- Entering a new year, the biggest risks – and opportunities – are always those that no one anticipates

- Such “surprises” indeed tend to matter more than getting the central macro scenario right

- Our 2025 crystal ball “predictions” will probably not all materialise, but they provide food-for-thought

Very best wishes for a healthy and prosperous 2025! Moving into this new year, I have polished my crystal ball to come up with 10 predictions that could shape portfolio returns over the next 12 months. Some can be considered as general macro themes, a few may be provocative, many will not materialise, while others seem crazy yet should be kept in mind. Indeed, surprises often tend to matter more than getting the central macro scenario right. This is because the biggest risks – and opportunities – are those that no one anticipates. Just think back to the last few years: the Covid-19 pandemic in 2020, an inflationary surge in 2021, Russia’s invasion of Ukraine in 2022, the collapse of Credit Suisse and absence of recession in 2023, and returns on US equities, gold and bitcoin that well exceeded expectations last year. As such, the most surprising thing in 2025 would in fact be… a lack of surprises.

1. Forget about credit in 2025! Either we remain in a Goldilocks scenario and equities remain the fastest horse of the asset allocation carriage, or economic growth peters out and sovereign bonds outperform. Considering also historically tight credit spreads, the odds of credit faring better than govies in a scenario of rising rates (due to an upside surprise on inflation or debt sustainability issues) are extra slim. And were inflation to be decisively anchored, sovereign bonds will again help diversify portfolios. Put differently, I am not saying that credit will post negative returns, only that it is now somewhat useless within a broad asset allocation.

2. The “Magnificent 7” will no longer lead equity indices (in another positive year) as market participation broadens out. This might be because AI productivity gains finally spread to other sectors, or simply the result of other sectors catching up, especially US small- and mid-caps. For that, we just need US long rates to fall below 4.5%, with a lack of upside inflation data allowing the Fed to continue easing gradually and cautiously.

3. Non-US equities stand to outperform. Trump policies might prove more counterproductive than expected for US stocks, especially if they lead to durably higher US rates and/or a weaker dollar. This could happen if US debt sustainability concerns make a comeback, or the Fed loses its credibility. In such a context, gold would probably take the lead. Note that Trump policies may also provoke reactions or wake-up calls in major US trading partners such as Canada, Mexico, Europe or China, which could prove self-beneficial and lead to an outperformance of their own equity markets (at least in local currency terms). Any doubt about this? Just look at the Argentinian equity market in 2024.

4. A profound reform of Germany’s debt brake will occur. The new coalition coming out of the February snap elections will have “no other choice” at some point, as punitive Trump tariffs push the German economy into a full-fledged recession and France experiences debt sustainability issues that reverberate across the euro zone, making ECB monetary easing less effective.

5. The French 10-year yield surpasses that of Italy. At 3.2% today, it is already higher than in Spain or Portugal – and on par with Greece. I suspect, however, that the French situation will worsen further in 2025, the country’s debt sustainability issue being far more serious than in other large economies for three main reasons: (1) its trajectory (France’s primary budget has not been balanced since 1981!), (2) the already high taxation level (France’s tax-to-GDP ratio is close to 45% vs. an OECD average of ca. 35% and less than 30% in the US) and (3) foreign investors own ca. 50% of overall French government debt, a much higher share than in Italy (25%) or the US (30%). At some point, the crisis will trigger a reaction, such as Germany abandoning its debt brake (see above), leading to a more integrated EU budget policy, or the ECB taking an aggressive easing stance.

6. The Japanese yield curve will undergo a bull flattening, with global growth slowing as the year proceeds (especially outside the US), Japanese wage growth finally disappointing but the BoJ having nonetheless already hiked rates at least twice. This will be in stark contrast with most other sovereign bond curves, which will tend to steepen as shorter rates fall more than long rates.

7. The UK economy will face stagflation with GDP growth slowing materially (close to 0% vs. IMF and OECD 2025 expectations of 1.1% and 1.5% respectively), persistently above-3% inflation (or at least higher than in any other G7 economy) and renewed debt sustainability concerns, leading to overall downward pressures on the cable. As a result, the BoE will cut its easing cycle short.

8. Oil prices to collapse below $50 per barrel as the war in Ukraine ends, tensions in the Middle East recede, global growth slows down and Trump policies push US oil/shale gas production higher. If this prediction proves correct, it will likely cement the favourable Goldilocks scenario and drive strong equity and bond performance, while being a headwind for gold.

9. Trump tariff policies lead to a full-blown trade war, causing major FX moves. Thus far, currency markets have been driven mainly by carry trade considerations and expectations regarding policy rate trajectories / end points. Let us now suppose that Trump tariffs are not just a negotiatory tactic but that campaign pledges are carried out. The dollar may appreciate strongly, either on the back of a more hawkish Fed or because other currencies lose significant ground as their growth prospects worsen, particularly since a higher dollar may help tame US inflation, while weaker currencies will allow their trading partners to remain competitive (offsetting part of the tariff hikes). In this context, two currencies will be worth keeping an eye on: the HKD (can the peg survive another year, especially if our prediction #10 comes true?) and the CHF (the SNB may be forced to abandon or again adapt its desperate fight against “bad” speculators).

10. China falls into a Japan-like deflation scenario. Chinese authorities are busy gesticulating to revive demand, but the structural headwinds (demographics, excess household savings, housing inventory, absence of large-scale infrastructure needs, high national debt) and lack of confidence will render their measures useless and ineffective. Moreover, Chinese policies are somewhat constrained by the US economic “exceptionalism”, which goes hand in hand with a relatively strong USD as it continues to attract most global investment flows. As a result, any potential cyclical recovery in China will soon hit a ceiling, with the economy returning to a much weaker “new normal” path (definitively below 5%). Not to mention the impact of a more fragmented world and rising trade tensions.

Written by Fabrizio Quirighetti, CIO, Head of multi-asset and fixed income strategies

A supportive Goldilocks environment still prevails

- Relentless equities rally unfazed by geopolitics… but not by a less dovish Fed

- Cautious optimism on the back of positive growth, lesser inflation risks and monetary easing

- Although bouts of volatility may occur, there are no compelling catalysts (yet) for a downturn

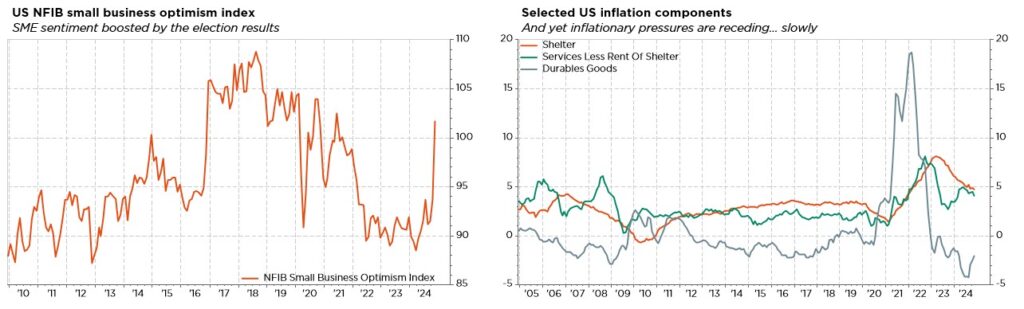

While global equity markets had remained imperturbable to the uncertainties related to the incoming Trump administration and tumultuous geopolitical developments across the globe – including no-confidence vote in France and Germany, annulled elections in Romania, the collapse of Bashar al-Assad’s regime in Syria, and political turmoil in South Korea –, a somewhat hawkish Fed cut triggered finally a pause in the two year-long rally. This seemingly cynical optimism among investors stems from several factors: favourable seasonality, substantial equity inflows, buoyant US pro-business sentiment following Trump’s victory and, most importantly, resilient earnings growth bolstered by still positive US economic indicators. In this context, the message from the latest Fed meeting was a welcome and relatively painless reminder to investors: you cannot have your cake and eat it too! Either US growth continues to surprise on the upside and the Fed may slow the pace of rate cuts, perhaps even decide to hike rates if inflation rebounds, or economic activity turns negative enough to lead to a sharp deterioration in the labour market, which will then trigger faster and deeper monetary easing.

Before that, global equity markets, led by US mega-cap tech stocks, had extended their rally to new all-time highs. Significant divergences had, however, emerged again, with the “Magnificent 7” and Broadcom (under the BAATMAAN acronym) masking the underperformance of most US stocks since early December. While some US market segments appear fully priced, others exhibit unwarranted pessimism, offering selective opportunities. Elevated index multiples mask the complexity beneath the surface, with regions such as Europe, emerging markets and small- & mid-caps presenting attractive value. Despite stretched valuations, earnings resilience and a lower equity risk premium have supported the past year’s rally, even amid fluctuating bond yields.

In the meantime, our base-case macro scenario remains broadly supportive for risky assets with slower but positive growth, inflation stabilising at levels acceptable to central banks, and thus a gradual data-dependent normalisation of policy rates. Risks of stickier-than-expected inflation, an abrupt economic slowdown or rising unemployment cannot be ruled out, as also noted by Jay Powell in his press conference following the latest Fed meeting, especially given the uncertainties related to the impact of the incoming Trump administration on growth and inflation trajectories.

As such, we maintain a neutral equity stance, reflecting cautious optimism driven by resilient economic activity, declining inflation risks, monetary policy easing and healthy earnings growth. Recent adjustments within our equity and bond allocations already reflect potential impacts of US policies. As a reminder, we still favour US equities, balancing small-mid cap exposure with less growth-sensitive mega-caps that benefit from deregulation and renewed confidence. Our outlook on Eurozone equities is more cautious (underweight), as they face headwinds from trade uncertainties and political instability. Ditto for EM equities, despite China likely presenting fewer risks than other regions. In fixed income, we remain neutral on duration but increasingly constructive given improved valuations alongside diversification benefits. We favour EUR IG over USD IG from a valuation standpoint, but USD HY over EUR HY due to divergent growth trajectories. Gold remains a core diversifier, alongside the USD and CHF as FX safe havens.

Entering 2025, we thus remain fundamentally constructive on equity markets. While a pause following two exceptional years is inevitable, we see no compelling catalysts for a downturn. Although bouts of volatility may occur due to policy rate uncertainty, geopolitical developments, inflation trends, a temporary growth scare or market rotations, we expect positive returns overall. Our strategy emphasises a diversified, high-quality approach, balancing equities, credit carry and high-quality bonds while maintaining significant allocations to diversifiers like gold, long high quality bonds or the USD.

Written by Fabrizio Quirighetti, CIO, Head of multi-asset and fixed income strategies

External sources include: LSEG Datastream, Bloomberg, FactSet, J.P. Morgan Asset Management, Statista.