The vast majority (yours truly included) was expecting, or rather fearing, a close race. Trump won the White House hands down, with a larger majority than expected in the Senate and most likely the House too (i.e. a red sweep). I thought Cagliari Calcio would be swept aside by AC Milan this week-end. And they managed the unhoped-for feat of taking a precious point (3-3) in the race against relegation with a magnificent 3rd goal. So, there’s been plenty to cheer about lately as the worst-case scenarios of a very tight for the US presidential election, leading potentially to unrest, or another defeat for the Cagliari calcio pushing it closer to the relegation zone, have been avoided.

While a big uncertainty overhang has now been cleared, leading to a relief rally on the equity markets, there will be lots of time in coming weeks, months and even years -speaking about US politics- to assess what all of this will mean on the economy and markets over the medium to long term. Like for any sport’s championships or in life, you clear one game, uncertainty or obstacle -with more or less success- and you usually quickly turn to the next one. In this case, looking ahead we may ask ourselves what will effectively be the policy changes implemented by the Trump administration.

Markets are assuming that they will support economic growth (extension of expiring tax cuts by the end of next year + some additional modest fiscal expansion), create some inflationary pressures (immigration and trade tariffs), not help to bring the budget deficit down, and therefore complicate Fed’s easing (most economists now believe Fed Fund rates won’t be fall much next year, stabilizing close to 3.5%-4%). Not to speak about the impacts for the rest of the world (likely less favorable in terms of economic growth), the possible interference from Trump in the Fed’s monetary policy, at least vocally, or the risks of a global trade tariffs war. In other words, the range of outcomes still remain wide and the world has likely become more uncertain with Trump at the White House. So, let’s keep hoping for the best liana ahead, while still preparing for grabbing the worst one.

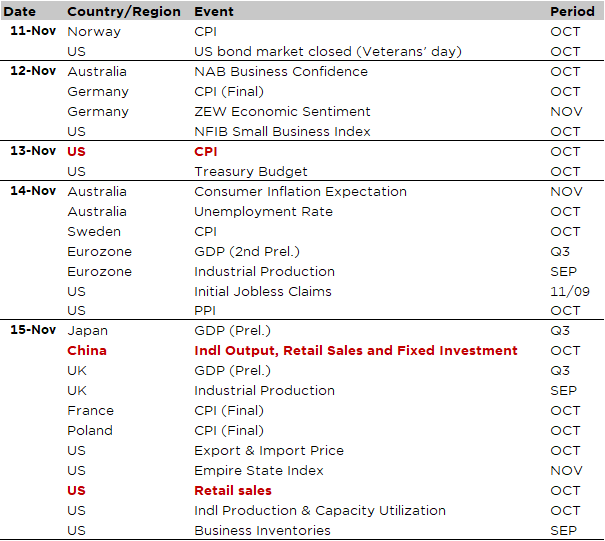

Economic Calendar

Life goes on… with dust continuing to settle down after the uncontested Trump’s victory at US presidential election. In this context, this week starts slowly as US bond’s market will be closed today (Veterans’ Day) but then investors’ attention will turn to US CPI (Wednesday) to go crescendo with the releases of Chinese and US activity data on Friday, as well as preliminary Q3 GDP prints for the UK and Japan on the same day.

October US CPI will likely be the key highlight of the week after last week Donald Trump’s victory as next US President (from January 20th 2025) and Fed’s rate cut. The consensus expects both the headline and core CPI to increase at the same pace than in September, i.e. +0.2% and +0.3% respectively, which will lead to annual inflation rate of +2.6% for the headline and + 3.3% for the core index (unchanged compared to the prior month). Lower or higher inflation readings may lead to a more or less relaxed Fed in the future (next meeting scheduled in December along with the updated dots plot and economic projections). In this context, there will be a lot of Fed speakers this week: their current views, gut feelings and stances post the election may be interesting. In addition, we will also get some economic activity data for October, namely retail sales and industrial production, on Friday: consensus is still foreseeing resilient retail sales/consumers (+0.3% expected) and struggling industrial production with growth slipping again (-0.2% expected after -0.3% in September).

Moving to Asia, the key releases will take place on Friday early morning, including the preliminary Q3 GDP report for Japan on Thursday (consensus expects real GDP to increase by an annualized rate of about +1.0% QoQ), while in China we will get the economic activity data for last month. Given latest favorable business sentiment surveys and ongoing policy support (even if it’s more vocal than factual as the stimulus package announced least night disappointed market expectations once again), industrial production, retail sales and fixed asset investment are seen up or stabilizing at minima. Turning to Europe, the UK Q3 GDP preliminary reading is also due on Friday. Before that, the Germany ZEW survey will be released tomorrow and some October CPIs prints will be out in the Nordic countries over the week.

Finally, with already 450 companies of the S&P500 having reported, the US earnings season is now winding down. However, there will still be a few key results to keep an eye on this week, including Home Depot (Tuesday), Cisco (Wednesday) or Walt Disney and Applied Materials (Thursday). It’s also worth penciling the results releases of Chinese tech giants, Tencent (Wednesday) and Alibaba (Friday).

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.