While US citizens have recently voted in favor of Trump and a united Republican government to make America great again, some Italian Serie A clubs are relying either on more respected football managers, such as Claudio Ranieri for Roma, or more unpredictable football players, such as Mario Balotelli for Genoa, in order to make their respective football clubs great again. “Why always them?” may both Italian’s soccer aficionados and US politics analysts contend. For the time being, one of them have already achieved favorable outcomes -if markets are any guides-, while for the remaining two, the results are more contrasted so far with a “respectable” defeat of the Roma against Napoli this week-end and a draw of Genoa against… Cagliari Calcio. Placebo effects don’t last long usually, but time will definitively separate the wheat from the chaff. In this context, I wish good luck to Genoa fans, while remaining attentive on the trajectories of the different US economic and financial variables going forward. Speaking about the potential impact of Trump’s victory (and a Republican sweep) on the global macro backdrop and on the financial markets, you will find a summary of our latest monthly strategy meeting here below.

Market Narrative: Make America Great Again… Again! – Trump is back, with a unified Republican government, and markets have enjoyed it overall so far. US equity markets made new high, Bitcoin and Tesla skyrocketed, US dollar got stronger, while rates have crept up further on the back of reignited animal’s spirits and higher inflation expectations for next year. In the meantime, US economic indicators continue to surprise on the upside, whereas the rest of the world economy struggles to stay afloat. These divergent trends have also been reflected in monetary policy easing cycle trajectories with ECB now expected to accelerate cuts going forward, while Fed may slow its pace. As far as EM markets central banks are concerned, Trump’s policies will likely complicate their tasks as they should overall be a drag for global trade (tariffs) but push inflation higher (stronger USD). In other words, the current US economic and financial boost has been made at the expenses of Europe, especially the Euro Area and the EM. In this context, China won’t be the main loser as it was already somewhat prepared (less reliant on exports to the US than in the past / more focused now on domestic demand, which is the real issue) and it will have also some power to negotiate on tariffs with the new US administration (at least certainly more than the Euro Area – likely the main victim – or smaller EM economies). Finally, geopolitical tail-risks remain omnipresent and may evolve quickly for the best, as well as for the worse, given this new Trump’s card.

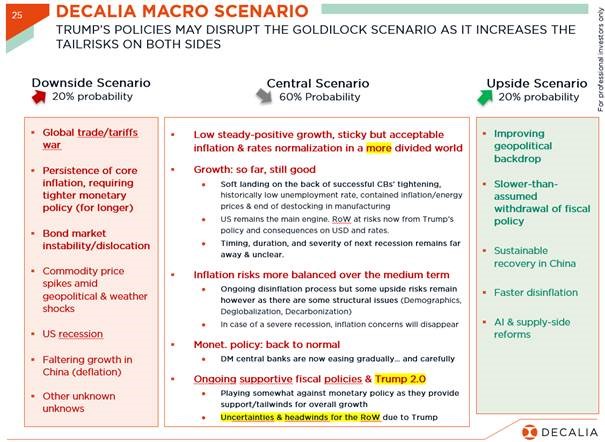

Global Macro Scenario: Our goldilocks scenario may eventually be challenged by Trump policies – Our base case macro scenario remains unchanged: a soft landing with slower but positive growth and slightly above central banks’ target, but acceptable, inflation levels leading to a gradual rates normalization over the next 12-18 months. In this context, central bank’s most difficult task going forward will be to walk a fine line as risks of a temporary reacceleration of inflation and/or an economic recession triggered by a sharp deterioration in financial conditions (due to higher for longer rates or a debt sustainability issues leading to a priced-for-perfection market’s correction) cannot be fully dismissed. However, the final impact on future growth (expected at this stage somewhat negligible on global growth, but tilted to the downside for the rest of the world) and inflation (slightly higher, especially in the US) will depend on both the persons nominated at key departments of the new US administration and the sequencing of their policies, as well as on the eventual policy responses of the rest of the world.

Equity: Too much, too fast, too narrow? Maybe not… – Helped by a broadly supportive macro backdrop along with resilient corporate earnings trends (consensus 2025 EPS growth +12.5%), further institutional & retail inflows, an expected pick-up in M&A activity going forward, a broader participation and even some related-FOMO trends on potential Trump’s policies winners such as Tesla or US small and mid-caps, global equity markets, but especially the US, have extended their rally to new all-time highs. Admittedly, many other regional equity markets haven’t participated as much to the party lately as their economies may suffer from Trump’s policies more or less directly (tariffs, trade or geopolitical uncertainties, higher US rates or stronger USD) soon. In this context, many good news is now priced in the US markets, while there is perhaps some excess pessimism elsewhere, which have translated also in the positioning obviously. Global markets, and US markets especially again, remain expensive by most valuation standards, but that’s nothing new (as for the credit market) and hasn’t stopped this year’s leg higher. In fact, current’s elevated equity index multiples conceal a much more complex reality beneath the surface with segments such as Europe, EM & Small-caps still offering some pockets of value beyond Magnificent US titans. However, selectivity is becoming increasingly key here too as some part of these “cheap” segments may now face even more severe headwinds in the next couple of months.

Fixed Income: Neutral on duration confirmed, while turning more selective on credit – The US elections results will likely have plenty of effects on the bond markets, from fiscal policy, to regulatory reforms, tariffs’ agenda, tighter immigration controls or even challenging Fed’s independence eventually. While the first reactions have obviously been negative to US rates, which have therefore continued to move higher, other bond’s markets -such as the euro area- have benefitted from it as Trump’s victory has clouded its growth outlook and thus potentially accelerate ECB easing cycle going forward. In this context, the Fed funds rate should drift back to a neutral level around 3.75% by the middle of next year (i.e. four additional cuts), while ECB may cut rates faster and deeper to bring its deposit rate below 2% by the end of the summer. As a result, US Treasury valuations have improved -even if there is a real possibility that the 10y UST yield has actually already bottomed (3.6% at mid-September)-, while the prospects for Euro rates have brightened. Tail-risks remain on the both sides as unambiguously bad economic data would likely lead to a fast and furious rates rally (with credit spreads widening), whereas on the opposite side, a spike in inflation/energy prices, US growth reacceleration, or supply debt concerns filtering into the long end of some sovereign curves can’t be ruled out. As far as credit is concerned, spreads are still historically tight and may remain so for a long while, making the prospect of a further significant tightening quite futile, in our view, and thus pleading in favor of greater selectivity in this area, especially in HY and EM, as well as of a gradual up quality (and duration) of bond’s allocation overall.

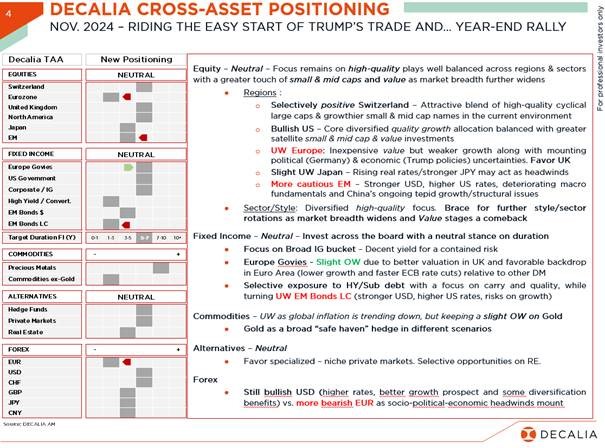

Tactical Positioning (TAA): Tilting the portfolios to mitigate collateral damage from reinforced US exceptionalism – At the portfolio level, we intend to benefit from the year-end rally by keeping our neutral stance on equity, reflecting our cautiously optimistic views in the short term, which has been reinforced by Trump and Republican’s victory. However, some (marginal) positioning changes were made within equities and bonds allocations in accordance with the potential impact of their expected policies consequences. We obviously keep our (structural) preference for US equities, carefully balancing our (actively-managed) small-mid caps allocation with somewhat less growthier mega-caps, which are now benefitting from reignited animal spirits and expected deregulations among others. Elsewhere, we are reducing further our Eurozone equity stance to underweight as it stands as the main loser of the Trump policies due to global trade uncertainties and its weak hand on negotiations, especially given the political instability in Germany or France. Same story for EM equities (downgraded to underweight) even if there are potentially less risks and headwinds for China than for others EM as explained here above. Moving to bonds, latest developments confirm our neutral stance, with a preference for sovereign duration as valuations have improved in the US and the UK, and backdrop has clearly turned more positive in Euro Area (Europe upgraded to slight overweight), as well as for IG credit in the short-end and belly of the curve over the HY/EM segment. We continue advocating for a greater selectivity in this area, especially for EM debt in local currencies, which has been downgraded to underweight. Finally, we continue to favor diversification through Gold as a broad safe haven in different scenarios and we downgrade EUR currency to underweight given the accumulation of global headwinds and domestic challenges it is now facing.

The Bottom-line: Riding the easy start of Trump’s trade and… year-end rally – Fundamentally, we remain constructive on equity markets in the foreseeable future but cannot exclude further bouts of volatility… especially next year (final destination of policy rates, nature of landing, geopolitics, inflation trajectory or market rotations among others) to drive some price consolidation and suggesting somewhat more muted returns down on the road.While we are thus getting more concerned about the future, macro and micro fundamentals remain healthy and should continue to provide support for risky assets in the near term. Remaining cautiously optimistic on the trajectory, we continue to favor an all-terrain approach to portfolio construction together with a well-balanced diversified asset and sector allocation tilted towards high-quality plays in equities, credit carry & high-quality duration in bonds, while keeping a meaningful allocation to Gold combined with USD & CHF as risk diversifiers.

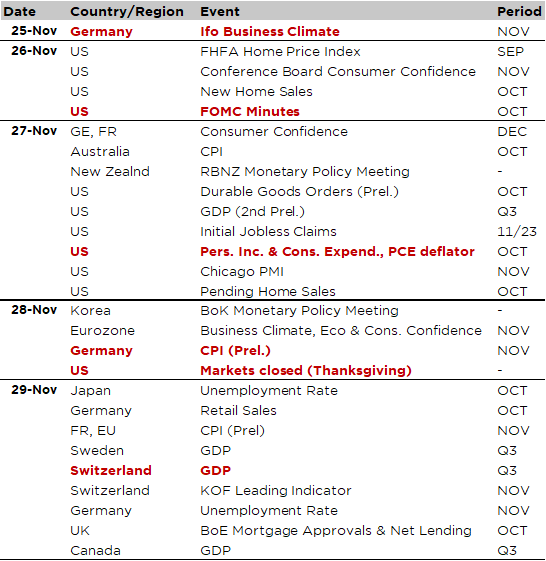

Economic calendar

As the US will celebrate Thanksgiving on Thursday, and there are plenty reasons to be thankful this year, especially from the perspective of US investors… As a result, the week will be somewhat shorter than usual with US markets closed on Thursday and opened just half-day the following day. In this context, the US economic data releases, as well as the few remaining US Q3 earnings results, will be front-loaded. The main highlights will be the US PCE deflator (Wednesday) and the FOMC minutes (Tuesday), while the flash November CPI prints for Germany, France and the Euro Area will hit investors’ screen on Thursday and Friday. We will also get some additional Q3 GDP figures across the globe (Switzerland, Canada, Sweden) and a 2nd estimate for the US (Wednesday). Finally, other notable data in order to get the pulse of the sick man of Europe include the German IFO index (today), consumer confidence (Wednesday) and retail sales (Friday).

The October PCE deflator, released along personal income and consumption data on Wednesday, will likely be the main highlight of the week as it may weigh on the next Fed decision (18 December), which is increasingly viewed as a close call between cutting or waiting. The consensus expects headline and core PCE up +0.2% MoM and +0.3% MoM respectively, leading to an uptick of the annual rate of these inflation gauges to +2.3% and +2.8%. Regarding income and consumption growth, they are expected to remain solidly positive overall even if some slowing down is due. Tomorrow evening, the Fed’s FOMC meeting minutes will also give more insights into officials‘ thinking ahead of their next meeting on December 17th. Other notable US data includes the Conference Board’s consumer confidence on Tuesday as well as durable goods orders and US Q3 GDP second estimate on Wednesday.

In Europe, all eyes will be on the flash inflation prints for November on Thursday and Friday: Euro zone annual inflation is foreseen accelerating to 2.3% YoY (2.0% in October), with a wide dispersion at the country-level (2.6% for Germany, 1.7% for France and 1.3% for Italy), which may complicate further ECB’s task. Will it frontload cuts (with a 50bps cut on December 12th) as growth backdrop is deteriorating or will it wait for further evidences of disinflation progress and more knowledge about Trump’s real intentions and impacts on the Euro Area growth and inflation trajectories. Here too, the jury is still out between a 25 or 50bps rate cut.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.