•Enabling iPhone users to refuse tracking was not just about defending privacy

•Ad budgets are shifting to platforms with first-party access to customer data

•Regulators need to balance risks to competition with privacy benefits for users

When Apple introduced App Tracking Transparency (ATT) back in April 2021, forcing applications to request permission before monitoring user behaviour to deliver personalised advertising, it drastically decreased the accuracy of online targeting – disrupting the business models of many tech companies. Meta and Google have the technological and financial clout to fight back, but smaller players are clearly coming under pressure.

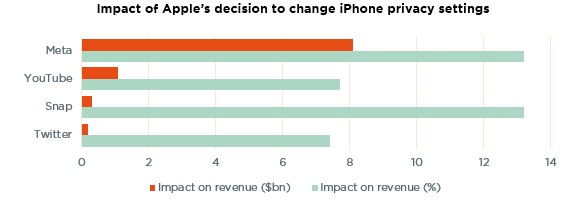

However much Apple insists that its motivation was purely altruistic, defending privacy as a basic human right, the truth of the matter is that the financial impact of its change in privacy settings has been huge. With most iPhone users preferring to opt out from tracking, advertisers suddenly found it much harder to generate a good bang for their buck. Their reaction: a sharp cut in spending on the big Snap, Facebook, Twitter and YouTube social media platforms (whose revenues are estimated to have suffered a USD 9.85 bn hit just for the second half of 2021), shifting their budgets instead to Android phone users and to Apple’s own advertising business. But with Google soon to offer most Android users that same ability to opt out of tracking, the going only promises to get tougher for ad revenue-dependent tech companies.

Meta’s response is twofold: build new tools that enable advertisers to regain a perspective on the efficiency of their campaigns and, further down the road, develop its own operating system for the metaverse – which it hails as the computing platform of the future. For controlling the operating system also provides control over the ad pop-ups that users see. As a recent Oxford university paper discussing the impact of ATT puts it, “the new changes by Apple have traded more privacy for more concentration of data collection with fewer tech companies”.

It is not surprising, then, that European antitrust authorities are keeping a close watch. Germany’s Federal Cartel Office just disclosed that it is undertaking an investigation of Apple’s ATT framework, worried that it is unduly self-preferencing or setting up unfair barriers to competition. And UK regulators are concerned that ATT may well ultimately hurt consumers by pushing up app prices and/or reducing their quality and variety.

In this new regime, having first-party access to high quality user data has become a magnet for advertisers. As such, one company certainly seems to be increasing its share of the pie. Last February, when reporting its full year 2021 results, Amazon released advertising sales figures for the first time: USD 31.2 bn, just under 7% of total revenues but an estimated triple of the level three years ago. Amazon’s attractivity for advertisers stems from its knowledge of users’ purchasing habits, a behavioural data set that may not be as broad as that of Meta but is much closer to actual transactions.

Meanwhile, Apple continues to push forward. Early June, at its annual software developer conference, it unveiled a set of new iPhone and Mac features, including notably a “buy-now-pay-later” option in the US – using its rich user data. A challenge this time for fintech companies, that are already facing a post-Covid slowdown in ecommerce and an inflation-driven upmove in interest rates…

Written by George Simmons, Senior Portfolio Manager for Discretionary Mandates

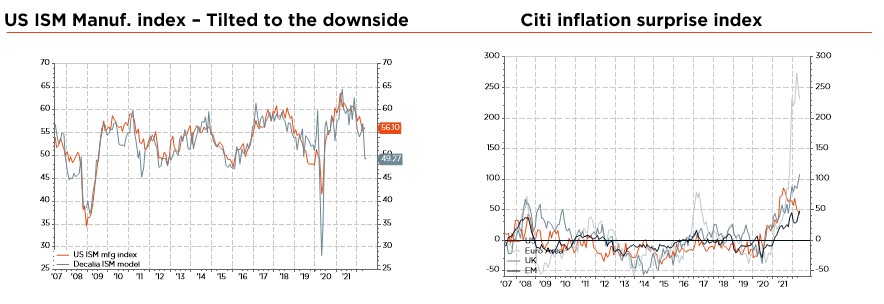

Admittedly, one could argue that much bad news has been priced in. The war in Ukraine and its knock-on effects are taking a backseat, corporate earnings downgrades are being progressively anticipated, investor positioning remains extremely bearish, and multiples look increasingly attractive, prior excesses having been washed out. However, the successive (rather than overlapping) nature of macro concerns has so far prevented a clear-cut capitulation in equity markets, which we still consider a prerequisite for a sustainable rebound.

In short, until we reach greater clarity on the occurrence, timing, duration, and severity of the next recession, we expect a continued bumpy ride for global equities – with factor rotations still driving dispersion among regions, sectors, and ultimately stocks. The same can be said of bond markets, with rates oscillating schizophrenically between a higher inflation risk premium and looming recession concerns, while liquidity withdrawal exacerbates the widening of credit spreads. Energy commodities and industrial metals are not immune to these contradictory forces, with cyclical risks now taking over an otherwise favourable structural trend.

At the portfolio level, we thus keep a slight underweight on both global equities and bonds, reflecting an overall cautious but still balanced asset allocation. Within equities, we retain our near-term cautious stance, owing to both the higher risk premium and limited overall visibility, and would be sellers of any meaningful “bear market rallies” until we see evidence of a clear capitulation. Meanwhile, we still emphasise the need for a more benchmarked stock selection than usual, alongside a balanced multi-style all-terrain approach to portfolio construction. As such, we only fine-tune our regional and sector allocations, moving EM-ex China (most at risk in the event of a recession) down one notch further in underweight territory.

In fixed income, we flagged last month the satisfactory yield that investors now get on the short end of the curve globally, short-term yields almost matching those of longer maturities (with less duration risk). Short-term rates have since increased further, while credit spreads are now pricing in a significant slowdown. With that in mind, we upgrade IG credit to a slight overweight, recognising also that corporate balance sheets remain solid overall, without significant refinancing needs over the next 2-3 years. Elsewhere, we stick to our overweight of gold (a “stability” haven), but downgrade other materials – especially industrial metals and to a lesser extent energy – to a slight underweight, cyclical downside risks being liable to temporarily offset supportive long-term supply/demand dynamics in the event of a severe recession.

Finally, we are turning more cautious on the US dollar, downgraded to a slight underweight. The greenback could peak soon in our view, as other major central banks catch up with the Fed. The CHF thus becomes our favourite currency, supported by still-solid structural fundamentals and the Swiss National Bank’s recent hawkish.

Written by Sandro Occhilupo, Head of Discretionary Portfolio Management