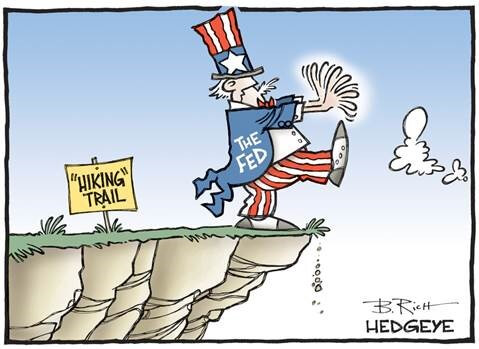

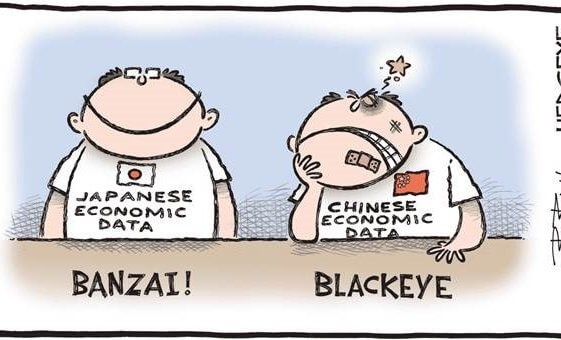

Trick or Treat?

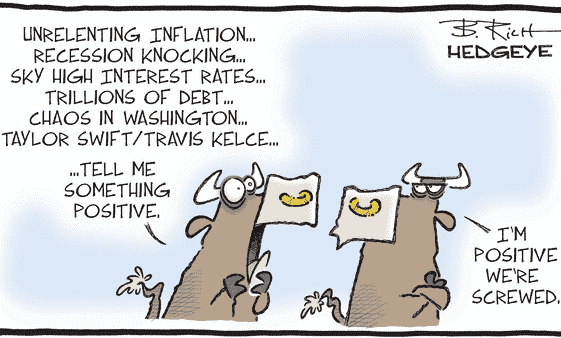

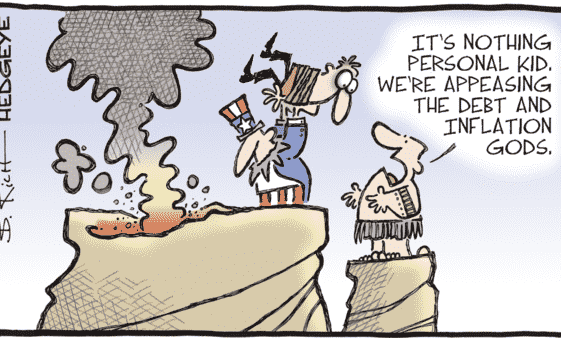

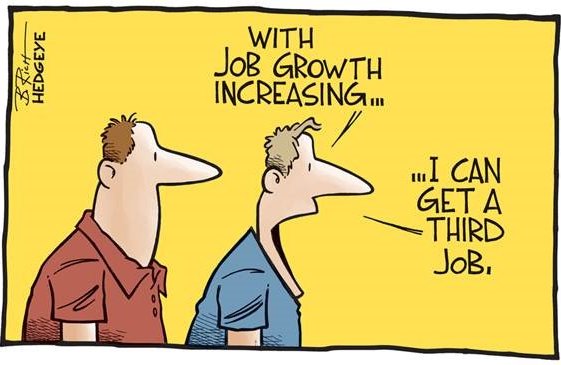

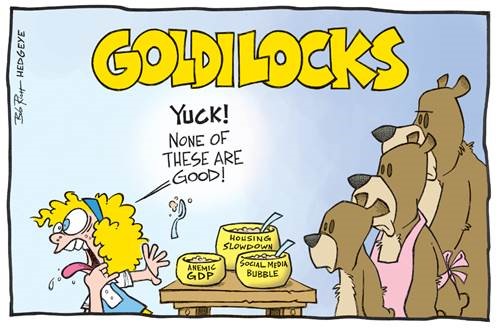

At the time this letter will hit your screen I will be on holiday. While I will obviously enjoy it and benefit fully from my days off treat, I am somewhat concerned about the many tricks that markets may play to frighten investors during my absence as a busy data-packed week await us. In the […]