By Alexander Roose, Head of Equities and Portfolio Manager for DECALIA Sustainable SOCIETY strategy

Key takeaways

- 2025: A Promising Environment, powered by Two Key Drivers:

– The AI Super Cycle: Driving innovation and reshaping industries.

– The Trump Agenda: Focused on cost optimization, deregulation, and re-industrialization. - Portfolio Highlights:

– Selective Overweight in Quality Mid-Caps: Proven sources of significant alpha generation, an attractive opportunity for Bottom-up Stock-pickers.

– Focus on Innovation and Resilient Business Models: Targeting leaders in the AI-driven transformation. - Sector Outlook:

– Strong Conviction in U.S. Industrials and Software: Positioned to capitalize on policy and technology trends.

– Cautious on Healthcare: Adopting a more prudent stance due to sector-specific headwinds.

2024 : An exceptional vintage

As we enter the final weeks of 2024 and assuming nothing derails the “picture”, it goes without saying it has been especially a good vintage for US equity markets, with the S&P500 up a whopping 26.5%: US exceptionalism in all its facets validated in absolute and relative terms by equity markets! No later than two years ago, the consensual US outlook view has evolved from an imminent US recession (2023), over to tepid earnings growth with a shaky soft landing (2024) and to double digit earnings forecasts and no landing (as of today).

Even renown bearish strategists on the street like Mike Wilson (Morgan Stanley) and Dubravko Lakos (JPM) have thrown in the towel and forecast a higher S&P500 in 1-year time…. making us slightly more reserved in all fairness as we prefer to have a high (positive) conviction depicted against a more neutral/negative consensus, such as in 2023 and 2024.

Throw in some frontloading of (US) equity performance in 2024 due to the perceived benefits of Trumponomics 2.0 (more on this below) and optically relativey high US multiples, and we end up with a more subdued 2025 outlook this time around.

Two key drivers for productivity

Despite this initial negative spoiler alert, we have however increased confidence of an emerging strong productivity cycle (mainly in the US), driven by 2 “rocket fuels”:

- The AI super cycle on which we have dwelled numerous times, with more tentative signs that AI is broadening beyond investments in the hardware infrastructure layer to monetizing AI (i.e. with software applications)

- The Trump agenda with a focus on optimizing government costs with the DOGE initiative and to a lesser degree a strong push for deregulation and a re-industrialization agenda.

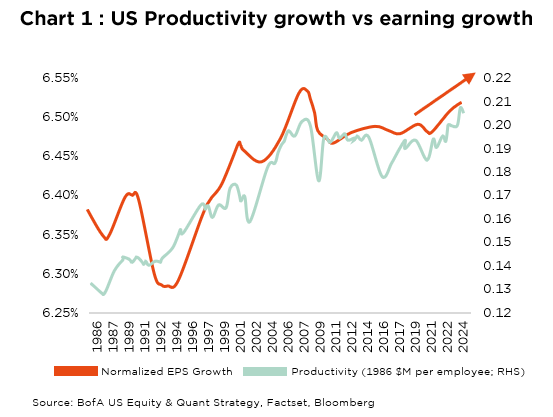

As indicated by Chart 1, productivity growth correlates closely with higher earnings growth, and as such we would expect earnings growth in 2025 to come in above (and also to be more widespread) already rosy top-down US earnings expectations. This is the main tenet of our (more moderate) positive view, helping companies to grow into their (high) multiples.

Although a lot of ink has been spilled on Trumponomics 2.0 despite numerous uncertainties as to the extent, breadth or sequence of ‘election promises’, we would argue it skews positively for:

- Continued US outperformance (with this being the most consensual view among strategists).

- US domestic industrials, especially given that US PMI figures have been moribund for a number of quarters (thus less discounted).

- Deregulation beneficiaries (financials but already well discounted, with more question marks on big Tech)

- US midcaps, helped by lower taxation, more M&A appetite.

- Software companies given being automation & AI beneficiaries and not exposed to the tariff threats.

While being potentially negative for:

•Some pockets in healthcare given the rather hostile rhetoric of the Trump administration and the spiraling healthcare costs versus GDP in many countries, and especially in the US. We have a structural preference for tech-savvy or innovative healthcare companies (such as medtech companies) as they tap into the “value-based” healthcare trajectory numerous governments will have to follow. (For more Information, please reach out for a more extensive article on the outlook for the healthcare sector written by our colleague Roberto Magnatantini.)

- Europe given it risks being the most impacted by tariffs, directly and indirectly (i.e. being the dumping ground of Chinese products) but this being very consensual as well.

- Labor intensive industries but providing scope to improve productivity through automation.

- Increased volatility, but providing opportunities for the active fund manager.

As we have already mentioned in previous articles, macro or political developments are by nature erratic and needless to say, under Trump’s presidency it will be no different (or as we know by experience even worse). Evidently, we cannot turn blind eye on these, especially if it potentially reinforces (or softens) top-down thematic convictions in our multi-thematic franchise SOCIETY, as described above.

Strategic positioning for a promising 2025

In conclusion, we continue to see upside for equity markets with the S&P500 potentially ‘tenbagging’ in the first half of 2025 from the ‘devils’ number’ bottom hit in 2009 (i.e. from 666 to 6660), with a fruitful environment for bottom-up stock pickers, like ourselves, as equity participation broadens. As such, this should benefit the high conviction but still balanced approach we have consistently applied over the many years for our above-mentioned multi-thematic expertise. The key tenets of the positioning of the multi-thematic expertise can be best summarized as follows:

1. Focus on the structural 7 themes defined by the acronym SOCIETY (Security, O²&Ecology, Cloud & Digitalization, Industry 5.0, Elder & Wellbeing, TechMed and Young Generation), whatever the macro scenario.

2. Focus on innovative companies, as innovation is often the ground cause for quality business models

Well positioned for the AI revolution, in a balanced way

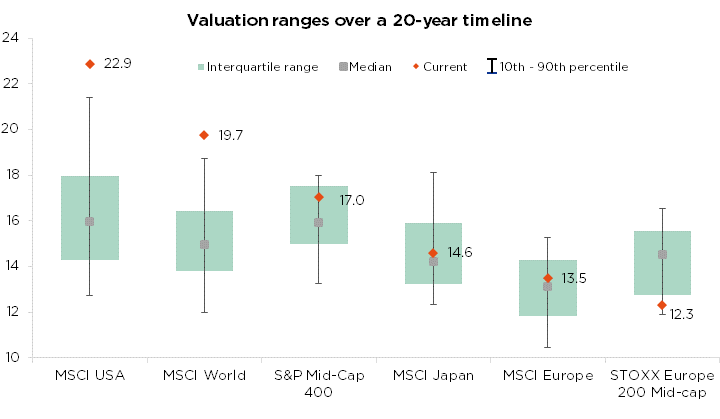

3. Selective overweight position in quality midcaps (40% vs 20% for the MSCI World), source of significant alpha generation in the past. Noteworthy, midcaps in Europe and the US trade below their average over the last 20 years in terms of p/e multiple (see chart 2).

4. Continued high conviction on software companies, more positive on US industrials and a more negative inclination towards healthcare.

Source: Factset, Goldman Sachs Global Investment Research

About DECALIA Sustainable SOCIETY strategy

- a multi multi-thematic global equity fund, investing in innovative sectors and disruptive companies shaping our SOCIETY in the future

- invests in the 7 themes (Security, O2 & Ecology, Cloud & Digitalisation, Industrial 5.0, Elder & Well being, Tech Med, Young Generation) regrouped by the acronym SOCIETY

- managed by an experienced team: Alexander Roose (ex-CIO of the Fundamental Equity of Degroof Petercam AM) & Quirien Lemey (ex-Lead PM of a Multi-thematic fund at Degroof Petercam AM)

Alexander Roose, Head of Equities

Quirien Lemey, Senior Portfolio Manager

About DECALIA SA

Established in 2014, DECALIA SA is a Swiss investment management company. With more than 70 employees and assets under management that stand at CHF5.2 billion, DECALIA has expanded rapidly, in particular thanks to its active-management experience built up over the last 30 years by its founders. The strategies developed by DECALIA focus on four investment themes deemed promising in the long term: the disintermediation of the banking sector, the search for yield, long-term trends and market inefficiencies. DECALIA is regulated by FINMA through a collective assets manager’s license. In addition to its Geneva headquarter, the group has offices in Zurich, Milan & distributors of the DECALIA Sicav in Spain & Germany.

Copyright © 2024 by DECALIA SA. All rights reserved. This report may not be displayed, reproduced, distributed, transmitted, or used to create derivative works in any form, in whole or in portion, by any means, without written permission from DECALIA SA.

This material is intended for informational purposes only and should not be construed as an offer or solicitation for the purchase or sale of any financial instrument, or as a contractual document. The information provided herein is not intended to constitute legal, tax, or accounting advice and may not be suitable for all investors. The market valuations, terms, and calculations contained herein are estimates only and are subject to change without notice. The information provided is believed to be reliable; however DECALIA SA does not guarantee its completeness or accuracy. Past performance is not an indication of future results.