Opinion by Fabrizio Quirighetti

In Europe, mercantilism is surviving, but is clearly no longer thriving. The UK’s current woes make this all the more apparent.

Its economy’s fundamentals bear an increasing resemblance to an emerging economy, or rather a submerged economy in this case, given the continuous growth of public and private debt, deindustrialisation, chronic external deficit, structurally higher inflation than in other developed economies, and the depreciation of the pound ever since the great financial crisis…

In many respects, the UK economy’s structural variables now more closely resemble an emerging market than a developed market. It also now has a sword of Damocles hanging over the sustainability of its debt, which could quickly turn into a crisis of confidence and create a vicious circle (consisting in a fall in the currency, inflationary pressure and higher interest rates) … as with the crises that the most vulnerable economies sometimes fall prey to.

Against this backdrop, and with the benefit of hindsight, Brexit ultimately seems to have merely sped up the economic downgrading process. And as is often the case, the degeneration is unfortunately not limited solely to the business world, but can also be seen in the country’s politics, culture and, of course, its military. The influence of Great Britain and its empire, the previous leading global power at the turn of the last century, is therefore continuing to wane. To crown it all, without wishing to make a bad pun, the death of Queen Elisabeth II was perhaps symbolic, triggering a collective and sudden recognition that the “great” British Empire is well and truly a thing of the past.

At the turn of the 20th century, British power was largely founded on early industrialisation as a result of the industrial revolution, and a powerful Navy that enabled it to expand its colonies and trade quickly and significantly, surpassing France as a rival power. Technological progress, favourable demographic trends and access to a more efficient source of energy/production are the ingredients necessary for economic development, creating the basis for mercantilism.

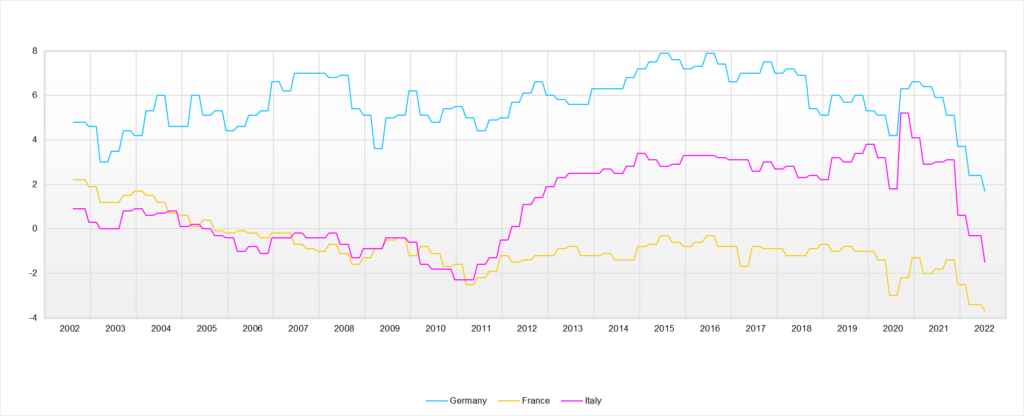

Like the tip of an iceberg, the UK is perhaps the most visible or apparent example of the Old Continent’s loss of momentum, for the reasons described above. Going back in time, Greece and Italy already lost their shine long ago, and above all their powerful worldwide domination of yesteryear. France, for its part, is trapped in a “mid-range” variety of industrialisation, where it is too expensive compared with Asian products and doesn’t offer enough added value compared with the likes of Germany and Switzerland.

Just look at the automotive market: Renault and Peugeot aren’t playing in the same league as BMW, Audi and Tesla, and are therefore competing with a whole series of brands, particularly in Asia (such as Toyota, Hyundai, Nissan and Mazda), but also elsewhere (e.g. VW, Fiat and Skoda), which often offer better value for money.

However, the French may (or may not) take consolation from the current situation in Germany, which is now hardly enviable, despite its role as the standard bearer for European mercantilism for the last two decades.

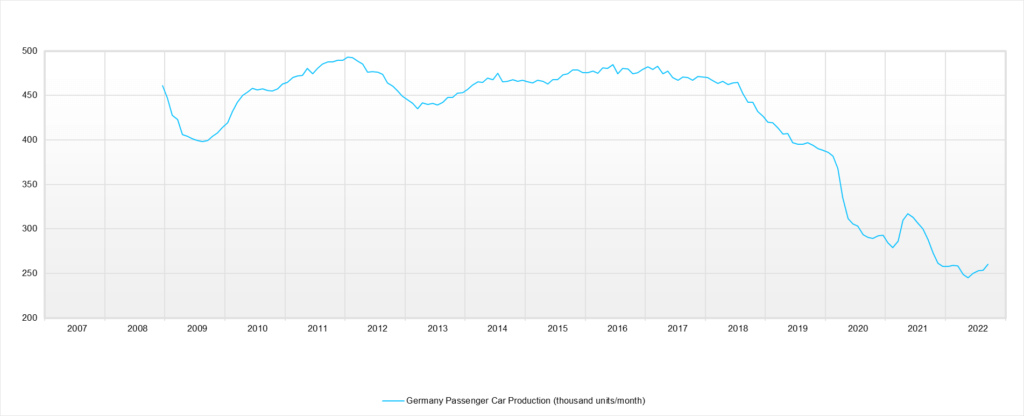

German industry, which already lost momentum following the VW diesel-gate scandal (the automotive sector accounts for the largest share of German exports at more than 15%), is also being put to the test by the challenges posed by the energy transition (there is no guarantee that German cars will dominate the electric vehicle market), energy supply issues (due to dependence on Russia and the political decision to abandon nuclear power), and the destabilisation of Eastern Europe (as a result of the war in Ukraine), which supplied it with lower added value low cost parts and labour for a large part of its industrial process.

Eastern Europe’s economic development, and especially the growth in its consumers, as in Poland in recent years, was of course a boon for German industry and mercantilism. This has at best merely offset the decline of consumption by the European middle class, however, since the advent of the Euro, given the austerity imposed and the structural impoverishment, for endogenous, as much as exogenous, reasons.

It has to be said that one of these reasons is the building of German mercantilism partly on the back of, and also to the detriment of, European consumerism.

German worker ants were very happy to sell their products to the cicadas of Southern Europe in the early 2000s, but this system was never going to be viable over the long term… unless the worker ants lent them money.

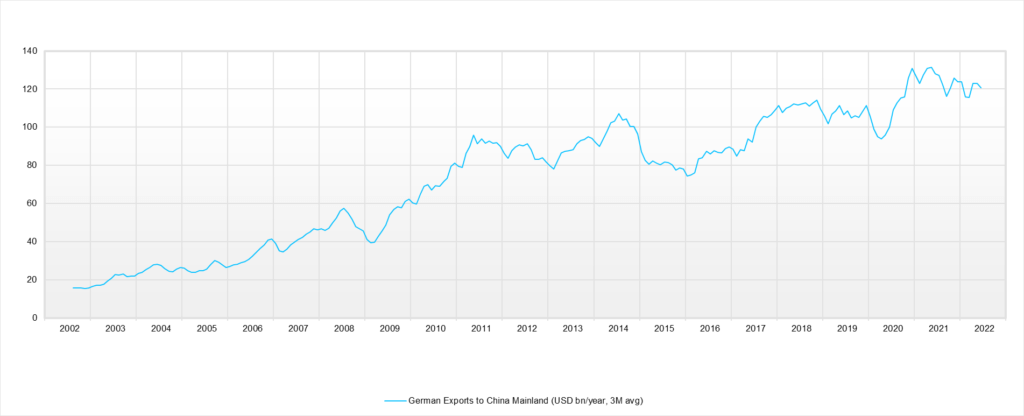

The emergence of Chinese economic power also helped fuel the boom in German exports during the past decade, when they doubled between 2009 and 2012, rising from $40bn/year to $80bn/year. China is now the second largest destination for German exports, currently accounting for $120bn/year, putting it behind the US but ahead of France, with a market share of around 8% (versus 9% for the US and 7.5% for France).

The problem for German exports, and for European mercantilism as a whole, is that Chinese growth has already begun to slow and has evolved.

Following the country’s economic development, investment and industry are naturally becoming less important, while the importance of consumption and services is growing. China is also now able to produce higher added value goods than in the past itself, and a form of economic independence is taking hold, again quite naturally, due to the size of its domestic economy, as in the US. In other words, German exports to China will now grow far more slowly, or even stagnate, if China continues to stall…

With regard to technological progress, Europe is behind the curve when it comes to IT, digitalisation and social media, on top of other structural ills (such as unfavourable demographic trends and now energy supplies), which are unfortunately not solely limited to Germany.

The latest balance of trade figures for the big three eurozone economies indirectly illustrate the decline of the European “industrial” model. As is often the case, what is bad news for some is good news for others, and especially the US, where there will be few objections to providing us with energy and weapons in the coming years. Certain political decisions may prove to be (very) costly… at least in the short term!

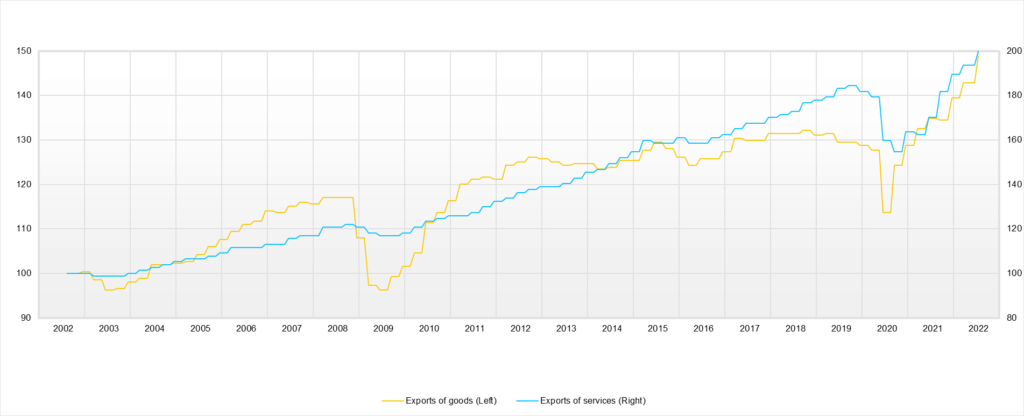

It would therefore be easy to end on a pessimistic note, with regrets or by opining about past errors. In economics, as in many other fields, nothing is set in stone, however,and there’s always a grain of hope. European mercantilism is perhaps just evolving, and in future Europe will export more services, a certain quality of life, history and expertise.

The tourism industry should thrive over the next few years, for example, boosted by a weak Euro and the emergence of an Asian middle class, while the luxury goods sectors (L’Oréal, LVMH and Ferrari) should continue to flourish all over the world.

Finally, Europe and its industry could ultimately even find a prime place for itself within the global economy, if it succeeds in taking up the challenge laid down by the energy transition and imposing itself as a leader in this field. Not only would it once again benefit from a competitive advantage over its competitors; it would become the principal provider of the processes and equipment required (intermediate goods) by its main trading partners. We therefore need to stay ahead of this particular curve, not only to save the climate, but also because the prosperity of our continent depends on it. Who said that these two objectives could not be reconciled?

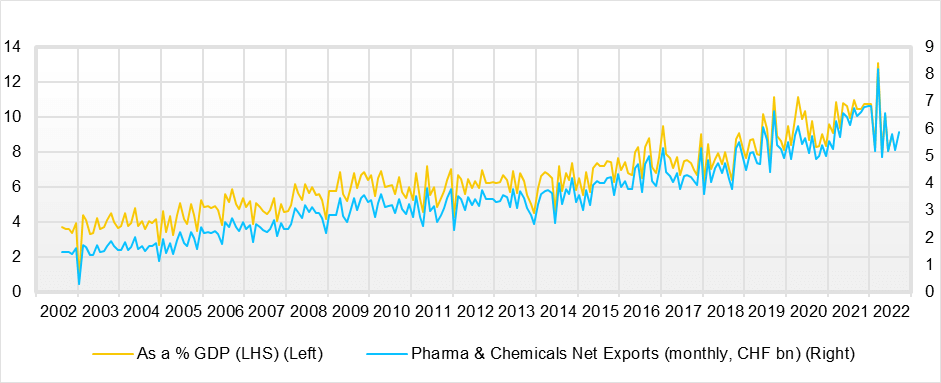

And what about Switzerland? Not for the first time, our economy is not immune to the woes suffered by Europe, as our largest trading partner, but it continues to show greater resilience, particularly due to its export mix, its unique position (as a small open economy without natural resources) and the strength of its currency, which favours high added value products and a constant search for efficiency through increased competitiveness.

In such an environment, the pharma/chemicals sector, which is now Switzerland’s main export driver (and therefore drives its economy), should continue to benefit from global structural trends such as the ageing of the population, the increase in health care costs, and the emergence of new consumers in emerging countries.

DECALIA CIO and Head of Multi-Asset and Bond Strategies

Before joining DECALIA, Fabrizio Quirighetti worked for more than 17 years at Syz Asset Management. Here he held the position of CIO and Head of Multi-Asset and Fixed Income Strategies. He previously worked for six years as a teaching assistant in the University of Geneva’s Econometrics Department. Fabrizio Quirighetti has a Master’s degree in Applied Econometrics from the University of Geneva. From 2014 to 2020, he was an external member of the Tactical Allocation Committee of Compenswiss, the manager of the social security funds AVS/AI/APG.

DECALIA has 4.9 billion Swiss Francs of assets under management.