By Roberto Magnatantini, CFA, Member of the Investment Team, Lead PM for DECALIA Silver Generation and co-lead PM for DECALIA World Compounders

Key points

- Possible Room for Recovery: Issues like the COVID overhang, rising interest rates, and sluggish M&A activity are showing signs of abating.

- New U.S Administration: Hostile rhetoric and the potential RFK Jr. nomination stir uncertainty, highlighting the need to back value-driven innovators like robotic surgery leaders over questionable players like PBMs.

- Long-Term Growth Drivers Remain Intact: Aging populations, breakthrough therapies (e.g., obesity drugs, CAR-T treatments), and medical technologies like surgical robotics offer robust opportunities.

- Innovation and AI Adoption: Transformative potential in R&D, efficiency, and client services could accelerate growth, with companies like Palantir acting as disruptors.

- Attractive Valuations Present a Contrarian Opportunity: Current sentiment is subdued, but discounted valuations and large upside potential suggest a favourable entry point for forward-thinking investors.

What to Do with Healthcare Stocks in 2025?

The healthcare sector has long been a cornerstone of global equity markets, offering a blend of stability, innovation, and growth potential. However, as we approach 2025, the landscape presents a mix of structural challenges, temporary headwinds, and opportunities for recovery and long-term growth.

Structural (But Not New) Negative Issues

Healthcare stocks face several entrenched challenges that have reshaped the industry over the past decade.

- Expensive Pipelines: The era of blockbuster “small molecules” drugs is giving way to more complex ones, driving up R&D costs and reducing hit ratios. Patent cliffs continue to erode revenues as generics enter the market, leaving many pharmaceutical companies struggling to maintain strong ROI.

- Drug Pricing Pressures: The U.S. remains the most profitable market worldwide, but its pricing model is increasingly under scrutiny, making healthcare a prime political target as government deficits rise.

- Increased Competition: Generics and biosimilars are eating into market share, while a more stringent FDA appears less favorable to large incumbents.

- Disappointing Emerging Markets (EMs): Once seen as engines of growth, EMs have underdelivered, largely due to pricing constraints. Notably, China has shifted towards a more closed and controlled market.

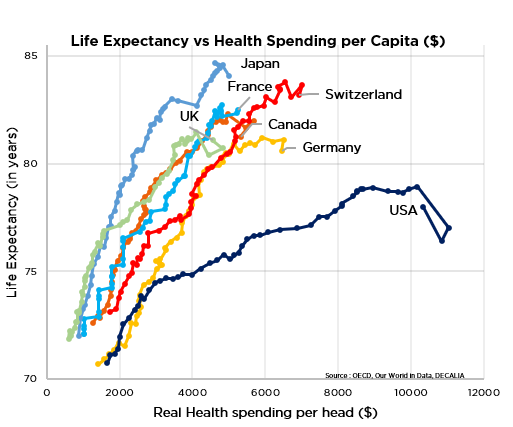

- Health Care Costs Ballooning: Across the developed world, Health Care costs are increasingly straining both private and public finances. The issue is particularly acute in the USA, where per capita costs are the highest globally, yet aggregate outcomes often remain mediocre at best.

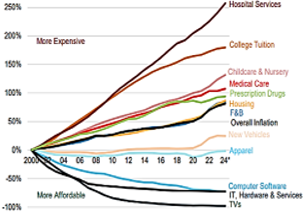

Price increases since 2000 for goods & services

Exhibit 1: Health Care has become increasingly expensive over time, widely outpacing most other goods and services (Source: Godman Sachs, BLS)

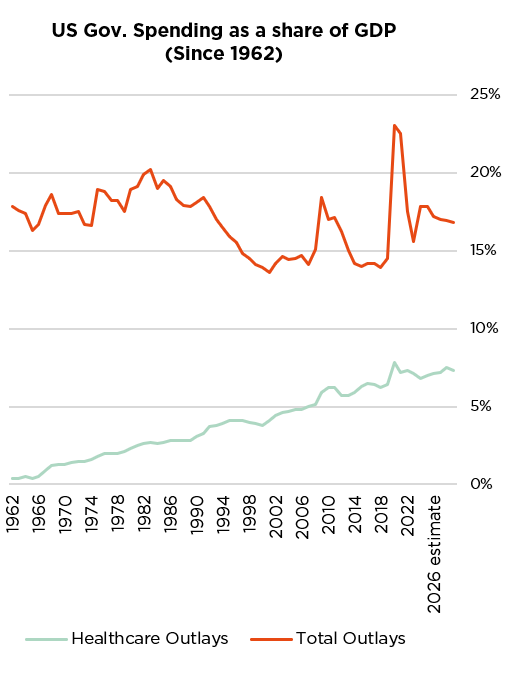

Exhibit 2: Health Care has been almost single handedly behind the increase in US Federal Spending (Source: White House Office of Management Budget )

Exhibit 3: Despite outspending all other developed countries, the US fails on many public health metrics, notably life expectancy (Source: OECD, 2024)

Temporary Negative Issues

In addition to these structural obstacles, healthcare is also contending with transitory pressures that have dampened performance in recent years.

- Covid Overhang: The pandemic-induced boom and bust cycle hit biotechs and life sciences particularly hard. Dwindling financing, workflow disruptions, and excess inventory have compounded the sector’s struggles.

- Interest Rates: As one of the most rate-sensitive sectors, healthcare has faced a challenging environment with rising interest rates. However, with rates expected to stabilize or fall, relief may be on the horizon.

- Lack of M&A Activity: Historically a key growth driver, mergers and acquisitions have slowed significantly due to expensive credit and less favourable regulations. This freeze has left many smaller firms without the lifelines they need.

- AI Uncertainties: While AI holds promise for healthcare in areas like R&D and efficiency, its potential has yet to be fully realized or priced into valuations, leaving investors in a wait-and-see mode.

What’s Next? The “Known Unknowns”

Looking forward, several critical factors remain uncertain but are worth monitoring closely:

- New U.S. Administration: Historically, Republican administrations have been positive for healthcare stocks. However, the rhetoric from Mr Trump and his entourage has been unusually hostile. The potential nomination of RFK Jr. as Health Secretary could also create serious uncertainties. It is indisputable that health care costs have soared to levels imposing a significant societal burden, highlighting the need for efficient resource allocation and cost management. This aligns with our longstanding stance of avoiding industries with questionable value creation (e.g., PBMs) and prioritizing investments in companies that deliver strong value for money, such as those in robotic surgery.

- Obesity Theme: After a stellar run in 2023, the obesity drug theme has faced pricing risks and mounting competition. Valuations have deflated, but the potential for growth remains massive once political uncertainties are resolved.

- M&A Revival, Pipeline improvements and Emerging Markets : these were discussed above and all have the potential to impact performances.

The Positives

Amid these challenges, healthcare offers compelling reasons for optimism.

- Intact Long-Term Drivers: Aging global populations provide a robust tailwind, while continuous innovation and high profitability underscore the sector’s enduring appeal. Healthcare’s modest cyclicality also makes it a reliable defensive play.

- Temporary Issues Are likely to prove … Temporary: The Covid overhang is fading, interest rates are stabilizing, and M&A is poised to rebound. These pressures are unlikely to persist long-term.

- Medical technologies: companies operating in the orthopedic fields or surgical robots, to name a few, benefit from the same general tailwinds of health care but are generally less exposed to regulatory risks or pricing pressures.

- New Therapies: The success of anti-obesity drugs has shown how new therapies can unlock enormous shareholder value. Gene editing, CAR-T treatments, Alzheimer’s drugs, nuclear therapies and autonomous surgical robots are among the imminent innovations that could drive future growth.

- AI Potential: From enhancing R&D and enabling tailor-made medical procedures to improving client service, AI offers transformative possibilities. Outsider companies like Palantir could shake an industry that has been very slow in adopting efficiency measures.

- Attractive Valuations: After a significant derating, healthcare stocks now sit at levels that should provide attractive long-term entry points. Investor sentiment is currently low, but this contrarian setup could yield significant upside.

- Positioning: It’s worth noting that investor enthusiasm for healthcare stocks was at its peak in late 2020 due to Covid, but the common wisdom of a rosy future actually marked a cyclical top for the sector. The current pessimism could signify a bottom, presenting an opportunity for forward-thinking investors.

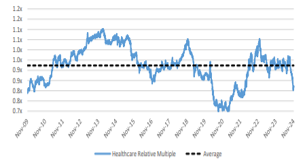

S&P500 Healthcare Relative Multiple over time

Exhibit 4: US Health Care trades at a discount to its long-term average (Source: Raymond James)

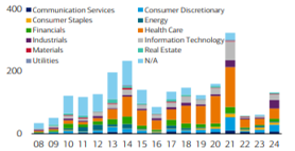

Numbers of IPO’s by sector since 1990

Exhibit 5: US Health Care faced a significant decline in capital raising, evident in the sharp reduction of IPOs. However, the sector is beginning to show signs of revival. (Source: Bank Of America)

Navigating the Road Ahead

2025 presents both challenges and opportunities for healthcare investors. While structural issues like drug pricing pressures and expensive pipelines persist, many of the current headwinds should prove temporary and are thus likely to subside. Long-term drivers such as demographic trends, innovation, and AI potential remain intact, offering substantial upside.

Our portfolios are exposed to highly innovative medtech names (eg Intuitive Surgical, Stryker and Abbott) that have a technological edge in the fast-growing market of robotic surgery. We are more prudent with Life Sciences, where as discussed previously the Covid overhang is still not entirely sorted out, but we are warming on CDMOs (eg Lonza) and CROs (eg Icon).

Lastly, pharma is probably the industry that is the most exposed to the various challenges surrounding Health Care, but it also the most heterogeneous. We are exposed through a mix of very well positioned growth names (eg Eli Lilly), attractively valued large caps (eg Roche) and a few riskier, smaller contenders. In the latter category, we like Biotech players like ArgenX or Zealand Pharma, two companies with strong internal expertise and a large potential for future sales. While this is not central to our investment case, these companies could also be attractive take-over prays if the M&A market reopens, as we expect.

Roberto Magnatantini, CFA

Senior Portfolio Manager

Healthcare sector Analyst

About the author

- Joined DECALIA in 2020.

- Expertise in Global & European equities.

- Lead PM of DECALIA Silver Generation & co-lead PM for DECALIA World Compounders.

- Over 12 years at SYZ Asset Management as Lead PM of OYSTER World Opportunities and OYSTER Global High Dividend strategies.

- 4 years as a lead PM for a Global Equity fund at HSBC Private Bank.

- 4 years as an analyst and as Lead PM of LODH European Opportunities fund, at Banque Lombard Odier Darier Hentsch.

About DECALIA’s strategies

- DECALIA Silver Generation is a thematic strategy investing into companies that will structurally benefit from the longevity trend. The strategy intends to capture opportunities across the full spectrum of the longevity value chain: Consumption plays, Healthspan plays and Transformational companies.

- DECALIA World Compounders is a global strategy that seeks attractive long-term capital growth along with healthy income generation by investing in equities of well-established global companies with proven superior quality attributes

- DECALIA Sustainable SOCIETY is a multi-thematic strategy investing in the 7 themes (Security, O2 & Ecology, Cloud & Digitalisation, Industrial 5.0, Elder & Well-being, Tech Med, Young Generation) that will shape tomorrow’s SOCIETY. The Elder & Well-being & Tech Med themes currently represent 22% of the fund.

About DECALIA SA

Established in 2014, DECALIA SA is a Swiss investment management company. With more than 68 employees and assets under management that stand at CHF 5.2 billion, DECALIA has expanded rapidly, in particular thanks to its active-management experience built up over the last 30 years by its founders. The strategies developed by DECALIA focus on four investment themes deemed promising in the long term: the disintermediation of the banking sector, the search for yield, long-term trends and market inefficiencies. DECALIA is regulated by FINMA through a collective assets manager’s license. In addition to its Geneva headquarter, the group has offices in Zurich, Milan & distributors of the DECALIA Sicav in Spain & Germany.

Copyright © 2024 by DECALIA SA. All rights reserved. This report may not be displayed, reproduced, distributed, transmitted, or used to create derivative works in any form, in whole or in portion, by any means, without written permission from DECALIA SA.

This material is intended for informational purposes only and should not be construed as an offer or solicitation for the purchase or sale of any financial instrument, or as a contractual document. The information provided herein is not intended to constitute legal, tax, or accounting advice and may not be suitable for all investors. The market valuations, terms, and calculations contained herein are estimates only and are subject to change without notice. The information provided is believed to be reliable; however DECALIA SA does not guarantee its completeness or accuracy. Past performance is not an indication of future results.