected to grow at a 4.5% compound annual rate through 2030, and faster even in the US (ca. 6%). The current energy crisis, coupled with policy support, could foster high-single-digit growth over the next decade. Innovative companies, exposed to the right mix of end markets, could of course do significantly better.

Delving further into wall insulation, which accounts for half of the total building thermal insulation market, could you describe the different types of materials that can be used?

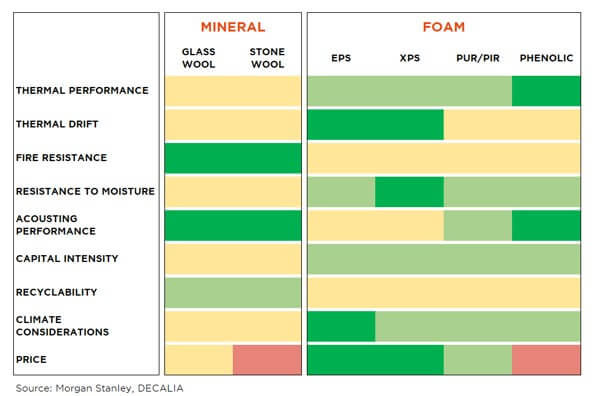

Setting aside plant- and animal-based “solutions”, which may be a factor at some point in the future but remain anecdotical for now, two types of materials are used to insulate buildings: foam and mineral wool.

Simply put, foam is oil derivative-based (e.g. expanded polystyrene EPS or extruded polystyrene XPS) while mineral wool is rock-based (stone wool is produced by melting basalt rock and coke, glass wool by melting sand, soda ash and limestone).

You clearly see foam as the most interesting of these materials today, why is that?

As illustrated below, foam offers the best thermal performance, in terms of conductivity and resistance notably. It is also less capital-intensive, thinner to install and cheaper from a

buyer perspective. The latter point may sound somewhat counterintuitive, given the upmove in the oil price over the past year.

Comparatively, though, mineral raw materials have risen a lot more. Petcoke for instance is up 132% year-on-year (January-July average price) vs. 48% for oil. Note also that the price pattern of MDI (methylene diphenyl diisocyanate), the oil-derivative that is used to produce foam insulation, has trailed that of oil, up only 14%.

What about roofing, does it make for an attractive investment opportunity too?

With resilience our key investment criteria, roofing clearly stands out. Renovations account for some 80% of that market and are generally of a non-discretionary nature. As mentioned earlier: if the roof of a building is damaged, it must be repaired – and urgently so.

We would also point out that up to 40% of a “re-roofing” ticket typically pertains to insulation, with some companies active in both wall insulation and roofing.

Could you provide some insights on the competitive landscape? Who are the major actors in the insulation market and what are

their respective areas of exposure?

The four large “pureplay” names are Kingspan, Rockwool, Owens Corning and Carlisle. The first two being active primarily in insulation (although Kingspan did recently acquire a roofing company), the latter two in both insulation and roofing.

In terms of type of insulation sold, Rockwool – as its name suggests – is active in mineral wool (more specifically in stone wool), Kingspan and Carlisle in foam, while Owens Corning produces both.

What is the potential for innovation in the insulation space, and who is driving it?

Where there is growth and market share to grab, there is incentive to innovate! A first example that we would share is Carlisle’s spray-foam.

Despite being more expensive and requiring professional installers, spray foam is growing at a faster pace (in the high single digits) than traditional insulation. Reasons for this superiority include its ability to fill gaps and cracks, its greater durability, the fact that it helps lock in moisture, and the possibilities that it opens to retrofit existing uninsulated walls.

Another interesting recent development is the integration of insulation into solar panels. Kingspan’s new generation «PowerPanel» for instance combines its highly performing «QuadCore» insulation technology with an efficient monocrystalline photovoltaic technology – making for much reduced time and complexity of installation.

- Buildings currently account for 40% of Europe’s energy consumption

- 64% of the energy consumed by European households is for heating

- 65% of European buildings are at least 30 years of age

- The European Commission wants to (at least) double the 1% renovation rate

- Properly insulating a home generates a payback within less than 90 days

When talking with you, Carlisle appears to stand out, both in terms of the company’s transition towards pure play sustainable building products and its continued commitment to ESG. Does the stock’s valuation not already reflect these attractive features?

Carlisle admittedly figures among the most expensively priced stocks, but we consider that to be justified by the company’s product mix (foam rather than mineral wool), its geographic exposure (the US accounts for 80% of revenues) and – perhaps most importantly – the end markets that it serves (90% commercial).

We would also note that Carlisle’s valuation currently stands at pre-Covid levels, despite the much-boosted outlook for insulation since 2019, and that the stock’s still positive year-to-date return is a testimony to the resilience of its business model. Indeed, competitor stocks are all in negative territory year-to-date.

Should the worst economic scenario pan out, i.e. Europe falls into a severe recession, what could be the downside for the different companies active in the insulation space?

We have run a form of “stress test”, using very negative assumptions for the various end markets of the four above-mentioned companies. We notably suppose a 40% decline in new residential building (as a matter of comparison, it dropped 50% during the 2007-2008 Great Financial Crisis) and a 25% decline in new non-residential construction. As for the repair, maintenance & improvement segment (aka renovations), which brokers see as remaining flat at worst, we pencil in a 5% decline.

All this adds up to a potential downside of 20% to 35% on insulation stocks, which is partly materialising as we speak. Investors should thus be looking out for opportunities to gain exposure to this promising and necessary component of the energy transition.

As we conclude this discussion about insulation, might you share with us other developments in the construction industry, as part of helping make the world greener?

Building companies are increasingly looking to address the issue of embodied carbon or, as defined by the World Green Building Council, “carbon emissions associated with materials and construction process throughout the whole life cycle of a building or infrastructure”. These so-called Scope 3 emissions represents the major part of their total emission (80% for instance at Kingspan). As such, our next Ecology Series publication will discuss circular business models that tackle this issue.

About the DECALIA’s Sustainable strategy

- a multi-thematic global equity fund, investing in innovative sectors and disruptive companies shaping our SOCIETY in the future

- invests in the 7 themes (Security, O2 & Ecology, Cloud & Digitalisation, Industrial 5.0, Elder & Well being, Tech Med, Young Generation) regrouped by the acronym SOCIETY

- managed by an experienced team: Alexander Roose (ex-CIO of the Fundamental Equity of Degroof Petercam AM) & Quirien Lemey (ex-Lead PM of a Multi-thematic fund at Degroof Petercam AM)

About DECALIA SA

Established in 2014, DECALIA SA is a Swiss investment management company. With more than 70 employees and assets under management that stand at €4.9 billion, DECALIA has expanded rapidly, in particular thanks to its active-management experience built up over the last 30 years by its founders. The strategies developed by DECALIA focus on four investment themes deemed promising in the long term: the disintermediation of the banking sector, the search for yield, long-term trends and market inefficiencies. DECALIA is regulated by FINMA through a collective assets manager’s license. In addition to its Geneva headquarter, the group has offices in Zurich, Milan & distributors of the DECALIA Sicav in Spain & Germany.