By Alexander Roose, Head of Equities and co-lead PM of the DECALIA’s Sustainable strategy

While equity markets started last year with a massive sell-off that set the stage for a sharply negative vintage, 2023 is giving encouraging signs of a turnaround. As we write, all major indices are firmly in the green, propelled higher by two major U-turns – on top of fading headline inflation numbers that took place over the last couple of months. Firstly, Europe is getting back on its feet, helped by lower gas prices and (thus) a more resilient consumer. As recently as the end of the summer of 2022, sentiment was uber-bearish, with predictions of an imminent and inevitable recession and high question marks as to whether Europe would make it through the winter without blackouts.

Secondly, an even more remarkable U-turn happened in China, shortly after the country had been labelled “uninvestable” following the 20th Communist Party Congress in October. Although more extreme in terms of negative sentiment, the similarities with Europe were striking. Rarely have we seen the investment community be caught so abruptly wrong-footed, when the Chinese government unofficially let go of its zero-Covid policy shortly after the Congress, triggering a massive rally in Chinese equities – which has continued in the new year (more on this below).

What, one might wonder, is the point of mentioning these two events since they have unfolded in front of our eyes and have presumably been discounted by equity markets? The answer is twofold:

– Macro developments are by nature erratic, meaning that predicting them is prone to error. As a consequence, top-down considerations within an equity investment framework should certainly not be solely based on macro considerations, quite the opposite. We believe that a well-established (multi) thematic investment process is key and acts as a beacon to capitalise on long-term secular trends.

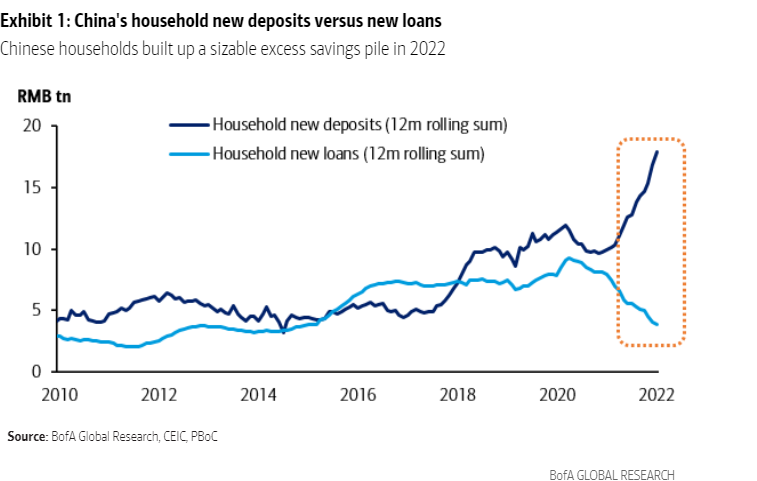

– Markets have a funny way of not doing what is widely expected. Rarely had we seen such a consensual view among sell-side strategists as was the case at the close of 2022. A recession, even in the US, was a done deal for 2023, only its timing was uncertain, and earnings estimates would need to be cut significantly. This consensus has paled starkly with the large range of potential macro and geopolitical outcomes that lie ahead of us in 2023, negative or positive. Though we would not claim to be macro pundits, the reopening of the Chinese economy is in our view the biggest wildcard for 2023, certainly when one considers the vast potential unleashing of accumulated savings during the two-year lockdown (see graph below).

Chinese new deposits versus new loans

As the graph illustrates, aggregate savings have almost doubled and now total nearly USD 2trn. Although Chinese consumers should not be compared to their US counterparts in terms of risk aversion (certainly coming out of traumatic two-year lockdown period), a mean reversion over time of these accumulated savings could prove a powerful tailwind for the Chinese and world economy… although it might also sow the seeds of an inflationary flare later in the year, annihilating hopes in the investment community that central banks could tone down their hawkish stance. As such, while we do not advocate a plain-sailing for equity markets in 2023, there are at least glimmers of hope as the risk of a (severe) recession recedes.

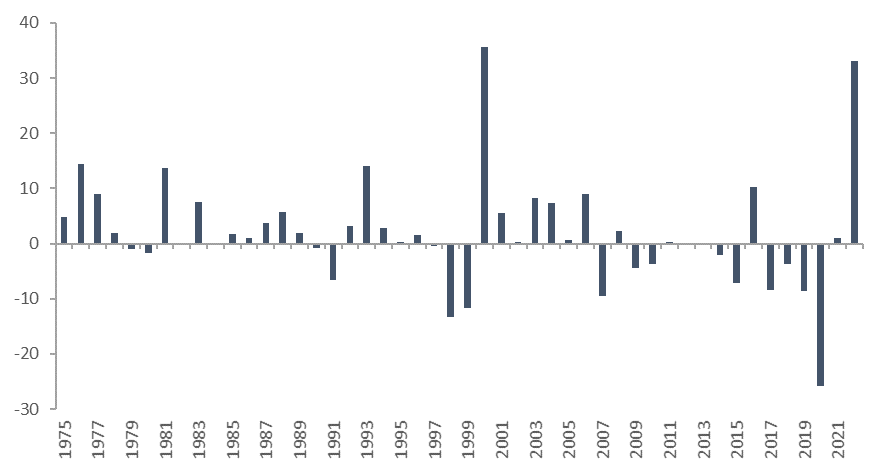

The shrewd reader might also ask: what is the narrative of the title? Well it refers to the collapsing gap between so-called value and growth stocks, i.e. the Great Reset, seen only on three occasions during the past five decades (see graph below):

Global MSCI value vs MSCI growth (annual relative returns)

We have never been big fans of putting stocks into value or growth buckets, certainly based on P/E or even worse P/B ratios which is the MSCI methodology.

We are of the opinion that it makes more sense to look at FCF yields and also consider qualitative elements to gauge the soundness of a business model, regardless of whether FCF generation occurs more in the present (akin to short duration stocks) or later into the future (i.e. long duration assets). Howard Marks synthesises this very well in his excellent memo “Something of Value”, by stating that “Not everything that counts can be counted, and not everything that can be counted counts”.

There are some interesting conclusions to be drawn from the graph above:

- As mentioned above, such a Great Reset only happened a few times in the past and following this reset, the differential in performance then petered out significantly. This was even the case after 2000, when valuations of larger cap growth stocks had reached stratospheric levels and unlike in 2022 were barely supported by any level of free cash flow generation. Hence, a uniquely value-style equity approach, as vindicated by some sell-side strategists, is probably not the best recipe for success going forward.

Along the same rationale, after the significant derating of small and mid cap stocks versus their larger peers during 2022, it also makes sense to consider smaller sized companies in an investment process, one of the key features of DECALIA’s thematic investing.

- The cause of the Great Reset lies first and foremost in the steepness of the 2022 hiking cycle in developed markets, causing longer duration assets (together with some areas of excessive valuation) to derail massively.

- Given evidence of decelerating inflation (e.g. US PCE price index released on 26 January) and the stability of terminal rate assumptions over the last couple of months, one cannot help wondering whether risks of a further derating of longer duration assets have sharply receded, especially as some of these longer duration assets exhibit current FCF yields in excess of those of shorter duration assets on top of better growth prospects in an uncertain world. The potential canaries in the coalmine are the stickiness of (US) wage inflation and the above-mentioned Chinese re-opening.

Going forward, a balanced equity approach should prevail when constructing portfolios, i.e. a right mix of companies with “sound growth at reasonable prices” and “cheap but not broken business models”. The quality of the business model is thus the cornerstone of a bottom-up investment process and a long-term-proven thematic approach with a deep-dive value chain analysis is in our view essential in this exercise to separate the wheat from the chaff.

In hindsight, most of these quality companies were not future proof for a world of higher rates as of the end of 2021, a situation that has certainly changed following the Great Reset.

Thematic investing had to navigate rough waters during 2022 but we remain intimately convinced – having been involved in thematic investing for more than 20 years – that it serves as a stronghold for both the top-down and bottom-up dimensions of an investment process… This especially in a fast -changing and complex world and after the Great Reset between value and growth stocks witnessed in 2022.

To conclude, it is worth emphasising the key tenets of DECALIA’s thematic investing approach:

- Identification and continuous scrutiny of the secular trends that will shape the world in the years to come

- Deep dive value chain analysis, essential to determine which companies in a particular part of their value chain have enduring quality business models (and if applicable also the potential to create a positive impact)

- FCF generation and growth as key elements of valuation, alongside balance sheet solidity

- Balanced ESG approach with proprietary quantitative and qualitative analysis

- No bias in terms of market cap, underreached mid-cap stocks being a source of alpha generation

O2 & Ecology is one of the seven main themes of the DECALIA’s Sustainable strategy that will shape our future society.

Five sub-topics (such as hydrogen, solar, insulation, circular economy and silicon carbide) have been developed in publications in the DECALIA Ecology series. Another theme will be developed in 2023 called DECALIA Wellness series.