Enticing, less correlated returns for those with an entry ticket

Reji Vettasseri, Lead Portfolio Manager of Private Markets Strategies

Read our latest Private Markets quarterly article US Sports Investing: More Than A Game, discussing how the US sports industry has begun to open up to institutional capital, creating attractive opportunities for the early movers in the space

Key conclusions:

US Sports benefits from

- Long term secular growth: Increasing opportunities to monetise of sports content, including growing demand from both streamers and traditional broadcasters for unmissable, live events with an exceptionally loyal fan base

- Low competition for deals: Until recently the US leagues restricted most forms of institutional capital from investing in sports, and even today only a small number of private investors are fully accredited, creating an attractive environment for deal-making

- Resilience in economic downturns: The majority of the industry’s revenues are derived from long term contracts with broadcasters and sponsors

More Than A Game

“Baseball is more than a game to me, it’s a religion.”

Bill Klem, Major League Baseball Umpire

Sport is more than a game. For billions of fans, supporting their team is a true passion, a sort of devotion, even a key part of their identity. That engagement also makes sports more than a game in another way. It is a highly attractive industry that generates $75bn of annual revenue in North America alone – 10% of all entertainment dollars. It offers super-prime content for a media industry ever hungrier for it. And, as much of its revenues are recurring (e.g. multi-year TV deals), cyclicality is low.

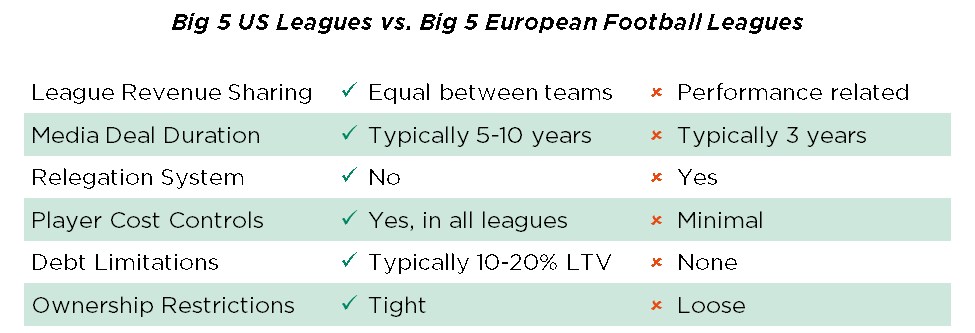

The industry is especially attractive in the US, where the leagues protect their sports. European football must grapple with wage inflation and earnings that fluctuate with performance on the pitch. In the US, leagues set salary controls, share revenues between clubs and there is no relegation, limiting these risks.

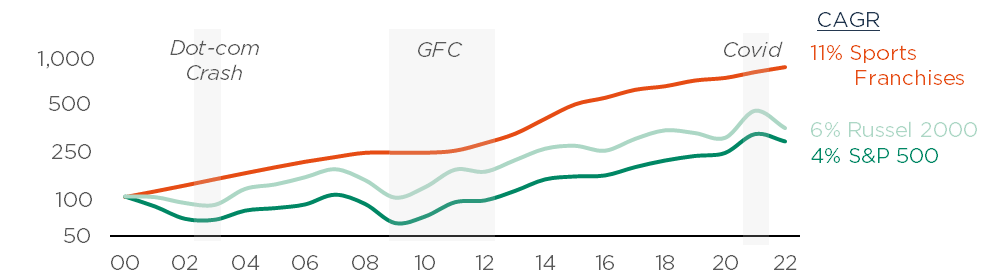

As illustrated below, the growth in value of US sports franchises has not only outstripped that of the S&P 500 over the long term, but it has done so with limited volatility over the cycle.

However, until recently the US leagues effectively shut out institutional investors. European football clubs have come to be seen as trophy assets attracting a wide range of capital providers. But, even today, only a handful of private markets investors are accredited to invest in US sports teams. With limited competition in an attractive industry, the opportunity for these early movers is considerable.

Valuation Growth of Sports Franchises vs. S&P 500 Companies

Sweating Your Assets

“If what you did yesterday seems big, you haven’t done anything today.”

Lou Holtz, NFL Coach

The growth of the sports business is a story of ever better monetisation.

US clubs have several revenue streams, but broadcast rights provide 45% of the total. In a changing media landscape, after the rise of the streamers, their value has grown. There are not only more dollars chasing the same content, but sports is now more strategic.

In the last five years, media revenues for the key purchasers of sports rights rose at a 20% CAGR. With tech entering the fray, bidding battles for rights have become more intense.

When the NFL recently put its TV rights for 2023 to 2033 up for grabs, it secured a $110bn package from both traditional channels and platforms such as Amazon and Paramount+, generating a 1.7x step up in annual revenues. Other leagues have had even greater success. For linear broadcasters, sports offers unmissable, live events that anchor schedules and are crucial for competing with on-demand. In 2021, 95 of the most watched 100 live US TV programmes were sports events, up from 14 in 2005. Meanwhile, for streamers, sports taps new subscriber pools and offers predictable viewing behaviour, reducing reliance on risky, scripted content.

Sizable opportunities also exist beyond media rights, including:

- Sports betting: The end of federal restrictions on sports betting in 2018 has been a boon for sports franchises. Teams are striking deals worth billions for sponsorship and data rights with betting firms, and also benefit from higher fan engagement.

- Internationalisation: Foreign revenue is underpenetrated at just 16% for the NBA and 6% for the NFL (vs. 46% for the English Premier League). But with increased investment, more overseas matches and the greater reach of streaming deals, this should improve.

- Real estate: Venues are becoming the centre of mixed-use real estate projects; with stadiums used for other events, and surrounded by synergistic retail, entertainment and hospitality.

- Sports tech: Data analytics, social media, NFTs and augmented live video are just some of the advances helping optimise existing activity and open new sources of income.

Along with top-line growth, US clubs are also seeing improving margins. In 2019, almost all franchises in the top 4 US leagues were profitable and half generated >20% operating margins; ten years previously only 14% did so.

In European football, the big clubs compete to outspend each other, and sometimes overreach in the process. In the US, the leagues try to prevent this in order to ensure competitive balance.

Crucially, all five major leagues have a collective bargaining agreement with their players to prevent salary costs getting out of control (in most case employing a cap on spending per team). As a result player costs have steadily declined from 57% in ‘06/’07 to 47% for the ’18/’19 season – well below European football levels of 64%.

Furthermore, the leagues are trade associations owned equally by their franchises. Proceeds from national media or sponsorship deals are evenly split and there is no relegation system to eject franchises. Losing in sport is emotionally painful, but, in the US, the financial hit is lower than in Europe.

Investing: A Less Competitive Game

“Do you know what my favourite part of the game is? The opportunity to play.”

John Singletary, NFL Coach

Investing in US sports franchises is not an opportunity open to all. The historic ownership model has been centred on wealthy individuals. Leagues, who assumed that such owners would care more about the interests of the sport, shut out commercial capital.

Whether or not the individual owner as “benefactor” thesis was ever true, the model has become outmoded. Some of America’s brightest and best billionaires from Microsoft’s Ballmer to Apollo’s Harris have bought teams. But they are too few to finance the growth of an industry where the average club is now worth c.$1.9bn, and where leagues limit the amount of financial leverage that clubs can employ.

The pressure was partially alleviated by minority equity ownership by other individual-type owners. However, this led to increased fractionalisation of ownership in an illiquid asset class where some investors became trapped.

In 2019, the leagues finally opened the door to private markets investors for minority equity stakes; but it is still only partially ajar. Firstly, the leagues are allergic to the idea of a group having control rights in more than one franchise and so exclude firms with prior funds, partners or even LPs that have a stake in a team. Secondly, sports deals are large, and leagues set high minimum capital requirements (>$500m). Thirdly, they have a strict accreditation process.

Only well-funded firms with specialist sports capabilities but no links to historic control deals need apply. Few existing platforms make the cut and not many new groups have the credibility to raise scale capital from scratch.

The handful of firms that qualify see rich opportunities. Franchises need capital for growth projects. Trapped investors have liquidity needs. With few other options, they are often open to minority equity deals at meaningful discounts to change-of-control valuations.

Big 5 US Leagues vs. Big 5 European Football Leagues

Performing Consistently

“Obstacles don’t need to stop you.”

Michael Jordan, NBA Player

Managing macro risk is top of mind for investors today; but many factors may help US sports weather cyclical headwinds. Revenue growth has been stable even through historic financial crises and listed sports stocks have outperformed this year’s volatile market.

- Recurring core revenues: Media rights generate almost half of revenues and sponsorship is a further 15%. Both are set in multi-year contracts (7-10 years for key deals) with price escalators.

- Stable underlying demand: Ticketing is the other main source of income (c. 29%), mostly season tickets. For top teams, these are over-subscribed with >80% renewal as fans fear being put back on waiting lists if they opt out.

- Cost visibility: Player compensation is the key cost item for clubs. However, salary caps are set in long-term agreements for each league, with an average of 6 years left to run.

- Strong Deal Structures: Despite being underwritten to strong PE style returns, sports deals tend to be more conservatively structured than a classic leveraged buyouts. League rules limit the amount of debt that clubs can take out, typically to around 10-20% LTV. Minority equity deals often include downside protection features (such as preferred returns).

Conclusion

US sport is one of the largest new opportunities to open up to private investors in recent years. And historically early movers in attractive but hitherto closed markets like US sport, have often reaped strong returns.

The risks lie in the long-term constraint of such an investment, and mainly in industry dynamics and league frameworks. If the current environment as described above persist over time, it would seem to offer a compelling combination of:

- Strong fundamentals: Super-prime content with increasing relevance

- Low competition for deals: Leagues heavily restrict who can invest

- Resilience: Recurring revenues, cost controls, and well-structured deals

External sources include:

- Forbes, “The World’s Most Valuable Sports Teams”

- Pitchbook, “Sports Teams and Private Equity Pair Up” (May 21)

- Evercore, “State of the Market” (Nov 21)

- Arctos, “Sports Assets and Inflation” (Jun 22)

- Barclays, “Pure Play Sports” (Jan 21)

- Houlihan Lokey, “Sports Market Update” (Aug 21)

- Sports Business Journal, “Sports TV Dominance at New Heights” (Jan 22)