I’m back after a long and beautiful vacation in Colombia, where I followed the ups and downs of the markets and Cagliari Calcio from afar. I don’t know if it’s just a feeling, but not much had happened during my absence – at least as far as the markets were concerned (Cagliari did manage to claw back a few places in the Serie A standing before tonight’s match against Lazio). But all it took was for me to come back last week, for a not so enjoyable show-time with

- Deepseek’s new AI model to make a big splash in US tech. It casts indeed some legitimate concerns about the richness of US mega-cap tech valuations and the massive investment made so far or underway. For the not-so-young readers, it could be reminiscent of the overinvestment made by the telecom companies during the TMT bubble…

- Trump finally putting his tariff threats into action this weekend as the he announced 25% additional tariffs on imports from Canada (ex-energy imports at 10%) and Mexico, and a 10% additional tariff on China. In response, Canada has already retaliated, while Mexico and China are expected to follow soon.

While our soft-landing scenario remains intact for the time being, a global trade war brings significant risks for both inflation to the upside (especially in the US) and global growth to the downside (especially for the rest of the world). As a result, we will stay on our guard about the ongoing developments regarding these trade tariffs and their ripple effects on financial markets (rates, equities and forex).

When thinking about what could be the catalysts for an equities’ downturn and thus the negative tail-risks of our rather supportive macro scenarios, I identify three main “known” risks: an economic recession, inflation reaccelerating or a self-induced implosion (similar to the burst of the TMT bubble or the 2008 GFC). Obviously, it could also be a mix of these 3 components in varying degrees and/or timing, as well as some sort of “known (or unknow) unknows” such a war, pandemic, natural disaster, systemic risk,… which may be the spark that ignites one or more of these 3 main risks.

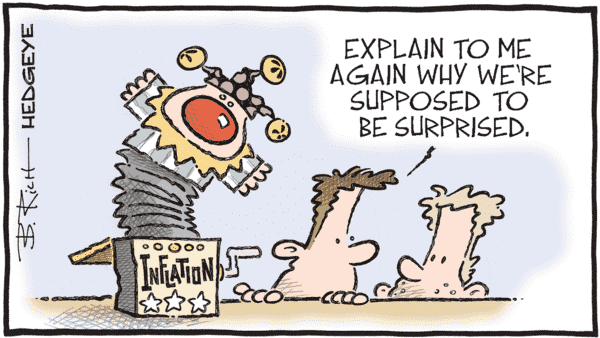

If I had to classify these 3 risks according to their probability of occurrence and the peril they represent for the markets and thus portfolios, inflation would certainly be my public enemy No. 1 today for the following reasons:

- Except a sudden external shock or a known (or unknown) unknow, there are absolutely little evidence of any significant or immediate risks of an endogenous or “immaculate” slowdown of the US economy. Just look at the latest 2024-Q4 US GDP print released last week or the still historically low level of US jobless claims consistent with a supportive labor market and thus resilient consumer spending. Even European, Japanese or Chinese economic growth aren’t doing so badly given the many headwinds they are facing.

US 2024-Q4 GDP breakdown: US consumers remain the main engine of world economic growth

- Banks, non-financial companies, as well as households balance sheets are in strong position overall, reducing therefore the risks of a sharp tightening of financial conditions, self-induced deleveraging, forced selling, etc. As most large companies and households locked in their financing costs by terming out their debt (before inflation and US policy rates soared), it explains why monetary tightening has not (yet) bitten into growth. Especially as, in the meantime, cash yields have now improved as well as asset prices returns…

US large cap locked in their financing costs by terming out their debt (same story for most households)

- In case of an economic slowdown, the Fed may cushion the drawdown by cutting rates as it is in a position of strength for the time being. It doesn’t seem behind the curve and it has some ammunitions.

- Moreover, if economic growth starts petering out, the diversification benefits of high-quality bonds may also improve, helping to cushion the eventual negative impact from equity allocation within balanced portfolios.

- This last point is key in terms of risks as in the case of a severe recession, inflation risks will likely disappear, while if inflation start rebounding, the Fed could be forced to cause a recession in order to keep prices under control…

- Moreover, higher rates will certainly prove more disruptive in the current context, weighting on some asset prices (excessive) valuations – think about crypto or some expensive stocks-, increasing the risks of deleveraging or a dislocation of the global bond markets (debt sustainability issues) with potential ripple effects also on the forex markets. In other words, the risk of a financial accident will increase significantly in this scenario and eventually ends in a severe recession

As stagflation could be even worse than “just” a stand-alone inflation issue, trade tariffs leading to a global trade war represent certainly a major risk for both the macro backdrop and the financial markets. Especially because it will complicate the tasks of the usual doctor-in-chief (the Fed) to administrate the right cures. In this context, some cautiousness may be warranted as long as there isn’t more clarity on this matter.

Economic Calendar

One more month down… Welcome to February 2025! As usual, this first week of a new month will provide several updates on key economic indicators, especially regarding the US economy with the US ISM indices (Monday & Wednesday) and the jobs report on Friday. Moreover, we will also get the global PMI final readings for January today (manufacturing) and on Wednesday (services & composite), the BoE monetary policy meeting on Thursday and the Q4-2024 earnings results of Alphabet and Amazon among many others. Last but not the least, investors will stay on their guard about the ongoing developments regarding US trade tariffs (exact scope, precise start date, duration or last minute’s concessions).

Starting with the macro release highlight of the week, namely the US jobs report on Friday, the Bloomberg consensus expects payrolls to grow by +170k, down from 256k in December, the unemployment rate to stay at 4.1% and the average hourly earnings growth rate to remain at +0.3% MoM (tricking down to 3.8% YoY vs 3.9% in December). Before that, other labor market indicators will be released including the JOLTS report (tomorrow), ADP survey (Wednesday) and the weekly initial jobless claims (Thursday), on top of the employment subcomponents of the ISM indices, which may also give some insights in the waiting of the payrolls figures and thus have some influence on consensus expectations.

The ISM indices released today (manufacturing) and Wednesday (services) will also be in focus. The consensus continues to foresee the US industrial activity gauge stagnating just below 50 in January (I still believe it could surprise on the upside one of these days or rather months), while the services should continue to fly high, remaining around 54. Investors will keep an eye on the prices components as the battle against inflation isn’t yet completely won. There will be other notable US data this week (factory orders, University of Michigan’s consumer sentiment or productivity and unit labor costs), but there shouldn’t move much the needle.

Given last few weeks rollercoaster moves on both the GBP currency and long rates, the challenging situation facing the UK economy with sticky inflation, growth decelerating quickly, a large and unsustainable current account deficit, the BoE decision, statement, economic projections and eventual guidance, if any, will be of great interest for many international investors. The consensus, while still widely divided about the future trajectory of rates (not cutting much policy rates over the next few months like the Fed vs. easing aggressively in coming months like the ECB), expects nevertheless the Bank of England to deliver its third -25bps rate cut of the cycle this week, bringing its target rate to 4.5%. Turning to Continental Europe, the main economic indicators include the January flash CPI for the Eurozone (today) and the Germany factory orders and industrial production (Thursday and Friday). Higher than expected activity in the German manufacturing sector will be good news… helping to sustain the removal of some excess pessimism surrounding the euro area since Trump get elected

Over in Asia, there won’t be many key releases, aside the China Caixin PMIs (manufacturing on Monday and services on Wednesday). The “official” Chinese gauges released last week came in below expectations. Finally, at the micro level, the earnings season goes on with the notable earnings reports of Alphabet (Tuesday) and Amazon (Thursday) after mixed-bag results from some Mag7 last week as well as DeepSeek-driven volatility. AMD, Qualcomm and Arm will also release their results this week, as well as a number of key pharma companies, including Eli Lilly, Novo Nordisk, Merck & Co, AstraZeneca and Pfizer. In consumer sectors, we will get the results from PepsiCo, Mondelez and Ford. In Europe and Japan, other notable earnings releases to watch are Total, Ferrari, Toyota and Nintendo.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.