“Un mars et ça repart !”. So far, so good, indeed, especially for the Cagliari Calcio, who beat Salernitana 4-2 this weekend to jump from 19th to 14th place in the Serie A ranking. That’s not only my favorite Italian soccer club ranking that’s melting up, but also risk-on assets with the Europe Stoxx 600 closing at fresh record highs (7th consecutive weekly gains), credit tightening further or even the greenback being a touch softer, usually synonym of a more favorable backdrop for global markets (read non-US ones).

As a result, the current bull market seems broadening out and, that said, it’s perhaps not a coincidence if the S&P500 was slightly down last week (-0.3%), dragged down by the Mag7 for ounce (failing therefore to advance for 17 of 19 weeks for the first time since 1964). In the meantime, recent economic data, inflation figures and central bankers’ insights all point to a favorable backdrop of soft landing, disinflation and rate cuts to come by June at the latest. But as ECB President Christine Lagarde said last week “we are not yet there…”.

So, what could go wrong in the coming months? A lot of things may be the short but useless answer. Focusing only on macro variables, let’s try to guess what could be the markets’ reaction to surprises (positive or negative) on growth, inflation and policy rates expected trajectory. Jumping directly to the conclusion, the biggest risk likely remains a sticky inflation on the back of supply side shocks (due for example to a spike in oil prices or renewed disruptions in the supply-chain). Here are my thoughts driving it.

Let’s start with inflation: if inflation surprises on the downside (everything else equal), that should be the most favorable scenario for balanced portfolio as both equity and bonds will certainly post positive performances in the coming months. At the opposite, sticky or, even worse, inflation creeping up again, may refrain central banks to cut rates this year (timing of the first rate’s cuts being delayed or the extent of easing appearing quite limited). In this context, to asses market’s reaction, it depends on the underlying cause of this “negative” surprise on inflation.

If it’s related to strong economic activity (demand-side led), equities -especially values style and financials in particular- may fare well, delivering positive gains, after digesting the disappointment of having to experience “higher rates” for longer than expected (because there is not really a landing), while bonds may struggle but their loses should be contained thanks to the carry/coupons (short term bonds and credit should outperform long term ones and sovereign). Assuming a supply-side shock, the odds of a policy mistake would increase significantly with the trajectory of growth prospects moving in the opposite direction (down) of the inflation (up). Central banks will face a dreaded and challenging dilemma: cut rates to sustain growth or hike to bring demand down at a level consistent with the restricted supply. As you can imagine, both equities and bonds will struggle in this context, especially as we can’t rule out a come-back at the forefront of the government’s budget deficits and overall public debt sustainability issue.

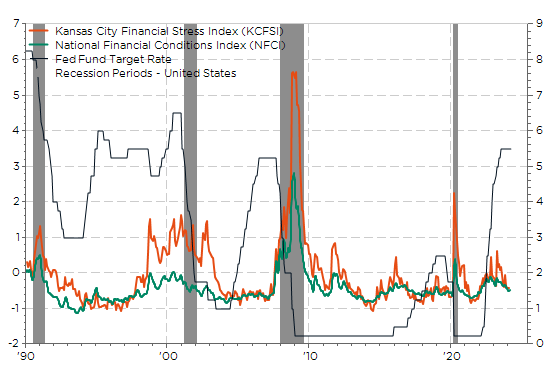

In the meantime, with no significant changes on both inflation and growth forecasts, central bankers may continue to feel reluctant to start easing their monetary policy, especially if they still have some doubts about inflation really moving (quickly enough) towards their target over the medium-long term (read beyond this year). In particular, Fed members are likely wondering what could happen to inflation (and fiscal policy) if Trump is elected in November and goes ahead with some of his promises on tax cuts and/or customs tariffs? In the current environment of positive resilient economic growth, low unemployment rate and overall easy financial conditions, I still believe central bankers, especially the Fed members, aren’t in a hurry to cut rates, preferring to err on the cautious side and racing against the clock.

Take it easy! US Financial Conditions Indicators, Fed Fund Rates & Recession Period

As a result, and paradoxically, it’s perhaps some disappointments and cracks on the economic growth outlook (with a significant increase in unemployment rate for example) rather than an eventually never-coming clear-cut evidence of sustained disinflation, that could force them to lower rates. In other words, some bad (but not awful obviously) economic news, leading to rates’ cuts, could be a favorable new growth driver for overall financial markets. Same could be said about the keeping of Cagliari Calcio in Serie A next season: it certainly won’t be able to save itself on its own… They have also to rely on their direct opponents‘ missteps! In this context, and without surprise, I will support the Lazio tonight as it plays against Udinese (17th in Serie A ranking).

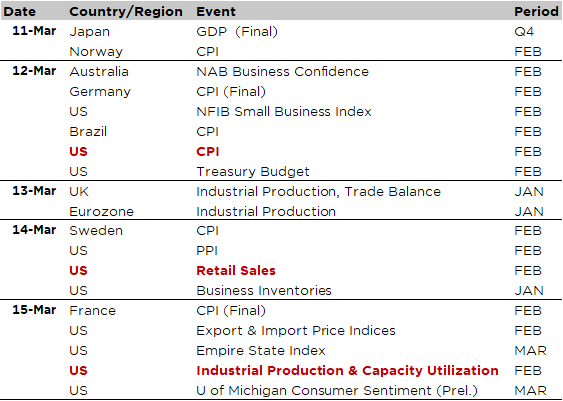

Economic Calendar

So far, so good, as recent economic data, inflation figures and central bankers’ insights all point again to a favorable backdrop of soft landing, disinflation and rate cuts to come by June at the latest (except obviously in Japan, see below). In this context, the main highlights of the week are the US CPI report for February (released tomorrow), the US retail sales on Thursday and industrial production on Friday. These data releases are widely expected to extend -or not- the prevalent Goldilocks’ narrative by confirming -or challenging views about- softer, or decelerating, prices pressures with an overall resilient activity backdrop, ahead of the Fed’s meeting that will take place next week (20 March).

The consensus is expecting monthly increases of +0.4% and +0.3% in headline and core CPI respectively in February, which will lead to annual inflation (yoy % change) of 3.1% (unchanged compared to January) and 3.7% (down from 3.9% the prior month). While weaker figures may eventually open the door for a rate cut before June, higher than expected CPI print could puck back again the timing of the first Fed’s rate cut (almost unanimously priced in June now).

As far as economic activity is concerned, we will also get the February retail sales on Thursday, which are expected to bounce back strongly (+0.7%) after the January blip (-0.8%), while industrial production should continue to muddle through (Friday). Other notable economic data next week also includes the NFIB Small Business Index (Tuesday) and the March preliminary reading of the University of Michigan Consumer Sentiment (Friday). Outside the US, there won’t be any significant data releases (just note Euro Area January industrial production on Wednesday and February final CPI). However, investors will pay attention to wage talks in Japan: Japanese corporate wages are set indeed to jump as annual negotiations with unions (shunto) wrap up on Wednesday, paving eventually the way for the BOJ to normalize monetary policy (i.e. abandoning the Yield Curve Control and raising key interest rate in positive territory).

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.