4 unique advantages that a human-size wealth management boutique has over larger firms

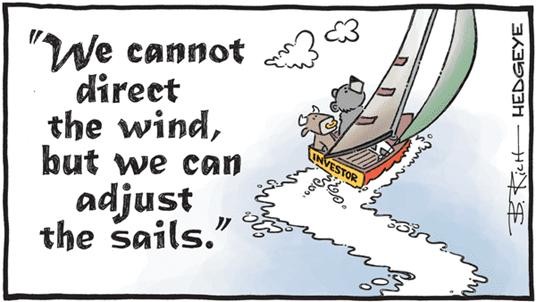

by Sébastien Demole, Partner & Head of Wealth Management What can a human-size wealth management boutique offer that larger firms can’t? At DECALIA, we believe that small is beautiful. As a human-scale boutique, we are convinced that large institutions often struggle to deliver: attention, alignment and agility. Wealth Management boutiques need to be big enough to provide access […]