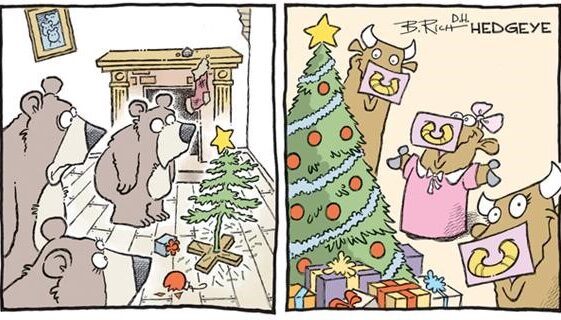

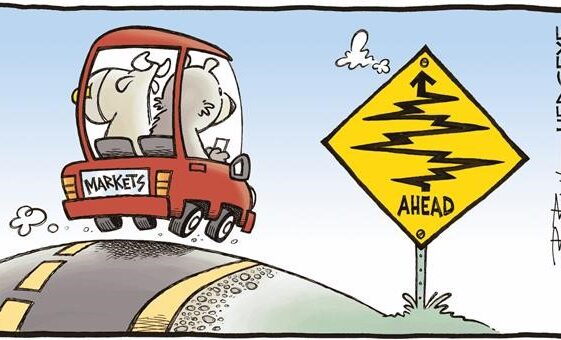

A few investor’s survival tips while waiting for an inflection

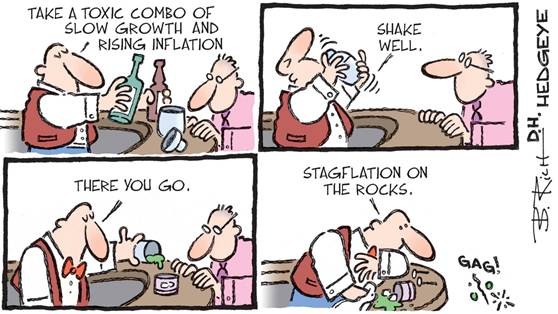

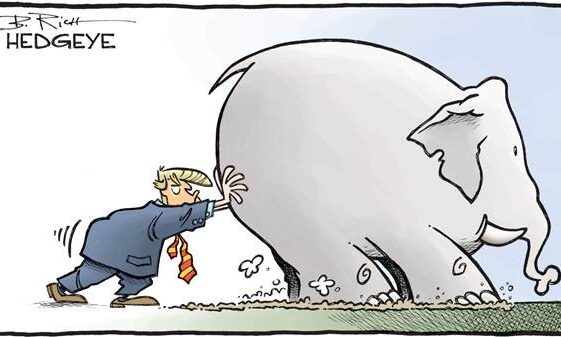

Apart my birthday and a spring-like weather, there was not much to celebrate recently… The announcement of reciprocal tariffs was worse than expected, both in terms of the percentages announced (higher than expected) and the method of calculation (a simplistic and arbitrary formula that further discredits the Trump administration), stock markets have been falling ever […]