Whether in sport or finance, everyone loves to score goals and thus take center stage for extraordinary performances… but it’s more often than not the defense, and behind-the-scenes work in general, that wins titles or championships and therefore proves to be a winner in the long term.

The latest example of this was last night’s Super Bowl LIX game at the New Orleans Superdome, where the Philadelphia Eagles’ defense annihilated all the offensive efforts of superstar Patrick Mahomes and his Kansas City Chiefs team. In my view, the turning point of the game was undoubtedly when Mahomes suffered 2 consecutive sacks before being intercepted on his 3rd attempt… which resulted in an Eagles touchdown from the defensive team. The die was cast, as the Chiefs’ quarterback’s few late bursts proved to be useless. It’s a bit like that with investments: if you suffer a big loss at some point, especially if it happens at the beginning of your investment, it’s going to be hard to recover… It’s worth remembering that you need a 100% gain to recover a 50% loss!

Obviously, it’s not enough to have a solid, effective defense; you also need players (or financial assets) capable of seizing opportunities to score points. Such was the case last night with the Philadelphia Eagles’ offensive line, spurred on by the perfect recital of its quarterback Jalen Hurts… or earlier in the afternoon with Cagliari Calcio winning an important game against Parma (2-1)!

In fact, we often spend too much time and energy researching and discussing financial assets whose prices are soaring, or star strikers who unleash passions and crowds, and not enough on the defensive or construction aspects (solidity and balance). PSG team is an excellent example where soccer is concerned, whereas in the fund industry, over the long term, it’s consistency rather than dazzle that proves winning over time.

In the meantime, turning to financial markets, our central scenario remains broadly favorable for risky assets: slower but positive growth, stabilization of inflation at acceptable levels and, therefore, gradual normalization of interest rates in accordance with published data. But the uncertainties surrounding the Trump administration’s impact on growth and inflation trajectories, as well as overall geopolitical developments, remain high. As a result, the risks of persistent inflation or a sharp slowdown in activity – without even mentioning the unknown unknows (obviously for good reasons)- cannot be totally ruled out. The end of the year, as well as any finish lines, are still a long way off. On the other hand, valuations remain stretched overall, leaving little margin of error, whether in equities or credit. So, the key to success this year will likely lie in the ability to adapt and respond quickly to unfolding developments, while needing also to be selective in the choice of securities to find pocket of (relative) value. After two years of strong performance by equity markets, led by US mega-tech companies, which coincided with the coronation of the Kansas City Chiefs’ offensive genius under quarterback Patrick Mahomes, it’s a safe (or at least wise) bet that qualities such as defense, tactics, balance and efficiency (read favorable asymmetric risk-returns) will be the key to this year success.

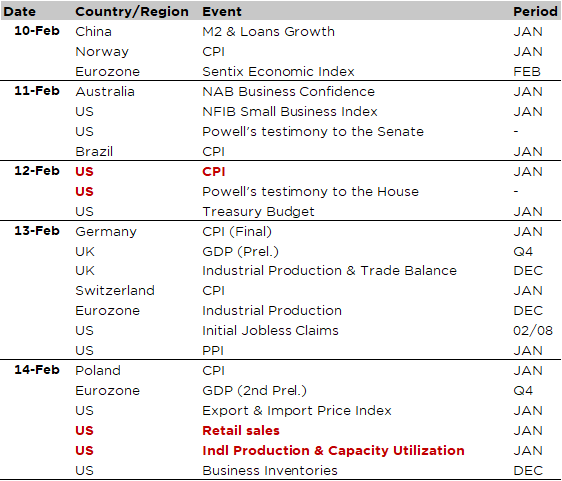

Economic Calendar

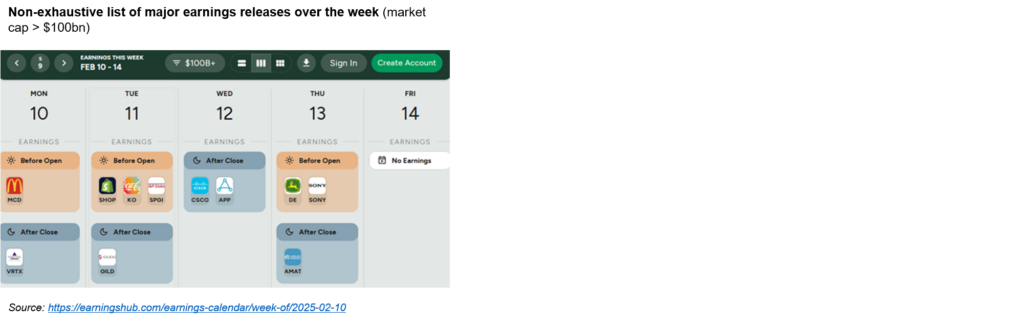

While it should be an overall quiet week in terms of economic data releases, a few ones could nevertheless impact significantly financial markets. In primis, the US January CPI print (Wednesday), but also the US January retail sales (Friday), especially if these releases exhibit significant upside or downside surprises, which may therefore hit or boost asset returns in the short term. On top of that, investors will likely continue to deal with the noise and smoke caused by Trump’s tweets, declarations and backflips. Apart from economic indicators and politics, US monetary policy will also be in focus through the semiannual testimonies by Fed Chairman Jerome Powell to the Congress (Senate Banking Committee on Tuesday and in front of the House Financial Services Committee the day after), especially as they will take place around the US inflation report. Finally, the Q4-2024 earnings season continues with the results of Coca-Cola, McDonald’s, Nestle, Unilever, Cisco, Applied Materials, Shopify, Siemens, Deere, Hermes or BP among the biggest market capitalizations to publish them this week.

The US January CPI report, along with annual revisions, due on Wednesday will likely be the main data release of this week. The Bloomberg consensus expects both headline and core CPI to come in at +0.3% MoM, showing a decline for the headline (from +0.4% in December), but an acceleration for the core measure (from +0.2% the prior month), while their annual rates remain broadly unchanged around 3% for both. We will also get the US PPI data on Thursday and the export and import prices report on Friday. More interestingly, several other CPI readings across the globe will be released over the next few days (Norway, Brazil, Switzerland, Poland) to assess prices trends in these economies, which could prove quite different from the US own trajectory. In China for example, the inflation report released this week-end showed a welcomed rebound in annual inflation to +0.5% in January from +0.1% in December as deflation remains the major threat for the Chinese economy as illustrated by the production prices (-2.3% on a year-over-year basis).

Finally, on Friday, an update on US economic activity will come from January retail sales and industrial production reports, with consensus forecasting ongoing resilient retail sales (excluding the volatile auto & gas components) and some due moderation in industrial production growth after a +0.9% surge in December.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.