As we said in French “Après la pluie, le beau temps”… So, after the sadness and the tears related to the loss and mourning of Gigi Riva (Italy’s soccer record goal scorer on top of a legendary and faithful player of the Cagliari Calcio), Italian sport’s fans enjoyed and celebrated the great historical achievement of Jannik Sinner, who won the Australian Open yesterday at the age of 22…

Like in sports or in life, financial markets are made of ups and downs, sadness and euphoria, successes and setbacks, through which we must navigate as best we can. In this context, all eyes will be on the Fed meeting on Wednesday as investors’ guess estimate of the first rate’s cut is still going on. So, let’s review and sum up the key US economic data released recently because monetary policy easing will be “data, not date dependent” as ECB President Lagarde said last week.

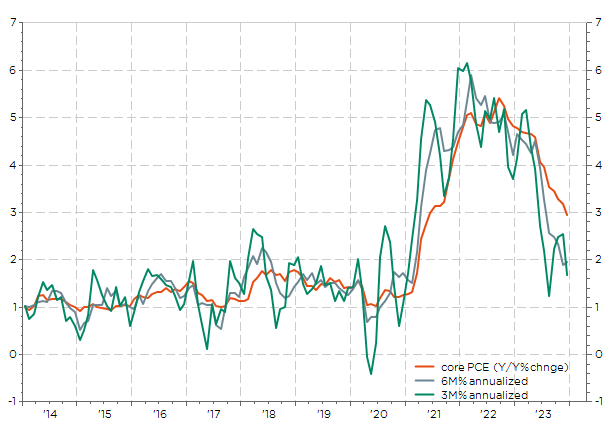

Let’s start with inflation. There is no doubt that the disinflation process is well under way, with a proven track-record now as illustrated by the core PCE deflator, which is now running at or slightly below 2% considering the annualized rate over the last 3 or 6 months.

US core PCE: 12, 6 and 3 months annualized rates of change

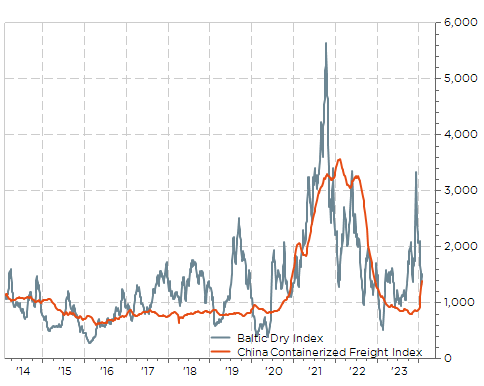

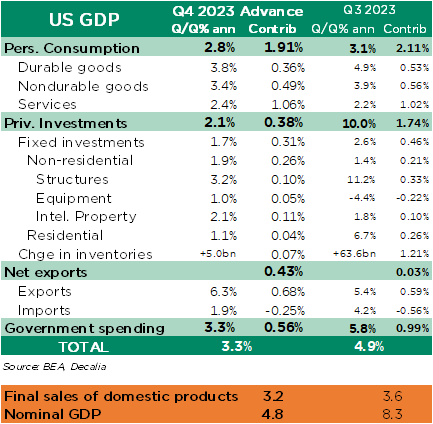

However, one swallow doesn’t make a spring… as the core PCE is just hitting now the Fed’s target. So, if it continues like that over the next 2-3 months, the Fed may feel relax enough to start easing. In the meantime, some upside risks to inflation persist in the form of some exogenous (and thus likely temporary) inflationary pressures due to the disruption and subsequent bottlenecks caused by the Houthi in the Red Sea, which are starting also filtering in the PMI delivery time subcomponent (rising), or, likely more concerning for the Fed, the ongoing resilience of the US economy and the labor market. On this matter, there is also no doubt about it given the preliminary reading of the Q4-2023 US GDP, which showed a 3.3% a.r. growth (vs. 2.0% expected) after an already stunning 4.9% the prior quarter. Moreover, it was a “good quality” growth with positive contribution from consumption, investment and exports. So, households’ consumption is still holding well as illustrated also by the better than expected December personal consumption expenditures released last Friday (+0.7% vs +0.5% expected and prior month revised up to +0.4% from +0.2%…), which will thus lead to an upward revision of Q4 consumption growth and contribution with the updated GDP figures.

Baltic Dry Index, China Freight Index

US Q4-2023 Preliminary GDP Breakdown and Contribution, vs. prior quarter

In this context, the jobs market remains also a key factor driving monetary policy decisions. That’s why, the spotlight will quickly turn to the US jobs report on Friday… On this front, while the trend is encouraging, the progress hasn’t been sufficient enough at this stage to allow the Fed to declare victory: weekly initial and continuing jobless claims remain well below the average of previous economic expansions of the last 40 years (while both population and labor market’s size have grown over the last decades), payrolls gains have moderated but remain above the 90-100k needed to absorb the net supply of workers and wages growth has eased but not enough yet (still running above 3.5%).

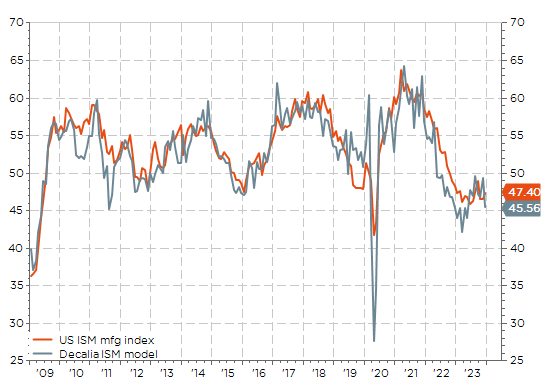

As a result, while some economists still expect a first cut of -25bps in March, we still believe the Fed will prefer to err on the cautious side and start easing later (perhaps faster then)… especially if growth and, above all, the labor market don’t weaken/ease more materially over the next 2 months. The US ISM manufacturing that will be released on Thursday (the day after the Fed’s meeting) may perhaps show some signs of weakening according to our proprietary model based on US regional manufacturing indices. Indeed, it forecasts a reading of 45.6 for January, while the consensus expects a rather stable print at 47.0 (vs. 47.4 in December)

US ISM manufacturing index proprietary model

As the date of the first cut remains a close “data-dependent” call, we therefore acknowledge that (1) we are looking in a rearview mirror when analyzing the macro backdrop and (2) things may change rapidly… like in sports or in life. We thus continue to scrutinize the horizon, find the “best” balance between sometimes contradictory elements and come then with the most suited investment decisions, finding the right tactics to adjust accordingly our positioning/stance. With more or less convictions and still a pinch of uncertainties at minima. Really like in sports or day-to-day life…

A great man… A marvelous champion… A legend! Fai buon viaggio « Rombo di Tuono » ♥️💙

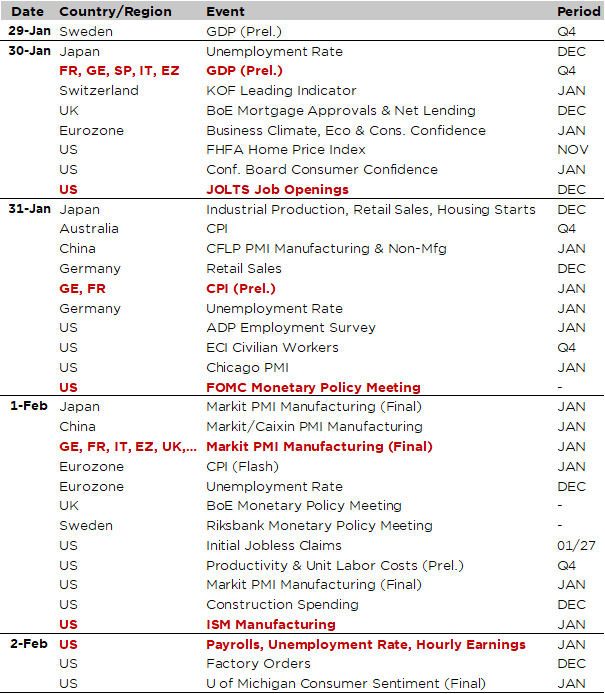

Economic Calendar

Another busy week is awaiting us with the Fed meeting on Wednesday as the key “pivotal” focus… as we will move from January into February (already), while there won’t be any shortage of economic releases all over the week with the preliminary 2023-Q4 GDP readings for the major Euro Area economies and the December JOLTS (job openings and quit rate) tomorrow, Germany flash CPI on Wednesday, the US ISM manufacturing index and the global final PMI for January on Thursday and then, on Friday, the spotlight will turn to the US jobs report for January.

On top of the Fed’s meeting on Wednesday, the UK BoE and Swedish Riksbank decisions are also due on Thursday. As none of these central banks is expected to change its key policy rates this time, the focus for investors will likely be on analyzing the subsequent speech and interview of Jerome Powell, scrutinizing any words, tone or any hints regarding the timing of the first rate cut given the still resilient US growth picture (more above on this topic). For sure, the disinflation process is now well underway as illustrated by the recent core PCE print released last Friday (+0.2% in December and running now at an annualized rate of 2% or less over the last 6M and 3M). While some economists still expect a first cut of -25bps in March, we won’t be surprised if the Fed will prefer to err on the cautious side and start easing later (perhaps faster then)… especially if growth and, above all, the labor market don’t weaken more materially over the next 2-3 months. So, the date of the first cut remains a close “data-dependent” call. Even for the Fed members! For the BoE, the story should be quite similar as they will likely signal they are now ready for a (soft) dovish pivot that should eventually take place before the summer.

As far as economic data are concerned, the key release will be the US January jobs report due on Friday. A softer (but not too weak) report with some moderation in payrolls gains and wages growth will keep the door wide open for a rate cut in March. At the opposite, re-accelerating jobs and wages growth may push rates higher and start to bite risk-on assets, which have enjoyed the great disinflation ride so far. In order to get ready and place your bets wisely, we will also get JOLTS report tomorrow (jobs openings and quit rate as a good leading indicator of wages growth), the ADP report on Wednesday, as well as the ISM manufacturing employment sub-component on Thursday.

Outside the US, it will be a busy week as well, with the PMI manufacturing indices across the major economies (Thursday), the preliminary releases of Q4-2023 GDP across the major European economies (tomorrow), the January flash CPI for both France and Germany on Wednesday, especially following last week’s ECB meeting, and a few key indicators for the Japanese economy on Thursday (retail sales, industrial production and housing starts). Finally, in China, the highlight will be the official PMI indices on Wednesday as well as the Caixin manufacturing PMI the day after. According to the consensus, these indices are expected to have improved marginally in January, at level still close to standstill (50).

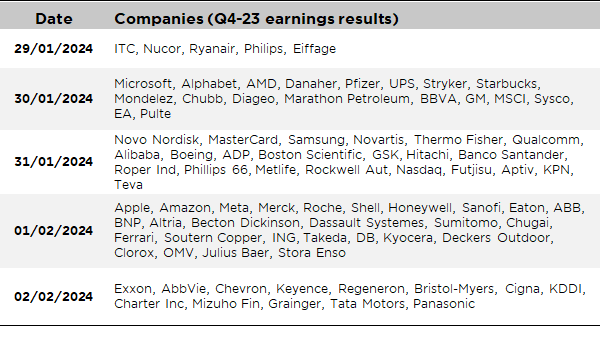

Last but not the least, investors will also juggle with more and more companies results as earnings season is now ramping up, with this week’s highlights including four out of the Seven Magnificent, namely Apple, Amazon, Microsoft and Meta. In the US, the equivalent of circa 1/3 of the market cap will report this week (the busiest one of the period). Healthcare (Pfizer, Novo Nordisk, Novartis, Roche, Merck, Sanofi, AbbVie) and Energy blue chips (Shell, Exxon, Chevron) will also be under the spotlight among many other notable earnings results to keep an eye on (Samsung, MasterCard, Starbucks, Mondelez,…)

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.