Apart my birthday and a spring-like weather, there was not much to celebrate recently… The announcement of reciprocal tariffs was worse than expected, both in terms of the percentages announced (higher than expected) and the method of calculation (a simplistic and arbitrary formula that further discredits the Trump administration), stock markets have been falling ever since, the probability of recession is rising, uncertainty reigns, the fear gauge is spiking and even Cagliari Calcio was unable to win this weekend against Empoli. So, it will likely be hard to cheer your mood up this morning by talking about the economy and the financial markets.

In this context, I will first rely on one of my usual weekend’s reads, i.e. John Mauldin and his “Thoughts from the Frontline” weekly letter: “Good news: Tariffs will not make the world end. American businesses will do what they do best, which is adapt.” That’s a good read overall explaining why these “reciprocal tariffs” will be self-harming for the US and thus not really resolving the several economic issues Trump’s administration want to tackle or eventually even lead to new ones (if US trade deficit closes). In other words, they are a very bad economy policy, especially in their current forms. And investors are thus voting with their feet, if not rushing out in panic for the exit.

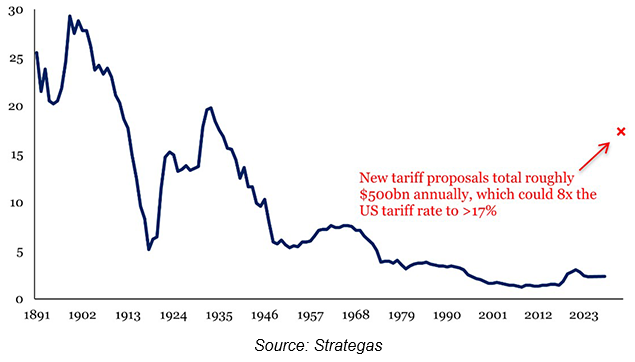

US Average Imports Tariff Rate

So, what’s next? Either Trump and his administration backs down at some point or we go into a full-blown trade war as other countries retaliate and Trump doubles down. In this context, Peter’s Navarro dismissal or removal as a close economic advisor of Trump will already be considered as a first step in the right direction… While it is hard to quantify precisely what could be the extent of damages on the economic growth, as well as their timing and duration, because there are also second round effects through heightened uncertainty seizing the economic machine by freezing investment and delaying consumption, or through the tightening of financial conditions, the fact that these tariffs will also tend to push US inflation higher (less so in the RoW), even if temporarily, blur further the near term picture. In this context, the task of the Fed is trickier than usual as the monetary policy medicine may be delayed, not sufficient or somewhat less efficient, in the event of a stagflation scenario (i.e. the Fed may be reluctant to cut its target rate quickly or deeply enough to cure growth malaise).

In the meantime, here are a few (and certainly not exhaustive) investors survival guide’s tips. They are obviously easier said than done (I am fully aware of it), but they may eventually help you to keep a cold head while hoping for the best, i.e. an inflection from the Trump’s administration… or preparing for the worst as much as we can from now.

- Don’t overreact or panic

- Don’t be too shortsighted: time horizon matters!

- Don’t try to catch a falling knife. While many bad news is already priced in and valuations have thus improved, it may get worse before to get better. We are perhaps close to a capitulation but then you need a trigger to propel the markets up on a sustainable manner. So, be aware that the markets may exaggerate the downside and/or the real rebound may take longer if there is no inflection in economic or monetary policies. So, don’t try to time the market

- Asset Allocation is key

- Too late for protection: reshuffle at the margin if needed, focusing on quality, defensive and liquidity characteristics

- You have probably some assets that fared well lately if you diversified. If not, be also careful about these investments -such as long term Treasuries or Gold – as their diversification benefits may not work perfectly in dislocation’s time. In other words, manage the risks but don’t speculate.

- Beware of hidden risks: currencies exposure, credit allocation, alternative funds or counterparties risks among others. Avoid investments that keep you up at night.

- If you want (or need?) to add risks, favor selling volatility through reverse convertible or short puts on index funds or ETFs if you’re unsure where to start as volatility creates also opportunities.

In conclusion, these investor’s survival tips make me realize that Cagliari’s lackluster draw wasn’t such bad news after all (it would have been much worse to lose) since the future of my favorite team wasn’t jeopardized by any ill-considered risk-taking.

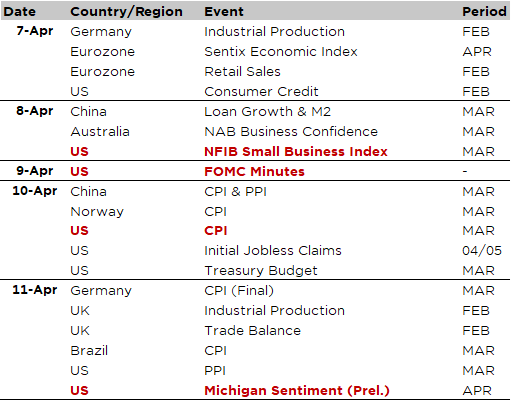

Economic Calendar

Tariffs will clearly dominate the agenda this week: will we see the US backing down? Or other countries trying to negotiate… or retaliate as did China on Friday? In the latter case, it would raise the risk of an escalatory spiral that will push the US and the global economy on the brink of a recession with further downside risks to the markets and heightened volatility on rates and forex. In this context, EU trade ministers are convening today to discuss a response to US tariffs.

Apart from these extraordinary events, the week will be “relatively quiet” in terms of economic data releases. The potential highlights to keep an eye on include:

- The NFIB Small Business Index (Tuesday) and the University of Michigan consumer sentiment (Friday) to assess the (first) impacts of Trump’s policies on US SME and consumer confidence. Given the high level of uncertainty and financial damage already perceptible, with rising odds of a recession, this should be less of a joy.

- Fed minutes on Wednesday: of little interest or impact in my view, given what’s happened since… Investors will anyway look desperately for a loophole that may allow the Fed to cut rates sooner and deeper than the current official base line stance

- The US CPI for March on Thursday: the consensus foresees +0.1% and +0.3% MoM for the headline and core indexes respectively, which would imply annual inflation down from 2.8% to 2.6% and underlying inflation down from 3.1% to 3.0%. Needless to say that it would be better for the markets if these figures were no higher, otherwise it could delay the arrival of the Fed’s cavalry in the event of a sharper slowdown in economic growth (i.e., the Fed may be reluctant to cut its target rate quickly or deeply enough).

Finally, US banks including JPM, MS and BlackRock, will kick off Q1 earnings season on Friday.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.