- What if the FIFA World Cup were played according to ESG merits?

- Western Europe would come out strong, placing 7 teams in the quarter finals

- And Switzerland would definitely figure among the best football nations

As the “Qatar World Cup of Shame”, to quote Amnesty International, sees the top football nations compete in brand new air-conditioned stadiums, we in true DECALIA tradition – and with perhaps just a touch of irony – propose an alternative competition. One in which these 32 countries win or lose their games based not on sporting talent, but on ESG criteria. Who, then, stands the greatest chance of lifting the sustainability trophy on 18 December?

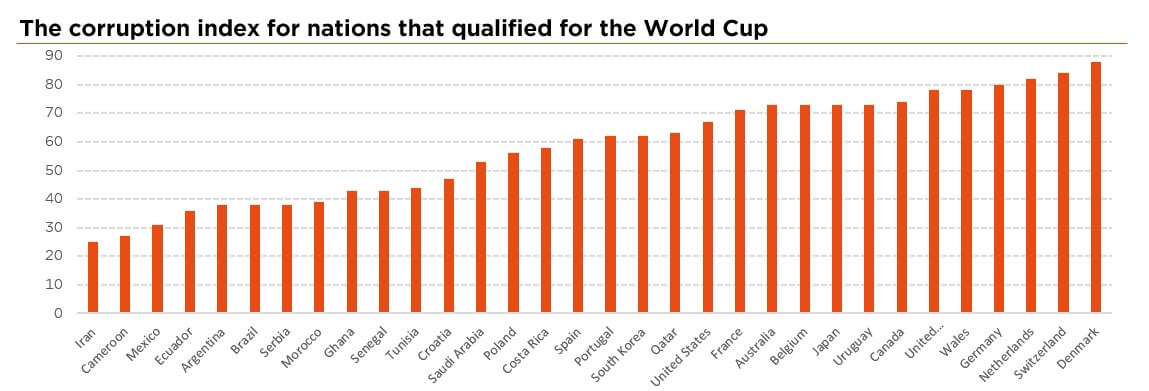

The metrics that we use to determine the outcome of each fixture are fourfold: per capita CO2 emissions (the lower quite obviously the better), the Bloomberg climate policy score (the higher the better), the GINI coefficient of wealth inequalities (the lower the better) and the corruption index (the higher the better). For each metric, when a team surpasses its opponent, it scores a goal. And should a game (after the group stage) end on a 2-2 score, a 5th criterion serves as the penalty shoot-out: the Bloomberg renewable energy score (the higher the better).

Not surprisingly, in group A, Qatar comes clear last, scoring no points at all, with Ecuador also eliminated (low CO2 emissions but bad on the other metrics, particularly corruption). Iran in group B suffers the same fate, in part for lack of ESG data it must be said. Group C sees Mexico and Saudi Arabia ousted, with just one point each – their match being a tie (Mexico slightly better on CO2 emissions and GINI, Saudi Arabia on corruption and climate policy!) In Groups D and E, Europe comes out strong: Denmark, France, Germany and Spain qualify for the quarter finals, at the expense of Australia (CO2 emissions), Tunisia (corruption and climate policy), Japan (CO2 emissions) and Costa Rica (GINI and climate policy). Group F has Morocco and Croatia leave the tournament, with rather similar ESG profiles (moderate CO2 emissions but below-average climate policy and corruption indices). Switzerland ranks top of Group G, seconded by Serbia – meaning that neither Brazil nor Cameroon make it through (both rank well in terms of CO2 emissions but much less on the other metrics). Finally, in Group H, Ghana and South Korea score zero points each, although they have opposite profiles as regards CO2 emissions.

Moving to the knockout stage, Europe (UK and Switzerland included, but Italy conspicuously absent!) takes a decidedly upper hand over the other continents – be it North America (the US and Canada figure among the heaviest CO2 emitters), Latin America (Argentina is weighed down by its corruption index) or Africa (Senegal also loses out on corruption, as well as climate policy). The other four eliminated teams stem from the eastern (Poland, Serbia) and southern (Spain, Portugal) parts of Europe, on account mainly of inferior climate policy and corruption metrics.

The quarter finals thus oppose the Netherlands to France (3-1), Germany to Switzerland (2-2, with the Nati pulling through during the penalty shoot-out), Denmark to the UK (3-1) and Belgium to Uruguay (2-1) – the latter two teams interestingly perfectly equal on the corruption count, hence the total of three rather than four points in the match score.

Our prediction for the semi-finals? Both end on penalties, with Switzerland just defeating the Netherlands in the first, on account of a more renewable energy mix, and Denmark pulling through against Belgium in the second, thanks to its emphasis on green energies.

Which brings us to the final, opposing two outsiders on the global football stage: Switzerland and Denmark. While the Swiss team does boast slightly lower per capita CO2 emissions, it cannot rival Denmark on the three other counts, climate policy, corruption index and GINI coefficient. And so it is unfortunately a 1-3 loss for the Nati – just one step away from being world ESG champion.

Written by Gian-Luca Grassini, ESG Analyst

“Groundhog Day” syndrome anyone?

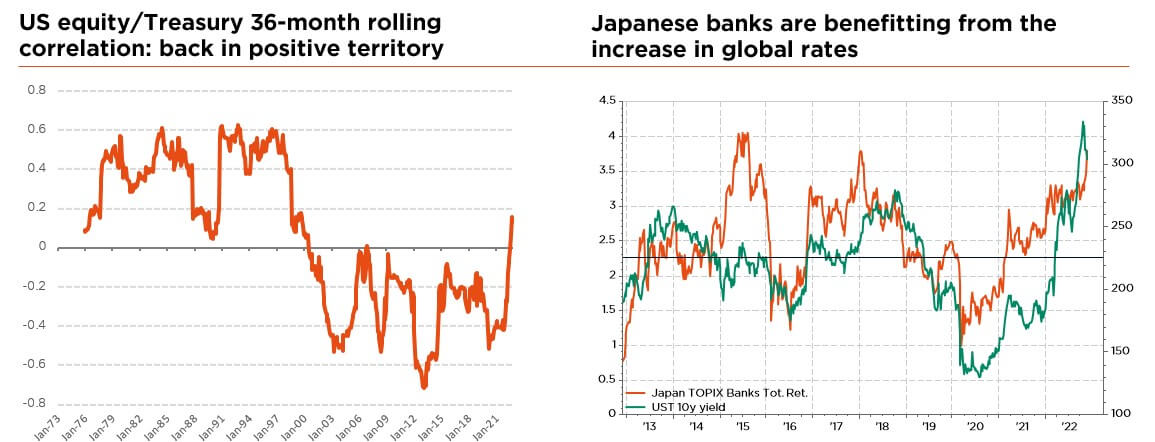

No, this is not about calling the end of winter for investors (yet) but rather alluding to the awkward feeling that markets have been reliving the same sequence of events repeatedly over recent months. Simply put, as distraught investors desperately look for signs of peak central bank hawkishness, key US economic reports have been ever more scrutinised with the slightest comforting surprise (e.g. recent softer than expected inflation) triggering a short-lived bear rally on the back of “pivot” hopes, until Fed officials ineluctably temper enthusiasm and send markets lower again… pending the next data release. With several geopolitical concerns having now taken a backseat, there is little doubt indeed that the timing of an equity rebound will coincide with that of a less hawkish Fed, as looser financial conditions eventually lead to an easing of (real) bond yields. However, we do not believe to be anywhere near that point yet with recession risks for 2023 still real and this year’s revived painful positive cross-asset correlations set to continue.

The key question for investors today remains what is already priced by global markets following the widespread 2022 correction. On the one hand, one could argue that the surge in rates has already taken a significant toll on (long duration) asset valuations and that ongoing earnings downgrades are now widely expected to last through 2023 by bearish and defensively positioned investors. Also, more resilient than expected economic growth to date, combined with peaking US inflation, easing global supply chains and growing Ukraine war “fatigue” as energy crisis fears dissipate (thanks to warmer than usual weather), may even suggest equity market upside.

On the other hand, risks of a more severe recession next year cannot be ruled out with the current rate hiking cycle set to last for longer, cooling off sticky consensus expectations for a Fed “pivot” in 2023 while weighing further on earnings, credit and ultimately equities. But aside from hurting future corporate growth prospects, such higher real rates would also accelerate the erosion of equities’ decade-long relative appeal, by providing investors with a new valuation framework and reasonable investment alternatives in bonds.

Admittedly, recent macro developments have proven somewhat more supportive for both risk assets and global bonds, but near-term visibility remains limited. With no clear signs of market capitulation within sight, we remain on the sidelines until we reach greater clarity on the timing, duration and severity of any economic recession and the evolution of the current tightening cycle. Our base case still presumes a soft-landing scenario, but further messy market trends likely lie ahead as hopeful sporadic dovish bear rallies alternate with discouraging higher rate-driven snap pullbacks.

As such, we retain our cautious tactical stance (slight underweight) on both Equities and Bonds, accounting for further rising real rates, a higher risk & inflation premium, the emergence of a new “world order” and subsequent massive rebalancing moves. Peaking inflation combined with the sharp recent valuation reset, favourable seasonality and current bearish investor sentiment may well provide attractive long-term investment opportunities already today, but we cannot rule out further downside in the short run. With the dispersion of outcomes still remarkably large, we thus maintain a balanced multi-style all-terrain approach to portfolio construction and continue to advocate for a well-diversified high-quality defensive equity allocation & selection. We have thus not made any significant changes to our tactical asset positioning, only rebalancing our portfolio allocation back to target by adding decorrelated assets such as Japanese banks.

Written by Fabrizio Quirighetti, CIO & Head of Multi-Asset