By Quirien Lemey, Co-lead Portfolio Manager for DECALIA Sustainable strategy

- Software and AI spending trends

- Main challenges in AI adoption

- A shift in software companies investments Buying opportunity in software?

Software and the state of AI

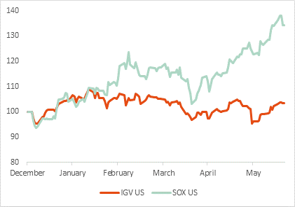

We wanted to provide an update on the current state of the software sector and the significant impact of AI-related spending. In light of recent meetings with various software companies, it’s become evident that the industry is encountering some challenges. We’ve observed a considerable divergence between software (IGV) and semiconductor stocks (SOX), driven by several key factors. (see Chart 1)

Performance of Semiconductors (SOX) against Software (IGV) YTD

Source: Factset

Software & AI Spending Trends

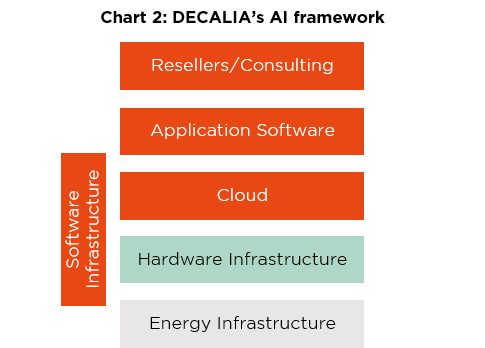

In the latter half of last year, we saw a substantial rally in both software and semiconductor stocks, driven by bullish sentiment around AI. Companies have been, and continue to be, optimistic about AI’s prospects and their potential impact on their business. Fast forward to today, it’s now clear that the majority of AI-related spending is concentrated on the infrastructure layer. Our DECALIA AI framework (see Chart 2) has identified several layers of potential AI beneficiaries, excluding companies merely adopting AI for efficiency or productivity improvements.

One could argue some spend is going into energy infrastructure and the cloud providers, maybe one or two application software companies, but the reality is, today, most of all the AI dollars are going into hardware infrastructure, with NVIDIA emerging as the principal beneficiary. Additional hardware beneficiaries encompass networking companies, industrial solution providers of electrical products, cooling systems, and numerous other firms supplying into datacenters.

In other words, today’s AI winners are the suppliers of the hardware infrastructure layer required to do AI, as well as those renting out that capacity, being cloud providers.

However, application software companies have not seen the same level of benefit. Major players like Adobe, Salesforce, ServiceNow, Shopify, and Snowflake have significantly underperformed compared to their semiconductor peers, with few exceptions like Microsoft and Synopsys that are direct AI beneficiaries.

Source : DECALIA

AI adoption challenges

This has given rise to the narrative that software companies might actually be threatened by AI, the inverse of being a beneficiary (as they were seen end of last year).

Although we do believe some software companies could be at risk, we believe many of them are not and something else is at play. Talking to companies, it is clear that many of them are putting IT spend on hold, to quote Morgan Stanley analysts: “Gen AI is creating analysis paralysis”. With no proper roadmap, the vast majority of companies are still figuring out how to harness AI’s potential, and depending on the size of the company, they are struggling with one or more of the following issues :

- Can we adopt gen AI? And what can it bring to us, for what use cases, which business unit could benefit, when…?

- Do we use existing LLMs or create our own? And in the former case, which ones?

- Is our company ready? Do we have a unified data platform? Is our data ready and in the cloud? Can our data move to the cloud or should it stay on premise…?

- Do we use our own hardware in our own datacenters or rent capacity at hyperscalers?

- How to deal with security and data governance?

- Do we need to change processes and the way we work?

- What does it cost? How do we pay for it? How much efficiencies do we get?

There are countless more questions that could be asked.

Most companies choosing to invest resources in AI are running at best a few pilot projects, having to reallocate budget that would have been ordinarily conveyed elsewhere, such as in software. Moreover, the process of developing an AI strategy might be causing a pause in spending, and could partially explain the weakness we see in some software pockets.

Optimization and Investment Cycles

Since the second half of 2022, we’ve also seen a trend of software optimizations, particularly in cloud consumption models like Snowflake, Datadog, and MongoDB. As companies were looking for efficiencies and cost cutting, the easiest and fastest way to do this is in cloud consumption software models. These models operate on a pay-as-you-go basis, the less you consume, the less you pay. There is now a rising narrative that after optimization on consumption software, companies are now starting to optimize on seat based SAAS software. In recent years, many companies have conducted extensive layoffs to boost margins. As their seat-based contracts approach renewal, they are now optimizing these agreements. It could be that spend is not necessarily going down but they might decrease the number of seats and take a few more modules for instance. In each case, this SAAS optimization could be a headwind for SAAS companies in the near future.

Furthermore, many software companies, after demonstrating significant margin improvements last year, are now shifting back to investment mode, focusing on sales, AI investments, and other areas. This shift has contributed to the current underperformance of software companies compared to semiconductor companies.

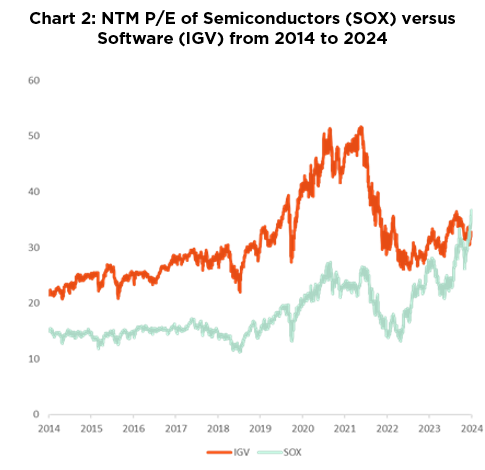

The reasons mentioned above have caused software companies to become cheaper than semi companies for the first time in more than a decade (actually, since the global financial crisis). The graph below is NTM P/E but a similar story can be seen on FCF yield:

Source : Factset

Long-Term Outlook

Despite the challenges, we remain long-term believers in AI. We believe the impact will be profound across many industries, though it may take more time to manifest broadly.

Many companies need to modernize their IT stack first. Despite software companies facing near-term headwinds, we believe the sector still has healthy long term prospects. The current optimizations are temporary and the space still offers strong potential for long-term investors.

We have always maintained a positive outlook on software, which is why we are solidifying our position in Salesforce and Dynatrace. On the short-term, we might also see a budget flush (end of year) similar to last year’s, acting as a catalyst. In the hardware space, we continue to be bullish on NVIDIA and other AI-related semiconductor companies but recognize that valuations are becoming increasingly expensive. One could opt for current cheaper alternatives, such as TSMC, but we suggest a gradual shift of some investments from the semiconductor space to the software space, keeping an eye on long-term opportunities that AI and software has to offer.

About the author

Highlights

- Co-lead Portfolio Manager, SOCIETY

- More than 15 years experience in Global Tech

- Ranked 7th best PM in Europe by Citywire/ AAA Citywire

- Successfully managing multi-thematic strategies since 2016

About DECALIA Sustainable strategy

- a multi-thematic global equity strategy, investing in innovative sectors and disruptive companies shaping our SOCIETY in the future

- invests in the 7 themes (Security, O2 & Ecology, Cloud & Digitalisation, Industrial 5.0, Elder & Well being, Tech Med, Young Generation) regrouped by the acronym SOCIETY

- managed by an experienced team: Alexander Roose (ex-CIO of the Fundamental Equity of Degroof Petercam AM) & Quirien Lemey (ex-Lead PM of a Multi-thematic fund at Degroof Petercam AM)

About DECALIA SA

Established in 2014, DECALIA SA is a Swiss investment management company. With more than 70 employees and assets under management that stand at €5 billion, DECALIA has expanded rapidly, in particular thanks to its active-management experience built up over the last 30 years by its founders. The strategies developed by DECALIA focus on four investment themes deemed promising in the long term: the disintermediation of the banking sector, the search for yield, long-term trends and market inefficiencies. DECALIA is regulated by FINMA through a collective assets manager’s license. In addition to its Geneva headquarter, the group has offices in Zurich, Milan & distributors of the DECALIA Sicav in Spain & Germany.

Copyright © 2024 by DECALIA SA. All rights reserved. This report may not be displayed, reproduced, distributed, transmitted, or used to create derivative works in any form, in whole or in portion, by any means, without written permission from DECALIA SA.

This material is intended for informational purposes only and should not be construed as an offer or solicitation for the purchase or sale of any financial instrument, or as a contractual document. The information provided herein is not intended to constitute legal, tax, or accounting advice and may not be suitable for all investors. The market valuations, terms, and calculations contained herein are estimates only and are subject to change without notice. The information provided is believed to be reliable; however DECALIA SA does not guarantee its completeness or accuracy. Past performance is not an indication of future results.