- Bitcoin is boasting a strong year-to-date performance, albeit of a still highly volatile nature

- On the demand side, the rally has gained support from SEC approval of bitcoin ETFs

- The recent “halving” has also considerably slowed the growth in bitcoin supply

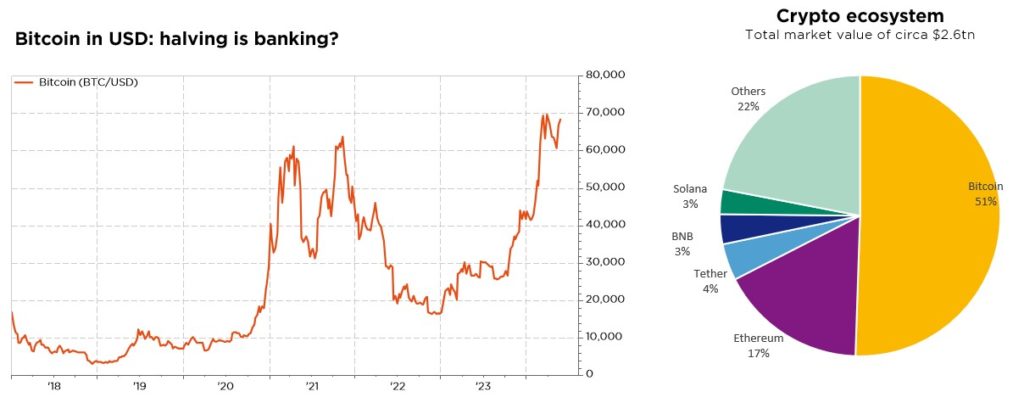

The first few months of 2024 have again proved choppy times for bitcoin, whose price started by soaring to an all-time high at over USD 73,000 on 14 March, before correcting sharply, recovering much of the lost ground and then dropping again. As of early May, bitcoin was down ca. 23% from its peak, but still up strongly on a year-to-date basis. And at the time of writing, its 2024 performance stands close to 65% – almost on par with the current stock market “darling”, Nvidia. Let us thus dare ask the question: can bitcoin now fit into traditional investment portfolios, or should its trading continue to be left to the speculative crowd?

On the regulatory front, the decision taken on 10 January 2024 by the SEC, the US financial markets watchdog, to authorise the listing of bitcoin exchange traded funds (ETFs) clearly helped fuel the rally. While such products allow investors to participate in bitcoin’s performance in a liquid manner, without having to buy the underlying directly on a dedicated exchange platform, their assets are indeed invested in the digital currency. The more popular these ETFs, the greater thus the demand for bitcoin.

Beyond its impact on the bitcoin price, SEC approval has also given a form of legitimacy to this asset – and to crypto-currencies more generally. The SEC chairman was known to be rather cautious regarding the industry, which he described as “highly speculative” at a hearing before the US Senate in July 2023, even going so far as to describe it as “rife with fraud and scams and hucksters”. On several occasions, the SEC refused to allow similar ETFs to be marketed, before a Washington court of appeals ruling in October 2023 forced its hand.

While debates regarding the regulation of bitcoin continue to rage across many jurisdictions, it seems safe to bet that the institutional adoption of bitcoin will continue, as more and more companies and investment funds incorporate the asset into their financial strategies.

The other key development this year for bitcoin has been the “halving”. Defined in the bitcoin protocol, this operation takes place every four years or so (every 210,000 blocks to be precise) and involves dividing by two the reward allocated for the work involved in “mining” bitcoins. Over the years, this reward has thus dropped from 50 bitcoins initially, to 25 in 2012, 12.5 in 2016 and 6.25 since 20 April. Such a drastic reduction has considerably slowed the creation of new bitcoins, which has fallen from 900 to 450 units per day. This trend, combined with a total end supply that is capped at 21 million, is helping confer a form of scarcity to bitcoin – and boost its price.

The rate of inflation in the supply of bitcoins currently stands at 0.85%, well below that of gold (ca. 2.3%). It could therefore be argued that bitcoin has become rarer than gold – even though the latter is seen as the ultimate safe-haven! Without actually endorsing bitcoin as a store of value for investment portfolios, insofar as its price remains extremely volatile and it is not accepted as a means of payment by governments, we must nonetheless emphasise the advantages that its digital nature provides, namely a greater divisibility and portability, positioning it as a modern means of exchange. And therefore, recognise that it does deserves some part in our market analyses. Because, as the old saying goes, “a known devil is better than an unknown angel”…

Written by Rayan Benmabrouk, Trader

The soft-landing scenario is back on the horizon

- After a few false starts, the global monetary easing cycle is now set to unfold

- Bombastic Q1 earnings: the bottom-up show is far from over, fuelling broad upgrades

- For fixed income investors, patience is a virtue…that should be rewarded at some point

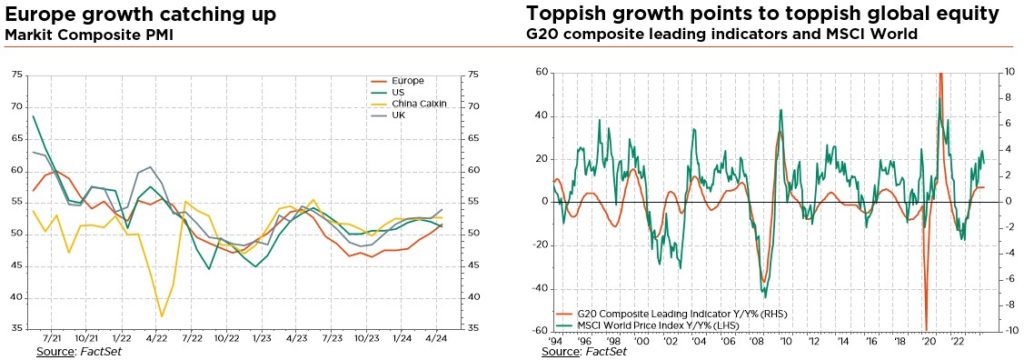

Recent weak US inflation, retail sales and employment data have brought the soft-landing scenario back on the world economic horizon. After a few false starts, the global monetary easing cycle is now set to come into force this summer, making for a combination of supportive rate cuts and resilient growth.

As a result, our central scenario remains unchanged (soft landing with slower but positive growth, and sticky but acceptable inflation, leading to a rate normalisation at some point), even though risks of a temporary reacceleration of inflation and/or an economic soft patch cannot be totally dismissed. In our view, stagflation would be the worst-case scenario for balanced portfolios, hurting both equities and bonds – as well as impeding a monetary policy remedy.

Meanwhile, it did not take long for global equity indexes to shrug off the latest rate and geopolitical fears. Bombastic Q1 earnings alongside more benign US inflation, easing bond yields, resilient fund flows and wider market breadth all contributed to this express “catch-up” trade. Indeed, the bottom-up show is far from over, with the strong Q1 season leading to broad upgrades of analyst estimates, supporting the consensus view of 10% global growth for this year and 2025. Sticky pricing (inflation), lesser destocking and AI-related productivity gains are set to remain key protagonists.

As far as valuations are concerned, we view today’s elevated equity index multiples as the tree hiding the forest. Indeed, looking beneath the indices still reveals attractively valued, though less-magnificent, market segments such as Europe and small-caps. To sum up, macro and micro fundamentals are keeping pace, while declining bond yields may warrant a further (modest) re-rating.

For fixed income investors, patience is a virtue…that should be rewarded at some point. Rates now appear fairly valued, expectations of central bank rate cuts being consistent with our global macro scenario. That said, the backup in rates has not (yet?) offered a sufficient valuation opportunity on duration in our view, as sticky inflation, higher for longer (neutral) rates, as well as sovereign debt sustainability concerns, cannot be dismissed. At the same time, it is hard to find credit exciting at these historically tight spread levels. We thus keep an overall cautiously neutral stance on sovereign duration, while our preference for corporates over sovereigns continues to involve a buy and hold approach at the short-end of the curve, and selectivity within the HY/EM segment in particular.

In equities, we remain constructively neutral (what else?) with no change to our overall allocation (after having taken some profits last month). Fundamentals are supportive, but higher market volatility risks (bumpy disinflation, geopolitics, timing of monetary easing) is likely to drive some consolidation, suggesting more muted returns in the near term.

We have nonetheless made minor changes to our tactical allocation views. More specifically, we have finetuned our regional preferences, taking profits on Japan (new slight underweight) and upgrading both Emerging Markets (lower US policy rates in view, macro fundamentals that are mostly favourable outside of China, which has just announced a new rescue package to shore up its depressed property market) and the UK (unloved and inexpensive in both absolute and relative terms, while domestic macro fundamentals are improving) to a slight overweight.

All told, we continue to translate our cautiously optimistic views by favouring an all-terrain approach to portfolio construction, with a well-balanced diversified asset and sector allocation tilted towards high-quality cyclical plays within equities, while aiming for carry, quality and convexity in the bond space.

Written by Fabrizio Quirighetti, CIO, Head of multi-asset and fixed income strategies

External sources include: Refinitiv Datastream, Bloomberg, FactSet, Coinmarketcap.com.