We got two positive surprises lately. The first one we almost got used to it, the US economy doesn’t show any signs of landing since the US ISM manufacturing rebounded above 50 in March and the non-farm payrolls (NFP) increased again more than expected last month as they rose +303k vs. +215k expected and +270k the prior month. The second one is that the Cagliari Calcio beat Atalanta 2-1 yesterday! In both cases, the odds of a hard landing scenario are decreasing further…

So, US jobs growth remains very solid, whereas the other parts of the job report came in line with the consensus expectations: unemployment rate ticking down to 3.8% (close to historical low levels), still firm wages growth, up +0.3% MoM and +4.1% YoY, down from 4.3% in Feb (a lot of progress has been made there but still a bit too high for a total comfort from some Fed officials), and the small uptick in participation rate to 62.7% from 62.5% providing a scant consolation for those fearing an overheating economy. On this matter, it’s worth highlighting that higher immigration (the US delivered close to 200k employment-based immigrant visas last year, far above the pre-pandemic number…) leads to higher jobs supply and thus a higher potential growth (somewhere in between 2.0% and 2.5%).

Basically, this latest US job report didn’t change materially the overall growth-inflation picture for the Fed compared to previous months. It remains consistent with resilient/strong growth and inflation slowly trending down to its target (even if the last mile may prove longer & bumpier than previously expected). As a result, it didn’t have a meaningful impact on the odds of a June rate cut by the Fed (they decreased slightly from about 65% to 50-55% currently). However, it clearly adds some doubts about the extent of cuts/monetary policy easing going forward, and thus some upward pressures on the neutral long-term rate debate (i.e. r*) and consequently on the current long-term rates too (US 10y yield are well above 4.4% this morning).

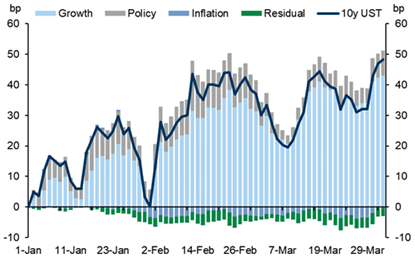

Decomposition of change in US 10y yields since January (source: Goldman Sachs)

In other words, the markets, like the Fed, seem now convinced that strong growth and low inflation aren’t so contradictory… similar to the experience of the 90’s (with many other notable differences obviously regarding for example geopolitics, public debt trajectory or globalization to name a few). Inflation may indeed behave in the foreseeable future even if US growth remains strong (>2%) thanks to strong immigration, a catch down of the shelter component, ongoing disinflation in goods and some pandemics-related distortions “leftovers” to unwind in services sector or AI productivity gains eventually (more a long-term story actually). That’s why the backup in long rates hasn’t derailed the bullish equity market’s trajectory so far, because (1) it’s all related to better growth prospects and (2) it’s not the timing of the cuts that matters the most but the investors’ confidence that they will happen at some point.

Rising US ISM/global PMI mfg indices with incoming rate cuts (at sight) may even lead to a catch-up from pro-cyclical laggards (i.e. outside the usual large cap quality stocks) such as small & mid-caps or materials/commodities related stocks and should continue to be broadly supportive for risky assets… How to calibrate the risk of higher rates on equity going forward? It’s all about inflation in the short term (see below the economic agenda), eventually debt sustainability in coming months and terminal rates beyond this year.

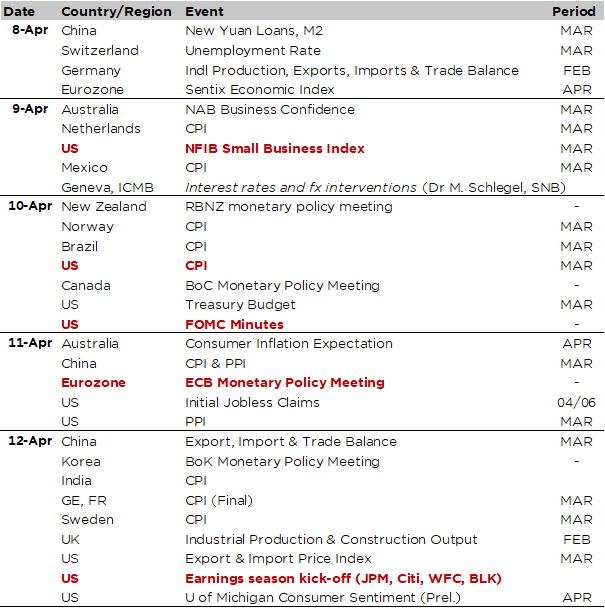

Economic Calendar

It will be all about CPI and monetary policy over the week, while the Q1-2024 US earnings season will kick-off on Friday with the releases of a few major US financials including JP Morgan, Citigroup, Wells Fargo or BlackRock. The key highlight of the week will happen on Wednesday with the releases of March US CPI figures in the afternoon, followed then by latest FOMC minutes in the evening. Investors will keep a close eye on both given the recent upbeat data (ISM mfg index rebounding above 50 and the better than expected March NFP print of +303k) to continue guess estimating the timing and the extent of Fed’s rate cuts. In fact, the rising odds the “no landing” scenario for the US make the case of “no cuts at all this year” not so outlandish from now…

The consensus foresees both headline and core CPI increasing +0.3% MoM in March, slightly below previous month gains (+0.4% in February), leading to modest decline in annual core inflation to 3.7% from 3.8% and an increase to 3.5% from 3.2% for the headline index. Note that the prior 2 months, US CPI surprised to the upside… Furthermore, other US inflation gauges such as PPI, imports and exports prices, or consumer inflation expectations from the University of Michigan’s survey for April are also due on Thursday and Friday. Before that, we will get the NFIB Small Business Optimism Index for March covering different current & expected activity topics (employment, investment, financial conditions, production, inventories, etc…) for small and medium-size US companies. Given its current depressed level, its name (“Optimism Index”) is somewhat misleading currently.

In Europe, the focus will be on the ECB decision on Thursday: President Lagarde and her central bankers’ team are expected to keep their target rates on hold as they are waiting for more (comforting) data before easing. Anyway, the ECB is also widely expected to pave the way for a first rate cut in June, barring significant upside surprises on inflation and/or activity (so without officially pre-committing to cut). Note also the ICMB public conference tomorrow evening at 18h30 in Geneva (Maison de la Paix – 2, Chemin Eugène-Rigot) where Dr. Martin Schlegel (SNB Vice Chairman) will give a lecture on “Interest rates & foreign exchange interventions: Achieving price Stability in challenging times”. Other notable central bank meetings due this week include the Reserve Bank of New Zealand (RBNZ) and the Bank of Canada (BoC) on Wednesday, while March inflation figures will pop out across the world over the week with CPI due in Mexico, Brazil, Netherlands, Sweden, Norway, India or China among others. For the latter, which is still flirting with deflation, current consensus estimates point to a softening of the YoY pace to +0.4% in March from +0.7% the prior month.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.