• More efficient heating/cooling systems are paramount in fighting climate change

• Technology, regulation & investment are helping drive down “operational carbon”…

• …making “embodied carbon” the next frontier for building industry – and investors

Alongside their many other geopolitical, economic and human ramifications, the dramatic events in Ukraine have pushed the oil price above USD 100, serving as yet another reminder of the necessary energy transition. With buildings currently responsible for some 40% of CO2 emissions, greener processes/construction materials simply have to be part of the solution.

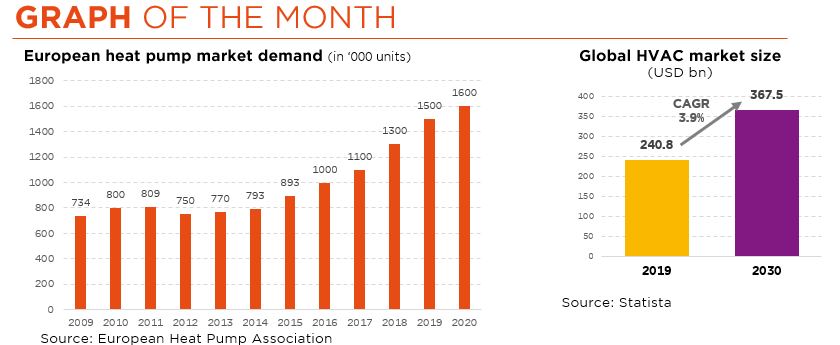

Heating and cooling alone currently account for nearly half the energy used in a typical office or home. Indeed, the global HVAC industry – an acronym that stands for Heating, Ventilation and Air Conditioning – weighs over USD 240 bn and is expected to grow 50% through 2030. In the US, more than 75% of homes (and 90% of new ones) are equipped with air-conditioners. The prevalence is of course lower in Europe, although heat pumps have been a game changer, driving 7% compound annual growth over the past decade.

Big numbers which make the HVAC industry a prime area for change – and for investing in this change. Achieving greater energy efficiency involves, first and foremost, technological improvements. Inverters, in particular, by controlling the speed of the motor inside an air-conditioner’s compressor, now make it possible to regulate the room temperature at a comfortable level while more than halving electricity consumption. Not to mention the noise benefit! In terms of companies involved, note that Japanese Daikin Industries currently leads the air-conditioner market, with a 2020 global share of 11%, followed by Chinese Midea Group and Gree Electric Appliances, both in the high single digits, and US Trane Technologies, Johnson Controls and Carrier Global, with mid-single-digit shares.

The other important driver of improved energy efficiency is of course governments, via infrastructure spending programs, notably the American Rescue Plan and the EU Green Deal, but also stricter regulation. As of 1 January 2020, the US phase-out of the R22 refrigerant (aka Freon) commonly using in air-conditioning systems was completed – a measure decided long ago because of its high ozone depletion impact. And, in 2023, the minimum SEER (seasonal energy efficiency ratio) requirement imposed by the US Department of Energy will move up from 13 to 14 in North America – affecting all new air-conditioning installations, but also older ones that require replacement.

The road to greener buildings will no simple or smooth one, though. An immediate issue facing the HVAC industry, similar to the economy at large in this Covid aftermath, is input inflation and shortages. Beyond the compressor (30%), copper and aluminium figure among the main cost components of a residential air-conditioner. As for present shortages, they pertain not only to accessing equipment, but also finding technicians to execute the installations.

Finally, but a little further down the road, once a building’s operational efficiency has been improved, the question of carbon emissions involved in its construction will need to be addressed. Indeed, by some estimates, “embodied carbon” is set to exceed “operational carbon” by 2035. Which in turn means that developers will have to switch to alternative building materials, such as cement substitutes – unfortunately still an expensive and early-stage proposition. For investors, though, the conclusion is clear: an ESG portfolio cannot do without some “greener building” bricks…

Written by Andrea Biscia, ESG Analyst & Junior PM

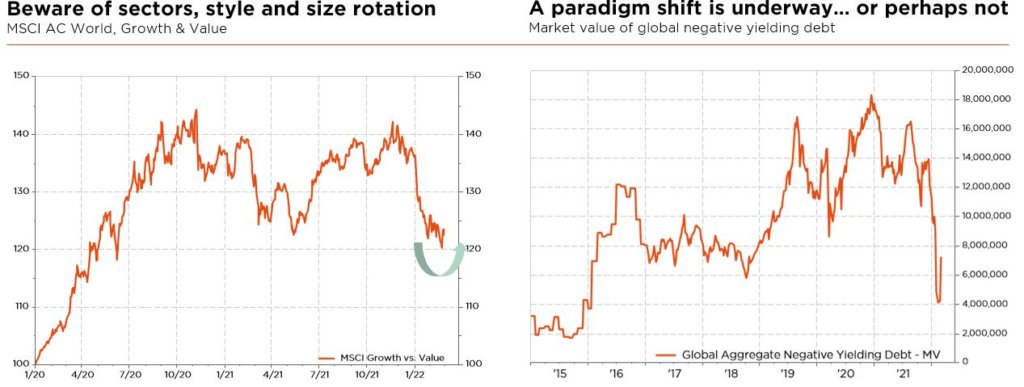

Ukraine conflict flogs outlook

• Inflation, policy tightening & now geopolitical tensions are exacerbating volatility

• Lower economic growth & higher inflation make central banks tasks harder

• Tightening financial conditions & rising uncertainties weight on risky assets

Just at the time where economies were on the mend and major central banks were planning to normalize monetary policy soon, investors face a new unexpected exogenous shock. The dramatic events unfolding in Ukraine and the increasing tensions between Russia and the West have indeed relegated investors prior main concerns (persistent inflation & rising rates) to a backseat.

While it’s obviously difficult to assess precisely what could be the overall economic consequences of this conflict, it will likely have a negative impact on economic activity, especially in Euro Area. However, the damage should be quite contained -and thus manageable- assuming it doesn’t escalade further. Headline Inflation is also expected to rise globally as energy, as well as other commodities prices, are moving higher given Russia preponderance in this area, but the impact on core inflation should be more limited. Finally, central banks’ tasks become clearly harder as they suffer, as us, from a lack of visibility, and monetary policy isn’t effective for supply-side inflation issues. A context of weakening growth and rising inflationary pressures is certainly central bankers’ blind spot. Anyway, this new macro backdrop plead for DM monetary policies remaining cautiously behind the curve at this stage, especially as financial conditions are now being tightened indirectly.

As a result, the probability of our mildly constructive base case macro scenario has diminished, while the odds of the negative tail have obviously increased. Unfortunately, markets haven’t waited on us to adjust to this new regime as plenty of bad news are already priced in. But, at this stage, while the lack of visibility prevented us from taking extreme measures, we decided however to reduce their overall risk exposure given the points here above.

With that in mind, at the portfolio level, we are firstly adopting a neutral stance on equities by diminishing mainly European equities (downgraded de facto to slight underweight), which are the most at risks of the economic and financial aftermath of this conflict given proximity and dependence on Russian energy.

Then, while we keep an underweight positioning in bonds, we are also becoming more cautious on overall credit risk. We thus downgrade IG & HY credit and EM debt to a slight underweight as the environment will likely become less supportive, with tighter financial conditions, reduced liquidity, geopolitical uncertainties and a potential policy mistake down on the road (i.e. recession). At the opposite, our stance towards US Treasuries has been raised to a slight overweight for their liquidity and safe haven features, but also because the US yield curve already incorporates much of the Fed’s hawkishness whereas the end of QE and negative rate policy by the ECB may prove much more damaging for Euro bond markets at some point.

In the Alternatives basket, and also related to the same reasons, we have downgraded private markets and real estate to a slight overweight. Concerning currencies exposure, our stance on CHF, supported by strong structural fundamentals, has been raised to a slight overweight stance. Finally, we have again raised our stance on gold to a slight overweight, given that it may act as a hedge in several different tail-risk scenarios such as stagflation, rising geopolitical tensions or social disorders, as well as in the case of a monetary policy mistake, while its downside now appears quite limited following the Fed’s latest hawkish pivot.

Written by Fabrizio Quirighetti, CIO, Head of multi-asset and fixed income strategies