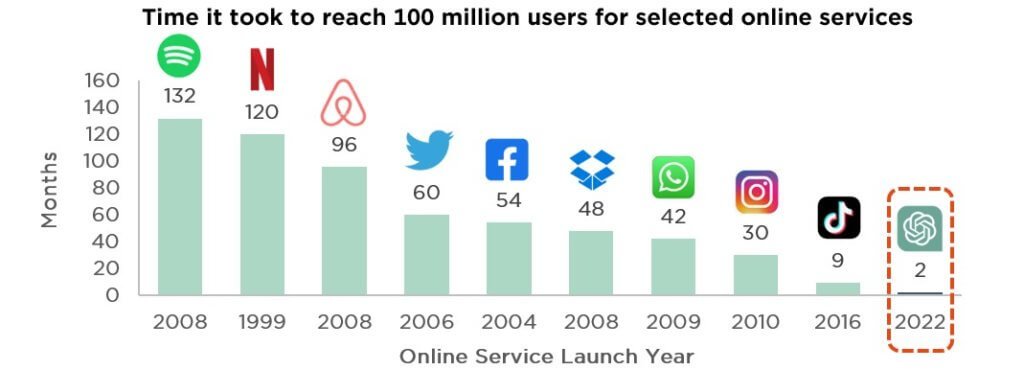

- We allocate some space in this month’s editorial to OpenAI’s ChatGPT

- Only to point out that Human Intelligence (HI) is instrumental to all revolutions

- And that successful long-term AI investors need to look beyond currently hyped stocks

Given the media and market hype surrounding Generative Artificial Intelligence (AI) these days, let us here take a step back and adopt a more balanced view. AI is not likely to fully replace Human Intelligence (HI) but will rather enhance it, augment it, and ultimately enable it to continue to lead mankind’s innovation and evolution. So, do not mistake the egg (AI) for the chicken (HI) and be assured that humans remain in the driving seat! Used wisely, AI should only confirm HI’s supremacy.

And who better than his Majesty himself, ChatGPT, to enlighten us on why AI cannot function without HI, why AI does not pose a fatal risk for the future of HI, and finally why HI will always be superior to AI in critically important creative areas.

Hence, when asked whether AI can work without HI, ChatGPT replies that “humans are responsible for designing the algorithms, creating the models, training the AI systems with data, and fine-tuning their performance”, candidly admitting that “AI lacks the qualities of HI, such as consciousness, emotions, and subjective experiences”.

Moreover, questioned on the future of HI versus AI, ChatGPT thankfully indicates that “HI is expected to continue developing”, referring in particular to neuroscience, cognitive science and genetics, but is also very optimistic on AI, writing that it “holds immense potential for further advancements” and listing many possible fields of utilisation “including healthcare, finance, transportation, and entertainment, to automate tasks, augment human capabilities, and provide innovative solutions to societal challenges”. It does, however, raise a word of caution on the ethical front: “Ensuring that AI is developed and deployed responsibly, with considerations for transparency, fairness, and human well-being, will be crucial in shaping the future relationship between HI and AI”.

And to our ultimate question, whether HI will remain superior to AI, ChatGPT begins with a reassuring disclaimer, saying that “as an AI language model, I don’t have personal opinions or beliefs”!

While it admits that “currently, HI excels in several areas when compared to AI”, it also stresses that “AI-powered technologies have surpassed human performance in certain tasks, such as chess, complex calculations, and image recognition”, even going on to say that “some researchers believe that the development of artificial general intelligence, which would possess human-like intelligence across a wide range of tasks, could be possible in the future”. Its conclusion is non-committal though: “The relationship between human and artificial intelligence is complex, and the balance of superiority may shift as technology advances”.

Back now to our (purely HI) thoughts on the subject, stressing first that technology is no obstacle to humanity. We have always evolved – physically, behaviourally, morally, biologically. The pace of innovation may have accelerated recently, but our ability to adapt to the latest technologies remains undeterred. In fact, HI has a long history in this regard, with innovative technologies created by humans always driving the major changes in our condition. Today’s AI revolution is not the first of its kind (think internet), nor the last, with the question not being whether but who will benefit the most.

From an investment standpoint, acknowledging that AI & HI stand to successfully co-exist in the future, our goal is to identify businesses that will best embrace this revolution. Looking beyond the market hype that currently surrounds the most obvious AI supply chain winners to a time when the dust will have settled and AI become more widespread, long-term investors should focus on agile companies with proven transformation skills, capable of rapidly integrating innovative AI tools. Put differently, we prefer to address the huge AI market opportunity through stocks of well-managed highly adaptive businesses, typically characterised by… superior HI!

Written by Damien Weyermann, Lead Portfolio Manager

The glass is still half empty, but investors are thirsty

- Macro: short-term growth and inflation relief in the US, more mixed elsewhere

- Unappealing equity market valuation? Take a look beneath the (index) surface!

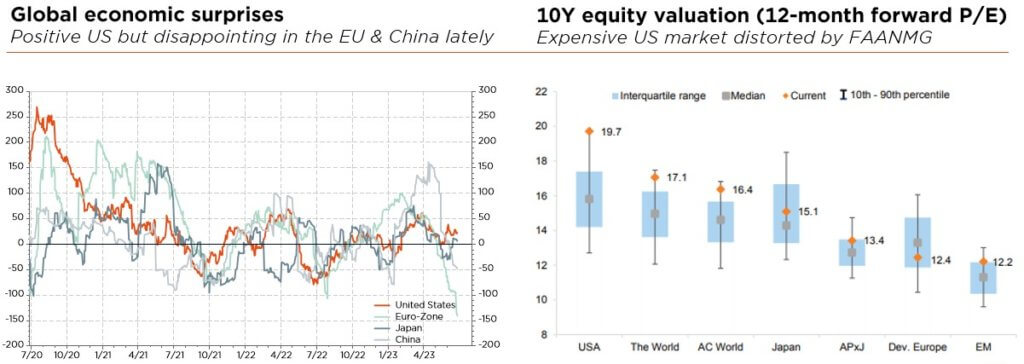

- Narrow market breadth is usually not a break, but beware of further rotations

The wall of worry climb may not be over, but things do appear to be moving in the right direction. Despite latent recession risks, the odds of a global soft landing have further increased with more resilient than expected US activity, inflation past its worst, US banking stress and debt ceiling now stories of the past, central banks nearing peak hawkishness, and labour markets rebalancing smoothly. Indeed, one may even argue that the US economy has landed, albeit is still rolling too fast. By contrast, China’s post-reopening recovery is already fizzling out and European trends remain mixed, with inflation to remain sticky in specific countries, but the dreaded global credit crunch probably postponed. In other words, the situation may paradoxically get better, before becoming (more) sour. Which suggests that we may be up for a few more rates hikes – as priced in by the markets.

Better-than-expected Q1 earnings reports, short-term relief on the US growth and inflation outlook, as well as the lack of a “sell in May & go away” move undoubtedly triggered a FOMO panic attack among investors. With sentiment fast switching from fear to greed, we caution against reading too much into such signals. History shows that technical overbought alerts can flash for some time before providing accurate indications. In fact, the average allocation to equities has increased only marginally (from a deep underweight) suggesting the newfound bullishness may be benefiting other asset classes too. We thus continue to see limited downside risk for equities, with the pain trade still to the upside for most investors.

Equity markets globally, and especially in the US, admittedly look expensive by almost all metrics, seriously impairing their relative appeal in today’s more attractive bond/cash yield environment. Interestingly however, looking beneath the index surface, all multiples are not that stretched. Outside of the US, or more specifically of the growthier parts of the US market, the valuation landscape looks much brighter.

As regards pushback related to the narrow market breadth, we note that participation has improved lately and that similar episodes in the past did NOT break subsequent market performance. As a result, we expect a gradual non-linear convergence of stocks beneath the index surface over the coming months, underpinning further equity factor/style/sector rotations. Put differently, we still see attractive pockets of value in equities today but requiring nimbleness and selectivity.

On the one hand, many market overhangs have been removed in recent months, while several indices have broken key technical resistance levels, indicating further upside. On the other hand, the aforementioned concentrated nature of this year’s rally, alongside unappealing valuations and somewhat stretched near-term sentiment indicators, still calls for caution. So while we have become progressively more constructive on equities over the past months, we still need greater economic visibility to turn resolutely more positive. Hence, our unchanged broadly neutral equity stance.

We did, however, make tactical changes to our equity positioning in June. The UK domestic stance was downgraded to a slight underweight, reflecting a lasting deterioration in the economic and political backdrop. Japanese equities were upgraded to a slight overweight, as the market should benefit from “Goldilocks” monetary policy, better economic perspectives, inflecting capital flows, an attractive valuation framework and improving corporate governance. Elsewhere, we keep our slightly overweight stance on Chinese equities but would consider taking profits on any potential stimulus-led near-term rebound. Finally, and at a more granular level, we now tilt our factor allocation more towards value (slight overweight).

Written by Fabrizio Quirighetti, CIO, Head of multi-asset and fixed income strategies

External sources include: Refinitiv Datastream, Bloomberg, FactSet, Goldman Sachs, World of Statistics