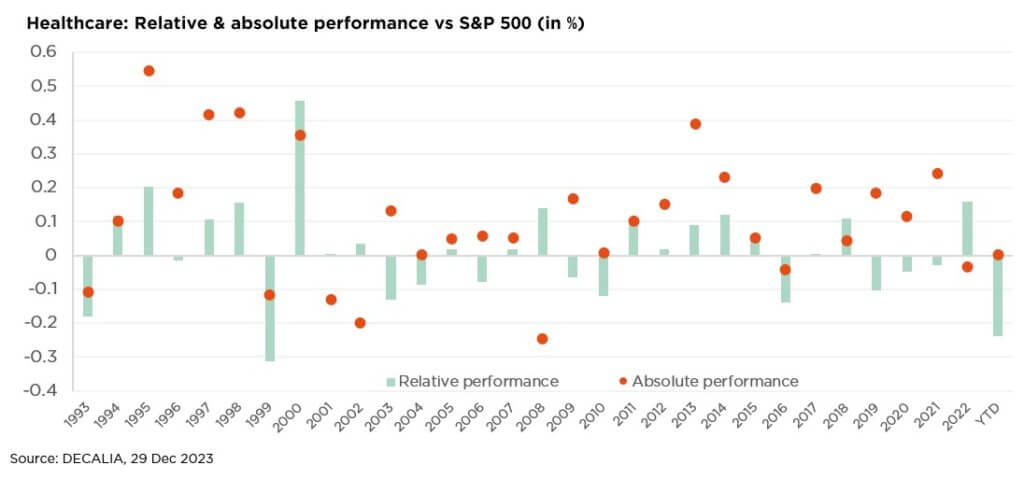

- In 2023, the healthcare sector posted its second-worst relative return since 1999

- The recent JP Morgan Healthcare conference saw companies adopt a much more positive tone…

- … owing to easing biotech funding concerns, the end of the Covid hangover and a pickup in M&A

JP Morgan’s Healthcare conference, in the second week of January, has become a traditional rendez-vous for investors. It is where numerous healthcare companies gather to kick off the year, discussing the latest developments in their respective businesses. The 2024 edition proved, yet again, a mine of information, warranting a summarised account here – and perhaps encouraging readers to follow on with our DECALIA Wellness Series, launched last year to shine a spotlight on the most captivating trends in the realm of well-being.

First, however, let us reflect on the past year which, for healthcare, turned out to be a challenging one indeed. In fact, 2023 witnessed the sector’s second-worst performance relative to the S&P 500 since 1999. This poor result can be attributed to several factors. During the 2020-2021 Covid years, healthcare companies experienced a surge in R&D spending, with a high return on investment. The gradual subsiding of the pandemic boost then had a cascading effect on the sector. Other issues also weighed on 2023, such as a decline in biotech funding, weakness in the Chinese economy and substantial de-stocking.

As such, the early-2024 JP Morgan Healthcare conference was eagerly awaited, with the hope that it would shine some light at the end of the tunnel. Which it certainly did! Among the positive takeaways, we would point in particular to the following:

- The week was heavy in M&A deals, a clear support for the biotech space. To name but some, Johnson & Johnson and Merck announced that they will be taking over cancer-focused biotechs Ambrx Biopharma and Harpoon Therapeutics, and Bristol Meyers is to acquire CNS (central nervous system) biotech Karuna Therapeutics (announced in December). Large pharmaceutical companies continue to be bullish on early-stage assets and disease areas such as oncology, obesity or immunology.

- Life sciences players mentioned no new, not already widely known, issues. As regards customer de-stocking, a trend that caused much of the 2023 struggles, all companies spoke at least of “stabilisation”, if not of an inflection point, when describing current order patterns. And although China remains a black box short term, most companies expressed confidence in the long-term growth opportunity the country represents.

- Medtech surprised on the upside, with the companies that preannounced delivering strong Q4 results and largely validating consensus expectations for 2024. Inflation and supply chain disruptions seem to have been put behind, and margins are expected to expand. Also, there was surprisingly little talk of GLP-1 anti-obesity drugs, which hurt medtech stock returns during the latter half of 2023, after Novo Nordisk reported a 20% reduction in cardiovascular disease risk associated with its Wegovy GLP-1 drug. The worry was that demand for medical interventions pertaining to obesity co-morbidities (heart surgeries, knee joint replacements, etc.) would fall. Regardless of potentially ongoing GLP-1 concerns, we believe that medtech companies boasting new products and pricing power, such as Stryker with its Mako robot or Intuitive Surgical, which announced a next generation da Vinci robot during the latest earnings call, are positioned to perform well.

All told, 2024 has the potential to mark a resurgence of the healthcare sector, thanks to several potential tailwinds: a recovery of biotech funding, the end of the Covid hangover, rising valuations helped by potentially lower interest rates and, last but not least, a pickup in M&A activity.

We thus maintain an optimistic view, lauding the industry’s continuous quest for innovation and capacity to deliver life-saving solutions.

Written by Iana Perova, Equity Analyst

Soft-landing runway cleared!

- Economic growth is still holding up well, while progress on disinflation continues

- A mixed equity bag: pockets of value and optimistic, but not unrealistic, EPS expectations

- Bottom-line: brace for what could prove a bumpy ride but remain invested

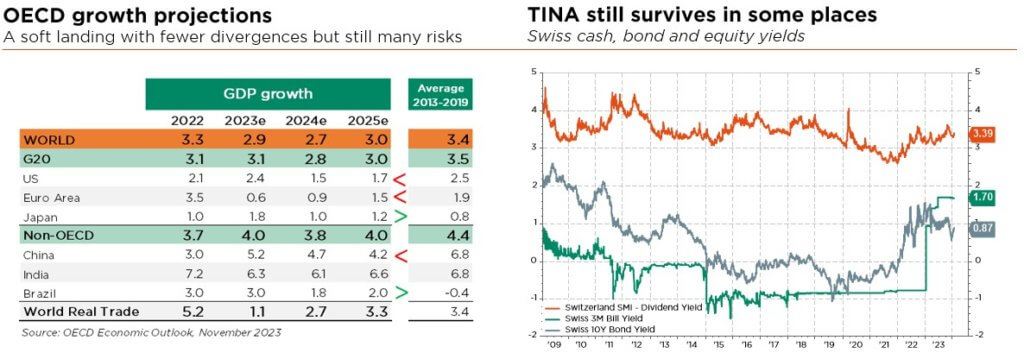

Our base case macro scenario still foresees a soft landing with slower but positive growth, and sticky but acceptable inflation (falling closer and faster towards central bank targets than previously anticipated, thus leading to more “relaxed” monetary policies). Central bankers are indeed now able to envisage a normalisation of rates.

Obviously, latent risks persist on both the growth and inflation fronts, on top of renewed geopolitical tensions in the Red Sea region or the incoming US presidential election. Still, the decrease in inflation markedly reduces the odds of a policy mistake and/or market accident.

The pullback in bond yields and an upbeat earnings outlook together warrant a re-rating of equity multiples, lending support to current lower risk premia. With the ongoing Q4 reporting season likely to bring full year 2023 global earnings growth to around breakeven levels, a much better-than-hoped outcome, investor eyes are now turning to 2024 (and beyond).

Despite a well-flagged slowdown and fading pricing tailwinds, resilient margins and easing destocking trends in our view support the 8-10% earnings rebound expected by consensus. Lastly, although investors have undeniably re-risked their portfolios lately, average equity allocations remain close to neutral historical levels, leaving room for further upside.

The aforementioned relief rally in rates observed during the last two months of 2023 and ongoing tightening of credit spreads have erased most undervaluation opportunities within the fixed income universe. In the current context, we consider bonds to be fairly valued across the board and recommend an overall neutral/benchmarked positioning, our preference for cash having been dashed by soon-to-come central bank rate cuts. In any event, we continue to recommend selectivity in the HY/EM space, staying away from the most fragile segments or issuers.

After gradually upgrading our equity stance from slight underweight to slight overweight during the final quarter of 2023, we stick to our constructive view in these first innings of 2024.

Though the ride will likely prove bumpy, we believe that today’s more benign macro backdrop and improved near-term visibility support further equity re-rating. Which is why we added “cheap” tactical protections at the end of last year, so as to own the upside potential.

The same could be said of fixed income: we gradually upgraded our stance from underweight to neutral last quarter, while also raising our duration target to a benchmark level (5-7 years). Here too, there will be some volatility, but it should be largely offset by the carry at the short end of the curve and a bumpy but nonetheless downward trend in rates.

Finally, we keep a slightly overweight stance on gold and an underweight exposure to commodities.

2024 will likely be another eventful year for global equities, having to navigate an economic slowdown, revived geopolitical uncertainties, a US presidential election and underappreciated side-effects of the ongoing AI revolution.

The investor journey could be far from quiet, but we do still see attractive upside potential for the braver. Overall, we continue to favour a diversified all-terrain approach to portfolio construction, combining a well-balanced high-quality allocation and selection in both equities and bonds.

Written by Fabrizio Quirighetti, CIO, Head of multi-asset and fixed income strategies

External sources include: Refinitiv Datastream, Bloomberg, FactSet, BofAML Survey, Statista